Crypto Weekly Wrap: 8th November 2024

Bitcoin’s New Highs Amid Trump’s Election Win and Pro-Crypto Policies

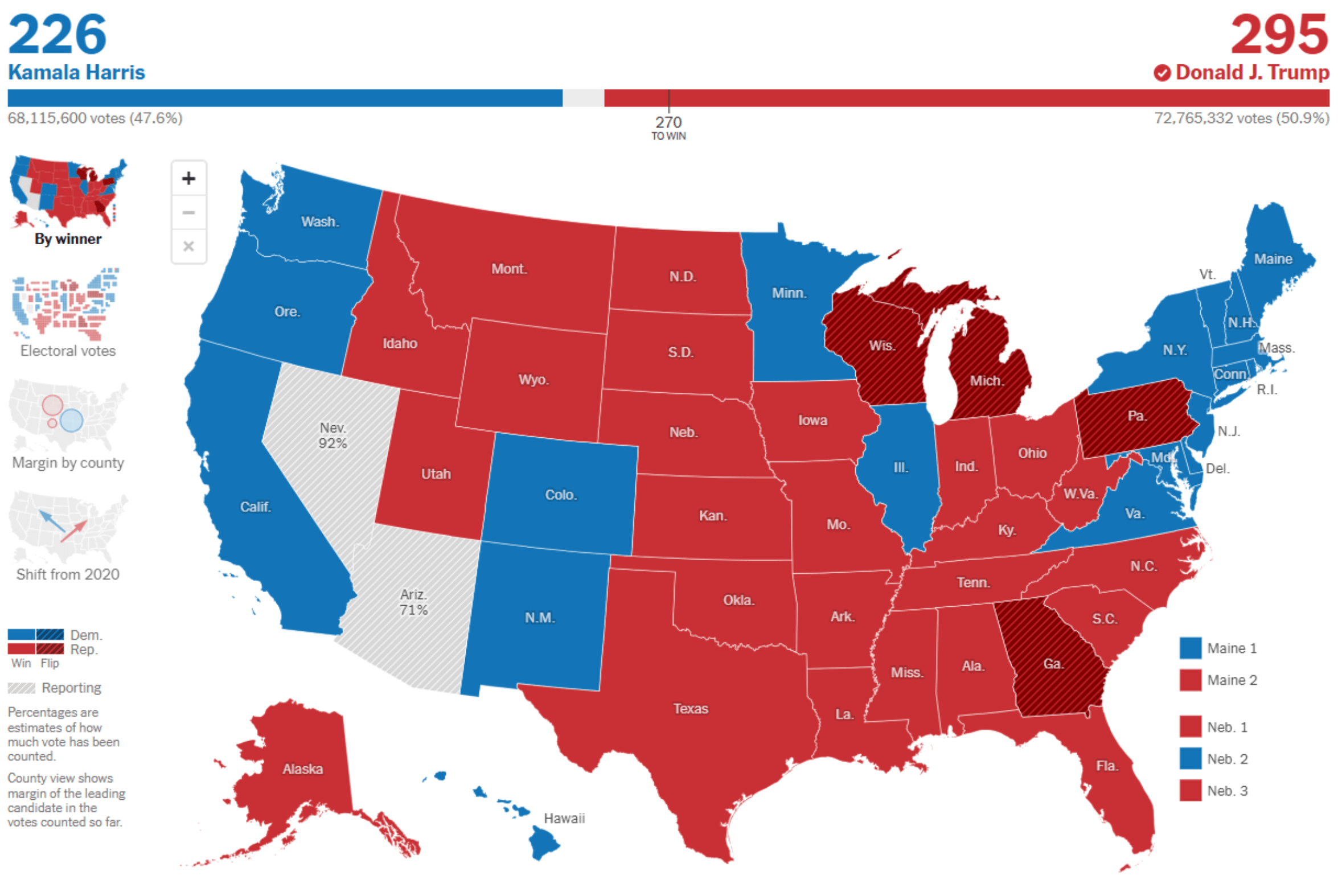

Bitcoin recently hit an all-time high of nearly $76,500 following Donald Trump’s election victory, marking a new milestone driven by optimism for his crypto-friendly agenda. Trump’s platform included policies like establishing a strategic Bitcoin reserve, which has sparked significant interest and boosted confidence across the cryptocurrency market. In response, Bitcoin has surged alongside stocks of major crypto-focused companies such as Coinbase and MicroStrategy, as well as altcoins like Ethereum and Dogecoin. With pro-crypto sentiment soaring, analysts suggest Bitcoin could reach $100,000 by early next year, spurred by Trump’s proposed regulatory changes and investor enthusiasm for a crypto-supportive administration.

