Crypto Weekly Wrap: 27th September 2024

Gary Gensler Under Fire for Handling of Crypto Regulation

U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler is facing increasing criticism over his approach to crypto regulation, warning that the industry will not survive without robust investor protections. In a recent interview with CNBC’s Squawk Box, Gensler doubled down on the need for clear disclosures within the crypto space, pointing to the market turmoil of 2022, when major firms like FTX, Three Arrows Capital, Celsius, and Genesis collapsed. The high-profile downfall of these companies led to significant financial losses and criminal charges, including nearly 25 years in prison for FTX CEO Sam Bankman-Fried.

Gensler emphasised that most cryptocurrencies should be classified as securities and that crypto platforms must register with the SEC. However, he reaffirmed that Bitcoin remains an exception, reiterating that both he and his predecessor do not consider it a security. He further noted that investors can now express their views on Bitcoin through exchange-traded products.

Source: X

Amidst the growing political debate surrounding crypto regulation, Gensler avoided commenting on the 2024 U.S. presidential candidates, such as Vice President Kamala Harris and former President Donald Trump. Trump has vowed to end what he calls an "unlawful and un-American crackdown" on crypto and even launched his own project, World Liberty Financial. Despite these political pressures, Gensler continues to stress the importance of investor protection, arguing that innovation and regulation can coexist to foster long-term trust in the market.

Turkey Scraps Additional Crypto Taxes, Boosting Bitcoin Sentiment

Turkey recently abandoned its plans to impose additional taxes on crypto and stock transactions, marking a significant policy shift that could bolster Bitcoin prices. Earlier this year, the government considered imposing taxes on crypto gains, but following public backlash, officials decided to abandon the plan. The removal of this regulatory hurdle could encourage further trading activity, as investors no longer face the prospect of added financial burdens. This policy shift could also positively impact crypto adoption in Turkey, one of the growing markets for digital assets.

