Crypto Weekly Wrap: 25th October 2024

Bitcoin Price Targets $68,000 Amid US Jobless Claims

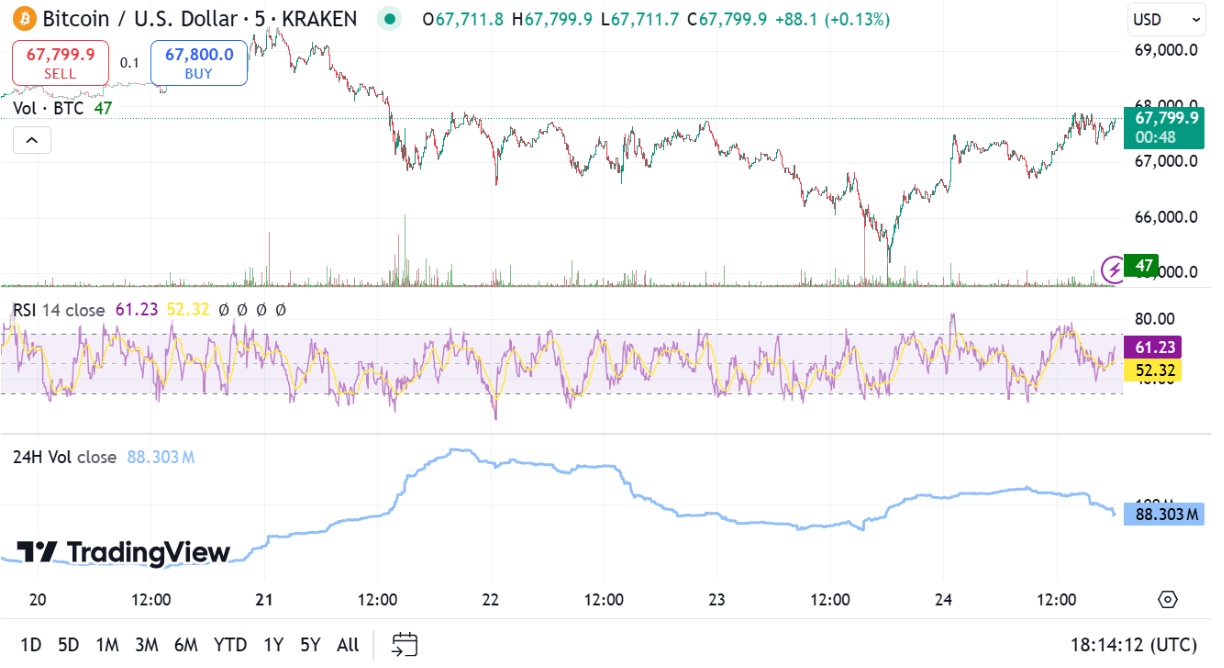

Bitcoin is approaching the $68,000 mark after recovering from a recent dip to $65,000, driven by favourable U.S. jobless claims data. The latest jobless claims came in below expectations for the second consecutive week, sparking optimism that the Federal Reserve may cut interest rates again during their November meeting. This potential rate cut has led to increased bets in favour of Bitcoin, with market sentiment growing more bullish. As a result, Bitcoin saw a 1.5% price gain, rebounding from its recent low. The price now faces resistance near $68,000, a level watched closely by traders. Analysts are optimistic that if Bitcoin can close above $67,900 by the end of the week, it could trigger a more sustained upward trend, possibly leading to new highs.

Whale Accumulation at Record High

Bitcoin’s whale activity has reached an all-time high, signalling strong long-term confidence among large holders. According to data, whales now hold around 670,000 BTC, surpassing previous accumulation levels. This continued accumulation is a positive sign for Bitcoin's long-term prospects, as whales typically drive market trends. A key observation is that when whales accumulate BTC, the market often sees reduced selling pressure, allowing prices to rise gradually. The current accumulation is similar to the trend seen in 2020, which preceded a significant bull run. Analysts view this as a "calm before the storm" scenario, with the potential for Bitcoin to surge higher once retail investors begin absorbing the selling pressure from whales. This consistent whale activity points to growing confidence in Bitcoin’s future price action, with some predicting a parabolic rise.