Source: nytimes.com

Ethereum’s Whale Reactivation and Future Outlook

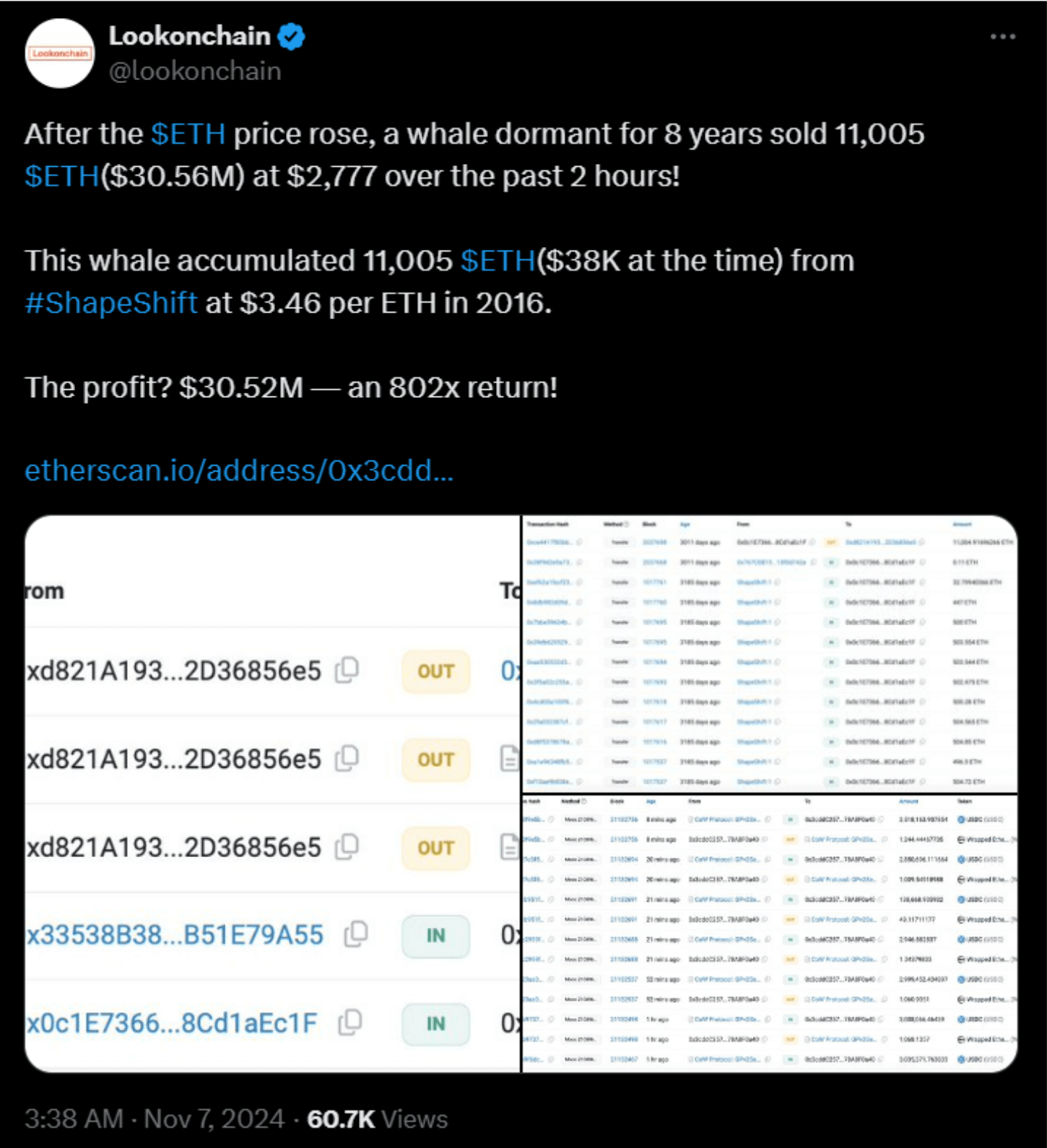

In recent market developments, a dormant Ethereum whale reactivated after eight years, selling 11,005 ETH at a profit of over $30 million. Initially acquired at $3.46 per ETH in 2016, this sale represents an extraordinary 802x return. This significant sale has led market analysts to closely watch Ethereum’s future price action, with expectations that Ethereum could soon experience a rally following Bitcoin’s recent highs. Market sentiment around Ethereum remains strong, particularly with increasing institutional interest in Ethereum ETFs and the asset’s improving technical indicators. Many analysts anticipate Ethereum may reach new heights if the current crypto bull market continues.

