Crypto Weekly Wrap: 28th March 2025

Bitcoin Market Outlook: Conservative Optimism Amid Regulatory Shifts

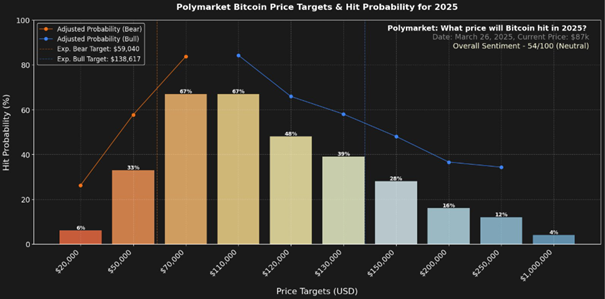

As Bitcoin continues to chart its course through the first quarter of 2025, market sentiment is showing signs of cautious optimism. Despite macroeconomic headwinds and shifting political landscapes, BTC currently hovers around $84,000, with some analysts predicting a ceiling of $138,000 for this bull cycle. Data from prediction markets like Polymarket reflect tempered enthusiasm, with expectations that Bitcoin’s gains this year may max out at around 60%. Analysts assessment of user sentiment across multiple betting arenas placed BTC’s potential trading range between $59,040 and $138,617 by the end of the year. While this may seem underwhelming for hardcore Bitcoin bulls accustomed to six-figure forecasts, the market remains grounded as it absorbs regulatory developments and economic policy changes under the Trump administration.

Source: Polymarket, X

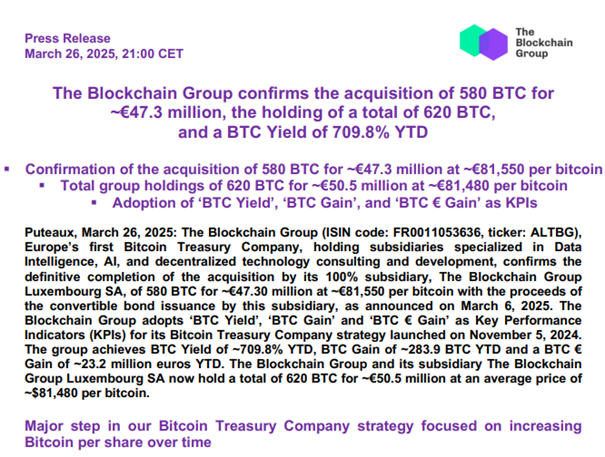

The Blockchain Group Deepens Bitcoin Commitment with Strategic Acquisition

In a bold display of confidence in Bitcoin's long-term value, The Blockchain Group, Europe’s first Bitcoin Treasury Company, has confirmed the acquisition of 580 BTC for approximately €47.3 million, bringing its total holdings to 620 BTC valued at around €50.5 million. The purchase, made through its 100% subsidiary The Blockchain Group Luxembourg SA, was executed at an average price of €81,550 per bitcoin, slightly below the group's overall average of €81,480 per BTC. This move follows a convertible bond issuance earlier in March 2025 and is part of the group’s treasury strategy launched in November 2024. To measure performance, the company has adopted innovative KPIs including ‘BTC Yield’, ‘BTC Gain’, and ‘BTC € Gain’—metrics that now show a BTC Yield of 709.8% YTD, a BTC Gain of 283.9 BTC, and a BTC € Gain of €23.2 million. The acquisition marks a major step in the company’s strategy to increase Bitcoin per share over time, positioning The Blockchain Group as a leading corporate force in Bitcoin treasury adoption across Europe.

Source: theblockchain-group.com

Institutional Appetite for Bitcoin Grows With Treasury Accumulations

The Blockchain Group’s accumulation strategy underscores a broader trend of corporate Bitcoin adoption. Since November 2024, the firm’s stock has surged 225%, thanks in part to strategic BTC purchases aligned with major market events. Similar moves by companies like GameStop and MicroStrategy, which recently surpassed 500,000 BTC in reserves, suggest that corporate treasuries are increasingly viewing Bitcoin as a viable financial asset. This behavior has prompted 41 Bitcoin reserve bills to emerge across 23 U.S. states. States like Kentucky and Oklahoma are already enacting laws to support digital asset treasuries, with Oklahoma’s “Strategic Bitcoin Reserve Act” passing the House and awaiting Senate confirmation. These developments highlight a growing effort to integrate Bitcoin into public finance frameworks.