Source: X

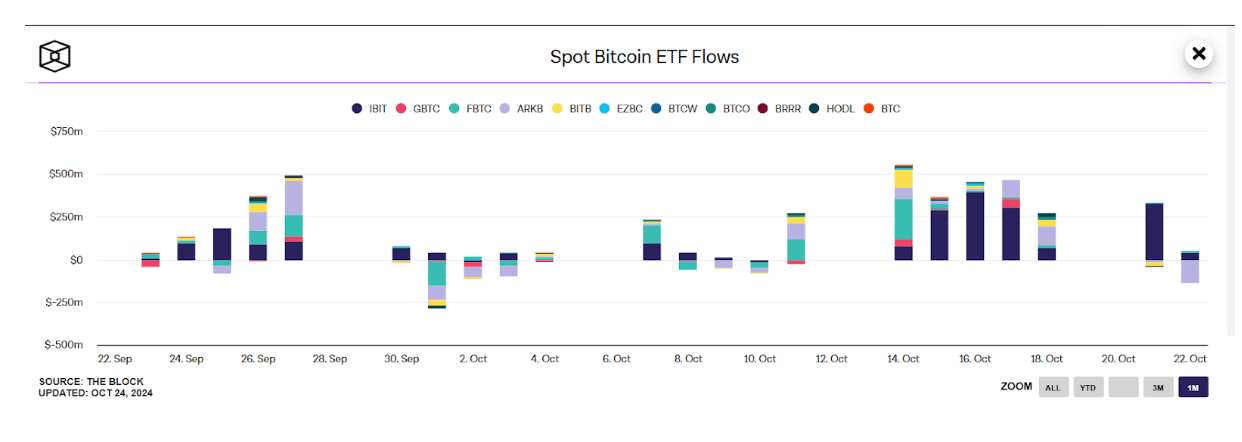

Bitcoin ETF Inflows Show Institutional Confidence

Bitcoin’s resurgence above $67,000 is also supported by strong inflows into Bitcoin exchange-traded funds (ETFs). After experiencing net outflows earlier in the week, ETF inflows surged by $192.4 million on October 23, indicating continued institutional interest. This uptick in ETF inflows, despite short-term price dips, demonstrates a bullish outlook from institutional investors. Bitcoin ETFs provide a more accessible way for traditional investors to gain exposure to the cryptocurrency, and growing inflows suggest that institutions are still confident in Bitcoin's long-term value. Analysts believe that if the inflows continue, they could push Bitcoin to break through the resistance at $68,000 and reach new highs. The ETF inflows are also seen as a key factor in maintaining bullish sentiment, as they reflect growing adoption and confidence in the asset.

Source: TheBlock

Technical Analysis: Bitcoin Eyes $70,000

From a technical perspective, Bitcoin’s recent price movements are promising, showing a strong recovery above $67,000. Bitcoin is currently trading within an ascending channel, with key resistance at $68,000 and support at $65,200. The Relative Strength Index (RSI) is around 61, signalling that Bitcoin is on slightly overbought territory. While this could suggest a short-term pullback, the overall trend remains bullish. Bitcoin is also supported by its 50-day exponential moving average (EMA) at $64,000, which has acted as a strong support level in recent weeks. A close above $67,900 this week would confirm the breakout, with the next target being $70,000. However, failure to hold this level could result in a temporary pullback to $65,200, although the bullish momentum suggests that any dips will likely be short-lived.

Source: TradingView

Tesla’s Bitcoin Holdings and Market Impact

Tesla’s involvement with Bitcoin has once again made headlines, as the company revealed in its Q3 financial filings that it has not sold any of its Bitcoin holdings. Tesla currently holds around $184 million worth of Bitcoin and has maintained this position for five consecutive quarters. This decision by Tesla to hold onto its Bitcoin signals a positive outlook for the asset, as corporate holdings often influence market sentiment. Earlier reports from Arkham Intelligence indicated that Tesla’s Bitcoin wallets had started moving funds, sparking speculation of a possible sale. However, Tesla’s latest financial disclosures confirmed that no Bitcoin had been sold, helping to alleviate fears of potential selling pressure on the market. Tesla’s continued investment in Bitcoin also highlights the growing acceptance of the cryptocurrency among large corporations, reinforcing its status as a long-term store of value.

