Solana (SOL): Latest Developments, Price Trends, and Technical Analysis

Solana’s ETF Momentum: Market Bets and Regulatory Winds

Solana (SOL) has found itself back in the spotlight following renewed investor confidence that a Solana spot exchange-traded fund (ETF) could be on the horizon. Recent events have boosted optimism that a more crypto-aligned regulatory approach could pave the way for Solana-based ETFs in the United States.

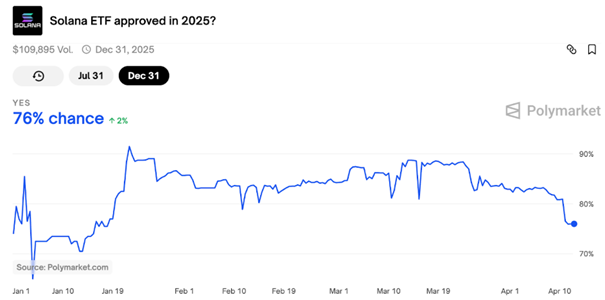

Betting markets like Polymarket have responded enthusiastically, with the probability of an ETF approval by the end of 2025 jumping to over 80%. This optimism alone has helped SOL climb above $130, despite broader uncertainty in the crypto space.

Source: Polymarket

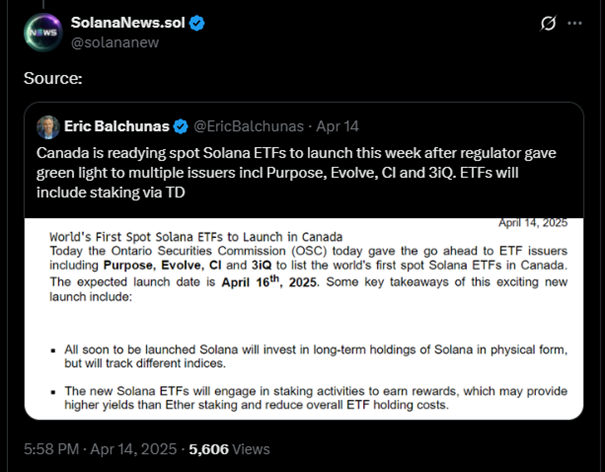

Canada’s Approval Signals Broader Institutional Interest

While the US continues to deliberate on altcoin ETF applications, Canada has taken a significant step forward. Four major asset managers—Purpose, Evolve, CI, and 3iQ—have been given the green light by Ontario regulators to launch spot Solana ETFs with integrated staking rewards. These products will hold actual SOL tokens and participate in staking, making them a high-yield alternative to traditional ETFs. Set to begin trading on April 16, these ETFs could set a precedent for more advanced staking-enabled funds in developed markets. Canada’s embrace of staking may serve as a blueprint for future US products, even as US regulators remain cautious.

Source: X

New Product Innovations Drive Ecosystem Growth

Solana’s ecosystem is expanding not just through financial instruments but also via consumer products aimed at bridging real-world use and on-chain value. One such example is the recently announced Solayer Emerald Card—a debit-style payment card that lets users spend digital assets directly without converting to fiat.

Fully integrated with the Solana Virtual Machine (SVM), the Emerald Card is launching with Apple Pay and Android Pay compatibility, and has already attracted more than 200,000 signups globally. By incorporating SolanaID to build on-chain reputations and issuing rewards for active users, Solayer aims to fuse crypto utility with everyday payment experiences.

Source: X

Technical Analysis: Momentum Weakens After Local Peak

Solana’s technical momentum has cooled down over the past five days, suggesting a period of consolidation rather than an immediate breakout. Price action shows SOL trading around $125, pulling back from highs near $133 earlier in the week. The RSI (Relative Strength Index) has dipped to 45.31, below the midline and its signal line at 44.13, indicating weakening bullish momentum and a possible loss of short-term upward pressure. The RSI’s failure to sustain above 50 confirms a shift toward a more neutral or slightly bearish stance.

Volume has steadily declined during this period, with 24-hour trading volume now sitting at 158.46 million, reflecting reduced buying interest. No significant breakout from recent resistance levels has occurred, and price movement remains bounded in a narrow range between $125 and $128. While Solana remains above key short-term support, the fading RSI and softening volume suggest that bulls lack the conviction needed to push toward the $150 resistance level in the immediate term.

