Crypto Weekly Wrap: 11th April 2025

Trump’s Tariffs Rattle Markets, Triggering a Crypto Reset

The global crypto market endured significant volatility this week following former U.S. President Donald Trump’s announcement of sweeping tariffs under his “Liberation Day” plan. The executive order imposed a 10% baseline tariff on all imports, with higher rates on countries with large trade deficits with the U.S., sparking fears of a global recession.

Bitcoin initially held steady above $82,000, surprising many analysts with its resilience amid a Wall Street and Nasdaq plunge. However, the relief was short-lived—BTC collapsed to $74,436 within 12 hours as equities in Asia and Europe followed the downward spiral.

Crypto investors quickly adopted a risk-off approach, with altcoins bleeding across the board and ETF flows showing heavy redemptions. Institutional confidence took a hit, with the S&P 500 officially entering bear market territory. The broader sentiment has turned defensive, with investors seeking to preserve capital amid mounting macroeconomic uncertainties and a loss of trust in U.S. fiscal stability.

Source: X

Bitcoin's Safe-Haven Appeal Grows as U.S. Dollar Slumps

Bitcoin’s safe-haven narrative is gaining traction as the U.S. dollar continues its steep decline. On Thursday, the ICE U.S. Dollar Index (DXY) fell 1.83% to 101.02—its sharpest single-day drop since 2022—briefly slipping below the 101 level and marking its lowest close since September. Since President Trump’s inauguration, the dollar has lost more than 7%, with over 2% of that drop occurring after the announcement of sweeping new tariffs.

Contrary to earlier expectations that protectionist policies would strengthen the greenback, foreign investors appear to be selling U.S. assets, applying downward pressure on both the dollar and domestic markets. This trend has been accompanied by sell-offs in U.S. stocks and bonds, fueling speculation of a broader economic slowdown. With rising demand for safe-haven alternatives like the Japanese yen and Swiss franc, Bitcoin’s decentralised nature and supply cap are once again making it an attractive hedge against traditional financial instability.

As the dollar weakens and global market anxiety rises, Bitcoin is increasingly viewed as a digital asset capable of preserving value in turbulent times.

Source: CNBC

Bitcoin Eyes $70K Bottom as RSI Recovers From Dip

Technically, Bitcoin has shown signs of stabilizing after last week’s sell-off, with its 5-day Relative Strength Index (RSI) now rebounding to around 62, suggesting renewed buyer interest after testing near-neutral levels. While earlier concerns pointed to RSI exhaustion, the current uptrend implies that short-term momentum is regaining strength.

The price has bounced from a local bottom near $78,000 and is now holding above $80,000, showing resilience despite broader market fears. Bitcoin’s 50-week exponential moving average (EMA) near $77,500 remains a key level to watch—failure to hold above it could still trigger a retest of the $70,000 zone, historically associated with strong accumulation. While current recovery is promising, fractal patterns suggest a breakdown of this zone could open the door to deeper corrections. For now, bulls are back in control—but caution remains warranted.

Source: TradingView

Ethereum Reclaims $1,550 After Brief Drop, but Stagnation Worries Persist

Ethereum has recovered above $1,550 following a steep decline earlier this week, which saw prices briefly dip below $1,480. The ETH/BTC ratio remains under pressure, recently touching a five-year low of 0.018, underscoring Ethereum’s prolonged underperformance relative to Bitcoin. Despite the rebound, the broader market sentiment remains cautious as the 5-day RSI climbs to 60—suggesting a moderate recovery in momentum, but not yet a strong reversal.

Ethereum’s core metrics continue to raise concerns, with relatively flat active address growth on its main chain over the past several years, prompting ongoing debates about long-term adoption. While Layer-2 networks have seen increased usage, base-layer stagnation is dampening investor confidence. Many long-term ETH holders are still at a loss, and without a significant catalyst, technical indicators suggest downside risks remain.

Although ETH has held support above $1,500 for now, the market is watching closely to see whether this rebound can evolve into a sustained recovery or if deeper corrections toward $1,400 or even $1,200 remain on the table.

Source: TradingView

Ripple Pushes Forward With $1.25B Acquisition as XRP Reclaims $2

Ripple's $1.25 billion acquisition of prime broker Hidden Road marks a pivotal move toward deeper institutional integration, as the company aligns traditional finance (TradFi) with decentralized finance (DeFi). Hidden Road currently clears over $3 trillion annually and serves 300+ institutional clients, providing Ripple a high-impact entry point into cross-asset brokerage services.

Despite the recent volatility, XRP has regained the $2 level, with RSI climbing to 55—indicating a modest recovery in momentum and suggesting investor sentiment is stabilizing. Trading volume remains subdued, signaling cautious optimism rather than a full bullish reversal. As part of the deal, Ripple will integrate its RLUSD stablecoin into Hidden Road’s collateral infrastructure and shift post-trade operations to the XRP Ledger, enhancing transparency and operational speed. CEO Brad Garlinghouse labeled this move an “inflection point” in digital asset adoption, following the company’s $50M SEC settlement.

Technically, XRP appears to have established short-term support above $1.95, and if momentum continues, a breakout above $2.05 could serve as the next bullish trigger.

Source: TradingView

Source: X

XRP ETF Launch and Outlook: Derivative First, Spot Later?

