Crypto Weekly Wrap: 6th December 2024

Bitcoin Reaches $100,000: A Milestone for the Cryptocurrency Market

Bitcoin (BTC) has achieved a historic milestone, surpassing the $100,000 mark for the first time on December 5, 2024. This landmark event follows a year of robust growth, during which Bitcoin’s price surged by 126% since January, fueled by increasing institutional adoption, demand for spot Bitcoin exchange-traded funds (ETFs), and the reduced supply caused by Bitcoin’s fourth halving in April.

The rally was further propelled by Donald Trump’s victory in the U.S. presidential election, which has significantly improved the regulatory outlook for cryptocurrencies. Bitcoin’s new all-time high of $104,000, reached shortly after crossing the $100K threshold, underscores the growing confidence in BTC as a reliable store of value and a cornerstone of the evolving financial ecosystem.

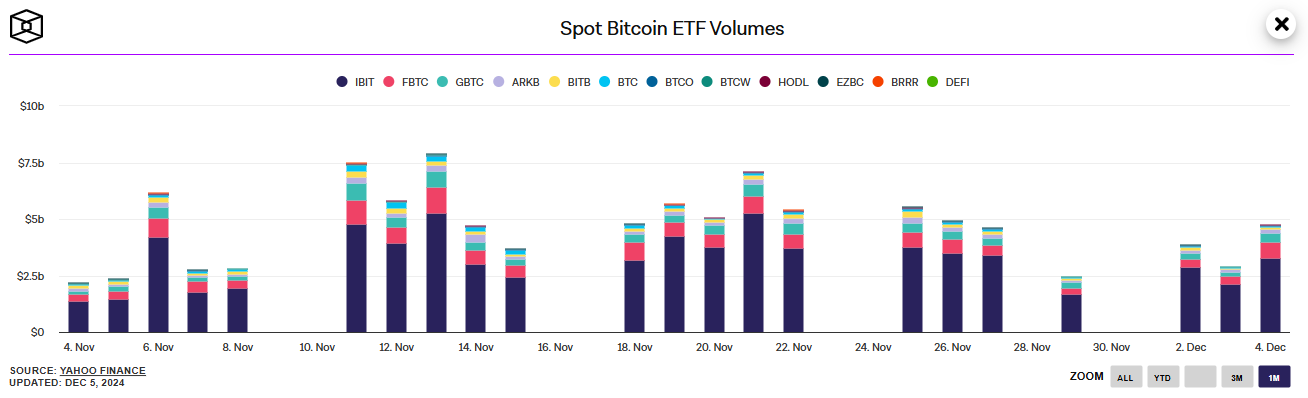

Institutional Adoption and Bitcoin ETFs Drive Growth

The introduction of spot Bitcoin ETFs in the United States has marked a turning point for Bitcoin’s institutional adoption. Since their launch in January, these ETFs have attracted over $31 billion in net inflows, providing a regulated and accessible investment vehicle for institutions. The approval of ETFs has opened the doors for companies, hedge funds, and high-net-worth investors to enter the crypto space with greater confidence. Moreover, Bitcoin’s reduced supply due to its halving event earlier this year has created a supply-demand imbalance, further driving prices upward. Institutions like BlackRock and Fidelity have led the charge, cementing Bitcoin’s position as a legitimate asset class and bridging the gap between traditional finance and cryptocurrencies.

