Crypto Weekly Wrap: 30th August 2024

Trump's New Crypto Venture Aims to Disrupt DeFi

Former U.S. President Donald Trump is entering the cryptocurrency space with World Liberty Financial, a new platform promoting access to "high-yield" investments in decentralised finance (DeFi). Marketed as "the only crypto DeFi platform supported by Donald J. Trump," the venture promises to connect users to secure, lucrative crypto opportunities. This initiative follows Trump's recent launch of a fourth NFT collection and his pledge to make the U.S. the "crypto capital of the planet" if elected. While details remain limited, the project could attract significant interest from his supporters and the broader crypto community, provided it can deliver on its ambitious promises.

Source: X

U.S. House Committee Prepares for Key Crypto Hearings

The U.S. House Financial Services Committee is planning a series of hearings in September to address key crypto industry issues, including decentralised finance (DeFi), the SEC's regulatory stance, and "pig butchering" scams. These discussions will feature testimonies from top officials, such as SEC Chair Gary Gensler, and could shape the future regulatory framework for digital assets in the U.S. Lawmakers are also negotiating potential legislation to adjust the balance of authority between the SEC and the Commodity Futures Trading Commission (CFTC), highlighting the evolving debate over crypto regulation and oversight.

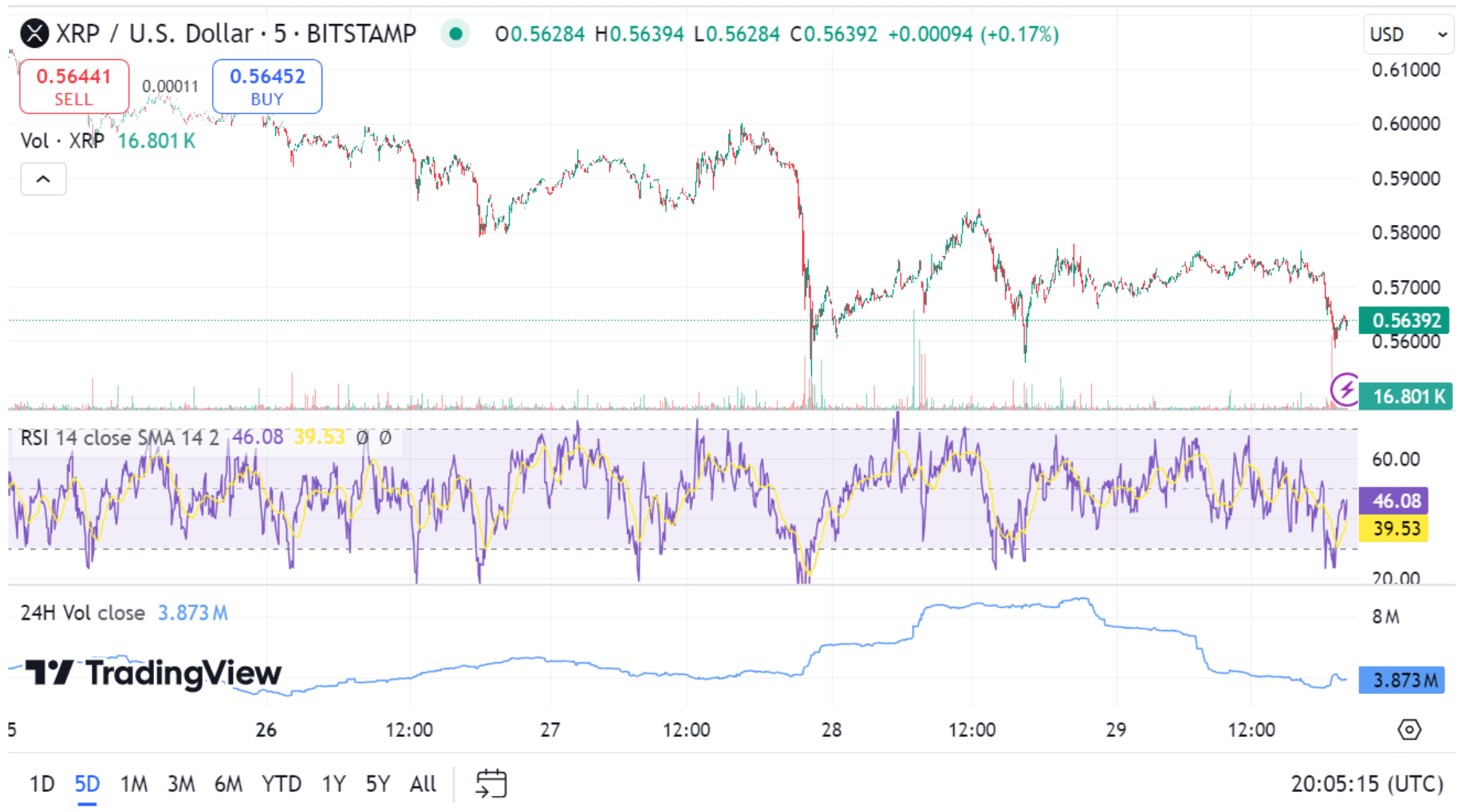

XRP and SHIB Struggle Amid Market Volatility

XRP and SHIB have also faced recent challenges amid market volatility. XRP’s price fell by nearly 10% at the start of the week but has since shown signs of recovery. The support at 54 cents remains solid, with buyers re-entering the market, potentially setting up a range between 54 and 63 cents.

