Zcash: Privacy-Focused Cryptocurrency on the Rise

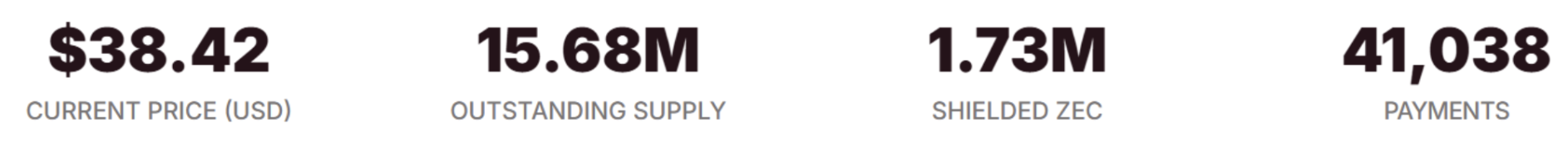

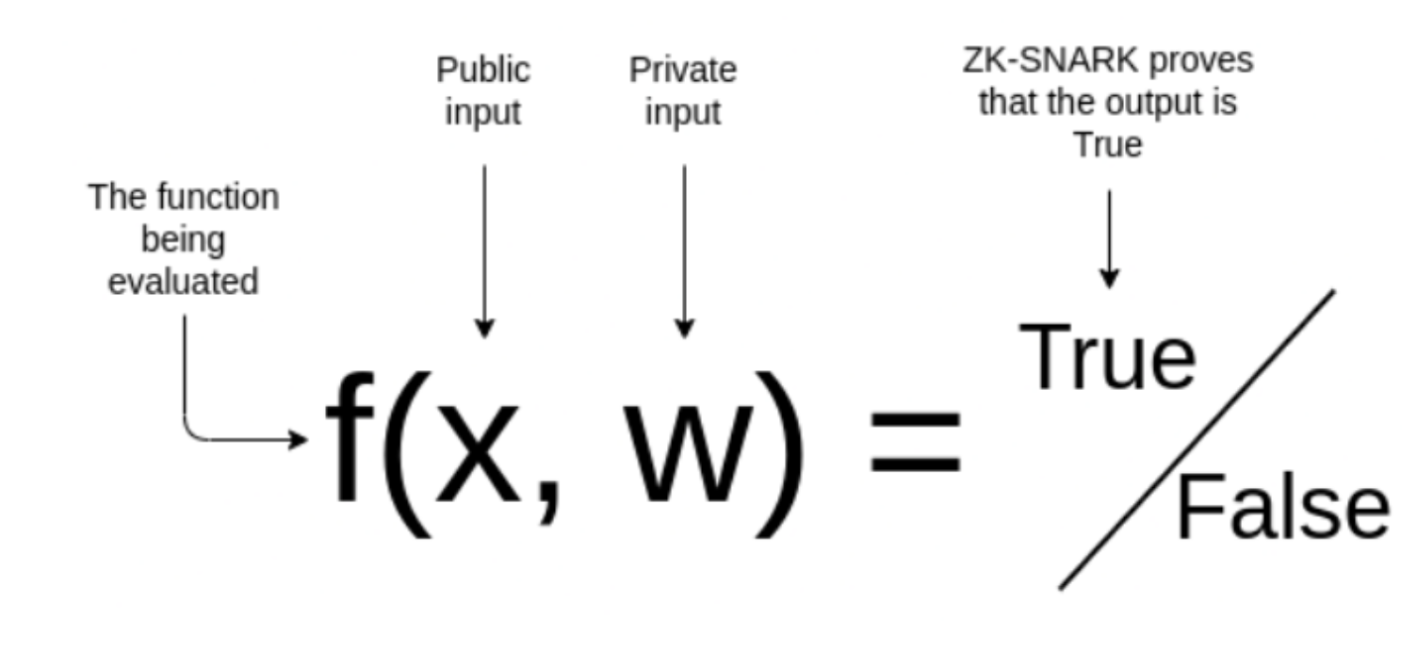

Zcash (ZEC) has established a notable presence in the cryptocurrency landscape due to its unique emphasis on user privacy and transaction anonymity. Unlike many other digital currencies, Zcash provides users with the flexibility to choose between transparent and shielded transactions, allowing for varying levels of privacy based on user preferences. This privacy is made possible by zk-SNARK technology, a sophisticated cryptographic tool that enables transaction verification without disclosing sensitive information, making Zcash highly appealing to privacy-conscious users.

As a decentralised and open-source blockchain, Zcash continues to innovate and attract users who value private transactions within a secure public ledger. Its high liquidity and substantial market activity contribute to its resilience and growth, helping it maintain a stable position in the evolving world of cryptocurrency. Zcash's unique attributes make it a compelling choice for investors, especially as privacy becomes an increasingly important consideration in the digital age.

