Crypto Quarterly Overview - Q1 2025

Bitcoin’s Rough Start to 2025: Weakest Q1 in Seven Years

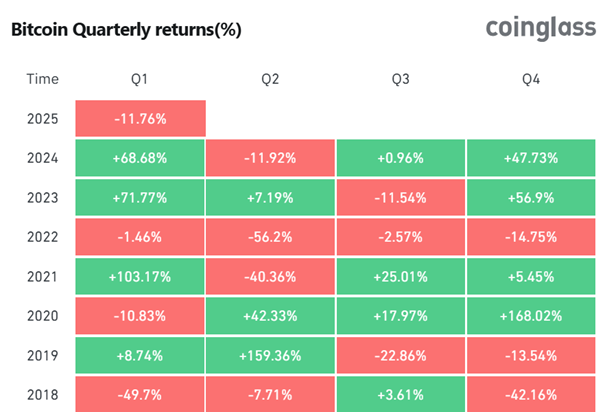

Bitcoin wrapped up Q1 2025 with a notable decline of 11.76%, making it the weakest first-quarter performance since 2018. This poor start comes despite strong momentum from 2024, when BTC surged over 68% in Q1 before stumbling through the rest of the year. Contributing to the slump are escalating macroeconomic tensions, particularly the reintroduction of US trade tariffs that rattled markets and weighed heavily on risk assets like Bitcoin. While traders are understandably cautious, some argue that this downturn could mirror previous cycles where similar dips preceded stronger recoveries in Q2 and Q3.

Source: Coinglass

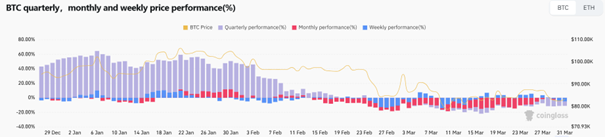

Source: Coinglass

Bitcoin Technical Analysis: Testing Support Amid Lower Volume

Bitcoin is currently hovering around $82,600 after seeing a rejection near $88,000 earlier in the month. The Relative Strength Index (RSI) shows mild bullish divergence, at 48.24 but trending upwards — suggesting potential short-term recovery if momentum strengthens. Volume has steadily declined since early March, though a slight uptick near the end of the month could indicate renewed interest. Price action remains choppy, and bulls will need to reclaim $84,000 to shift short-term sentiment more decisively.

Source:

Market Tensions Ahead of ‘Liberation Day’ and Fed Policy Decisions

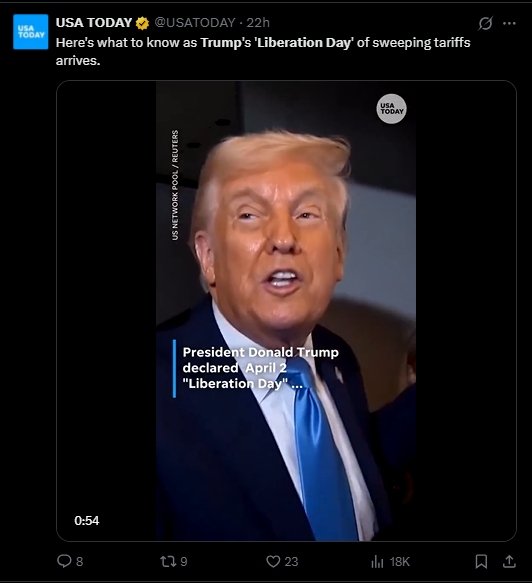

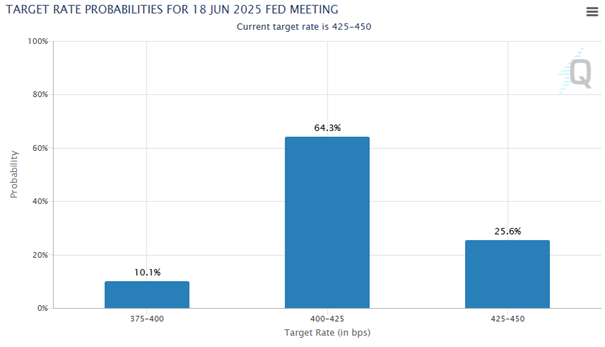

April 2, labeled “Liberation Day” by US President Donald Trump, looms large as new tariffs targeting over 25 countries are scheduled to take effect, injecting additional volatility into global markets. Simultaneously, a packed economic calendar — including US jobs data and a speech from Fed Chair Jerome Powell — has kept crypto investors on high alert. These events, combined with growing uncertainty over interest rate policy, have amplified short-term risk-off sentiment in crypto and equities alike. However, the FedWatch Tool still signals strong odds for a rate cut in June, offering hope for more favorable conditions in the near term.