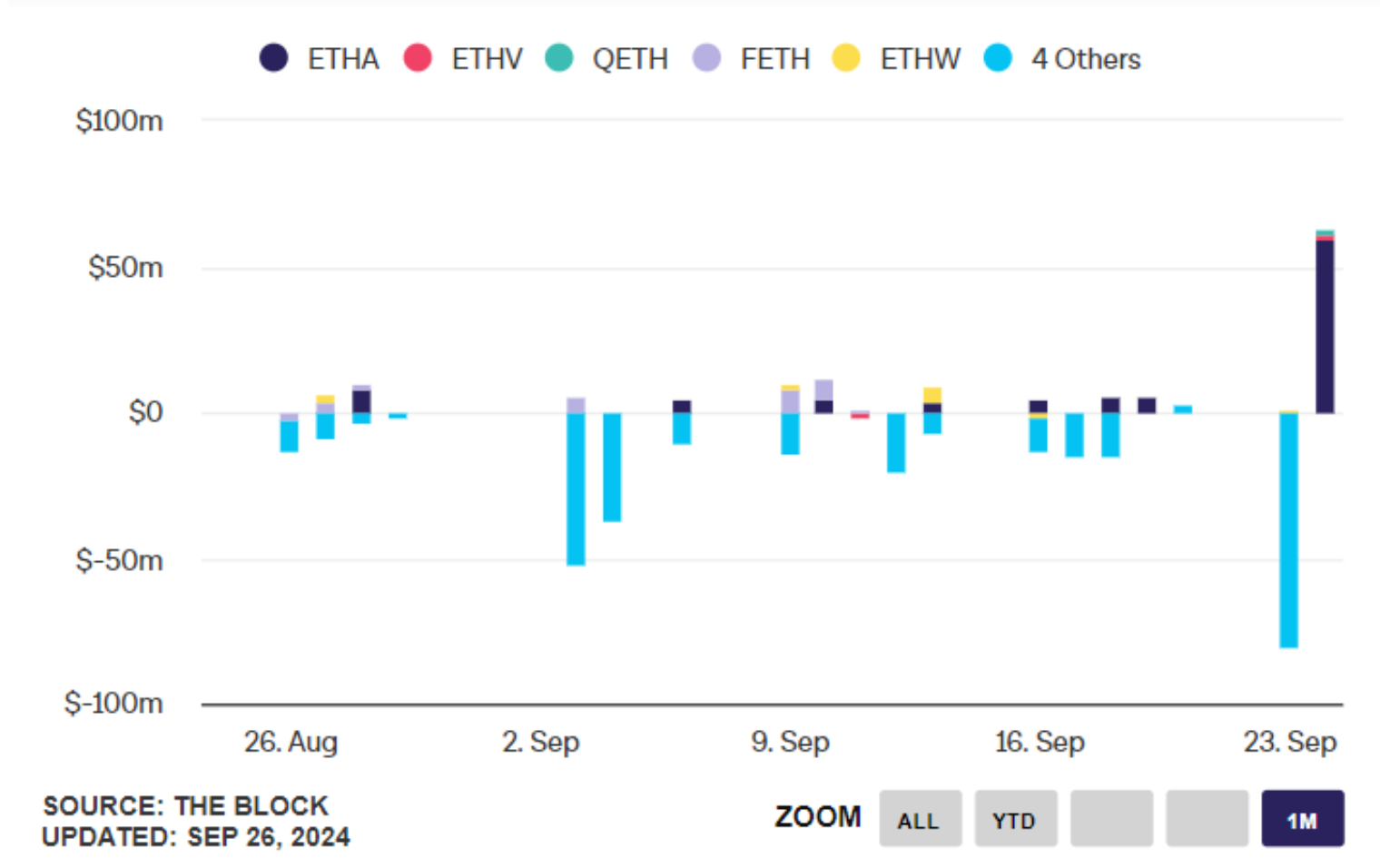

US Spot Ethereum ETFs See Largest Outflows Since July

U.S. spot Ethereum ETFs saw their largest daily outflows since July, with Grayscale’s Ethereum Trust (ETHE) leading the way. ETHE reported a net outflow of $80.55 million on Monday, contributing to the overall decline in Ethereum ETF holdings. Despite this, some Ethereum funds, like Bitwise’s ETHW ETF, recorded net inflows, highlighting the mixed sentiment in the market. As Ethereum prepares for upcoming developments like Eigenlayer, analysts remain optimistic about its long-term performance. Additionally, the U.S. SEC’s delay on approving Ethereum ETF options adds an element of uncertainty, though investors are closely watching the market for signs of recovery.

Source: The Block

Technical Analysis of Bitcoin (BTC)