Source: TheBlock

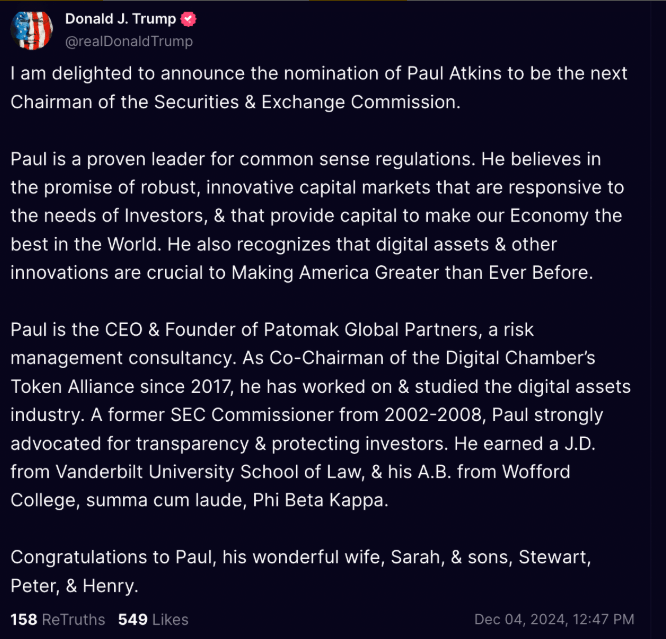

Regulatory Changes and a Crypto-Friendly SEC

One of the most notable factors contributing to Bitcoin’s recent rally is the improving regulatory environment under President-elect Donald Trump’s administration. The nomination of Paul Atkins, a pro-crypto advocate, as the new chair of the Securities and Exchange Commission (SEC), has raised hopes for a more favorable regulatory framework. Atkins’ track record as a former SEC commissioner and his advocacy for transparency and investor protection suggest a departure from the enforcement-heavy approach of his predecessor, Gary Gensler.

Industry analysts anticipate that many of the lawsuits against crypto firms initiated under Gensler’s leadership could be resolved, reducing legal uncertainties and paving the way for broader adoption. These regulatory shifts signal a pivotal moment for the cryptocurrency market, with increased clarity likely to encourage more institutional and retail participation.

Source: X

Bitcoin Technical Analysis: Breaking Barriers

Bitcoin’s technical indicators reflect strong momentum as it consolidates above the $100,000 level. After a week of sideways movement, BTC decisively broke through the psychological barrier, driven by a combination of technical and fundamental factors. Key resistance levels at $99,855 and $102,382 have been overcome, suggesting a bullish trajectory. The Relative Strength Index (RSI) has climbed to 80, and is now in neutral position, while the Moving Average Convergence Divergence (MACD) has crossed into positive territory, signaling upward momentum.

Additionally, the 50-day moving average recently crossed above the 200-day moving average, forming a golden crossover, a strong indicator of long-term bullish potential. Analysts predict that Bitcoin could target $120,000 in the coming months, although short-term pullbacks to support levels at $97,866 remain possible. This technical setup, combined with strong market fundamentals, sets the stage for further price appreciation.

Source: TradingView

Ethereum Poised for Growth Amid Improved Market Conditions

Ethereum (ETH) is showing signs of renewed strength following months of underperformance compared to Bitcoin. With its price stabilizing near $3,900, Ethereum is benefiting from increasing adoption in decentralized finance (DeFi), non-fungible tokens (NFTs), and enterprise blockchain solutions. Analysts point to Ethereum's rollup-centric roadmap, which includes scalability improvements via layer-2 solutions, as a key driver for future growth. Additionally, the potential introduction of staking rewards in Ethereum-based exchange-traded funds (ETFs) could attract significant institutional interest.

Ethereum is poised to solidify its dominance in the smart contract ecosystem, offering improved efficiency and lower fees. While competition from blockchains like Solana and Sui remains strong, Ethereum’s robust developer community and widespread network effects position it for long-term growth in the evolving crypto landscape.

Source: TradingView

XRP's Resurgence Amid Market Optimism

XRP has experienced remarkable growth in recent weeks, solidifying its position as a leading altcoin in the crypto market. Following Ripple's partial legal victory against the SEC earlier this year and the impending regulatory shifts under the new pro-crypto administration, XRP’s price has surged by 400% in the past month, reaching new multi-year highs.

The bullish momentum has been fueled by the resolution of legal uncertainties, increased adoption for cross-border payments, and significant institutional interest. XRP could soon test its all-time high of $3.40, with its breakout from a long-term wedge pattern serving as a strong technical indicator. Furthermore, Ripple's growing partnerships and use cases for XRP in decentralized finance (DeFi) and tokenized assets underscore its potential for sustained growth.

Source: TradingView

Source: X

What’s Next for Bitcoin and the Crypto Market?

Bitcoin’s ascent to $100,000 marks the beginning of a new chapter for the cryptocurrency market. Analysts predict that this milestone could trigger a full-scale bull run, with altcoins like Ethereum (ETH) and Solana (SOL) expected to follow BTC’s lead. Ethereum, in particular, is poised for growth, with increased adoption of its decentralized finance (DeFi) ecosystem and potential staking rewards for ETFs fueling demand. Meanwhile, Bitcoin’s market dominance is likely to attract new retail and institutional investors, creating a positive feedback loop that sustains the current rally. However, experts caution that Bitcoin may face resistance at higher levels, with profit-taking potentially leading to short-term corrections. Despite these challenges, the overall market sentiment remains overwhelmingly positive, with the $100,000 milestone serving as a testament to Bitcoin’s resilience and long-term potential.