Crypto Weekly Wrap: 7th February 2025

MicroStrategy Rebrands to ‘Strategy’ as Bitcoin Holdings Surge

One of the most significant corporate developments in the Bitcoin space is the rebranding of MicroStrategy to simply ‘Strategy.’ The move aligns with the firm’s deepened commitment to Bitcoin adoption, symbolized by adding the ‘₿’ Bitcoin logo next to its new name. Founded in 1989 by Michael Saylor as a business intelligence company, Strategy has transformed into the largest corporate Bitcoin holder in the world.

In its Q4 2024 report, Strategy revealed a net loss of $670.8 million, largely due to aggressive Bitcoin accumulation. The company added 218,887 BTC in the last quarter alone, bringing its total holdings to 471,107 BTC, valued at over $45 billion. The firm’s revenue for Q4 stood at $120.7 million, a 3% year-on-year decline, missing analyst expectations. However, Strategy remains focused on its “21/21 Plan,” which aims to deploy $42 billion over three years to further expand its Bitcoin reserves.

Source: YouTube, CNBC Channel

Bitcoin Poised for a Decisive Price Move, Market Volatility and Recent Sell-Off

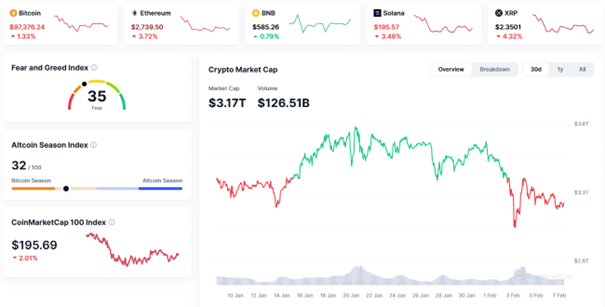

Market analysts anticipate Bitcoin (BTC) is on the brink of a significant price movement. The Fear and Greed Index currently sits at 35, indicating a fear-driven market sentiment, which often precedes volatile price action.

Over the past month, Bitcoin has struggled to maintain momentum, now trading at $97,316.22, down 1.29%. Despite recent weakness, BTC has held above key psychological levels, but the declining crypto market cap—now at $3.17T—suggests broader risk aversion.

Recent macroeconomic concerns have led to increased market turbulence. Altcoins have also suffered, as shown by the Altcoin Season Index at 32, signaling that the market is still in a Bitcoin-dominant phase rather than an altcoin rally cycle.

Bitcoin previously traded above $100,000, but selling pressure has intensified, pulling prices lower. The market experienced a sharp drop at the beginning of February, aligning with broader uncertainty and reduced trading volume ($126.51B).

Source: CoinMarketCap

SEC Scales Back Crypto Enforcement Team

In a policy shift under the Trump administration, the U.S. Securities and Exchange Commission (SEC) has downsized its crypto enforcement division, reassigning more than 50 staff members. The move aligns with Trump’s executive order aimed at eliminating excessive regulation on digital assets.

Commissioner Hester Peirce, known for her pro-crypto stance, has outlined new SEC priorities, including evaluating whether crypto assets should be classified as securities or commodities and granting temporary relief for token issuances. Furthermore, Congress has formed its first-ever Congressional Crypto Working Group, led by Senate Banking Committee Chairman Tim Scott. The group is expected to advance legislation such as the GENIUS Act, which focuses on USD-backed stablecoins.

While the SEC’s new leadership aims to foster a more innovation-friendly regulatory landscape, critics argue that reducing enforcement could lead to greater market manipulation and fraud. However, crypto firms see this as an opportunity to reset the regulatory framework, making the U.S. more competitive in the global digital asset space.

Source: X

Bitcoin Technical Analysis: Key Levels and Market Sentiment

As of early February, Bitcoin is trading at $97,305, reflecting a minor 0.01% decline. The asset remains in a consolidation phase, struggling to regain momentum after failing to break above key psychological levels. Several technical indicators provide insight into its near-term price action:

Support and Resistance Levels

Immediate support: $96,000–$97,000, acting as a crucial short-term level.

Stronger support: $92,500, the recent low following Trump’s tariff announcement.

Immediate resistance: $98,500–$99,500, where previous rejections have occurred.

Major resistance: $102,000–$104,000, with the next barrier at $109,000 if momentum strengthens.

Indicators and Market Sentiment

Relative Strength Index (RSI): Currently at 61.93, suggesting Bitcoin is nearing overbought territory but still has room for upward movement.

Moving Averages: Short-term trends show Bitcoin hovering near key moving averages, while the 50-day SMA is acting as dynamic resistance.