Source: X

Source: CmeGroup

Bitcoin vs. Gold: Shifting Sentiment in the Safe-Haven Debate

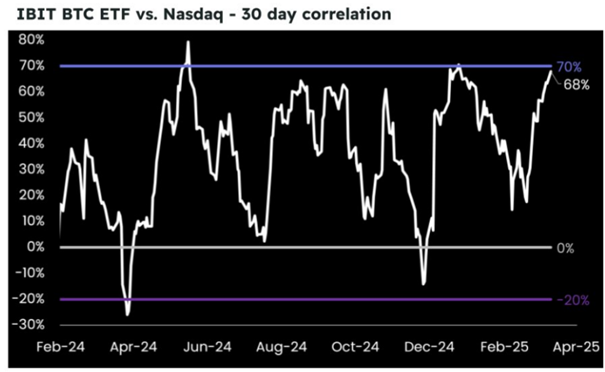

As geopolitical risks intensify, gold has clearly outshone Bitcoin in Q1, soaring to all-time highs above $3,150 while BTC remained under pressure. This divergence has reignited debates over Bitcoin’s role as “digital gold,” especially as investors seek stability in uncertain times. Although Bitcoin dropped 6% in March, it has shown surprising resilience compared to traditional equities like the S&P 500 and Nasdaq, both of which posted larger losses. As more institutions allocate BTC to their balance sheets, the asset’s long-term role as a hedge could solidify, even if its short-term correlation with tech stocks persists for now.

Source: Matrixport

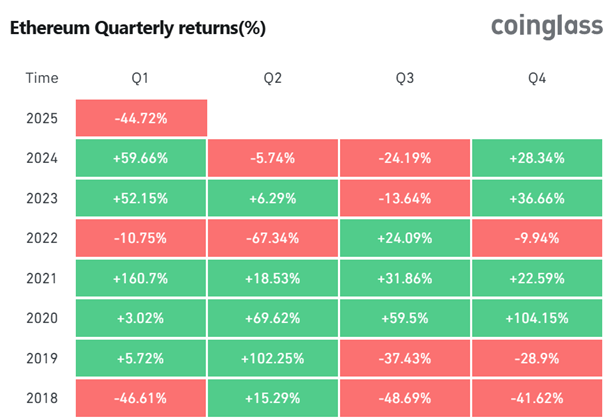

Ethereum’s Slide and the Trump Effect on Altcoins

Ethereum faced an even steeper decline in Q1 2025, plunging by 44.72%, partly triggered by market-wide volatility and partly by controversial endorsements. Eric Trump’s public push for ETH investments was followed by increased scrutiny of the Trump-linked World Liberty Financial platform, which rapidly expanded its Ether holdings while the price dropped. While some technical indicators now suggest a further dip below $1,500 is possible, other patterns hint at a potential reversal. A confirmed double-bottom could send ETH back toward $2,500 in April, particularly if broader market sentiment improves and technical support holds.

Source: Coinglass

Source: Coinglass

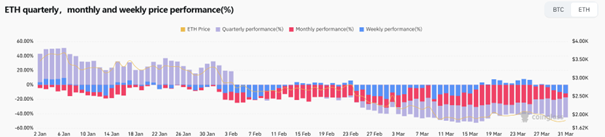

Ethereum Technical Analysis: Weak Momentum Below $1,850

Ethereum is currently trading near $1,829 after failing to hold above the $2,000 mark earlier this month. The RSI is sitting at 52.22, indicating a slight bullish tilt but lacking strong momentum. The 24-hour volume trend has declined significantly throughout March, now resting at 265 million, which signals reduced trader participation. Unless ETH reclaims the $1,900–$1,950 zone, short-term bias remains bearish, with possible downside pressure if volume doesn’t pick up.

Source: TradingView

DeFi Security Still a Concern Amid Hack Surge

March reminded the crypto community of persistent vulnerabilities in decentralized finance, with over $22 million stolen across four high-profile hacks. Though this pales in comparison to February’s massive Bybit breach, it has reignited concerns about the industry's readiness to defend against sophisticated exploits. Analysts have warned that unless projects take accountability and improve infrastructure, regulation may become inevitable. Despite the setbacks, innovation hasn’t stalled — DeFi teams continue to build, and March’s crypto conferences highlighted promising security-first tools and proposals.

Source: DefiLlama

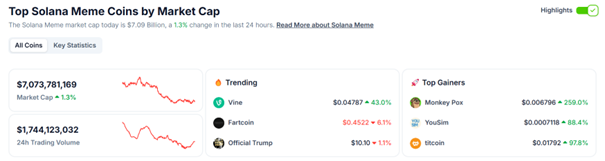

Solana’s Revenue Slump: Memecoin Craze Comes Crashing Down

After peaking in January, Solana’s memecoin boom has fizzled dramatically, with revenue plunging 99% and DEX volumes dropping from $3.9 billion to just $782 million in March. The downturn reflects a cooling off of speculative mania and a return to fundamentals, leaving the network’s builders to adapt and recalibrate. Despite the contraction, leading figures like Kain Warwick argue that the memecoin frenzy had a silver lining — it drove substantial infrastructure investment across Solana. As the dust settles, Solana appears better positioned than ever for serious adoption in the next phase of development.

