Crypto Weekly Wrap: 31st January 2025

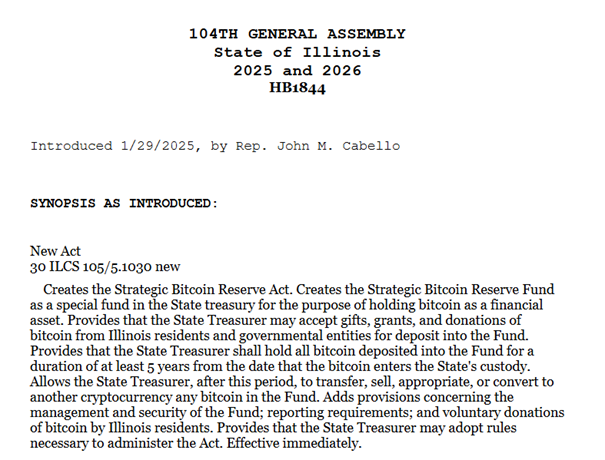

Illinois Advances Bitcoin Reserve Bill

The state of Illinois has become the latest to propose a strategic Bitcoin reserve, signalling a growing trend among U.S. states embracing Bitcoin as a financial asset. House Bill 1844 (HB1844), introduced by State Representative John Cabello, aims to create a Bitcoin reserve fund within the state treasury.

A crucial aspect of the bill is the mandatory five-year holding period before any conversions or sales are permitted. This move aligns with President Donald Trump's vision of incorporating Bitcoin into state and federal financial systems. Similar legislation is gaining traction across the U.S., with Arizona advancing its own Bitcoin reserve proposal. Texas officials are pushing for a state Bitcoin fund as part of their 2025 legislative priorities.

According to industry experts, this state-by-state approach allows for regulatory experimentation before national policies emerge. If more states follow Illinois’ lead, Bitcoin could become an institutional financial instrument, fundamentally changing the role of cryptocurrencies in traditional finance.

Source: ilga.gov

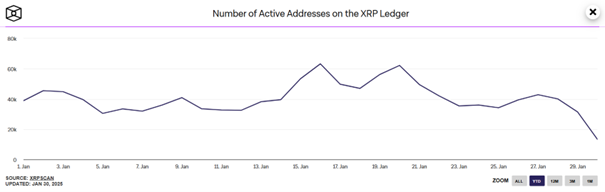

XRP Faces Potential Market Correction

After a record-breaking rally, XRP shows signs of topping out, echoing its 2018 post-bull-run correction. Analysts warn that XRP is trading near the lower trendline of a symmetrical triangle pattern, a technical setup suggesting a possible breakdown to the $2.50 demand zone.

The primary concerns for XRP stem from on-chain data indicating a decline in user engagement. Active addresses have dropped by over 39% in the last month, signalling profit-taking among investors. XRP could experience further pullbacks if this trend continues before its next rally. However, there is still hope for a recovery if XRP maintains key support levels and breaks above resistance at $3.30, potentially triggering a run toward $4.60.

Source: TradingView

Despite market volatility, XRP remains a strong contender in the altcoin sector, with investors closely monitoring whether its price will stabilise or correct further.

Source: TheBlock

Tesla’s Bitcoin Gains Surge After Accounting Rule Change

Tesla has reported a $600 million jump in its Bitcoin holdings’ valuation thanks to a newly implemented digital asset accounting rule. The Financial Accounting Standards Board (FASB) updated its policy, allowing companies to mark Bitcoin holdings at fair market value rather than the previous requirement to report them at their lowest recorded price.

Tesla’s Bitcoin holdings now stand at approximately $1.19 billion, with 11,509 BTC under management. The electric vehicle giant has long been a key institutional holder of Bitcoin, and this accounting change now provides greater transparency in crypto balance sheet reporting. The policy update is expected to benefit other public companies holding Bitcoin, encouraging further corporate adoption of cryptocurrencies.

Source: X

Trump Media Expands into Crypto with Truth.Fi

Donald Trump’s media company, Trump Media and Technology Group (TMTG) is making another foray into the financial sector with the launch of Truth.Fi, is a fintech platform focused on both traditional investments and cryptocurrency markets.

The project has been allocated $250 million to develop investment vehicles, including exchange-traded funds (ETFs) and separately managed accounts (SMAs). Truth.Fi aims to position itself as a key player in digital asset management, further reinforcing Trump’s pro-crypto stance since his election win. Regulatory approvals for the platform are still pending, but industry analysts expect it to contribute significantly to the growing intersection between traditional finance and digital assets.

Source: X

Crypto Market Faces Short-Term Pullback

After several days of substantial market gains, cryptocurrency is experiencing a slight pullback. The global market capitalisation has dropped by 3%, now at $3.7 trillion.