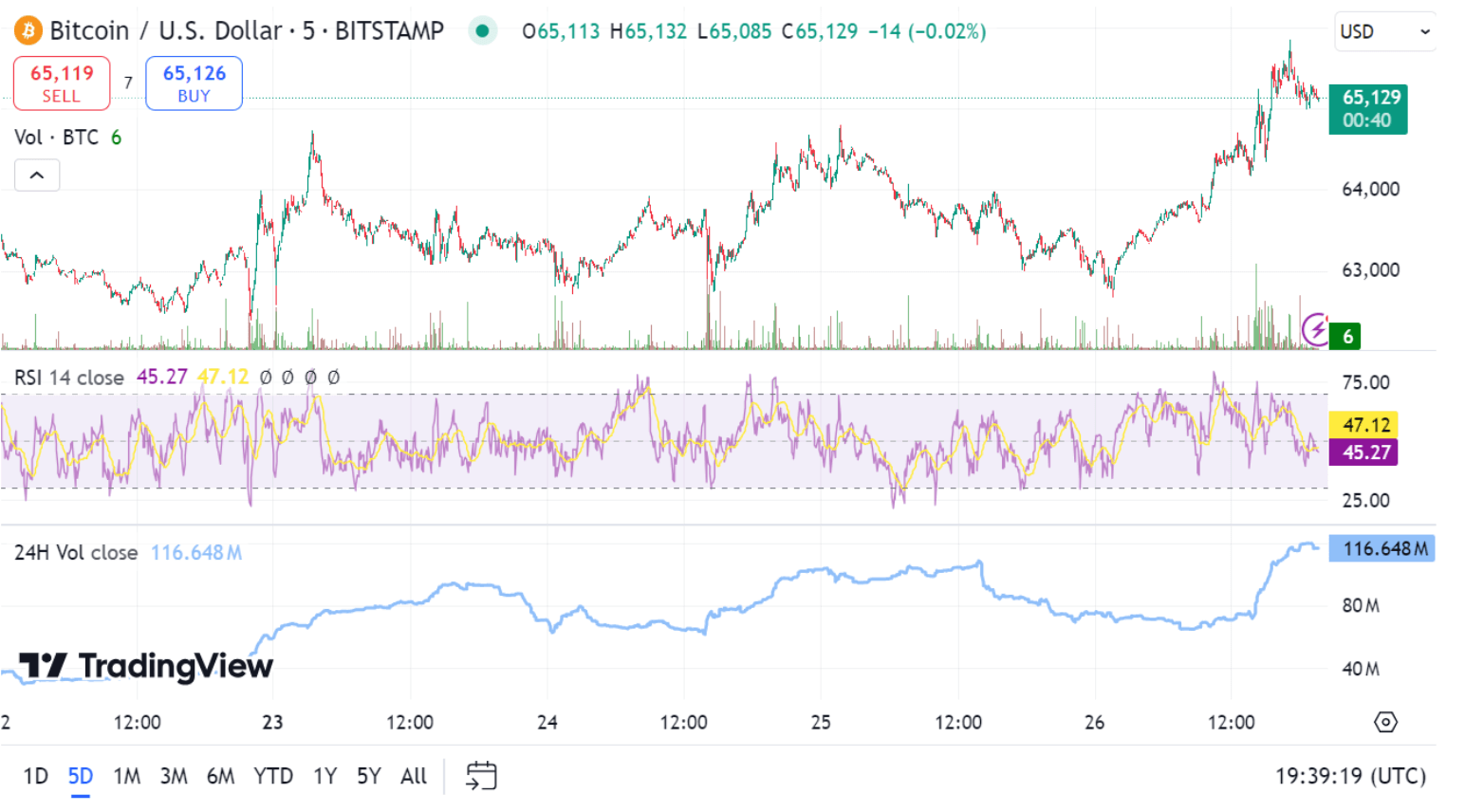

Bitcoin (BTC) has surged past $65,000 for the first time since early August, reigniting investor interest in the cryptocurrency market, particularly in U.S.-based spot ETFs. The move might be fueled by significant monetary stimulus from both the U.S. Federal Reserve and China, signalling a broader market shift. Currently, Bitcoin trades around $65,130, reflecting a 3% rise over the past 24 hours. This surge is particularly notable as BTC has broken key resistance levels and is approaching the next resistance zone at $65,990, which has acted as a psychological barrier in recent weeks.

Technical indicators show signs of continued bullish momentum. Bitcoin is trading above its 50-day EMA, which has now become a key support level. A successful break above $66,010 could see BTC testing the next resistance at $66,480, followed by a potential climb toward the $67,000 level. The Relative Strength Index (RSI) currently reads 45, indicating neutral momentum with room for further upward movement. Meanwhile, downside risks are limited by strong support at $63,350, with further backing around $62,700 if the price fails to hold its current levels.

Source: TradingView

Renewed interest in Bitcoin spot ETFs, such as BlackRock’s iShares Bitcoin Trust (IBIT), which saw inflows of nearly $185 million in a single day, has provided additional upward pressure. If this momentum continues, Bitcoin could see a prolonged rally through October, driven by macroeconomic factors and institutional support. Traders should remain vigilant for any shifts in market sentiment, particularly from global economic developments or U.S. Federal Reserve announcements.

