Crypto Weekly Wrap: 18th April 2025

Market Rebound Faces Geopolitical Headwinds

The crypto market is experiencing cautious optimism following a volatile start to April. Although major assets like Bitcoin and Ethereum have stabilised above key support levels, global economic uncertainties—particularly surrounding Donald Trump’s renewed tariff strategies and escalating trade tensions with China—continue to cast a shadow over sentiment.

Bitcoin has held firm above $83,000 and currently trades at $84,735, posting a 3.38% weekly gain. Ethereum, on the other hand, remains range-bound near $1,596, with a slight -0.25% dip. Solana leads the rebound among major altcoins, surging 16.76% to $133.74, followed by notable gains in Bitcoin Cash (+13.5%), Avalanche (+6.39%), and XRP (+4.98%).

However, not all assets are in the green—SUI, SHIB, ADA, and HBAR are in negative territory, with HBAR dropping sharply by -7.19%. The ongoing macroeconomic jitters have driven significant capital into traditional safe havens like gold, with Bank of America reporting that gold funds have pulled in nearly $80 billion year-to-date—double the inflows seen during the pandemic rally in 2020.

In contrast, spot Bitcoin ETFs have seen prolonged outflows, shrinking their net inflows to just $165 million, highlighting the current investor tilt toward tangible assets over digital ones.

Weekly Heatmaps

Source: Quantifycrypto

Source: Coinmarketcap

Bitcoin Holds Ground, Eyes $95K Next

Bitcoin continues to hold its ground above the $84,000 level, with the latest 5-day chart showing the price consolidating around $84,845 after recovering from recent dips. The Relative Strength Index (RSI) sits at 67.06, nearing overbought territory and indicating rising bullish momentum, while volume has cooled slightly to 111.62 million.

This technical posture suggests that short-term traders remain optimistic, though a clear breakout has yet to materialise. While BTC is trending steadily higher, the psychological resistance near $85,000 is proving sticky, and bulls will need stronger volume to push through. Should buyers manage to reclaim the recent local high and extend gains past the 200-day SMA resistance near $87,660, a run toward $95,000 could follow. However, without renewed volume surges and spot market demand, any breakout attempt risks falling short of confirming the next leg higher.

Source: TradingView

Ethereum Struggles but Remains Long-Term Favourite

Ethereum is hovering around $1,597 with modest volatility over the past five days, showing signs of short-term weakness as buyers struggle to reclaim higher resistance levels. The RSI stands at 54.79, suggesting mild bullish momentum but with no clear breakout confirmation. Volume has held steady at 166 million, indicating cautious market participation.

Despite attempts to regain ground, ETH has failed to push beyond the $1,600–$1,620 range, and a decisive move above $1,697 remains elusive. If bulls can break this threshold, a run toward the 50-day SMA near $1,919 and the $2,111 target could become viable. However, any slip below $1,471 may reignite downside pressure, opening the door to $1,368 or even $1,150.

Still, Ethereum maintains its long-term appeal due to its foundational role in DeFi and smart contracts—keeping institutional and developer interest strong amid macro headwinds.

Source: TradingView

Altcoin Roundup: XRP, SOL, ADA, and Others in Focus

Altcoins are showing mixed signals as the market stabilises, with Solana (SOL) leading the gains—rising over 6.2% to $133.97. Despite recent selling pressure near the $120 zone, SOL's strong performance reflects a broader market rebound. A break above the 50-day SMA could open the way toward $153, while any drop below $110 risks reigniting bearish momentum.

XRP has edged up 1.09% to $2.11, continuing to consolidate between $2 and $2.23. A clear move above the 50-day SMA would strengthen bullish sentiment, while a drop below $2 could lead to a retreat toward $1.61.

Cardano (ADA) is slightly down at $0.62, testing key trendline support. If it fails to hold this level, it may slide to the $0.50 support zone. On the other hand, a move above $0.70 would pave the way for a rally to $0.83.

