Crypto Weekly Wrap: 21st March 2025

The cryptocurrency industry continues to evolve rapidly, with new ETF filings, legal battles, and institutional adoption shaping the market. This update explores the most significant recent developments, including Solana and Ripple news, Ethereum’s network growth, stablecoin adoption, and the impact of macroeconomic factors on crypto prices. Additionally, we analyze technical trends in major cryptocurrencies, providing insights into their future trajectories.

Solana Futures ETF: A Step Toward Institutional Adoption?

The first Solana futures exchange-traded fund (ETF) is set to debut, marking a milestone in institutional investment. Volatility Shares launched two Solana futures ETFs, SOLZ and SOLT, on March 20.

We believe this ETF could boost Solana’s liquidity and demand, bringing it closer to Ethereum’s market capitalization. However, some experts remain skeptical, warning that investor inflows could be limited, similar to what happened with Ethereum spot ETFs, which lagged behind Bitcoin ETFs in terms of capital attraction.

Source: Volatility Shares

Despite these concerns, institutional adoption of Solana appears to be growing. U.S. President Donald Trump’s inclusion of Solana in the country’s crypto strategic reserve, alongside Cardano, has further strengthened its legitimacy.

From a technical perspective, Solana (SOL) is currently consolidating around $127.83. The RSI (Relative Strength Index) stands at 44.79, signaling neutral momentum, while 24-hour volume is at 116.11M, indicating a steady level of market activity. The price recently faced resistance around $134, with support holding near $126. If bullish momentum increases, SOL could break past $130 and test $135, but failure to maintain current levels may result in a retest of the $124 support zone.

Source: TradingView

Ripple’s Legal Victory: A Win for Crypto?

Ripple has secured a major legal victory as the SEC has dropped its appeal, effectively ending one of the most high-profile regulatory battles in the crypto industry. CEO Brad Garlinghouse stated that this decision provides certainty for Ripple, although some legal uncertainties remain.

While Ripple is celebrating the outcome, experts caution that this case does not set a legal precedent for other crypto firms. The SEC’s withdrawal does not establish new regulations, meaning future legal battles could arise unless Congress introduces a clear crypto regulatory framework.

Despite the mixed legal implications, the market reacted positively, with XRP surging by 9% within an hour of the announcement. However, Ripple still faces a $125 million penalty and a five-year prohibition on fundraising, which could impact its future operations.

XRP is currently trading at $2.39865, showing a slight decline. The RSI (Relative Strength Index) is at 42.14, indicating that XRP is approaching oversold levels. Volume in the past 24 hours stands at 63.69M, suggesting that the initial surge in buying activity has slowed. If XRP fails to hold support around $2.35, a further retracement toward $2.25 is possible. However, a breakout above $2.45 could signal renewed bullish momentum.

Source: TradingView

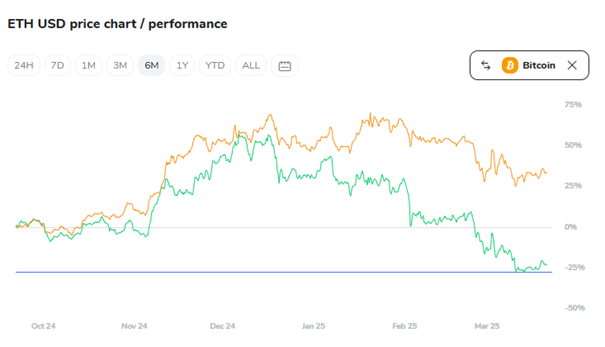

Ethereum Performance Analysis

Ethereum continues to cement its position as the leading smart contract platform, with Coinbase emerging as the largest node operator on the Ethereum network.

At the same time, Ethereum’s ETH/BTC ratio has hit a five-year low, signaling that Ethereum is underperforming compared to Bitcoin. This has raised concerns among investors, as Ethereum struggles to maintain momentum despite a broader crypto market recovery.

Ethereum (ETH) is currently trading at $1,961.42, reflecting a slight dip. The RSI (Relative Strength Index) sits at 34.99, approaching oversold territory, which could indicate a potential rebound if buying pressure increases. The 24-hour volume stands at 202.82M, showing consistent trading activity. Key resistance lies at $2,000, and a breakout above this level could push ETH towards $2,060. However, if selling pressure continues, Ethereum may retest the $1,940 support zone.

We believe that Ethereum’s dominance in DeFi and institutional staking services will help it retain its market position. However, competition from Solana and other Layer 1 blockchains is growing, which could put pressure on Ethereum’s market share in the long term.