Source: X

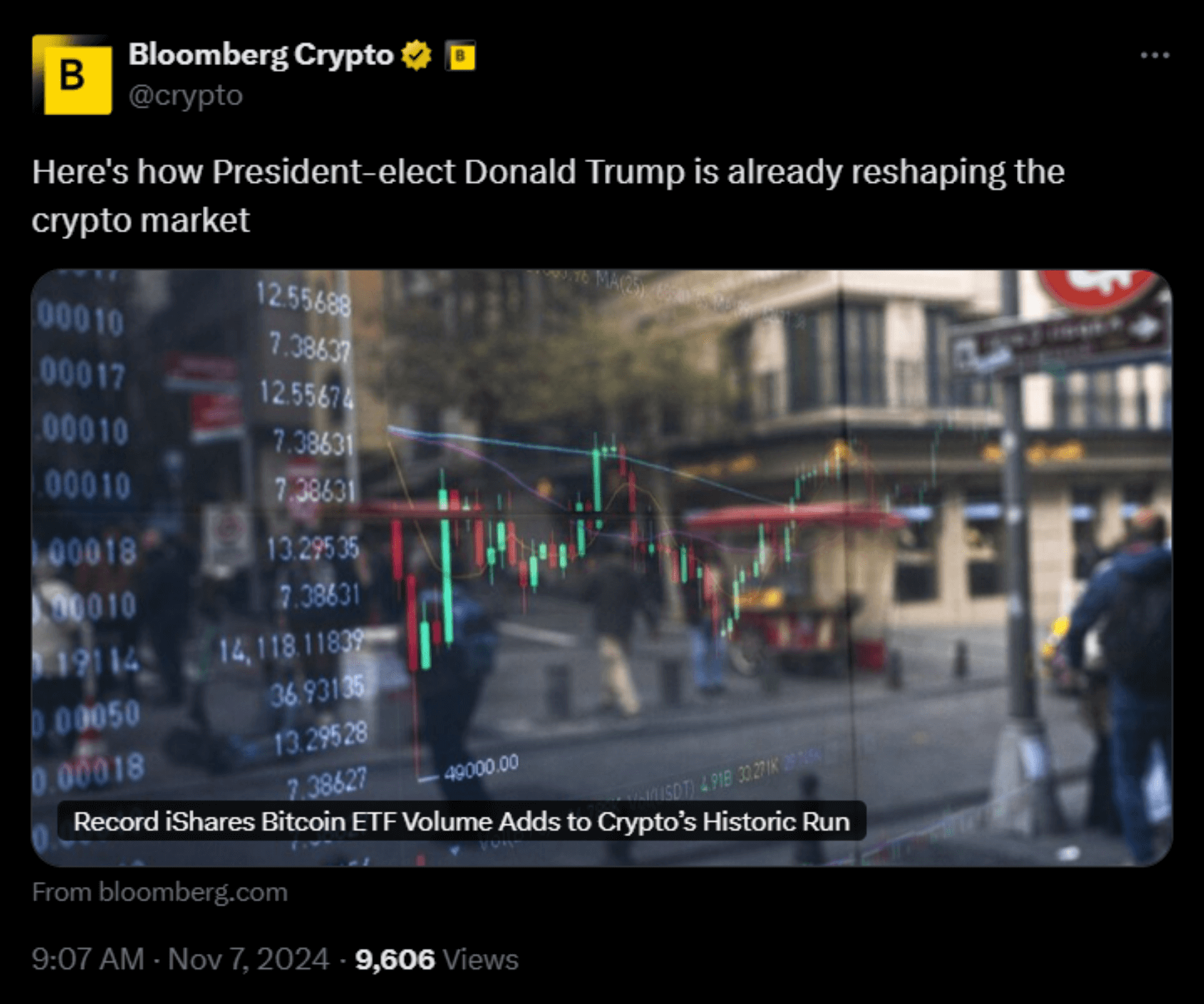

Record ETF Inflows Highlight Growing Institutional Demand

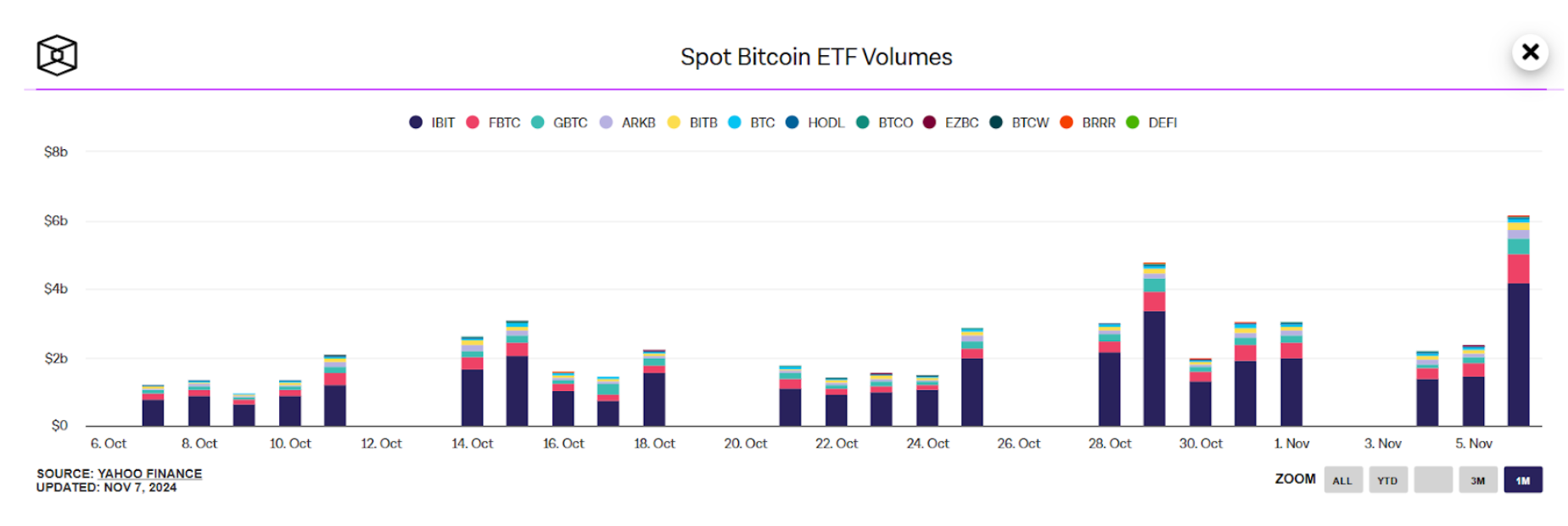

Record-breaking inflows into U.S.-based Bitcoin ETFs demonstrate increasing institutional appetite for cryptocurrency exposure within regulated investment vehicles. On Election Day alone, Bitcoin ETFs saw inflows surpassing $4.1 billion, with BlackRock leading the pack. This spike reflects the heightened interest among institutional investors, as Trump’s win has instilled confidence that his administration will introduce favourable regulations for crypto markets. Analysts forecast that continued ETF inflows could drive Bitcoin’s price even higher, making Bitcoin ETFs an attractive option for those looking to gain exposure without directly purchasing digital assets. With major players like BlackRock and Fidelity involved, Bitcoin ETFs are emerging as a bridge between traditional finance and the burgeoning crypto space.

