Crypto Weekly Wrap: 29th November 2024

Bitcoin Faces Consolidation as Momentum Slows

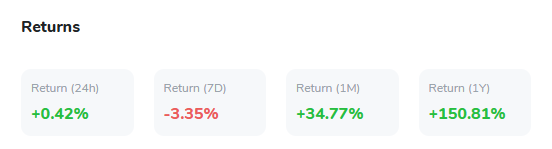

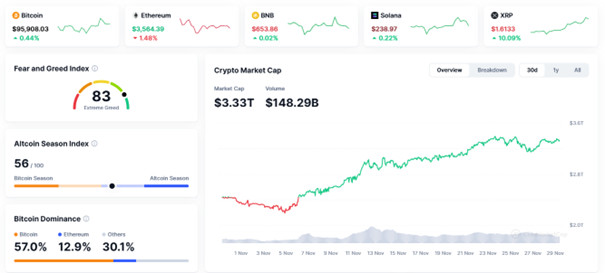

Bitcoin (BTC) remains a key focus in the cryptocurrency market, although its approach to the monumental $100,000 mark has slowed. Currently trading at approximately $95,754, Bitcoin has experienced a 3.37% decline over the past seven days, signaling a period of consolidation rather than sustained upward momentum. Despite this pullback, BTC retains its position as the leading cryptocurrency, supported by a robust market cap of $1.88 trillion.

While the slight downturn highlights market volatility, Bitcoin's trading volume remains substantial, reflecting continued interest from both retail and institutional investors. As 2024 draws to a close, Bitcoin's performance showcases its resilience in the face of market fluctuations, setting the stage for renewed activity as macroeconomic conditions and investor sentiment evolve. Though momentum has slowed, the broader crypto landscape still looks to Bitcoin as a bellwether for future trends.

Bitcoin ETFs Fuel Institutional Adoption and Market Growth

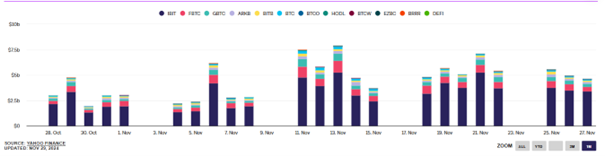

The surge in Bitcoin's popularity is further bolstered by the continued success of Bitcoin exchange-traded funds (ETFs), which have become a significant driver of institutional adoption. With total assets under management surpassing $102 billion, Bitcoin ETFs now account for approximately 5.4% of Bitcoin's total market capitalization.

BlackRock’s IBIT leads the pack with $31.6 billion in cumulative inflows, showcasing the growing confidence of institutional investors in the crypto space. The approval of these ETFs has provided a regulated and accessible on-ramp for traditional investors, contributing to Bitcoin's recent price rallies. Despite a slight pullback in ETF inflows recently, the consistent demand underscores their pivotal role in integrating Bitcoin into mainstream financial portfolios, potentially paving the way for further market maturity and growth.

Technical Analysis: Bitcoin’s Consolidation and Key Levels to Watch

Bitcoin’s price is currently consolidating at $95,843, reflecting a 3.37% decline over the past week, as it moves further from the psychologically significant $100,000 milestone. Resistance levels at $97,200, $98,500, and $99,855 serve as critical barriers that must be breached for Bitcoin to regain upward momentum. On the downside, key support levels have shifted slightly to $94,646, $93,800, and $92,500, acting as cushions against deeper retracements.

The Relative Strength Index (RSI) has declined to 42.38, suggesting the asset is now in a mildly oversold territory, potentially signaling the opportunity for a bounce if buying interest picks up. Meanwhile, the Moving Average Convergence Divergence (MACD) indicator still shows a weak momentum, with the MACD line trailing below the signal line, indicating that the bulls are yet to reclaim control.

Should Bitcoin fail to hold above $94,646, it risks a deeper correction toward the $92,500 support zone. Conversely, a sustained move above $97,200 could trigger renewed bullish momentum, setting the stage for a push toward $99,855. Overall, the current technical landscape reflects a cautious outlook, with potential for recovery hinging on improving macroeconomic sentiment and market participation.

Source: TradingView

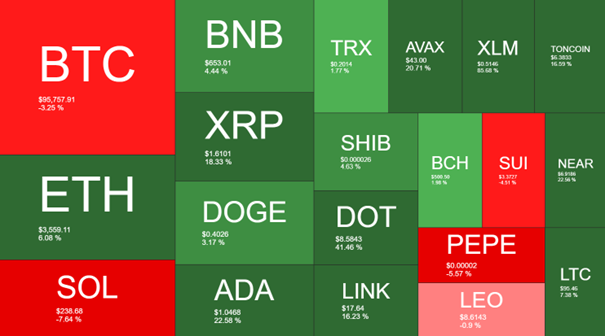

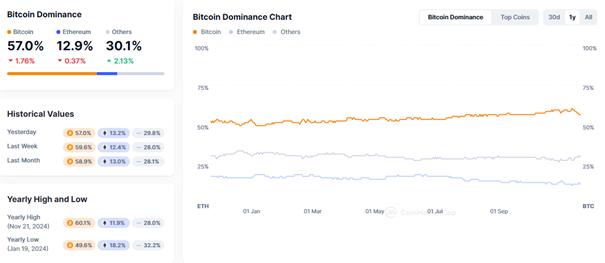

Altcoins Poised for Gains as Bitcoin Dominance Wanes

Bitcoin’s market dominance has climbed to 50%, a threshold not consistently observed since early 2023, signifying its strong position in the market. While this dominance reflects confidence in Bitcoin, it also signals the possibility of an impending shift toward altcoins, often referred to as "altcoin season." Historically, a decrease in Bitcoin dominance has been accompanied by substantial price rallies in smaller-cap cryptocurrencies, offering lucrative opportunities for traders.