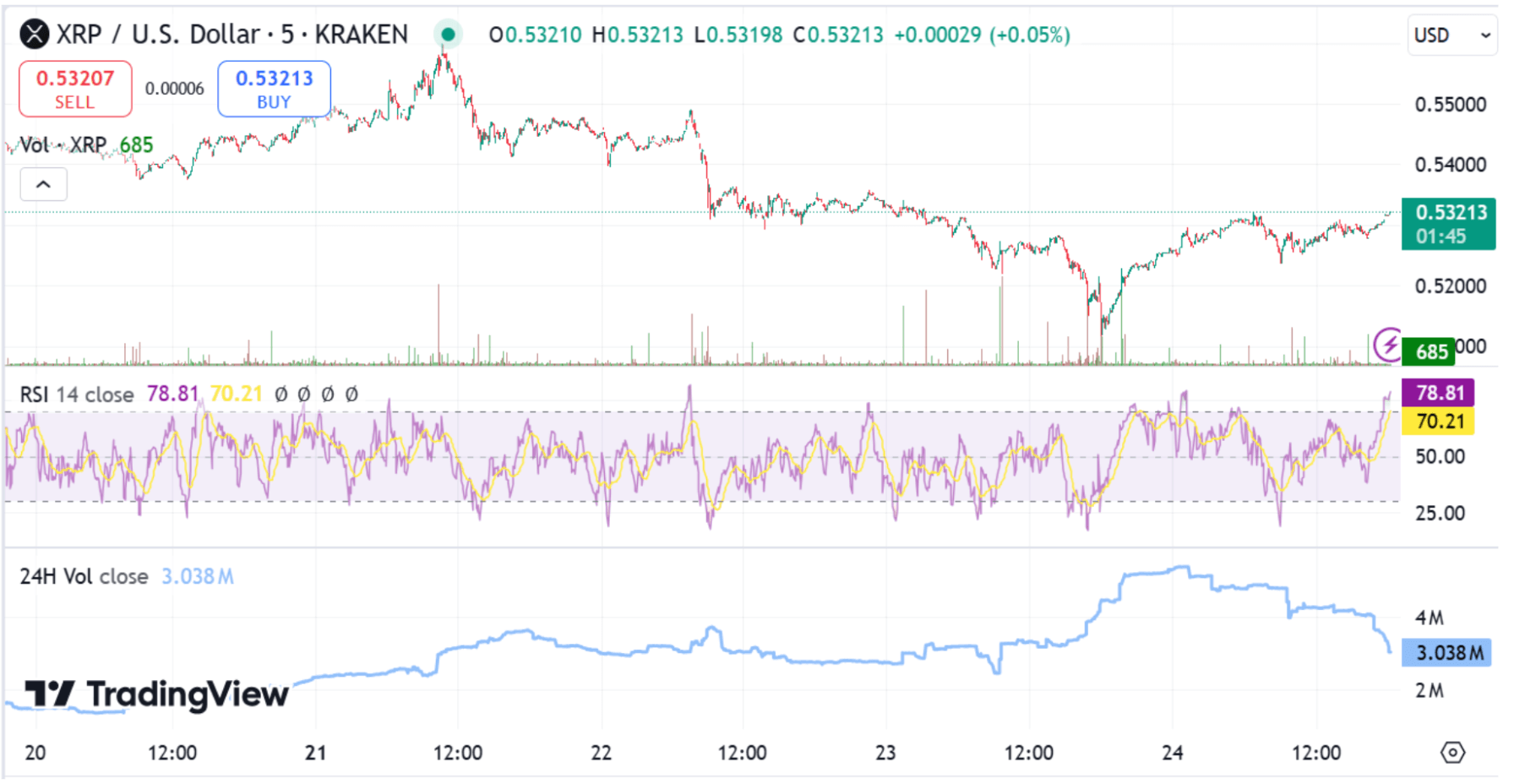

XRP Shows Signs of Rebound as Selling Pressure Weakens

XRP has faced a significant drop recently, trading at around $0.532, down 3% in the past 24 hours. However, despite the short-term bearish trend, analysts suggest that a rebound may be on the horizon as selling pressure begins to wane. XRP’s Chaikin Money Flow (CMF) indicator has shown a decline in selling pressure, indicating that the market may be shifting toward a more bullish phase. The CMF recently rose from -0.36 to 0.29, signalling that accumulation is starting to outweigh selling activity. Investors are keeping an eye on Ripple’s legal developments with the SEC, which could act as a catalyst for further price movement. Should XRP continue to consolidate at these levels, a break above $0.55 could signal the start of a stronger upward trend in the near future.