Source: Zcash

Recent Price Movements and Investor Sentiment

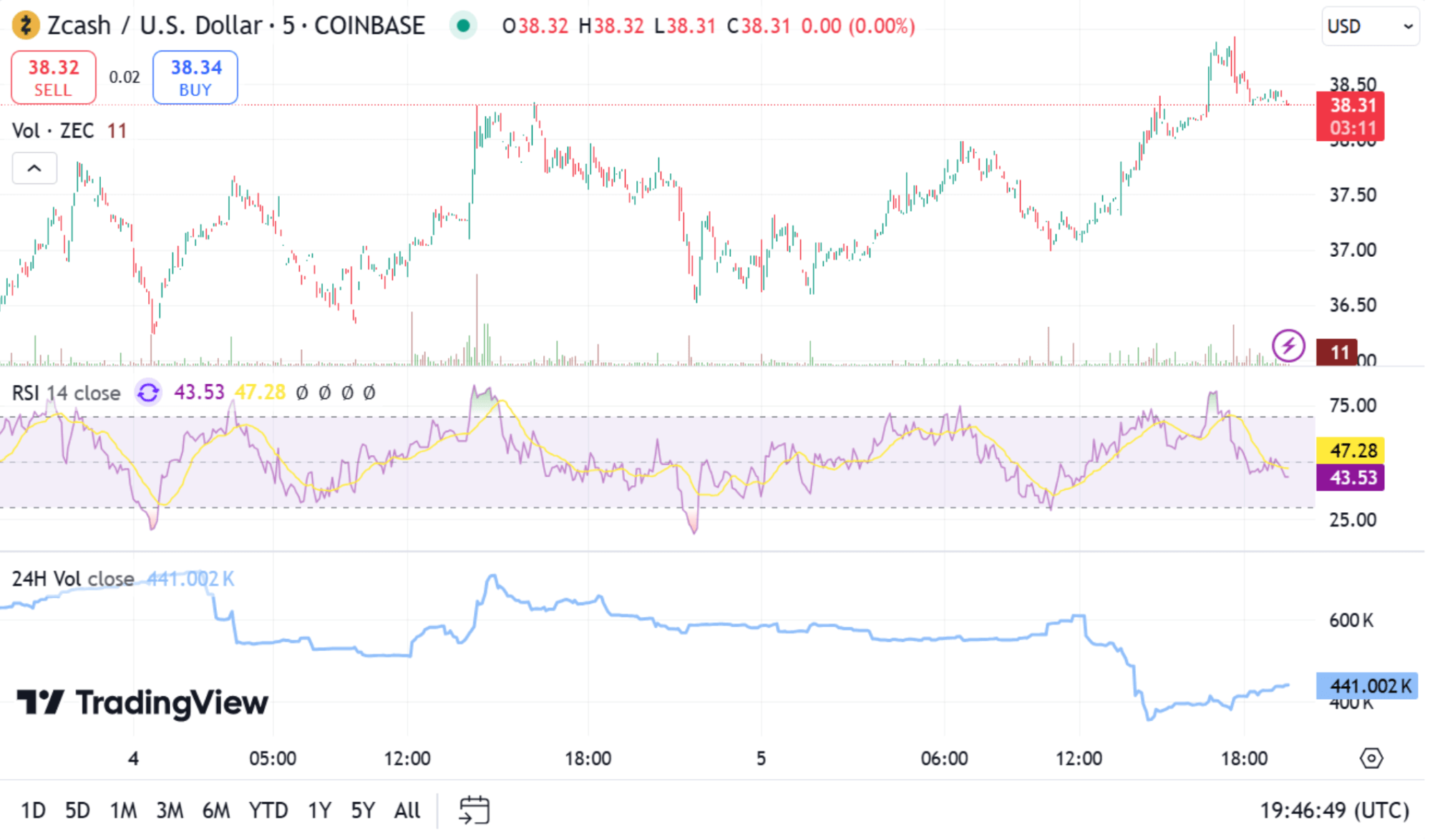

Zcash has recently seen a strong surge in price activity, hitting a high of $38.8 with an impressive increase over 24 hours, reflecting a renewed interest among investors. This positive movement has been bolstered by Zcash surpassing its 50-day SMA, a key technical indicator that signals potential upward momentum and optimism in the short term. Currently trading within a range of $35–$40, Zcash’s steady climb suggests further growth if this bullish sentiment persists. Analysts are optimistic, predicting a potential high of $50 at the beginning of 2025 and possibly reaching as much as $50 by the end of 2025 if Zcash’s market performance remains on track.