XRP Whales Activity

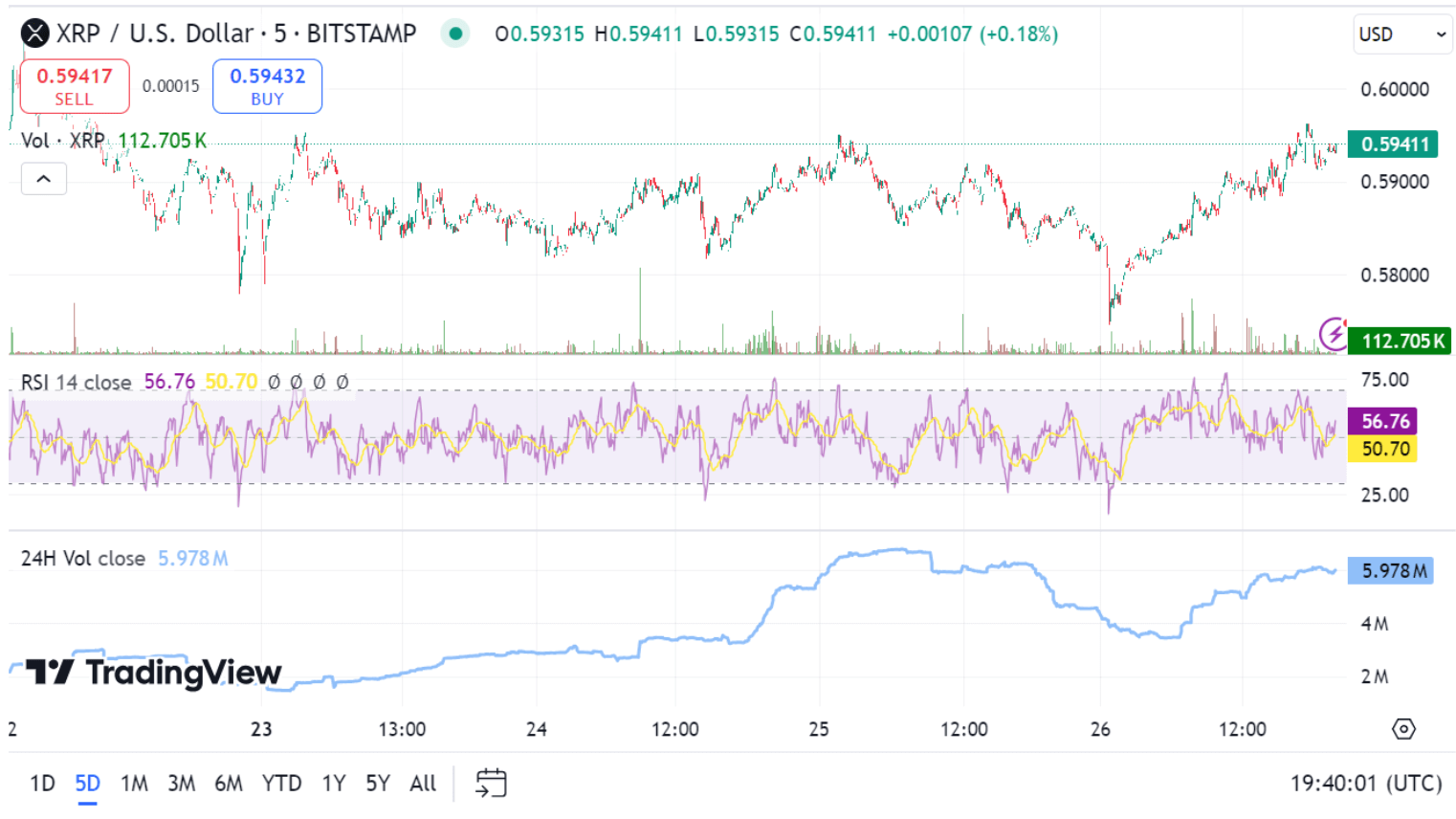

XRP whales have sparked concern by moving $23.4 million worth of tokens to Binance over the past two weeks, leading to speculation of an impending sell-off. However, despite this increase in exchange reserves, XRP's price has risen by 9.5% in the same period, suggesting that large transfers do not always result in immediate price drops. Currently trading at $0.5941, XRP is up 1% for the week and 9.5% for the past fortnight. While some analysts warn of potential short-term dips, XRP’s technical indicators remain positive, with its relative strength index rising and its moving averages showing upward momentum. Additionally, the coin’s robust trading volume and Ripple’s ongoing expansion efforts may contribute to further gains, potentially pushing XRP to $0.60 in the coming weeks.

Source: TradingView

Source: X

Source: X