Source: TheBlock

Technical Analysis: Key Bitcoin Levels and Potential Pullback

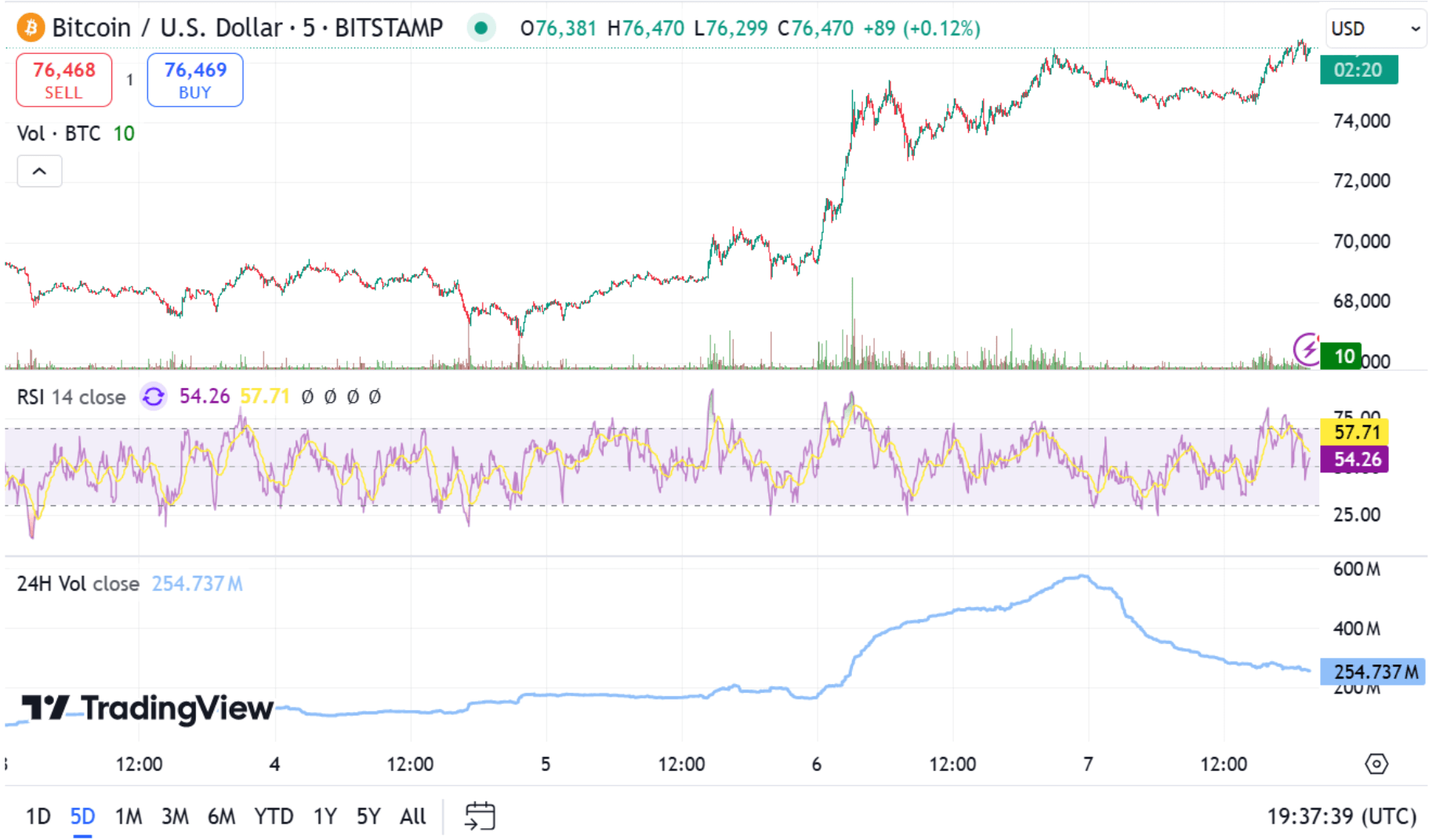

Bitcoin’s recent rally to $76,500 has hit a significant resistance level, corresponding to the 127.2% Fibonacci extension. The Relative Strength Index (RSI) currently indicates overbought conditions, at 54, suggesting a possible short-term pullback. The appearance of an inverted hammer candlestick pattern further hints at potential downward pressure, and Bitcoin could test support levels at $73,610, with additional support at $72,125 and $71,017 if the decline intensifies. However, if Bitcoin manages to break through the resistance at $75,450, it could aim for the next resistance target at $77,807, setting the stage for continued bullish momentum. This consolidation phase might be crucial for Bitcoin’s trajectory, and a clear break could bring about a sustained rally into the new year.

