XRP: A Leader in Tokenized Finance

XRP is cementing its status as a trailblazer in cryptocurrency by spearheading advancements in tokenized finance. The recent collaboration between Ripple, Archax, and UK asset manager abrdn has introduced the first tokenized money market fund on the XRP Ledger (XRPL), a decentralized blockchain.

This integration of abrdn’s $3.8 billion US Dollar Liquidity Fund into the XRPL highlights the platform’s ability to deliver efficiency and cost savings in financial operations. Beyond operational benefits, this milestone emphasizes XRP’s expanding role in institutional decentralized finance (DeFi), paving the way for further innovations in real-world asset (RWA) tokenization. As tokenized assets are projected to reach $16 trillion by 2030, Ripple’s initiatives position XRP as a key player in transforming traditional financial markets.

SEC Developments and Ripple’s Legal Milestones

The upcoming resignation of SEC Chair Gary Gensler in January 2025 has sparked renewed optimism about Ripple’s legal and regulatory outlook. Ripple’s partial legal victory against the SEC in 2023 clarified XRP’s status as a non-security, bolstering investor confidence and solidifying its position in the market. This win removed a significant barrier for institutional investors, who had previously hesitated due to regulatory uncertainty. With President-elect Donald Trump signaling a pro-crypto agenda, the likelihood of a more favorable regulatory environment has increased. These developments could catalyze XRP adoption, helping it gain traction in institutional portfolios and opening doors to new financial use cases globally.

Source: X

Tokenization and XRPL’s Institutional Appeal

Ripple continues to set industry benchmarks with its tokenization initiatives on the XRPL, showcasing the blockchain’s institutional-grade capabilities. Designed with native functionalities like trading, escrow, and secure asset movement, the XRPL is a preferred choice for institutional applications. The recent $5 million allocation by Ripple into abrdn’s Lux fund demonstrates the company’s commitment to scaling tokenized RWA solutions on the XRPL. Ripple's decade-long experience in providing blockchain solutions has enabled it to build trust with institutional clients, further strengthening XRPL’s reputation. By collaborating with Archax and leveraging its custody solutions since 2022, Ripple ensures secure, compliant, and efficient asset management, driving adoption across traditional financial sectors.

Source: xrpl

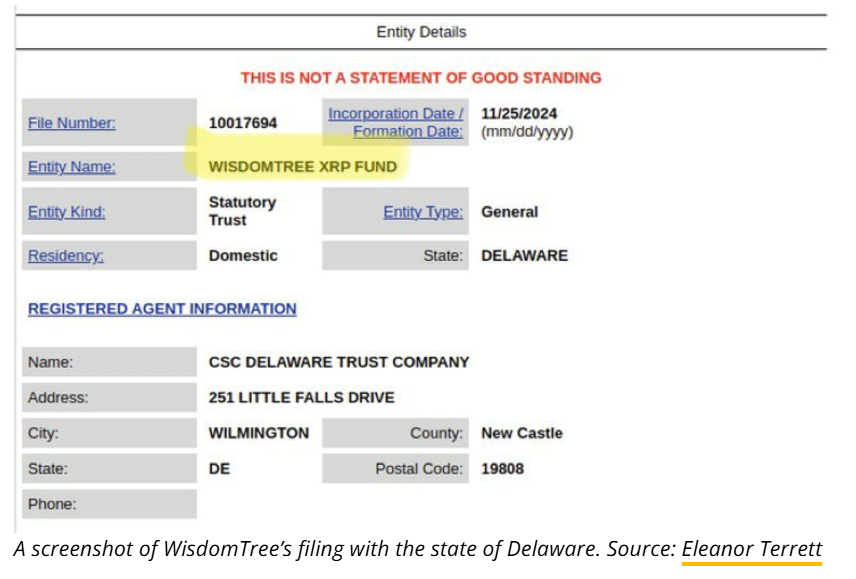

XRP Price Momentum and Market Performance

XRP has been a standout performer in the current crypto rally, trading at $1.38 with a 25% gain over the past week. This resurgence reflects the growing confidence in Ripple’s technology and its ability to navigate regulatory challenges. The token recently hit its highest price since May 2021, buoyed by optimism around potential ETF approvals and institutional adoption. The filing of an XRP ETF by WisdomTree in Delaware has amplified interest, with several firms like Bitwise and 21Shares following suit. Analysts suggest that the combination of regulatory clarity, increasing use cases, and macroeconomic tailwinds could propel XRP beyond its all-time high of $3.84, with predictions of a $10 target by 2025.

Source: X (Eleanor Terrett)

Ripple and Mercy Corps Ventures: Unlocking Opportunity for Financial Inclusion

Ripple has expanded its partnership with Mercy Corps Ventures (MCV) to launch Unlocking Opportunity, a program aimed at supporting entrepreneurs and small-medium enterprises (SMEs) in emerging markets. The initiative will provide financial and technical resources to startups leveraging blockchain and fintech innovation, including solutions built on the XRP Ledger (XRPL) and Ripple’s forthcoming Ripple USD stablecoin (RLUSD). With a focus on financial inclusion, the program targets transformative use cases such as savings, remittances, micropayments, and tokenization of real-world assets. Ripple’s commitment of over $5.5 million underscores its dedication to empowering underserved communities through innovative technologies, reinforcing its mission to create scalable, impactful solutions for global financial resilience. Through this partnership, Ripple and MCV aim to drive meaningful change, equipping entrepreneurs with the tools to implement Web3 technologies and address critical financial challenges in frontier markets.

