Crypto Weekly Wrap: 27th December 2024

- Bitcoin Market Dynamics: A Holiday Pullback and Critical Support Levels

- Global Adoption: South Korea Leads the Way in Crypto Growth

- ETF Developments: Record Outflows Shake Confidence

- BTC Technical Analysis: Key Levels and Momentum

- Regulatory Developments: A Changing SEC Landscape

- Altcoins and Market Sentiment: Mixed Signals Persist

- Holiday Market Trends: Bitcoin Finds Stability

The cryptocurrency market has faced renewed challenges during the holiday season, with Bitcoin showing signs of a pullback.

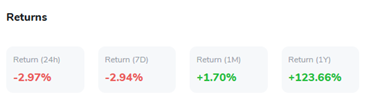

After reaching highs near $108,000 earlier this year, Bitcoin is trading at $95,022.59, reflecting a 2.97% decline over the past 24 hours and a 2.94% decline over the last seven days.

Key technical indicators, such as the Relative Strength Index (RSI), suggest that the asset remains in a neutral-to-bearish zone, with failed attempts to push prices higher, signalling a cautious market sentiment.

To regain upward momentum, Bitcoin needs to reclaim its systematic trend and sustain strength above critical levels, particularly the Point of Control (PoC).

Currently, Bitcoin is navigating between its 21-day and 50-day Simple Moving Averages (SMAs), positioned at $99,600 and $94,650, respectively. This tight range highlights a pivotal moment for the market, with support at $94,650 as a critical floor to prevent further declines.

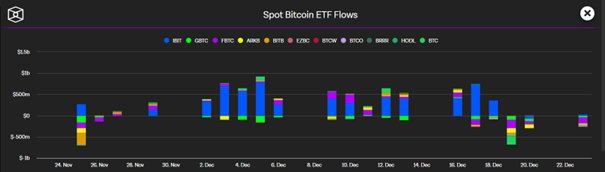

While Bitcoin’s resilience remains a key factor, the recent outflow of $1.5 billion from U.S. spot Bitcoin exchange-traded funds (ETFs) has dampened sentiment, reflecting broader uncertainty in institutional investment trends.

Maintaining support above key levels will be essential for Bitcoin to stabilise and potentially reclaim its bullish trajectory in the weeks ahead.

South Korea continues solidifying its position as a cryptocurrency hub, with notable growth in adoption rates and market activity. According to recent data, over 15.6 million South Koreans held accounts on the country’s top five cryptocurrency exchanges in November, representing more than 30% of the population. The nation’s total deposits in crypto exchanges doubled from 4.7 trillion won ($3.2 billion) in October to 8.8 trillion won ($6.03 billion) in November, signalling heightened investor interest.

Source: X

The rise of the “Kimchi Premium,” which measures the price gap between South Korean and international exchanges, underscores strong local demand. CryptoQuant reported a 5.12% premium during recent market corrections, suggesting robust optimism in the region. This local enthusiasm has bolstered speculative activity and reinforced Bitcoin's global appeal, even as international markets navigate regulatory uncertainties and market volatility.

The U.S. spot Bitcoin ETF market has recently experienced significant turbulence, with $1.5 billion in outflows over a four-day period. This marks the most prominent streak of withdrawals since Donald Trump’s re-election earlier this year. On December 24 alone, $338 million was withdrawn, with BlackRock’s IBIT ETF leading the losses at $188 million, followed by Fidelity’s FBTC and ARK Invest’s ARKB.

Despite these outflows, total assets under management (AUM) across Bitcoin ETFs remain at $107.53 billion, supported by daily price gains of up to 6.48%. Ethereum ETFs have seen inflows, highlighting the divergence in investor sentiment between these two leading digital assets. While Bitcoin ETFs face challenges, the continued inflows into Ethereum products suggest a growing appetite for diversified crypto exposure among institutional investors.

Source: TheBlock

Bitcoin's price movement has been marked by notable fluctuations, reflecting both market challenges and its inherent resilience. Currently trading at $95,302, Bitcoin faces a critical test at key support and resistance levels.

The 50-day SMA at $94,650 acts as a vital support zone, while immediate resistance is observed near the 21-day SMA at $99,600.

The RSI, now at 40.79, suggests neutral-to-bearish momentum, signalling room for potential recovery or further consolidation depending on market dynamics.

Source: TradingView

With 24-hour trading volume at $165.12 million, recent patterns reveal limited buying interest, reflecting cautious sentiment.

To regain upward momentum, Bitcoin must reclaim and sustain levels above $99,600, which could open the door to a psychological barrier at $100,000. Failure to maintain current support levels might trigger a retest of lower zones around $92,000 or even $90,000.

Traders are advised to monitor volume trends and price behaviour for directional cues closely.

The regulatory environment for cryptocurrencies is poised for transformation as President-elect Donald Trump prepares to take office. His nominee for SEC Chair, Paul Atkins, is expected to introduce a more crypto-friendly approach, shifting priorities from the enforcement-heavy stance of outgoing Chair Gary Gensler. This change could foster innovation and provide greater clarity for digital asset firms.

The SEC's approval of Bitcoin and Ethereum spot ETFs earlier this year has already set the stage for further product development, including staking-enabled ETFs. However, pending rules like Regulation ATS could redefine the scope of crypto exchanges and decentralised projects. With a new administration, the crypto industry anticipates a more balanced regulatory framework that supports growth while addressing security and compliance concerns.

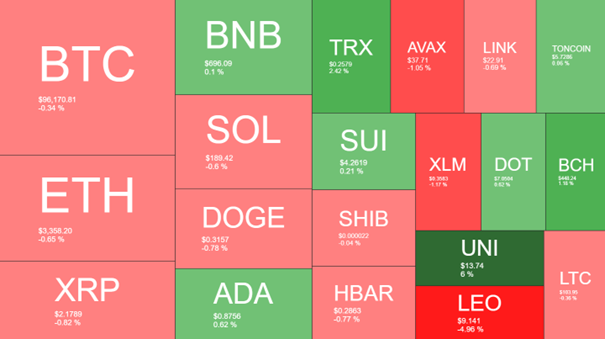

The broader cryptocurrency market continues to experience a mix of optimism and caution as altcoins show varied performance. While some altcoins, like SUI and ADA, posted modest gains amid market recovery, others, like Dogecoin and AVA,X faced selling pressure, testing critical support levels.

The global crypto market capitalisation increased by 3.1% over the past 24 hours, driven by strong trading volumes. However, record outflows from U.S.-based spot Bitcoin ETFs and cautious sentiment in traditional financial markets have tempered bullish enthusiasm.

As we approach the close of 2024, investors closely monitor altcoin performance and overall market sentiment for cues on broader trends heading into the new year.

Daily Heatmap

Source: QuantifyCrypto

The holiday period has ushered in a phase of relative calm in the cryptocurrency market, with Bitcoin consolidating above critical levels.

Trading near $95,000, Bitcoin appears to be stabilising as reduced volatility and the closure of traditional finance markets provide temporary relief from selling pressure.

This pause allows traders and investors to recalibrate their strategies and assess market trajectories heading into the new year.

Bitcoin’s ability to hold above key supports and eventually breach resistance points will determine its direction in early 2025. The ongoing integration of crypto into mainstream financial products and the development of innovative blockchain solutions set the stage for broader adoption.

However, evolving regulations and macroeconomic factors will remain key variables shaping Bitcoin’s path in the coming months.

Source: CoinMarketCap