Source: TradingView

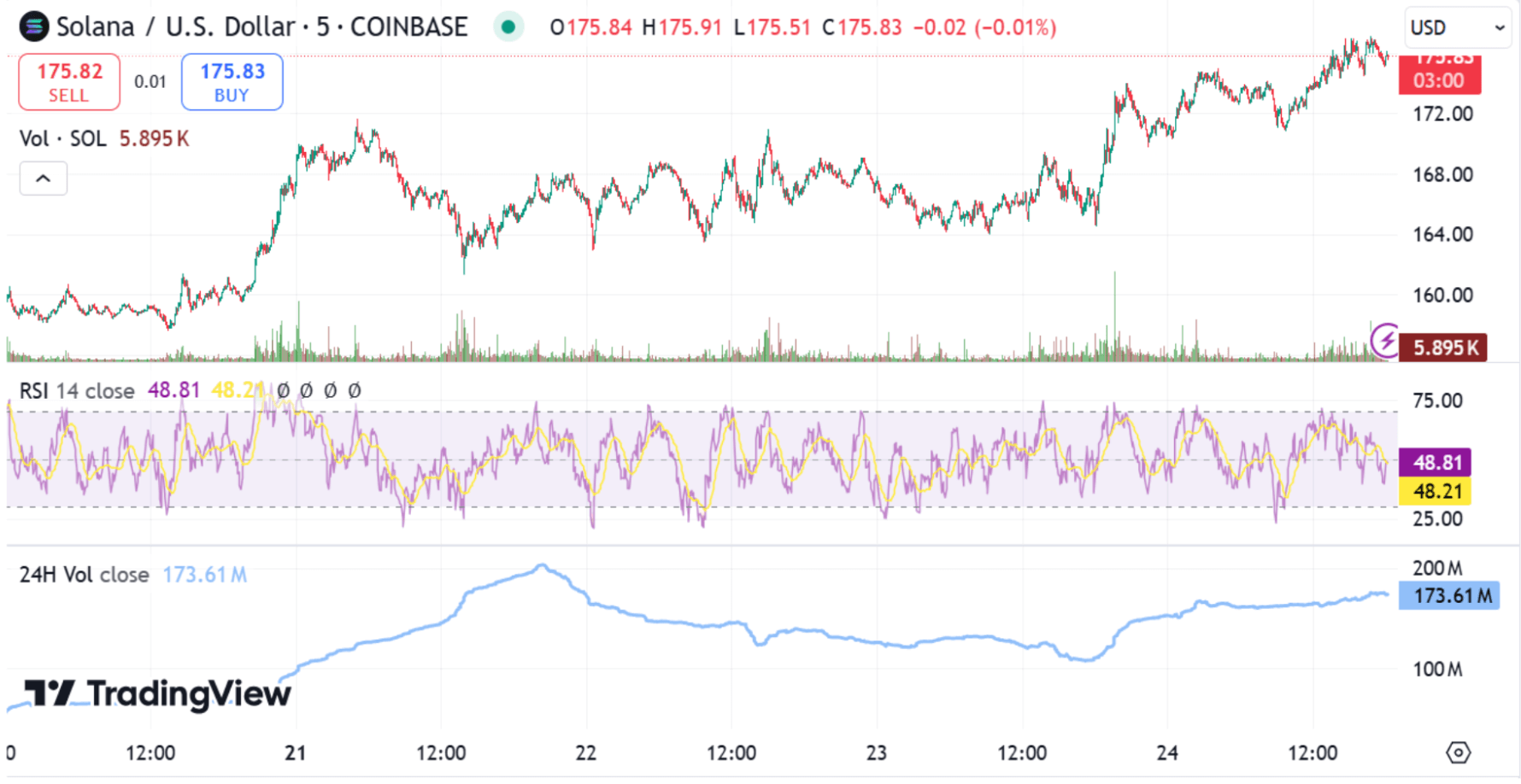

Solana Surges Against Ethereum Amid Growing Network Usage

Solana has emerged as a strong contender to Ethereum, with its price surging by approximately 600% against ETH since 2023. This dramatic rise is largely driven by Solana’s increasing decentralised exchange (DEX) usage and memecoin activity, which has fueled substantial growth on the network. Solana’s daily DEX trading volume has frequently matched or even surpassed Ethereum’s in recent months, highlighting its growing appeal among traders. The lower transaction fees and faster transaction speeds have made Solana an attractive alternative to Ethereum, particularly for users engaging in memecoin trading. Analysts are now discussing the potential for Solana to "flip" Ethereum in market capitalization, with upcoming network upgrades like Firedancer aiming to boost Solana’s capacity to handle up to 1 million transactions per second by 2025. While Solana's price has climbed significantly, technical indicators suggest that a correction may be due, but the long-term outlook remains bullish as Solana continues to attract more users and institutional interest.