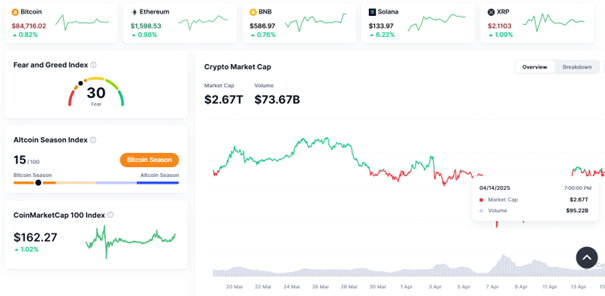

Meanwhile, the Fear and Greed Index shows a score of 30—indicating ongoing fear in the market. The Altcoin Season Index remains low at 15/100, suggesting Bitcoin dominance still persists. Still, with a total crypto market cap at $2.67 trillion and volume at $73.67 billion, there's cautious optimism building across the space.

Source: Coinmarketcap

DeFi on Solana Heats Up Amid DEX Wars

A fierce DeFi rivalry is unfolding within the Solana ecosystem as Raydium and Pump.fun intensify their battle for dominance. Raydium’s LaunchLab, a fast and permissionless token creation platform, offers instant integration with its AMM and features like community fee distribution, referral rewards, and real-time token visibility. This comes in direct competition with Pump.fun’s PumpSwap, which is already processing over 6 million swaps per day and recently surpassed $2.5 billion in weekly trading volume. The competitive energy has drawn major attention to the Solana ecosystem—evident in its position as the second most visited token on the day, with a price jump of 6.47% to $133.89.

Meanwhile, Solana-based meme tokens like Fartcoin are riding this DeFi wave, appearing in the top five most visited projects, while the platform's broader impact is reflected in overall market sentiment. Total DeFi market cap has surged 3.67% to $149.65B in 24 hours, with trading volume climbing 17.30% to $12.5B. Top daily gainers such as DIGIMON (+158%), MAPS (+72.67%), and MUSKIT (+55.21%) underscore the high-risk appetite among traders exploring fresh DeFi plays—many of which are launching directly through Solana’s rapidly evolving infrastructure.

Source: Coinmarketcap

Secret Service and Canadian Regulators Tackle Ethereum Scam

In a major international crackdown, the U.S. Secret Service and Canadian law enforcement partnered to dismantle a $4.3 million Ethereum phishing scheme. Dubbed "Operation Avalanche," the effort used blockchain analytics to identify compromised wallets and alert victims. This collaboration highlights the growing use of cross-border forensics in tackling transnational crypto fraud, as well as increasing regulatory scrutiny around DeFi security.

Source: X

Bitwise Expands Institutional Access with LSE Crypto ETPs

Bitwise has made a bold move to attract institutional capital by listing four new crypto exchange-traded products (ETPs) on the London Stock Exchange. These include physically backed Bitcoin and Ethereum ETPs, one of which also distributes staking rewards. Designed for professional investors, the products align with institutional compliance standards by using regulated custody and trustee frameworks.

The launch represents a significant step toward integrating digital assets into traditional investment portfolios, offering exposure without direct custody concerns. By expanding into Europe’s largest ETP trading venue, Bitwise is not just providing access—it’s actively bridging the gap between legacy finance and decentralised assets, potentially opening the floodgates for broader institutional adoption.

Source: X

Outlook and Price Forecasts for the Coming Weeks

Looking ahead, Bitcoin appears well-positioned to continue its climb toward $95,000 if it can clear resistance at $87,660 and overcome persistent outflows from institutional products. Long-term projections remain bullish, with some models forecasting $112,000 by mid-2025. However, liquidity and volume metrics must improve to support a sustainable rally.

Ethereum faces more immediate resistance, but its long-term value proposition remains strong—especially if inflation fears and central bank liquidity injections return. Smart investors are treating the current dip as an opportunity to accumulate.

Solana, while still down from its highs, is showing signs of a breakout candidate. ETF optimism, strong derivatives positioning, and vibrant on-chain activity (despite volatility) suggest it could be one of the top altcoin performers this cycle.

Elsewhere, Avalanche, Chainlink, and Dogecoin have important technical hurdles to overcome, while ADA’s potential role in Bitcoin DeFi—championed by Charles Hoskinson—could shift its narrative if backed by developer growth.

Meanwhile, the AI-focused Render token is under pressure following Trump’s ban on Nvidia AI chip exports to China. While short-term sentiment has turned bearish, strong fundamentals and a high RSI suggest the dip may be temporary, with room to rally if macro headwinds subside.