Cronos (CRO): Latest Developments, Price Trends, and Technical Analysis

Cronos (CRO) Price Explodes After Trump Media Deal: A Closer Look at the Token’s Latest Surge and Market Sentiment

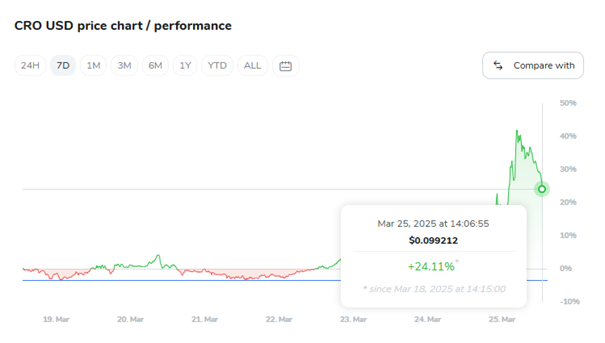

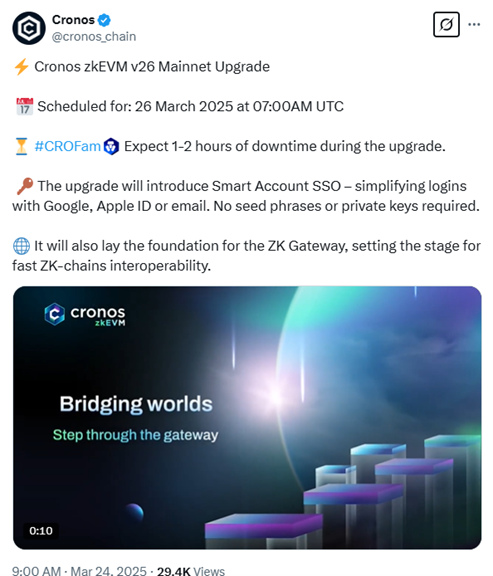

The Cronos (CRO) token has made a significant splash in the crypto market following a major announcement involving a partnership between Trump Media and Technology Group (TMTG) and Crypto.com. With the token rallying by over 27% in 24 hours, hitting highs around $0.12 before retracing slightly to $0.0991, CRO has become one of the most talked-about tokens this week. In this report, we’ll explore the latest developments, price action, technical indicators, and underlying concerns shaping Cronos’s current trajectory.

Source: ir.tmtgcorp.com

Trump Media & Crypto.com Partnership Boosts CRO

The rally in Cronos began after TMTG, which owns Truth Social, announced a strategic partnership with Crypto.com to develop exchange-traded funds (ETFs). These ETFs will offer exposure to Bitcoin, Cronos, and various industries like energy. Branded under “Truth.Fi,” they’re expected to launch across U.S., European, and Asian markets, pending regulatory approval. This marks a major milestone in bridging traditional finance and digital assets and places CRO in the spotlight as a key token in this ETF lineup.

The announcement sparked immense investor interest, with trading volume spiking from $21 million to $326.47 million, and market cap surging to $2.8 billion. According to the daily chart, this upward movement aligns with a longer-term reversal, positioning CRO for a potential trend shift.

Source: X

Price Performance and Technical Analysis

CRO’s 24-hour return stands at +21.26%, while the weekly gain is +24.70%, and the monthly performance is +33.49%, according to market data. Despite a one-year loss of over 30%, the recent rally suggests renewed momentum. The CRO/USD chart shows the price facing resistance at the $0.12 level, forming a bearish inside bar followed by two consecutive red candles — indicating short-term correction.

CRO’s Technical Setup Signals Cautious Optimism

Cronos (CRO) recently experienced a notable rally, driven by bullish fundamentals like the Trump Media ETF partnership and the upcoming zkEVM v26 upgrade, but technical indicators now signal short-term caution. After peaking near $0.12, CRO faced strong resistance and began retracing, currently trading around $0.0991 with a 0.60% intraday drop. The RSI sits at 20.86, indicating the token is in oversold territory, though the persistent downtrend suggests weakening momentum.