Source: TradingView

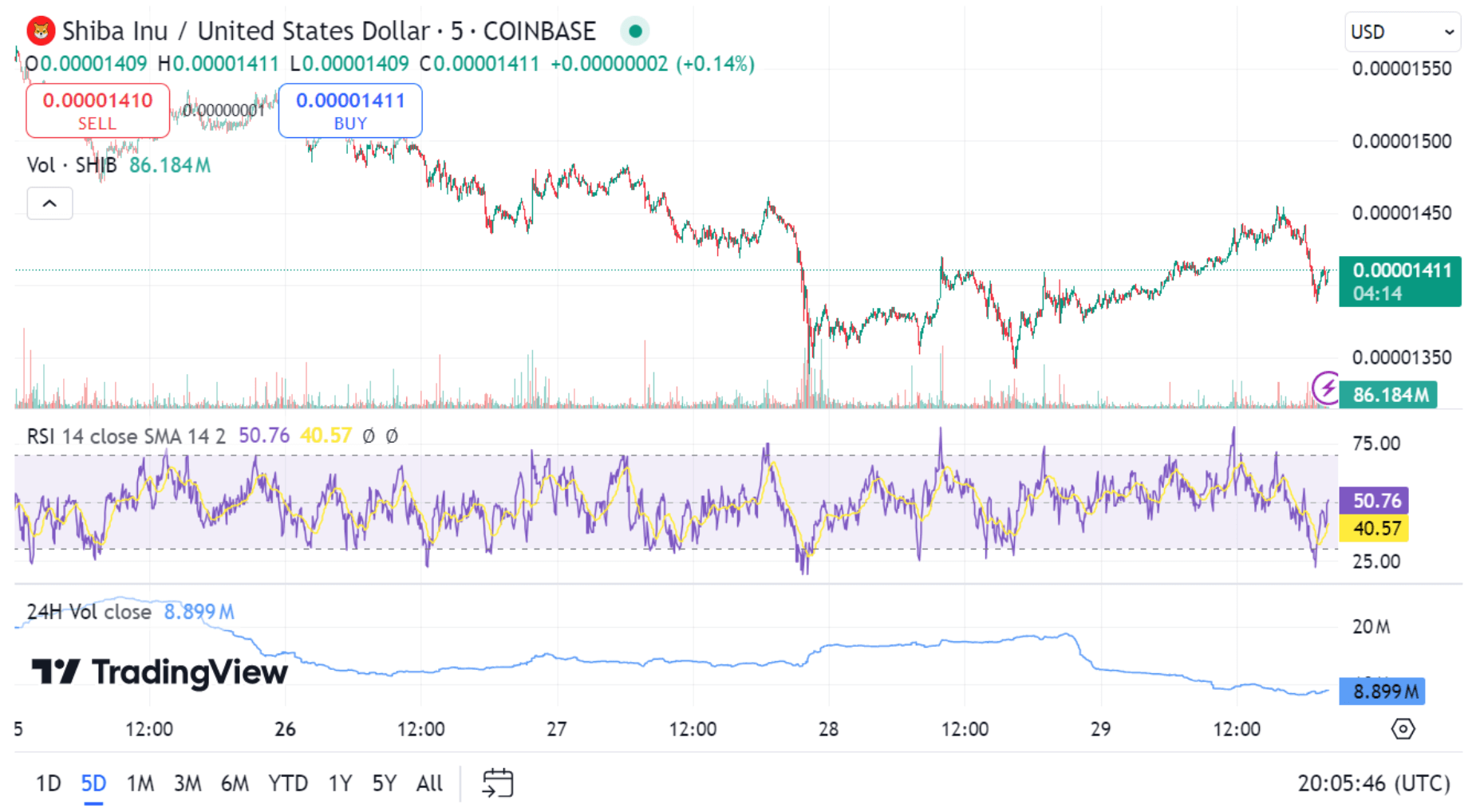

Meanwhile, SHIB initially rallied above $0.000014, only to fall back below this critical level as market conditions turned bearish on Monday. To resume its upward trajectory, SHIB needs to reclaim $0.000014 as support, with the next key resistance level at $0.000022.

Source: TradingView

Both cryptocurrencies are navigating uncertain waters as they attempt to find stability in a market that remains highly volatile. Investors are watching closely for decisive breakouts or breakdowns to determine their next moves.

Ethereum ETFs Attract Positive Inflows Amid Nine-Day Outflow Streak

Ethereum exchange-traded funds (ETFs) have finally seen positive inflows after a prolonged period of outflows, which lasted for nine consecutive days. A total net inflow of $5.8 million has been recorded, marking a shift in sentiment toward Ethereum-based investment products. BlackRock’s ETHA ETF led the inflows with $8.4 million, followed by Fidelity’s FETH ETF with $1.3 million. Despite these positive signs, Grayscale’s ETHE ETF experienced continued outflows, suggesting mixed investor sentiment.

The cumulative effect of these inflows and outflows has brought the total net flow for Ethereum ETFs to nearly $500 million within the first five weeks of their launch. Analysts have noted that while interest in Ethereum ETFs may not be as robust as Bitcoin ETFs due to the absence of staking and lower liquidity, there is still potential for growth. BlackRock’s recent expansion of its cryptocurrency offerings to international markets, such as Brazil, also indicates ongoing interest in Ethereum as a viable investment option.