Unless trading activity and on-chain demand rebound soon, SOL may struggle to recapture its previous highs. For now, traders should watch the $122 support and $128 resistance zones closely, with a break in either direction likely to set the tone for the next move.

Source: TradingView

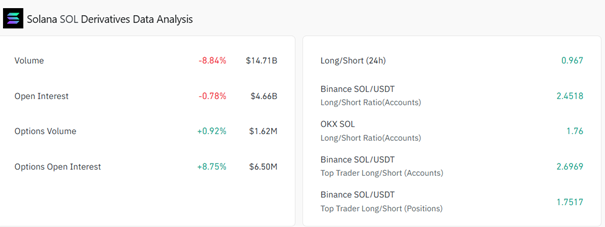

Derivatives Market Metrics Reinforce Bullish Momentum

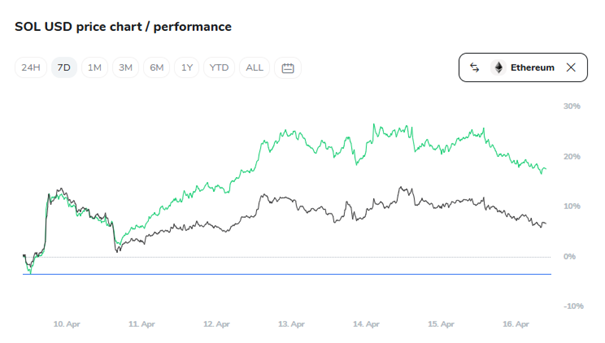

The latest Solana (SOL) derivatives data strengthens the narrative of growing bullish sentiment. As seen in the performance comparison chart, Solana has outperformed Ethereum over the past week, with SOL climbing nearly 20% compared to ETH’s modest gains.

This divergence reflects increased investor interest in Solana, which is echoed in the derivatives market. Despite an 8.84% drop in overall volume, open interest in options has climbed by 8.75% to $6.50 million, while options volume also rose 0.92%. The long/short ratio across major exchanges reveals a decisive lean toward bullish bets. This data aligns with strong price action and suggests that traders are positioning for continued upside. With SOL currently trading around $125, strong derivatives metrics and the approval process for Solana ETFs further fuel the positive momentum. Together, these factors indicate a healthy risk appetite and institutional confidence building in favour of a sustained Solana rally.

Source: Coinglass

Can SOL Reach $300 Again?

Despite a strong 7-day performance with Solana gaining over 19% and currently trading at $125.75, the path back to its previous all-time high near $300 remains challenging. Over the past week, SOL has surged from around $105 to nearly $136 before retracing slightly—showing solid momentum but still sitting more than 58% below its peak. The market capitalisation has dipped 4.04% to $64.92 billion, and 24-hour trading volume has declined by 15.14% to $3.27 billion, indicating fading near-term buying enthusiasm.

Although the price action suggests investor optimism—the rally will likely need stronger on-chain participation to sustain further gains. Key resistance levels to watch remain at $150 and $180, with any strong rejection from these zones potentially triggering renewed selling pressure. On-chain metrics continue to lag behind the price momentum, raising questions about whether current valuations are sustainable without a parallel spike in decentralised finance (DeFi) activity.

Source: Coinmarketcap

Solana’s Ascent Still in Progress

The recent surge in Solana’s price is driven by a confluence of factors—from renewed optimism over ETF approvals and technical breakouts to ecosystem expansion and institutional engagement. With Canada preparing to launch staking-enabled SOL ETFs and the US SEC potentially warming to similar products, SOL appears well-positioned to attract more attention in the months ahead. However, the road to new all-time highs remains uncertain. On-chain data reveals declining network activity, which could hinder further upside without renewed user participation.

Solana’s future now depends on the continuation of bullish momentum and, more importantly, the reactivation of its ecosystem fundamentals. If staking-enabled ETFs, layer-two solutions like Solaxy, and payment tools such as the Emerald Card succeed in drawing new users, Solana may very well reclaim its place among the top performers in the crypto market.