Trading volume surged to 22.86 million during the rally but has since cooled, reflecting buyer hesitation or profit-taking. If CRO holds support at $0.09, it could bounce back toward $0.105 and eventually retest the $0.12 resistance; however, a breakdown below $0.09 may trigger a deeper correction. Longer-term, CRO’s structure remains bullish, with a quadruple-bottom pattern since August 2023 at $0.0715 and a neckline target of $0.2332. The token has also climbed above its 50-day moving average, reinforcing upward momentum. While macro factors support growth, traders should watch for consolidation or minor pullbacks before the next breakout attempt, especially if volume and RSI fail to recover soon.

Source: TradingView

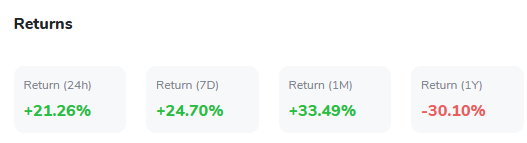

Cronos zkEVM v26 Upgrade Set for March 26

Fueling optimism further is the upcoming Cronos zkEVM v26 upgrade, which introduces key features like Smart Account SSO for smoother login via Google or Apple ID and lays the groundwork for the ZK Gateway to enable fast interoperability across zk-chains. The upgrade will involve a brief 1–2 hour downtime but is expected to enhance scalability and user experience, encouraging adoption among developers and institutions.

Source: X

The current total value locked (TVL) on the Cronos network is up from $330 million to $424 million, signaling a recovery in DeFi activity on the chain. However, the Cronos zkEVM ecosystem still faces challenges, with its TVL standing at just $13 million, suggesting that broader traction is yet to be achieved.

Source: DefiLlama

CRO Strategic Reserve Vote Sparks Governance Controversy

While the ETF partnership and upgrade have been received positively, Crypto.com is also under fire after reversing a previously celebrated 70 billion CRO token burn. Initially touted in 2021 as “the largest token burn in history,” the burn was reversed following a vote dominated by Crypto.com-linked validators, leading to the reissuance of the tokens and raising the total supply back to 100 billion.

The move triggered backlash across social media, with accusations of vote manipulation and centralized control. CEO Kris Marszalek defended the company’s overall financial stability but failed to directly address concerns about the tokenomics and fairness of the vote.

This governance issue has introduced uncertainty among some investors, who now question the company’s long-term commitment to decentralization and community governance.

Source: X

Cronos' Roadmap and Role in ETFs

According to Crypto.com’s roadmap, the CRO token will play a central role in its ecosystem, serving as the “economic engine” for future integrations. The upcoming ETFs backed by CRO are part of a broader initiative to position the token as a bridge between traditional and decentralized finance.

By handling backend infrastructure and custody through its Crypto.com Custody Trust Company, and offering the ETF through its U.S. broker-dealer arm, Crypto.com aims to make these investment products accessible to both retail and institutional investors.

Mixed Sentiment Amid Strong Fundamentals

While fundamentals surrounding CRO appear strong in light of major partnerships and protocol upgrades, the controversy around token reissuance continues to cast a shadow. Social media reaction has been mixed, with some praising the token’s momentum while others criticize the governance structure.

Still, short-term sentiment remains bullish, especially with President Donald Trump vocally endorsing cryptocurrencies and vowing to make the U.S. the “undisputed Bitcoin superpower.” His backing could bring more mainstream attention to crypto ETFs and further fuel CRO’s market activity.

Conclusion

Cronos (CRO) is in a pivotal moment. With its explosive price action driven by major news, upcoming technical upgrades, and ETF integration, the token shows strong upside potential. Yet, governance concerns and centralization fears remain valid. Investors should keep an eye on how the zkEVM upgrade unfolds on March 26 and whether the market sustains confidence in the token’s revised supply dynamics. If successfully executed, CRO could solidify its position as a top-tier altcoin for both utility and investment exposure in the coming cycle.