Source: TradingView

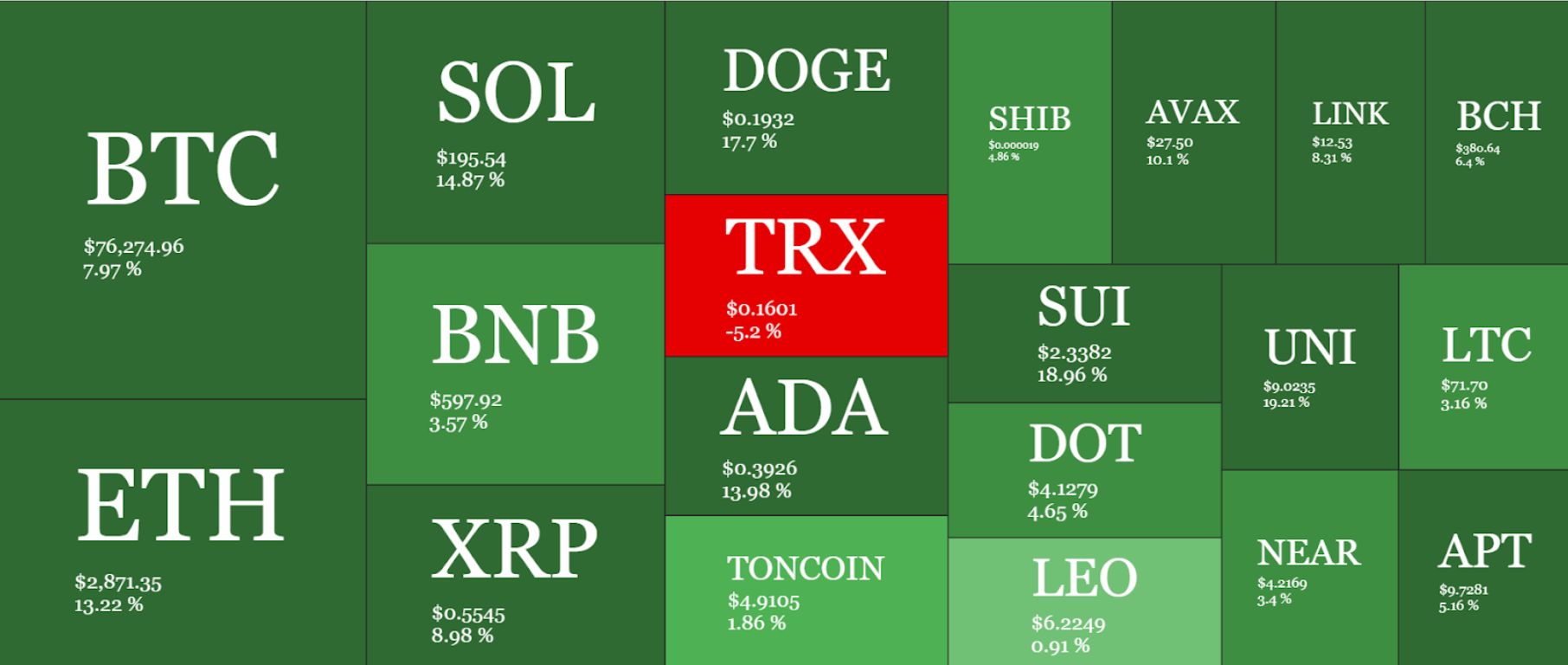

Spotlight on Altcoins: Ethereum, Solana, and Dogecoin

While Bitcoin has captured the headlines, several altcoins are also experiencing significant growth. Ethereum has crossed the $2,800 level, with traders anticipating a potential “monster rally” due to growing demand and bullish sentiment. Solana’s price has also been trending upwards, benefiting from increased decentralised finance (DeFi) and NFT activity on its blockchain. Meanwhile, Dogecoin, often considered a meme coin, is riding the wave of market optimism, reaching new monthly highs. Altcoin performance remains mixed but promising, with many analysts suggesting that coins like Ethereum and Solana could experience more substantial gains if Bitcoin’s momentum continues to attract new investors to the market.

