Bitcoin in Your Business: Why SME Business Owners Are Adopting a Bitcoin Strategy:

In 2020, MicroStrategy made headlines when its Chairman and Co-founder, Michael Saylor, took a bold step by buying Bitcoin as a hedge against inflation and an alternative to cash reserves on the company’s balance sheet. This marked the start of the company’s digital asset strategy, setting a precedent for other businesses.

Today, MicroStrategy owns over 250,000 Bitcoins, making it one of the most prominent corporate investors in the cryptocurrency space. While its scale is exceptional, its approach to integrating digital assets has been mirrored by many businesses, both large and small. According to a recent report by River, a Bitcoin technology and financial services company, businesses now account for 3.3% of Bitcoin’s total supply, with corporate holdings growing by 587% since 2020 (business-bitcoin-report…).

So why are more businesses turning to Bitcoin as part of their financial strategy? Let’s explore the key reasons.

Why Businesses Are Embracing a Bitcoin Strategy

1. A Hedge Against Inflation

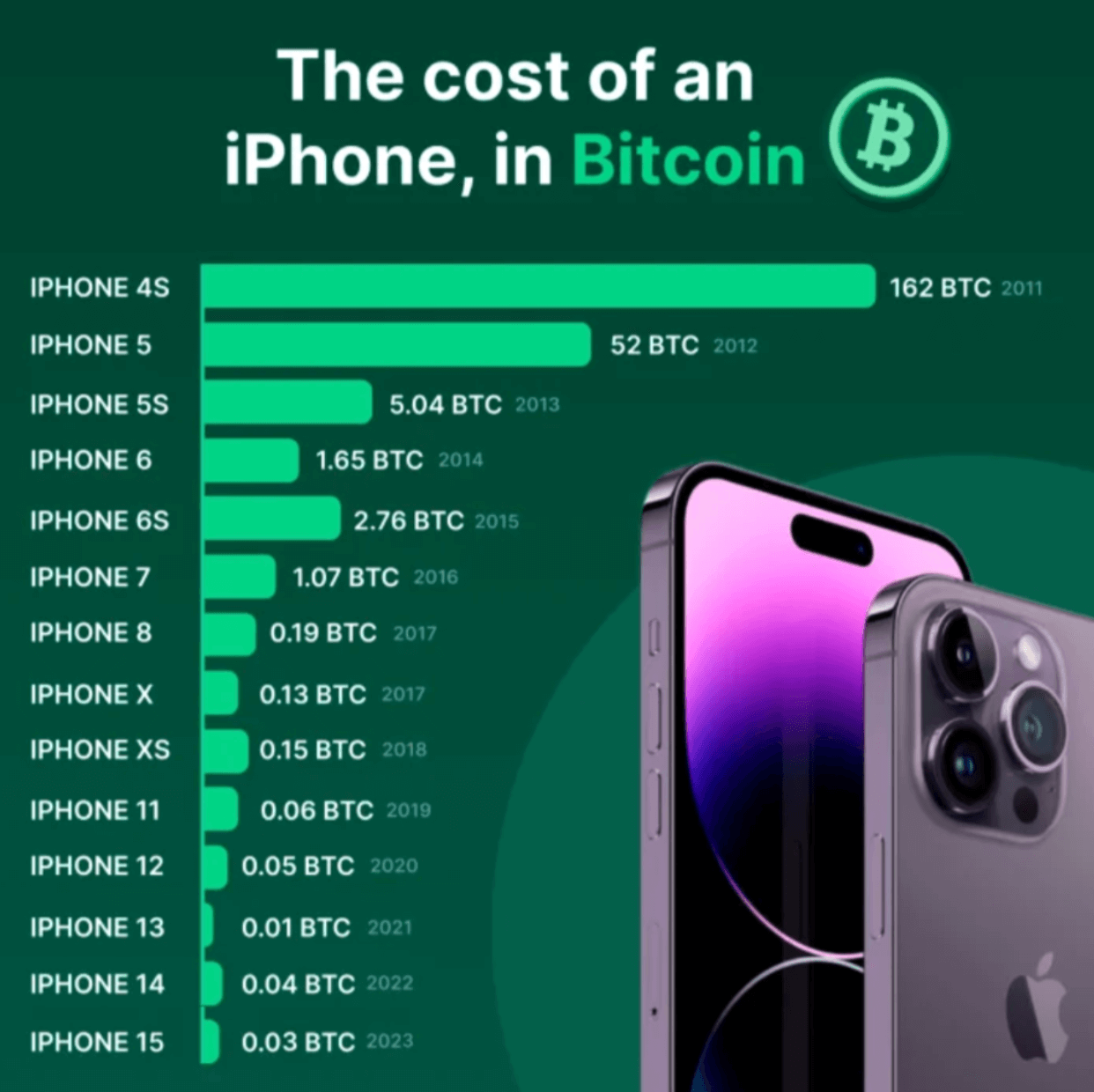

The most compelling reason for companies to adopt Bitcoin is inflation protection. Holding cash in reserves exposes businesses to inflation, which erodes purchasing power as central banks print more fiat currency. By contrast, Bitcoin's fixed supply of 21 million ensures scarcity and its value has historically increased as demand rises. Assets become cheaper when measured in Bitcoin, the same can’t be said with fiat currency.

Since its inception in 2009, Bitcoin's price has grown from $0 to over $70,000, while fiat currencies like the GBP and USD have lost value. In fact, the GBP has seen more than a 50% decrease in purchasing power over the same period. Businesses like SummerPlace Homes, highlighted in the River report, have adopted Bitcoin to preserve wealth across generations and protect against inflation(business-bitcoin-report…).

2. Protection from Fiat Currency Fluctuations

For businesses involved in international trade, volatile exchange rates can significantly impact margins. Stablecoins like USDT and USDC offer a solution by being pegged to assets such as the US dollar, providing stability. Although Bitcoin is more volatile than stablecoins, its potential for upside and inflation resistance makes it an attractive addition to a business’s treasury, mitigating currency risks.