Source: CoinGecko

Regulation Moves Forward: US and UK Tackle Stablecoins and Oversight

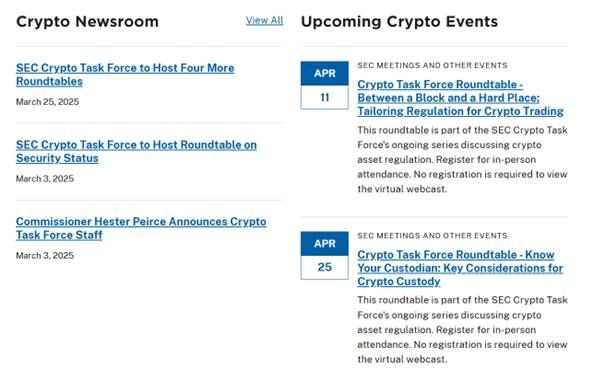

On the regulatory front, momentum picked up significantly in March. The US SEC announced four new public roundtables and unveiled the Crypto 2.0 Task Force, aiming to strike a better balance between enforcement and collaboration with the industry. Meanwhile, Congress introduced the STABLE Act to regulate dollar-backed stablecoins, signaling bipartisan interest in providing clearer rules for crypto innovation. In the UK, policymakers floated a stamp duty on crypto trades, sparking debates about digital asset taxation. Overall, these moves suggest that regulators are finally shifting toward more constructive engagement — a positive step for the market’s maturation.

Source: Sec.gov

Source: X

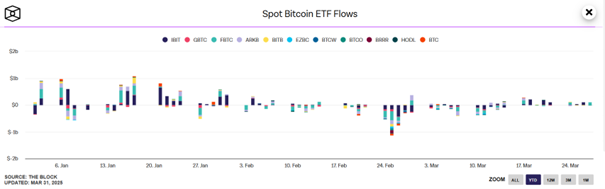

Institutional Trends: Bitcoin ETFs See Volatility, But Long-Term Signals Hold

Institutional flows into spot Bitcoin ETFs have been choppy throughout Q1, as shown in the chart below. While BlackRock’s IBIT ETF remains dominant among issuers, inflows have cooled significantly since early January, with brief surges followed by periods of net outflows — including a notable $93 million exit on March 28. February marked the most turbulent stretch, with several consecutive days of ETF redemptions across nearly all major funds. Despite this short-term hesitance, long-term indicators remain positive: over 80% of IBIT shares are held by public entities and retail investors, and institutional BTC holdings have surpassed 1 million coins. These structural trends point to Bitcoin’s gradual evolution from a speculative asset into a strategic reserve tool.

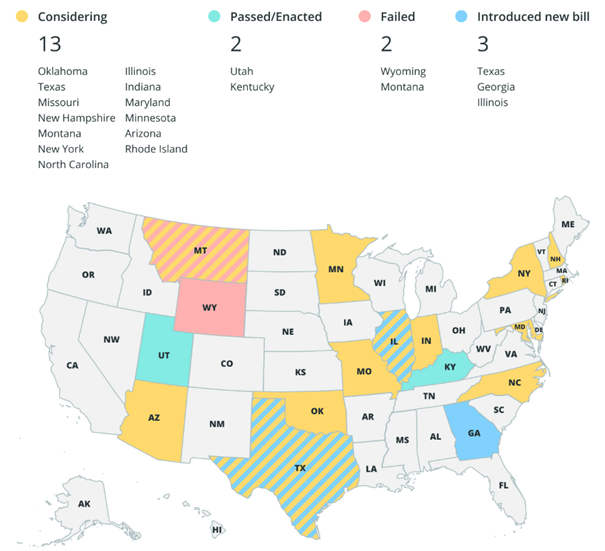

State-Level Crypto Legislation: US States Step Up

In March, two US states — Utah and Kentucky — passed legislation aimed at defining and protecting crypto activity, particularly around mining and business acceptance. Thirteen other states, including Texas and Illinois, also advanced bills that range from creating oil-backed stablecoins to exploring public pension crypto allocations. These state-level efforts demonstrate growing interest in crypto policy at the grassroots level. If momentum continues, we could see more comprehensive frameworks emerge in 2025, potentially influencing federal legislation as well.

Source: CoinTelegraph

Outlook for Q2: Risk, Rebound, and Regulatory Milestones Ahead

Looking into Q2, markets face key inflection points. April 2, with its new wave of trade tariffs, could set the tone for the quarter — but the outcome remains uncertain, especially given past reversals from the Trump administration. Meanwhile, signs of resilience remain: Bitcoin’s MVRV ratio has normalized, and historical cycles hint at potential rebounds after Q1 corrections. With regulatory clarity improving and institutional adoption rising, the stage could be set for a cautious yet constructive Q2 across the crypto market.

Monthly Heatmap Overview: March Ends in the Red for Most Majors

The March heatmap paints a predominantly bearish picture across the crypto landscape. Bitcoin dropped by -3.13%, while Ethereum experienced a sharper decline of -17.5%, underlining the broader weakness among top assets. Memecoins and altcoins were hit particularly hard—DOGE fell -18.88%, SHIB -9.21%, and SUI plunged -19.55%. Notably, Litecoin took a steep dive of -33.7%, and HBAR was down -30.82%. On the brighter side, Toncoin (TON) stood out with an impressive +25.02% monthly gain, followed by modest positives from ADA (+3.13%) and TRX (+3.1%).

Source: QuantifyCrypto