Zcash Technical Analysis: Key Support and Resistance Levels

From a technical standpoint, Zcash is showing positive momentum as it trades above the 50-day SMA, an encouraging sign for potential short-term gains. The currency is testing a critical support level at $36; holding this level could provide a solid base for further upward movement and price consolidation. If Zcash manages to maintain this support, it could challenge the next significant resistance level at $45.39, which, if breached, could confirm a stronger and more sustained bullish trend. However, should Zcash fail to hold above $36, a correction may follow, with a potential retracement to around the $33 range for further consolidation.

The RSI indicator recently moved into neutral territory, with traders showing cautious optimism about potential future gains. Although short-term pullbacks may occur, the long-term trajectory for Zcash remains promising, and technical indicators suggest that consolidation above $37 could set the stage for further growth and a potential retest of higher resistance levels.

Source: TradingView

Community Engagement and Development Updates

Zcash continues to prioritise community engagement, as evidenced by a community call on November 5th to discuss network development and sustainability initiatives. These types of initiatives are part of Zcash’s broader strategy to involve its community in decision-making processes and to promote transparency in its development efforts.

Recent updates to the network include enhancements to its zk-SNARK privacy protocol, further solidifying Zcash’s commitment to security and privacy as core components of its ecosystem. Zcash’s dedication to privacy has attracted major partnerships, such as collaborations with JPMorgan and the Ethereum Foundation, both of which aim to explore potential privacy enhancements for their respective networks. These developments signal that Zcash is not only responding to community and market demands but also positioning itself as a leader in privacy-focused blockchain solutions. By continuously improving its technology and engaging with its community, Zcash aims to maintain its competitive edge in the rapidly evolving cryptocurrency landscape.