3. Mitigating Central Bank Policies

Central bank interest rates affect industries reliant on credit, such as real estate. Rising interest rates make borrowing more expensive, slowing growth in sectors dependent on debt financing. Bitcoin offers an alternative asset that isn’t subject to central bank policies, providing diversification and the potential for higher returns. River’s research highlights businesses like Tahini’s, a rapidly growing restaurant chain, that have embraced Bitcoin as a core part of their treasury strategy to safeguard against traditional market downturns (business-bitcoin-report…).

The Growth of Corporate Bitcoin Adoption

Corporate Bitcoin adoption is accelerating. According to River's 2024 report, businesses now hold approximately 683,332 BTC, with the number of publicly traded companies holding Bitcoin increasing by 40% from 2023 to 2024(business-bitcoin-report…). Even small and medium-sized enterprises (SMEs) are finding value in Bitcoin. Companies such as Real Bedford F.C. have incorporated Bitcoin as a long-term investment and a means to connect with the global Bitcoin community, demonstrating that Bitcoin’s benefits extend beyond finance to branding and community-building (business-bitcoin-report…).

How ICONOMI Can Help Your Business Implement a Bitcoin Strategy

ICONOMI offers corporate business accounts that enable business owners to easily access Bitcoin and other digital assets. Whether your company seeks to hedge against inflation, protect against currency volatility, or diversify its financial strategy, ICONOMI’s platform provides a seamless entry point into the world of digital assets.

Conclusion: A Strategy for the Future

The adoption of Bitcoin by businesses is no longer a fringe phenomenon. Forward-thinking companies are embracing digital assets to safeguard their purchasing power, mitigate economic risks, and seize new growth opportunities. As River's report shows, the growth in corporate Bitcoin holdings is substantial and ongoing, making it clear that Bitcoin is here to stay as a core part of modern financial strategies.

Explore how ICONOMI can support your business in adopting a Bitcoin strategy today.

Learn more about ICONOMI business accounts