DOGE and SHIB were among the most brutal hit, dropping by 5.12% and 6.4%, respectively. Meanwhile, LTC was the top performer, rising by 17% to trade at $133. Bitcoin has remained relatively stable, hovering around $105, with Ethereum at $3,254. Analysts see this as a normal market correction following strong rallies, expecting further volatility in the coming days.

Source: QuantifyCrypto

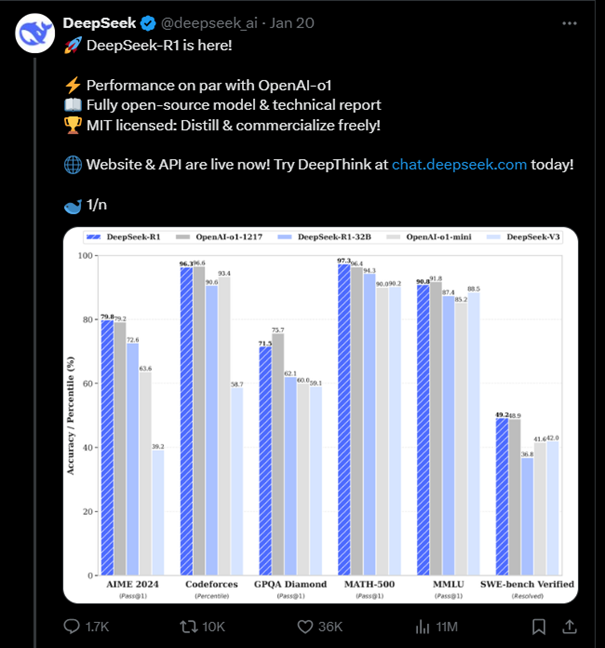

DeepSeek's AI Disruption Shakes Markets and Crypto Sector

The global tech and crypto markets faced an unexpected disruption on January 27, when Chinese AI company DeepSeek launched its R1 model. The AI industry was shaken by DeepSeek’s ability to match top competitors like OpenAI’s o1-mini while using significantly fewer resources. The revelation led to a $1 trillion sell-off in the Nasdaq Composite Index, with NVIDIA suffering a record-breaking $600 billion market loss.

DeepSeek’s breakthrough also sent shockwaves through the crypto market, particularly impacting GPU-dependent crypto mining firms and AI-focused tokens. Riot Platforms (RIOT) and Cipher Mining (CIFR) saw their shares drop by 15.5% and 25%, respectively. AI-related cryptocurrencies such as Render (RNDR), The Graph (GRT), and Artificial Superintelligence Alliance (FET) also experienced double-digit declines. The sell-off appears to be a knee-jerk reaction rather than a structural shift, as AI-crypto projects still represent only a tiny fraction of the broader crypto market. Nevertheless, the event raises concerns about the future of GPU-reliant industries.

Source: X

Bitcoin Technical Analysis: Balancing Bullish Momentum and Short-Term Resistance

Bitcoin Market Overview

As of January 29, 2025, Bitcoin is trading at $104,813, moving within a 24-hour range of $100,272 to $104,900. Its market capitalisation is $2.02 trillion, supported by $35.55 billion in daily trading volume.

Key Resistance and Support Levels

Bitcoin’s immediate resistance is between $105,000 and $106,000, while key support levels are at $102,000 to $103,000. The market’s next move depends on whether buyers sustain momentum or selling pressure forces a retracement.

Technical Indicators

Relative Strength Index (RSI): At 44, indicating a neutral market stance.

MACD (Moving Average Convergence Divergence): Currently bearish at 1,466.6, signalling caution.

Momentum: Still bullish at 730.0, suggesting a potential upward move.

Moving Averages Analysis

Bitcoin’s short-term moving averages present mixed signals:

10-day EMA (Exponential Moving Average): Bearish at $102,407.2.

10-day SMA (Simple Moving Average): Bearish at $103,337.0.

Longer-term MAs (20-200 days): Bullish, reinforcing underlying strength.

Potential Scenarios

Bullish Outlook: If Bitcoin holds above $102,000-$103,000, it could rally toward $107,000-$109,000. A breakout above $105,000 would confirm upward continuation.

Bearish Risks: Failing to breach $105,000 resistance could lead to a $97,500-$98,000 retest. Low trading volume could amplify downside pressure.

Bitcoin remains bullish in the long term, but short-term corrections could offer buying opportunities for traders watching key support levels.

Final Thoughts

The crypto market continues to evolve with major institutional shifts, state-level adoption, and growing corporate interest. Illinois’ Bitcoin reserve bill could pave the way for broader state-backed crypto adoption, while Tesla’s gains highlight the benefits of improved accounting regulations. Meanwhile, Trump Media’s fintech expansion demonstrates increasing institutional interest in digital asset management.

While XRP faces potential downside risks, Bitcoin’s overall trajectory remains bullish as long as it holds key support levels. Market corrections are a normal part of crypto cycles, and investors should focus on long-term trends and macroeconomic developments for a better perspective.