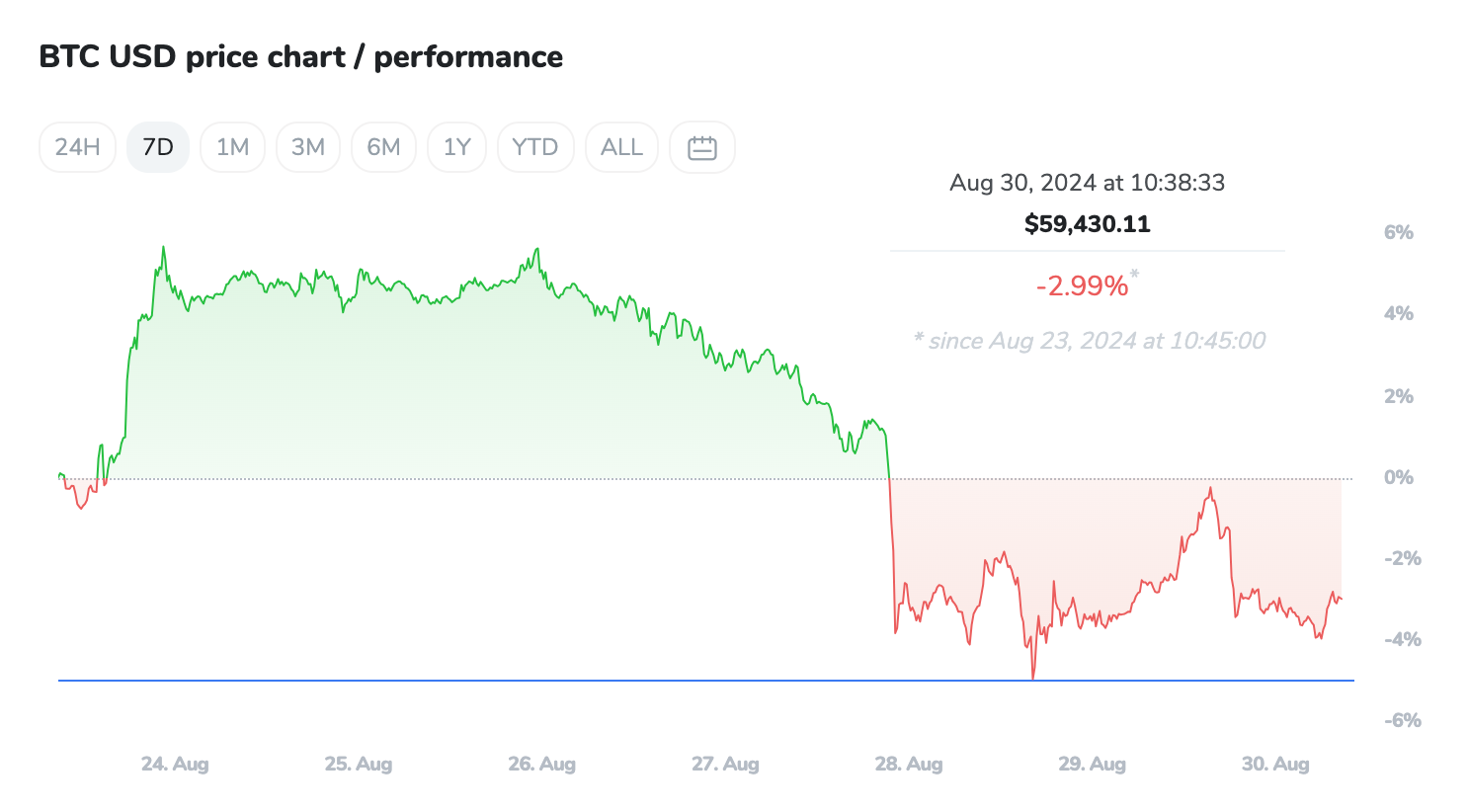

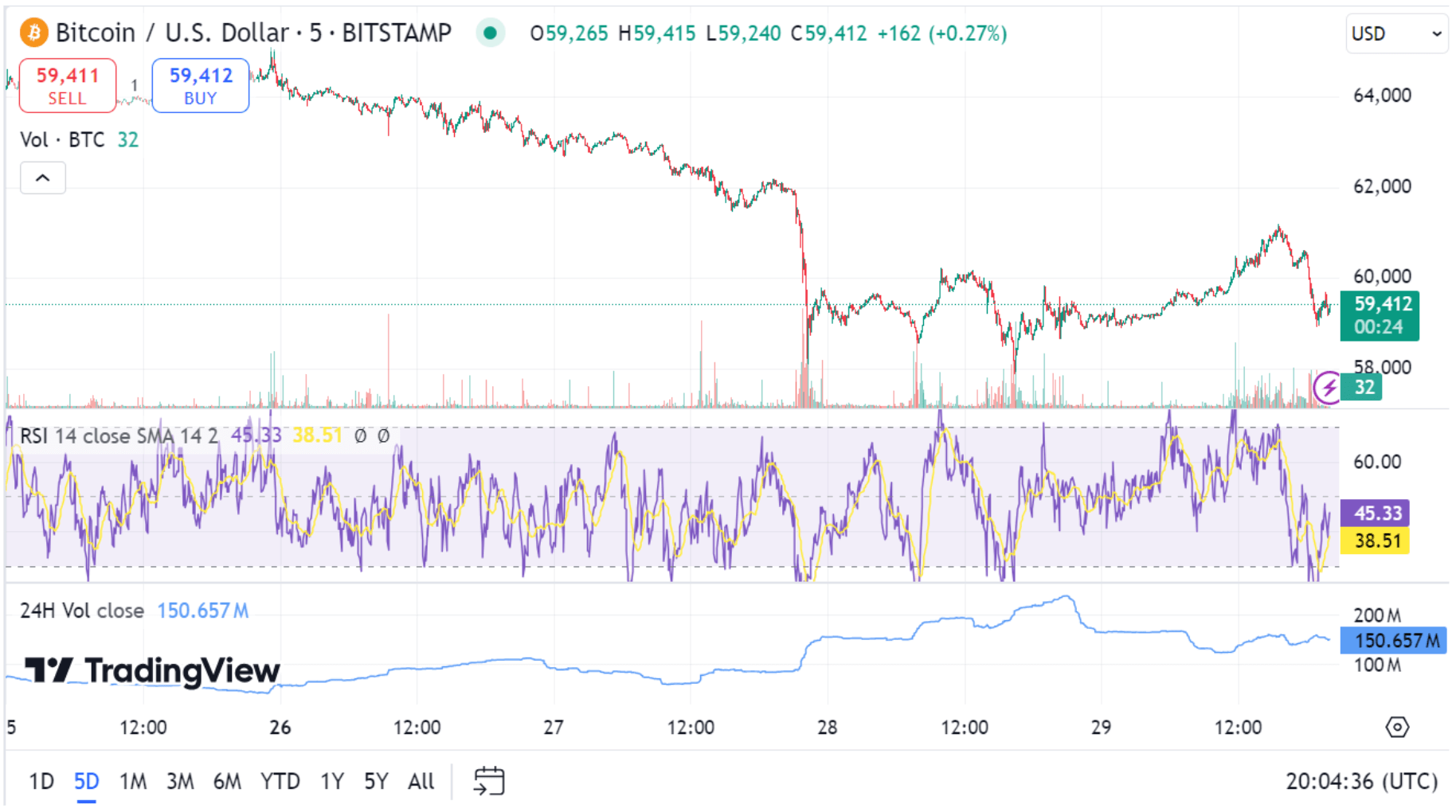

Bitcoin Price Analysis: Bearish Momentum Continues

Bitcoin is nearing the end of a challenging week, having dropped 2%. Despite this, buyers have shown resilience, especially around the key support level at $58,000. The price fell between Monday and Tuesday, forming a bearish wedge, but buyers stepped in to stop further decline. It is crucial for Bitcoin to hold above the $58,000 support level over the weekend to prevent sellers from taking full control and pushing the price down to the low $55,000s, similar to early August.

Source: TradingView

The overall momentum for Bitcoin remains bearish, as indicated by the weekly Moving Average Convergence Divergence (MACD). Both moving averages are currently falling, but there is a glimmer of hope, as the MACD histogram is making higher lows. This could suggest a potential reversal of the current downtrend in the near future. To confirm a bullish reversal, Bitcoin’s price needs to break above the $64,000 resistance level and establish it as a new support. Only then can a more optimistic outlook for the leading cryptocurrency emerge.

Conclusion

The cryptocurrency market remains highly dynamic, with various digital assets experiencing significant volatility and unpredictable movements. Cryptocurrencies like XRP and SHIB are trying to recover from recent drops. Meanwhile, Ethereum ETFs have shown a shift towards positive inflows after a lengthy outflow period. As for Bitcoin, technical indicators suggest that while bearish momentum remains, there are signs of a potential reversal, which could provide a more favourable outlook if key resistance levels are breached. Investors will continue to monitor these developments closely to make informed decisions in this ever-evolving market.