Volume Trends: 24-hour trading volume stands at 159.58M, indicating a recent decline, which could suggest weaker buying pressure.

A decisive break above $99,500 could fuel a rally toward $104,000, but failure to hold $97,000 may result in a retracement to $92,500. Traders should watch for confirmation signals, as Bitcoin’s RSI and moving averages suggest potential short-term consolidation before a decisive move.

Source: TradingView

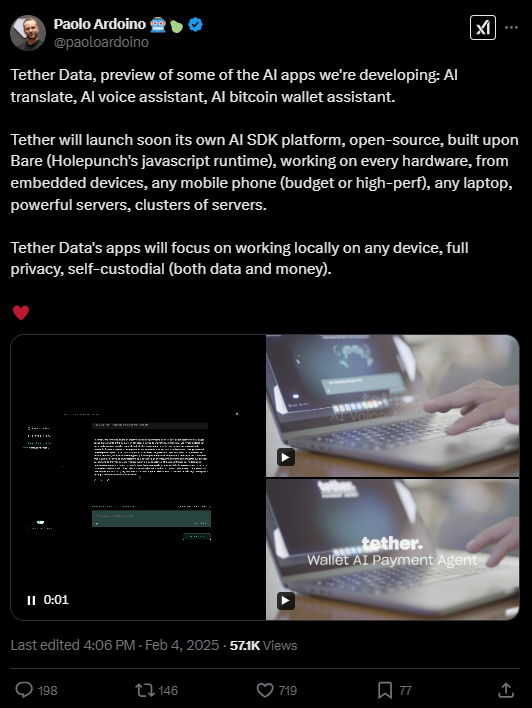

Tether Expands into AI and Bitcoin Wallet Assistants

Tether, the issuer of USDT, is making significant strides in artificial intelligence (AI). CEO Paolo Ardoino announced the development of multiple AI-powered applications, including AI Translate, AI Voice Assistant, and an AI Bitcoin Wallet Assistant. These tools will operate locally on devices while maintaining user privacy and self-custody of funds.

A demo showcased how the AI Bitcoin Wallet Assistant can autonomously handle transactions, allowing users to send BTC via chatbot commands. Tether is also preparing to launch an AI SDK platform, making its AI technology accessible across different hardware, from smartphones to enterprise servers.

Meanwhile, Tether’s USDT stablecoin has reached a new market cap of $141 billion, following the issuance of another $1 billion USDT. Tether remains a dominant force in the stablecoin sector, with $113 billion in U.S. government bonds backing its reserves.

Source: X

Crypto Market Overview: A Deep Red Week for Digital Assets

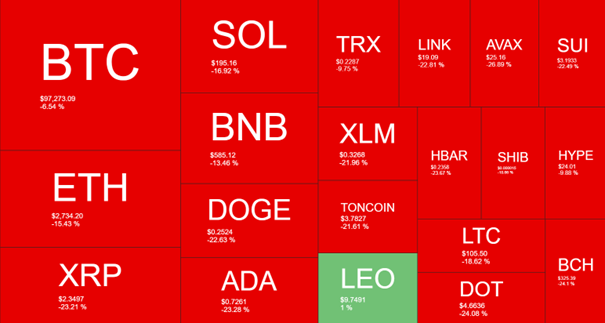

The cryptocurrency market has faced a sharp sell-off, with global market capitalization dropping significantly. Bitcoin (BTC) has fallen 6.54% over the past week, currently trading at $97,273.09, while Ethereum (ETH) tumbled 15.43% to $2,734.20.

Biggest Weekly Losers

Solana (SOL): Down 16.92%, trading at $195.16

Cardano (ADA): Dropped 23.28% to $0.7261

XRP (XRP): Plummeted 23.21% to $2.3497

Chainlink (LINK): Suffered a steep 22.81% decline, now at $19.09

Avalanche (AVAX): Fell 26.89% to $25.16, making it one of the worst-performing altcoins

Shiba Inu (SHIB), Stellar (XLM), and Sui (SUI): All lost over 20%

With macro uncertainty, regulatory developments, and profit-taking pressures, the crypto market remains volatile. However, long-term investors may see this dip as a potential buying opportunity, especially with Bitcoin still holding above the $97,000 support level.

Source: QuantifyCrypto

Final Thoughts

January and early February have been eventful for the crypto sector, with Bitcoin’s consolidation phase, Tether’s AI expansion, and SEC’s regulatory pivot shaping the landscape. Bitcoin remains in a bullish cycle, but short-term volatility could continue as markets digest macroeconomic shifts. With institutional interest growing and regulatory clarity improving, Bitcoin’s next decisive move could set the tone for the rest of 2025.