Source: TradingView

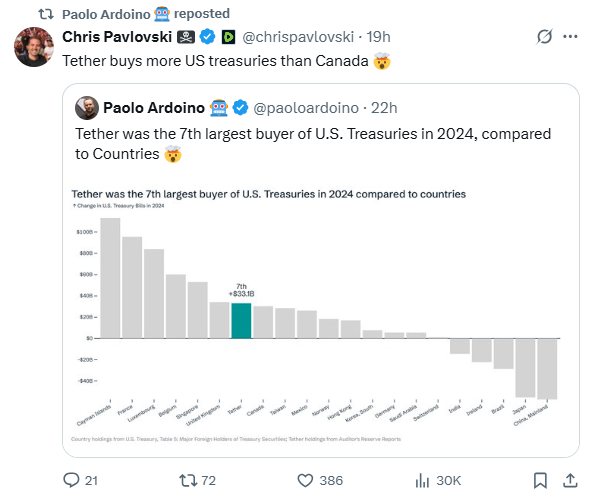

Stablecoins on the Rise: Tether Surpasses Global Economies

Stablecoins are experiencing significant growth, with Tether (USDT) becoming the seventh-largest holder of U.S. Treasury securities, surpassing countries like Canada and Taiwan. This demonstrates the increasing demand for stablecoins as a reliable store of value and means of exchange.

Tether’s holdings in U.S. Treasuries now exceed $33.1 billion, reinforcing its role in global finance. The rise of stablecoins has also increased regulatory scrutiny, with U.S. lawmakers expected to pass stablecoin legislation by August. A clearer regulatory framework could further accelerate stablecoin adoption and boost investor confidence in the sector.

Source: X

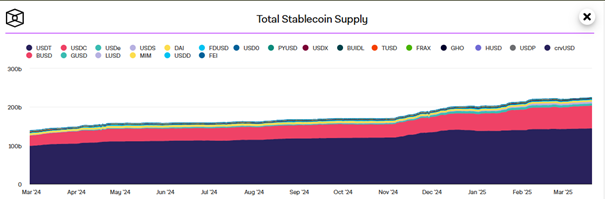

Meanwhile, the total stablecoin market supply has surpassed $219 billion, with analysts suggesting that the current bull market is still in its mid-cycle rather than reaching its peak.

Source: DefiLlama, TheBlock

Macroeconomic Impact on Crypto Prices

The Federal Reserve has confirmed that interest rate cuts are likely in 2025, fueling optimism across both traditional and crypto markets. Bitcoin (BTC) is currently trading at $84,134.53, up 1.91%.

President Donald Trump has urged the Fed to cut rates sooner, arguing that easing tariffs could stimulate the U.S. economy. However, Fed Chair Jerome Powell has maintained a cautious stance, stating that rates will remain elevated if economic conditions require tighter policy.

Source: Reuters

This macroeconomic uncertainty has impacted cryptocurrencies in various ways. Ethereum (ETH) has gained 3.99%, trading at $1,969.39, while BNB saw a significant 9.21% surge, reaching $631.79. Other notable gainers include XRP (+4.17%), DOT (+10.08%), and TONCOIN (+28.18%), showing strong investor interest in alternative assets.

However, some altcoins faced losses. Cardano (ADA) is down 1.1% at $0.71, Dogecoin (DOGE) dropped 1.06%, and Hedera (HBAR) fell 3.2%, highlighting mixed sentiment in the market. Pi Network (PI) experienced the biggest drop, crashing by 42.47% to $0.9002.

The overall market recovery is evident, but uncertainty over trade policies and inflation continues to influence investor sentiment. Analysts suggest that if economic pressures increase, the Fed may be forced to lower rates sooner than expected, which could benefit risk assets like cryptocurrencies in the long run.

Weekly Heatmap

Source: QuantifyCrypto

Bybit Hack: The Largest Crypto Heist in History

Bybit recently suffered the biggest hack in crypto history, losing over $1.4 billion in digital assets. Blockchain security firms have identified North Korea’s Lazarus Group as the likely perpetrator behind the attack.

Despite efforts to launder the stolen funds, nearly 89% of the hacked assets remain traceable, raising hopes of partial recovery. Bybit has offered a 10% bounty for white-hat hackers and investigators who can help track the stolen funds.

This incident highlights the ongoing security risks in the crypto industry, even for major centralized exchanges with strong security measures. Analysts warn that more sophisticated cyberattacks could emerge in the future, emphasizing the need for enhanced blockchain security and decentralized solutions.

Source: X

Dubai’s Real Estate Tokenization: A Blockchain Breakthrough

Dubai has announced the pilot phase of its real estate tokenization project, positioning itself as a global leader in blockchain adoption. The Dubai Land Department (DLD) is working with Dubai Virtual Assets Regulatory Authority (VARA) and Dubai Future Foundation (DFF) to tokenize property title deeds.

Source: X

The initiative aims to increase real estate liquidity, enable fractional ownership, and attract global investors. Dubai expects the tokenized real estate market to reach $16.4 billion by 2033, accounting for 7% of the city's total property transactions.

This move could set a precedent for other global real estate markets, demonstrating how blockchain technology can revolutionize traditional asset ownership.

Source: X

Final Thoughts

The crypto market is at a pivotal moment, with institutional adoption, legal battles, and macroeconomic factors shaping its future. While regulatory clarity remains uncertain, developments such as the Solana futures ETF, Ripple’s legal victory, Ethereum’s network expansion, and Dubai’s blockchain initiatives indicate growing mainstream integration.

Despite security concerns and market volatility, investor confidence remains strong, with stablecoin adoption and ETF approvals paving the way for further crypto market maturity. As 2025 approaches, the industry’s long-term growth potential remains promising, provided that regulatory challenges and security risks are effectively managed.