Ethereum (ETH), Solana (SOL), and XRP are among the altcoins showing significant potential, with Solana recently achieving an all-time high of $263. XRP, in particular, has gained traction due to its innovations in cross-border payments and financial applications, drawing increased institutional interest. As Bitcoin consolidates near $100,000, the growing momentum in altcoin markets presents a promising landscape for diversification and speculative gains.

Source: Quantifycrypto

Source: Coinmarketcap

Cardano's Momentum Builds as ADA Supply Moves into Profit

Cardano (ADA) is experiencing significant bullish momentum, with 88% of its circulating supply now in the profit zone, according to recent Santiment data. This surge reflects a sharp increase from earlier in the month, when only 40% of ADA's supply was profitable. Currently trading at $1.05, ADA has seen a 5.92% increase in the past day and a 21.73% rise over the past week. This rally has pushed the total value of profitable ADA holdings to $31 billion, signaling robust market sentiment and strong investor confidence.

Despite the positive outlook, the high Market Value to Realized Value (MVRV) ratio of 76.2% indicates potential overvaluation, which could trigger selling pressure as investors might look to lock in gains. If holders remain restrained and market confidence persists, ADA could break through the $1.15 resistance level, a milestone not seen since April 2022. Cardano's trajectory underscores the importance of balancing bullish momentum with potential profit-taking, as the coin aims to sustain its upward trend amidst the broader crypto market recovery.

Source: TradingView

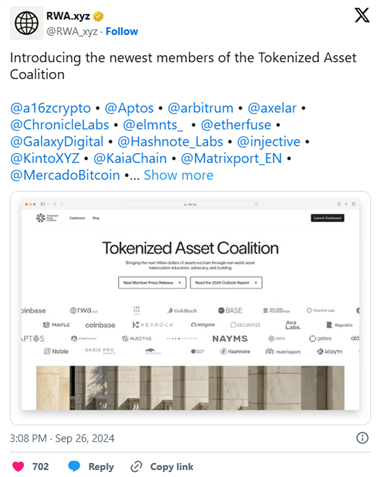

Real-World Asset Tokenization Gains Momentum

The tokenization of real-world assets (RWAs) has emerged as a transformative trend in the cryptocurrency industry, reshaping traditional finance with blockchain technology. With the total value of tokenized assets surpassing $13 billion in 2024, RWAs represent one of the fastest-growing sectors in the crypto ecosystem. Regulatory clarity and technological advancements have played a pivotal role in driving this adoption, enabling seamless integration with traditional financial systems.

Ripple’s tokenized money market fund on the XRP Ledger and Solana’s efficiency in handling tokenized assets highlight the potential of blockchain in real-world applications. The U.S. presidential election outcome has further energized the decentralized finance (DeFi) space, with President-elect Donald Trump’s pro-crypto stance likely to accelerate adoption. As RWAs continue to gain traction, the sector offers exciting opportunities for both institutional and retail investors seeking innovative financial solutions.

Source: X

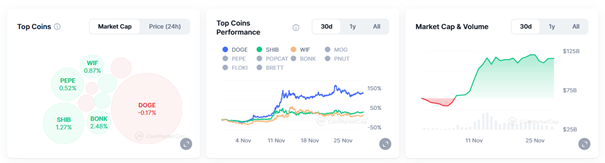

The Role of Meme Coins in the Bull Market

Meme coins, often considered a niche market, have surprisingly played a significant role in the current cryptocurrency bull market. SUI and Solana have experienced notable gains driven by the growing popularity of meme coins, highlighting their influence on the broader market.

SUI’s native meme coin market cap surged by 30% in 24 hours, contributing to a 7.58% rise in the SUI price, while Solana’s DEX platforms recorded record-breaking trading volumes. This trend underscores the ability of meme coins to attract retail interest and stimulate ecosystem growth, creating opportunities for both investors and blockchain developers.

Beyond their speculative appeal, meme coins have demonstrated their capacity to enhance network activity, drawing new participants into the cryptocurrency space. While Bitcoin remains the market leader, the impact of meme coins on altcoin ecosystems continues to reshape market dynamics and fuel trading enthusiasm.

Source: Coinmarketcap

Outlook for Bitcoin and the Crypto Market

As Bitcoin nears the $100,000 milestone, the cryptocurrency market is poised for a pivotal phase of growth and transformation. Institutional inflows, combined with macroeconomic tailwinds, provide a solid foundation for further advancements in the crypto space. Bitcoin’s dominance underscores its strength, but the rise of altcoins and innovative sectors like RWAs and meme coins reflect the market’s evolving diversity.

The holiday season, historically a period of heightened market activity, could bring renewed speculation and set the tone for 2025. Traders and investors should remain vigilant, monitoring key resistance and support levels for Bitcoin while exploring emerging opportunities in the altcoin market.

Whether Bitcoin surpasses $100,000 or consolidates further, its performance will undoubtedly shape the cryptocurrency narrative and investor sentiment in the coming year.

Source: Coinmarketcap