Source: vitalik.eth.limo

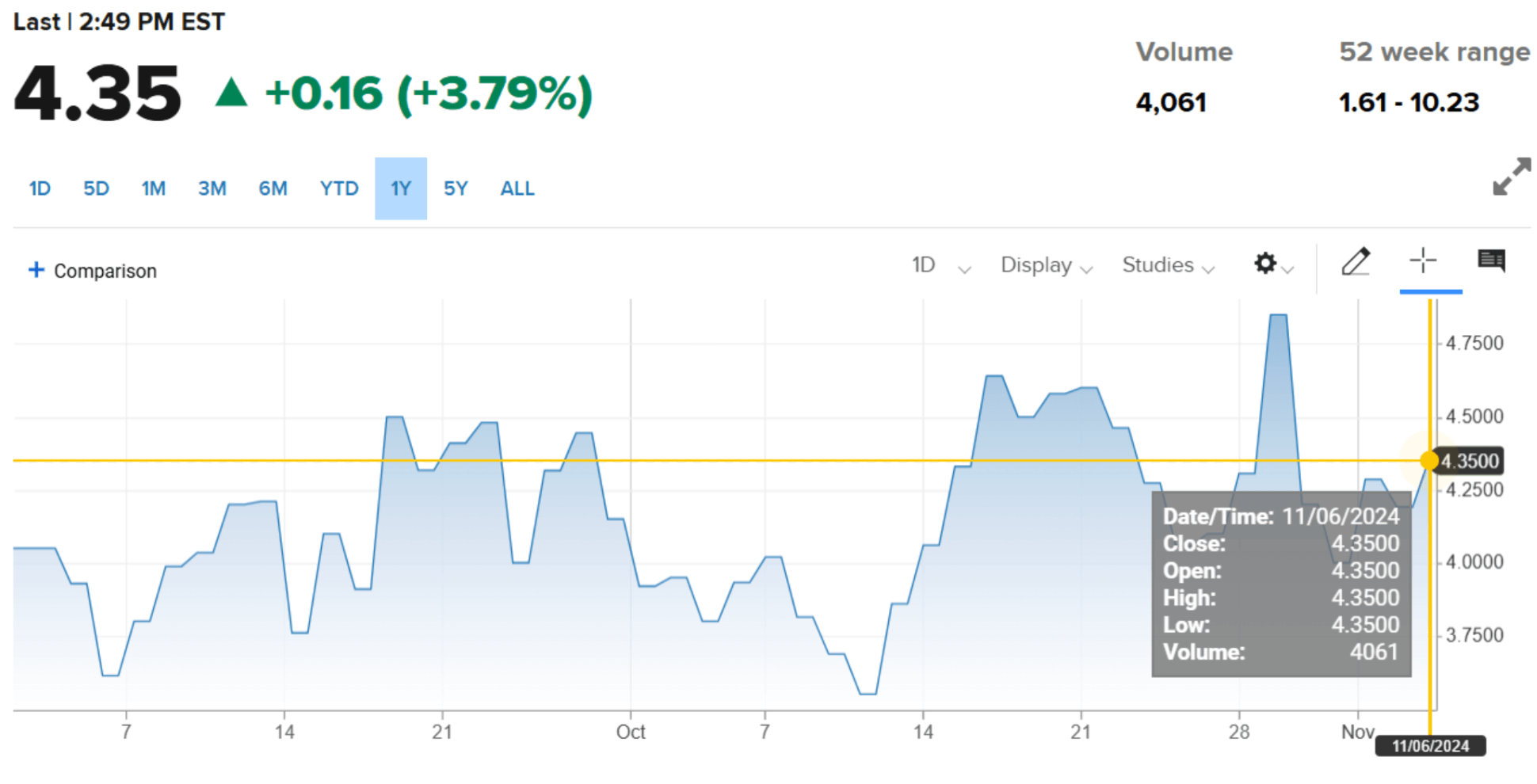

Grayscale Zcash Trust: Growing Institutional Interest

Institutional interest in Zcash has increased substantially, with Grayscale’s Zcash Trust leading the charge in terms of exposure to the cryptocurrency. Recently, Grayscale issued an additional 55,700 shares of Zcash Trust, raising approximately $175,460 in net proceeds, highlighting the demand for privacy-focused digital assets among institutional investors. This institutional interest signals a growing acceptance of privacy-centric cryptocurrencies as essential assets in diversified portfolios. By offering exposure to Zcash without requiring direct ownership, the Trust allows investors to sidestep the complexities and security concerns of managing digital assets independently.

The continuous expansion of Grayscale’s Zcash Trust reflects a steady rise in demand for Zcash, underlining its potential as a valuable asset for privacy-oriented investors. The growing participation of institutional investors in Zcash strengthens its position within the cryptocurrency market and underscores its viability as a long-term investment.

Source: Cnbc.com

The Future of Zcash: Potential and Price Predictions

Looking toward the future, Zcash appears to hold significant promise as global privacy concerns continue to increase, driving demand for secure, anonymous transactions. With a fixed supply of 21 million coins, similar to Bitcoin, Zcash benefits from a scarcity model that could enhance its value over time, especially as privacy becomes a sought-after feature in digital finance. The network’s proven reliability, scalability, and ongoing enhancements position Zcash as a strong candidate for continued growth, with some experts forecasting a price of $178 by 2030 if adoption rates and institutional interest stay on course.

Recent moves by Grayscale, along with ongoing developments in its privacy features, add to the credibility of Zcash as a viable option for long-term investment in privacy-focused crypto. As the demand for privacy-centric solutions grows in response to regulatory pressures and increasing digital surveillance, Zcash is well-positioned to retain its status as a leading choice in this sector, balancing user privacy with robust functionality and security.

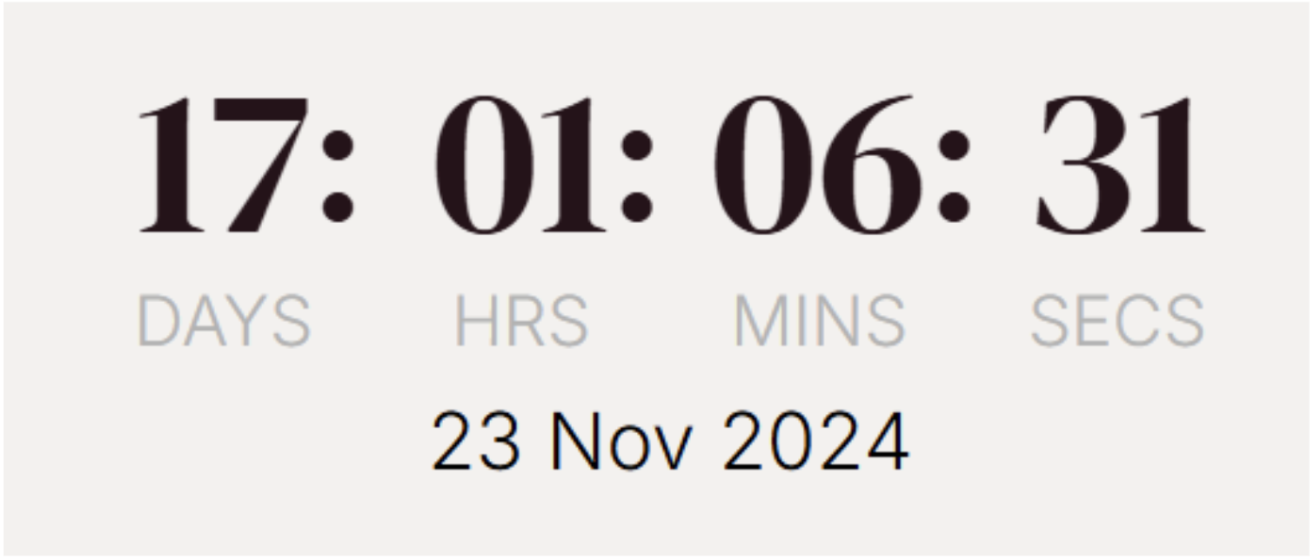

Halving Countdown

Source: z.cash