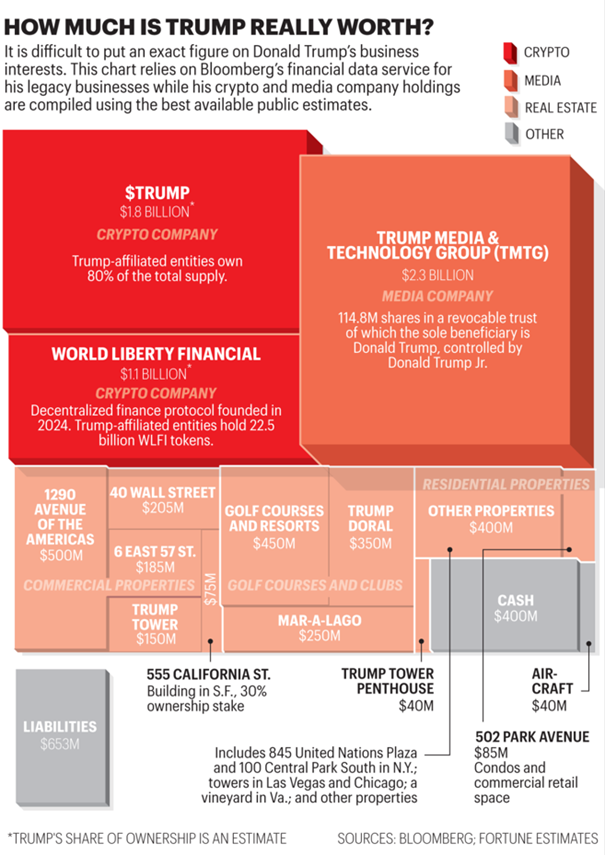

Challenges Ahead: Trump’s USD1 Stablecoin Sparks Controversy

While institutional interest in Bitcoin is rising, the launch of President Trump’s stablecoin project, USD1, has triggered a wave of controversy. Released under World Liberty Financial (WLFI), a crypto venture linked to the Trump family, the stablecoin claims to be 100% backed by U.S. Treasuries and fiat reserves. However, legal experts have raised red flags about potential violations of the U.S. Constitution’s emoluments clause, citing conflicts of interest due to Trump’s 60% ownership of WLFI. Critics argue that this project could enable foreign actors to gain influence over U.S. policy through stablecoin investment, compromising the financial system’s integrity. While USD1 is pitched as a tool for cross-border transactions, it also poses regulatory risks and may distort the stablecoin market landscape.

Source: Fortune

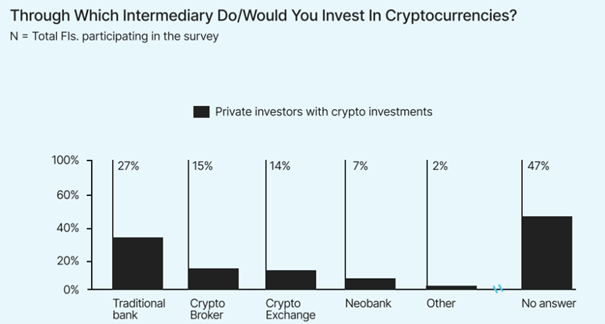

European Market Lag: Institutions Struggle to Meet Crypto Demand

Across the Atlantic, European banks are grappling with their own crypto challenges. A recent Bitpanda survey found that fewer than 20% of EU financial institutions currently offer crypto services, despite growing demand. Over 40% of European business investors already hold digital assets, yet only 19% of banks recognize this demand. The main barrier appears to be internal — a lack of resources or expertise — rather than regulatory uncertainty. With MiCA (Markets in Crypto-Assets Regulation) now providing clear guidance, Bitpanda’s deputy CEO Lukas Enzersdorfer-Konrad warns that banks delaying crypto integration risk losing both customers and revenue. Notably, 27% of retail investors said they would prefer to invest in crypto through traditional banks, suggesting that established financial players could reclaim significant market share if they adapt quickly.

Source: BitPanda

Technical Analysis: BTC Price Holding Key Support, Cautious Bulls Remain

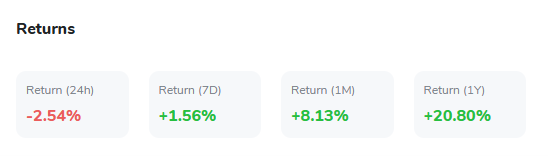

Bitcoin is currently trading around $85,100 after a recent -2.54% dip in the past 24 hours, though it still holds a +1.56% gain over the week and +8.13% over the month. RSI readings sit at 39.59, signaling a slight bearish divergence but not yet oversold territory.

From a technical standpoint, Bitcoin is clinging to crucial support zones amid increasing volatility.

Despite the pullback, trading volume remains healthy, with 24-hour volume near 134 million, indicating active market participation. Forecast models still suggest that BTC could rally toward the $130,000–$138,000 range if institutional interest picks up and macroeconomic tailwinds such as rate cuts and ETF demand continue to support the asset class.