Another major development this week was the launch of the Teucrium 2x Long Daily XRP ETF (XXRP) on NYSE Arca—the first U.S.-listed XRP ETF. This leveraged product, using derivatives rather than directly holding XRP, targets active traders seeking amplified exposure to daily price moves. While the ETF comes with heightened risk, its approval reflects the growing institutional interest in altcoins beyond Bitcoin and Ethereum. Meanwhile, the SEC has formally acknowledged Canary Capital’s application for a spot XRP ETF, initiating a 21-day consultation process.

Although approval is not guaranteed, analysts interpret this as a shift in regulatory openness. A spot ETF would offer safer and more transparent exposure to XRP, especially for retail and long-term investors. Teucrium’s derivative product may serve as a stepping stone toward that future, but the market still awaits a fully approved spot vehicle that could unlock broader participation.

Source: CNBC

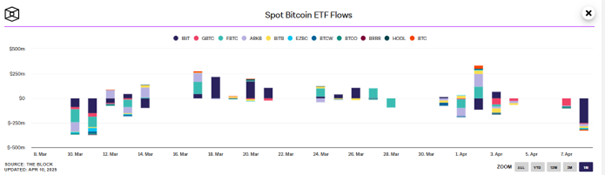

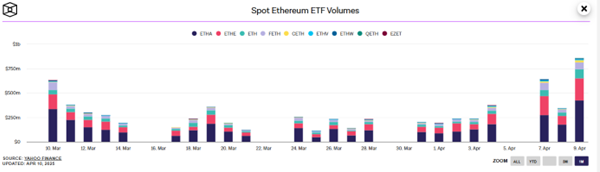

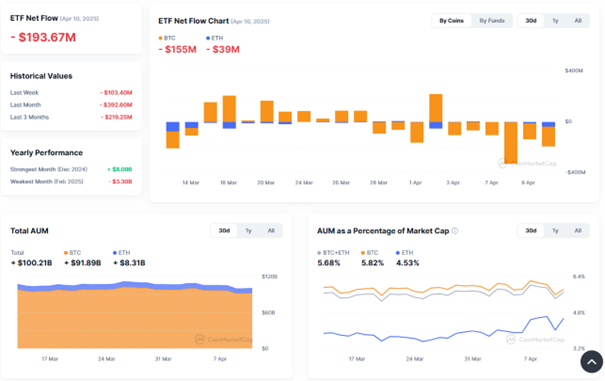

Crypto ETFs Bleed Nearly $200M as Market Sentiment Weakens

Crypto ETFs faced mounting pressure in early April, culminating in a sharp net outflow of $193.67 million on April 10. Bitcoin products led the decline with $155 million in redemptions, while Ethereum ETFs posted $39 million in outflows. This selloff aligns with a broader month-long trend—ETF products have now shed $392.6 million in the last 30 days. Despite the continued buzz around XRP and new listings, institutional appetite appears to be fading amid heightened geopolitical tension and persistent market uncertainty.

The total combined assets under management (AUM) for BTC and ETH ETFs remains over $100 billion, but the AUM as a percentage of overall market cap is slipping, with Bitcoin ETFs now accounting for 5.82% and Ethereum ETFs 4.53%. While ETF trading volumes surged briefly in early April, the persistent net outflows point to a risk-off sentiment dominating institutional strategies as April unfolds.

Source: TheBlock

Source: TheBlock

Source: Coinmarketcap

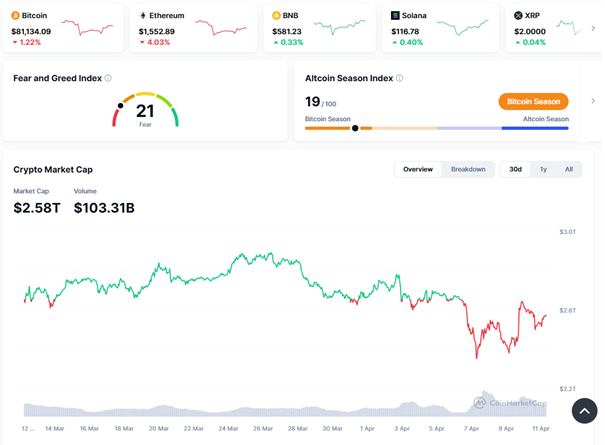

Market Overview: Volatility, Fear, and Shifting Narratives

As global markets digest the ripple effects of Trump’s tariff escalation, the crypto space is caught in a whirlwind of volatility, sharp ETF outflows, and growing macroeconomic unease. Bitcoin, traditionally hailed as digital gold, is now seen by some analysts as more resilient than the U.S. dollar itself, especially with the U.S. Dollar Index slipping and confidence in traditional finance fading.

However, the charts tell a sobering story. Over the past 30 days, Bitcoin ETFs have experienced a net outflow of $155 million, while Ethereum ETFs lost $39 million, with a combined crypto ETF net loss of nearly $194 million as of April 10. Ethereum remains under pressure, down over 13% weekly, reinforcing concerns about stagnation and its fading dominance in the face of faster-moving ecosystems.

The Fear & Greed Index stands at 21—deep in fear territory—while the Altcoin Season Index reads just 19, signalling that investor sentiment overwhelmingly favours Bitcoin over altcoins. Despite a $2.58 trillion market cap, the broader crypto market remains hesitant, with major tokens like ETH, XRP, and DOT posting double-digit losses.

Yet amidst this uncertainty, Ripple’s acquisition of Hidden Road and the arrival of leveraged XRP ETFs reflect a maturing, institution-facing infrastructure that continues to evolve despite the chaos.

Weekly Heatmaps:

Source: QuantifyCrypto

Source: Coinmarketcap