Source: TradingView

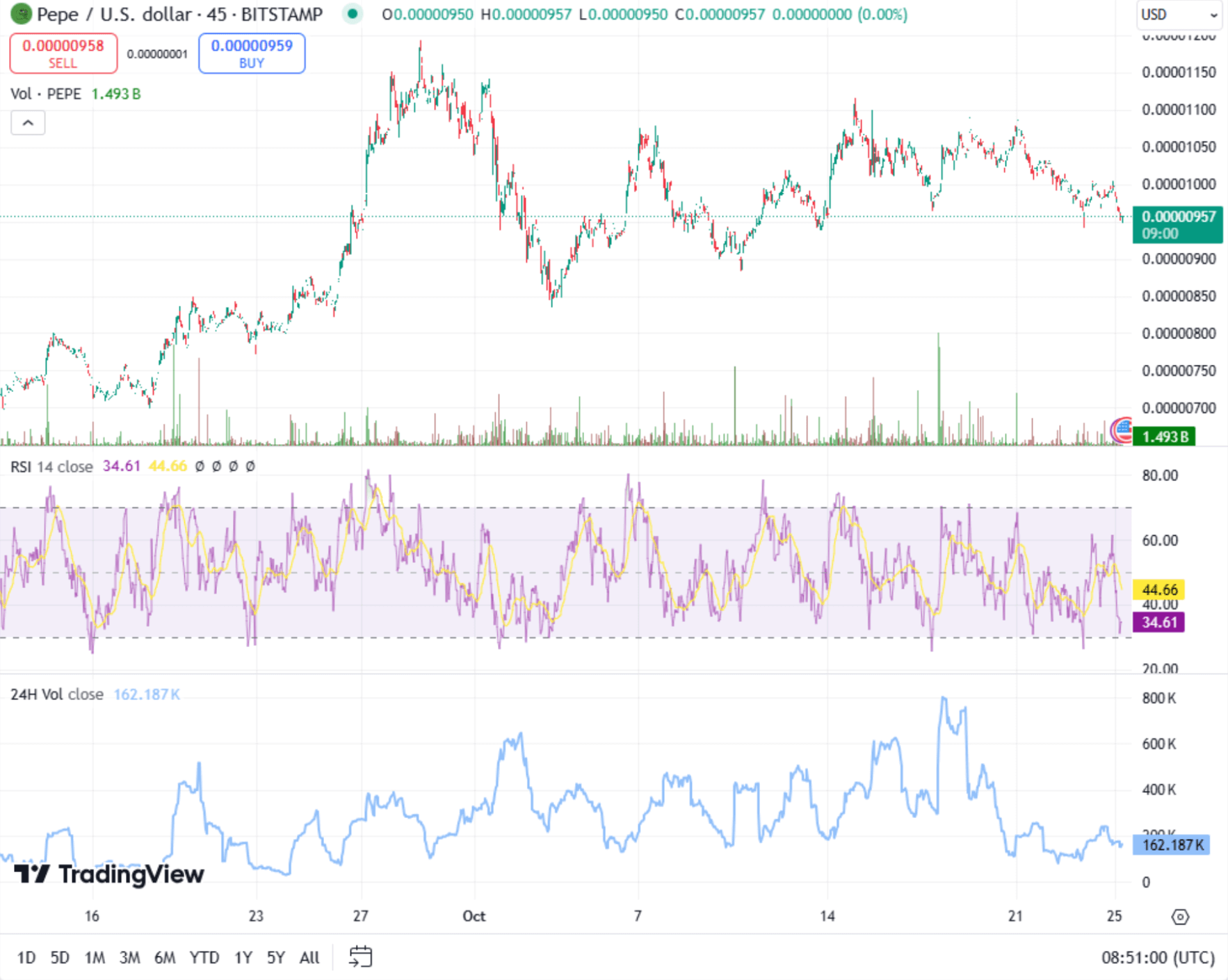

Pepe Coin's Breakout Potential Gains Momentum

PEPE has garnered increased attention as analysts point to a potential breakout, despite a recent dip to $0.0000096. This drop, though slight, comes on the heels of a year that saw PEPE's impressive rise, making it one of the year's top-performing tokens. The coin’s trading volume remains strong at $1.2 billion, and data shows substantial whale activity, with one trader accumulating over 33 billion PEPE in recent days. Market insiders suggest that the token's medium-term price chart, forming a bullish pennant shape, could precede a significant surge in value. If current trends continue, PEPE could potentially target a $25 billion market cap, with optimistic forecasts hinting at a price of $0.00002 in the near future. Enthusiasm around PEPE has grown, particularly in light of possible market boosts from a pro-crypto presidential candidate, and as layer-two projects like Pepe Unchained (PEPU) gain traction with a dedicated ecosystem for meme tokens and faster transaction speeds, PEPE’s broader network expansion could also bolster its market presence.

Source: TradingView

Source: X