Source: TradingView

Zebec Network Launches Mastercard-Powered Crypto Debit Card

Zebec Network, built on Solana, has introduced Zebec Carbon—a new crypto debit card developed in collaboration with Mastercard. The card allows users to spend stablecoins like USDC anywhere Mastercard is accepted, with instant fiat conversion at the point of sale. It features zero fees, no ID verification for U.S. residents, and full compatibility with Apple Pay and Google Pay. With a $1,000 transaction cap and a $10,000 daily limit, Zebec Carbon focuses on ease of use and privacy.

This launch places Zebec among a growing number of crypto platforms integrating digital assets with real-world commerce. Competitors like MetaMask, Floki, and Avalanche have also rolled out crypto debit cards supporting a range of tokens and blockchain networks. Meanwhile, Mastercard continues deepening its blockchain involvement by linking its Multi-Token Network with J.P. Morgan’s Kinexys Digital Payments platform to improve global cross-border payments. The momentum behind these developments signals a broader shift—crypto payments are increasingly becoming a practical part of daily financial life.

Source: X

Solana Technical Analysis: Volatility Increases Near Key Support

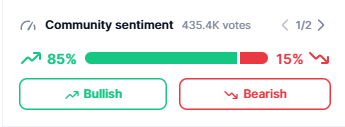

Solana (SOL) is currently trading at around $130.94, showing a slight weekly gain of 2.22%, though recent price action suggests bearish pressure is mounting. The RSI has dropped to 31.78, signaling that the asset is approaching oversold territory. Volume remains relatively stable at 134.79 million, but momentum is weakening, as indicated by the steep decline from recent highs above $145.

Source: Coinmarketcap

Source: Coinmarketcap

Despite this, the community remains highly bullish, with 85% of over 435,000 voters expressing positive sentiment. Support is currently being tested in the $130 range, and if this level breaks, SOL could revisit the $125 zone. However, the broader trend still leans bullish, especially if price rebounds with increasing volume and RSI recovery.

Source: TradingView

Wyoming Stable Token Nears Launch, Pioneering State-Backed Digital Dollar

Wyoming is preparing to roll out its state-issued stablecoin, WYST, in July 2025, marking a major step in integrating blockchain into public financial infrastructure. Backed by U.S. dollars, treasuries, and repurchase agreements, WYST will be fully collateralized with a 102% reserve ratio and aims to enable fast, low-fee global transactions. The state is considering nine blockchain platforms for deployment, including Ethereum, Solana, and Polygon. Governor Mark Gordon emphasized transparency and innovation, stating that WYST could open new markets for residents and provide a new revenue stream through interest on reserves. The project already completed successful testnet transfers via LayerZero’s Stargate protocol, signaling solid progress toward full implementation.

Source: X

Weekly Crypto Market Overview: Key Movers and Shifting Sentiment

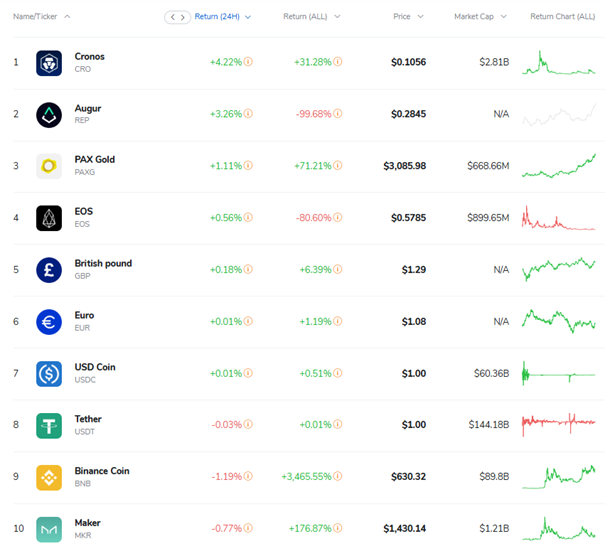

It was a dynamic week across the crypto space marked by institutional momentum, rising adoption, and growing regulatory activity. Bitcoin continues to dominate headlines, holding support above $85K while maintaining its bullish structure despite recent volatility. Solana gained traction with the Zebec-Mastercard partnership and strong ETF speculation, while Cronos saw renewed investor interest after its Trump Media collaboration and ahead of its zkEVM upgrade.

Ethereum's market presence remains solid, but its network activity continues to cool. Meanwhile, Wyoming’s WYST stablecoin and EU crypto banking trends reflect evolving institutional integration. According to today’s attached heatmaps, SUI, Toncoin, and AVAX stood out with double-digit weekly gains, while ETH and XRP faced pullbacks. Iconomi’s top 24H Return performers include Cronos, PAXG, and REP. In short, while market sentiment remains cautiously optimistic, today’s landscape confirms a growing maturity in the crypto sector, where utility, regulation, and strategic partnerships are steering long-term direction.

Source: QuantifyCrypto