Source: Ripple

Technical Analysis: XRP’s Bullish Outlook

XRP’s technical indicators reflect a strong bullish trend, with its price forming a rounded bottom pattern on the daily chart. The token recently tested resistance at $1.60, nearing its April 2021 high of $1.96. The Relative Strength Index (RSI) at 53 indicates sustained buyer interest while leaving room for further upward movement. Elevated open interest in XRP futures, which peaked at $2.68 billion, underscores growing market activity and investor confidence. Key resistance levels to watch are $1.60 and $1.96, with a potential breakout opening the path to $2.25 and beyond. Conversely, a close below $1.35 would signal a bearish reversal, with strong support likely around $0.93. The elevated on-balance volume (OBV) and converging RSI suggest that XRP remains poised for continued gains, contingent on broader market conditions and Bitcoin’s performance.

The Road Ahead for XRP

Ripple’s ongoing innovations, including the launch of tokenized money market funds, are setting the stage for significant growth. The XRPL’s scalability and cost-efficiency make it an attractive platform for institutional players seeking blockchain solutions. As regulatory clarity improves and President-elect Trump’s pro-crypto agenda unfolds, Ripple is well-positioned to expand its partnerships and market share. Ripple’s long-standing reputation for innovation, coupled with its ability to navigate legal and market challenges, strengthens its prospects for long-term success. While challenges such as market volatility persist, XRP’s strong fundamentals, robust institutional backing, and expanding use cases ensure it remains a leading contender in the rapidly evolving cryptocurrency space.

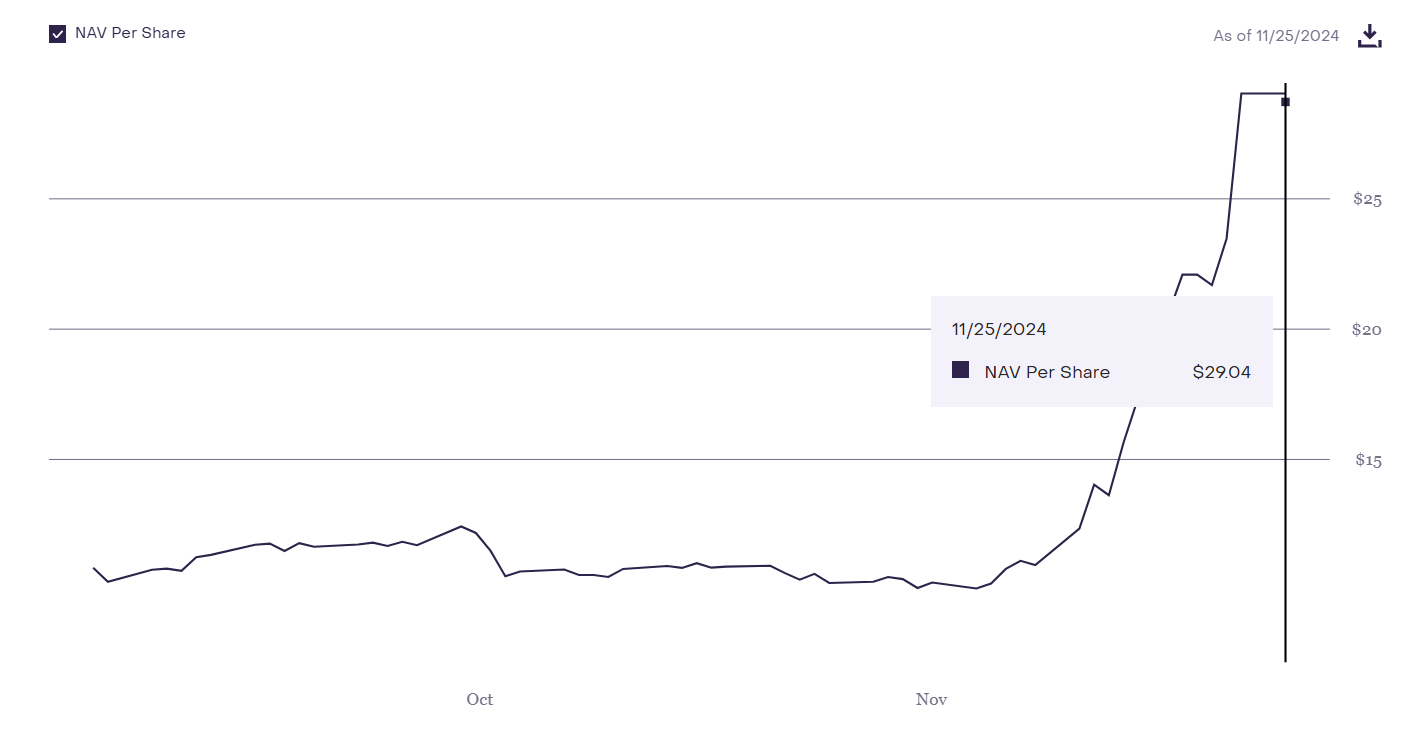

Grayscale XRP Trust

Source: Grayscale