Weekly Performance

Source: QuantifyCrypto

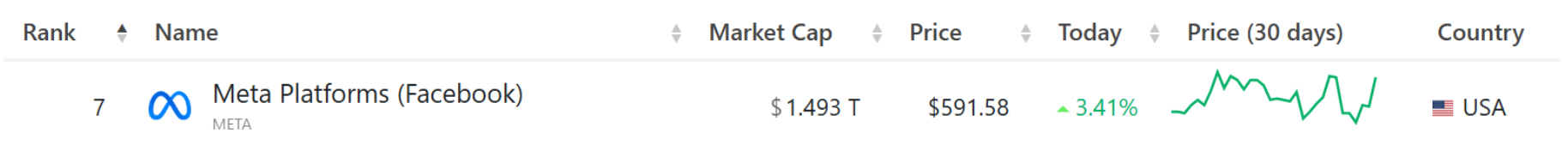

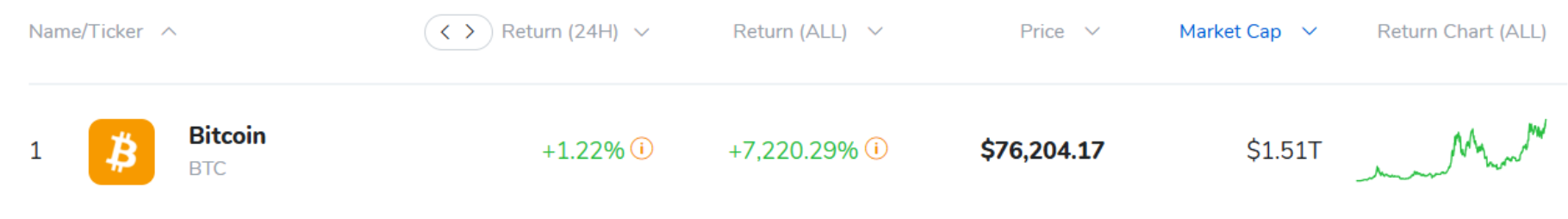

Bitcoin Overtakes Meta’s Market Cap as Crypto Gains Traction in Mainstream Finance

In a significant milestone, Bitcoin’s market capitalization has now exceeded that of Meta Platforms, underscoring the cryptocurrency’s expanding role within the global financial ecosystem. Valued at approximately $1.46 trillion, Bitcoin is now ranked as the ninth-largest asset globally, surpassing some of the biggest tech companies. This achievement reflects the cryptocurrency’s growth and solidifies its reputation as a store of value, particularly during economic uncertainties. Market analysts point to Bitcoin’s resilience and increasing acceptance by institutional investors, particularly as the U.S. election has further strengthened the case for Bitcoin as a viable long-term investment. As more funds flow into Bitcoin ETFs and major financial institutions continue to engage with cryptocurrency, Bitcoin’s standing among the world’s largest assets is likely to become even more prominent.

Source: companiesmarketcap.com

What’s Next for Crypto Policy under the Trump Administration?

With Trump’s pro-crypto stance at the forefront, the crypto community anticipates several key policy changes under his administration, including regulatory reforms that could pave the way for crypto innovation. Trump has proposed appointing a crypto-friendly SEC Chair, potentially Hester Peirce, also known as “Crypto Mom,” who has consistently supported industry growth. Additionally, Trump’s pledge to end Operation Choke Point 2.0 and support crypto mining within the U.S. could transform the regulatory landscape. These changes are expected to reduce compliance burdens and make the U.S. more competitive in the global crypto economy, aligning with the industry’s push for a transparent and supportive regulatory environment.

Source: X

Bitcoin’s Long-Term Potential Amid Regulatory Shifts and Institutional Growth

The combination of regulatory support, increased institutional participation, and a strong macroeconomic environment sets Bitcoin up for promising long-term growth. Trump’s administration could bring regulatory clarity and support for crypto innovation, potentially establishing the U.S. as a global leader in blockchain technology. Additionally, institutional interest, as evidenced by record ETF inflows and Bitcoin’s market cap growth, reflects the growing appeal of Bitcoin as a stable, long-term asset. With fourth-quarter market conditions favouring crypto and Bitcoin’s historic performance in post-halving years, the cryptocurrency is well-positioned for sustained growth. Should these factors continue aligning, Bitcoin may not only achieve new highs but solidify its position as a major asset within global financial markets.