Crypto Weekly Wrap: 24th January 2025

Crypto Market Overview: Major News and Insights

The cryptocurrency market continues to experience rapid changes, with significant developments shaping its trajectory. From the evolving regulatory landscape to groundbreaking moves by institutions and governments, crypto is steadily transitioning from a speculative investment to an essential element of global finance. Key updates include Bitcoin's price trends, growing adoption of crypto-based ETFs, and strategic moves by states and corporations. Meanwhile, the altcoin market and venture capital space remain vibrant, reflecting broader innovation within the industry.

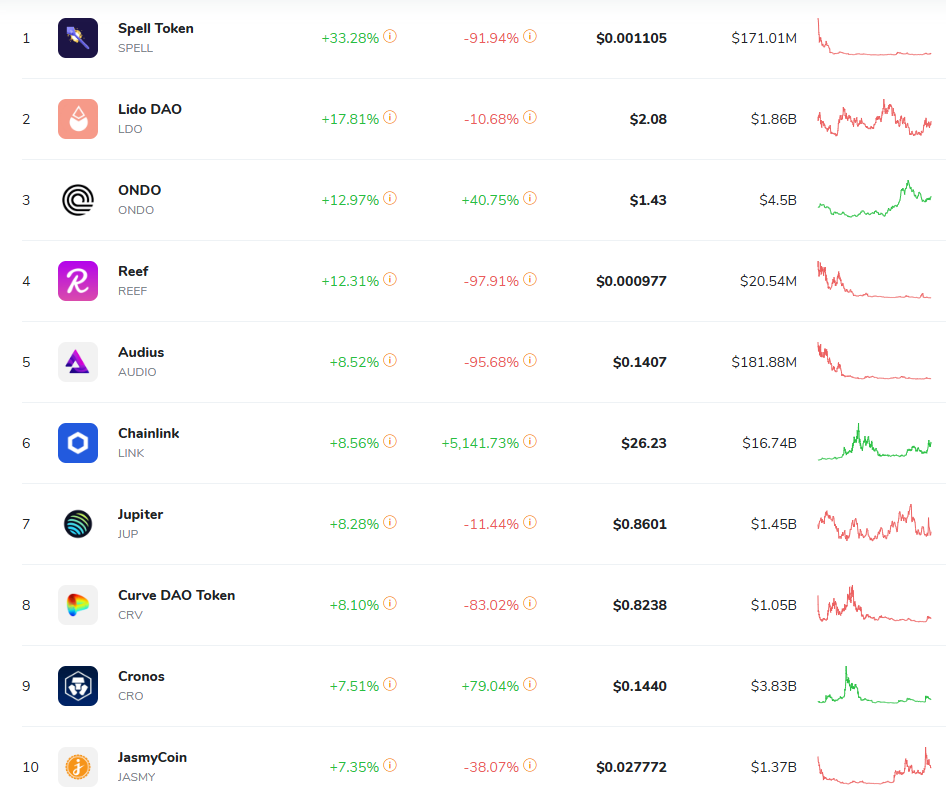

Cryptocurrencies by 24H Return

Regulatory Shifts and Strategic Bitcoin Reserves

The regulatory environment is undergoing pivotal changes under the Trump administration. The appointment of Mark Uyeda as the acting SEC chair and the creation of a crypto task force signal a new era of clearer guidelines for digital assets. This business-friendly approach aims to foster growth and innovation while addressing concerns around investor protection.

Simultaneously, states like Wyoming, Texas, and New Hampshire are introducing Bitcoin reserve legislation, emphasizing its role as a hedge against inflation and a safeguard for state finances. Globally, corporations like MicroStrategy continue to accumulate Bitcoin, further solidifying its position as "digital gold." These developments underscore the growing recognition of Bitcoin as both a financial asset and a strategic reserve.

Source: cfodive.com

Crypto ETFs Surge Amid Regulatory Optimism

Crypto-based exchange-traded funds (ETFs) have seen a remarkable increase in applications following Gary Gensler’s resignation as SEC Chair. Notably, Dogecoin and Trump-themed ETFs have joined the roster, reflecting a surge in investor interest across diverse assets. According to Bloomberg, ETF filings have doubled, with over 33 submissions now under review by the SEC.

Source: X

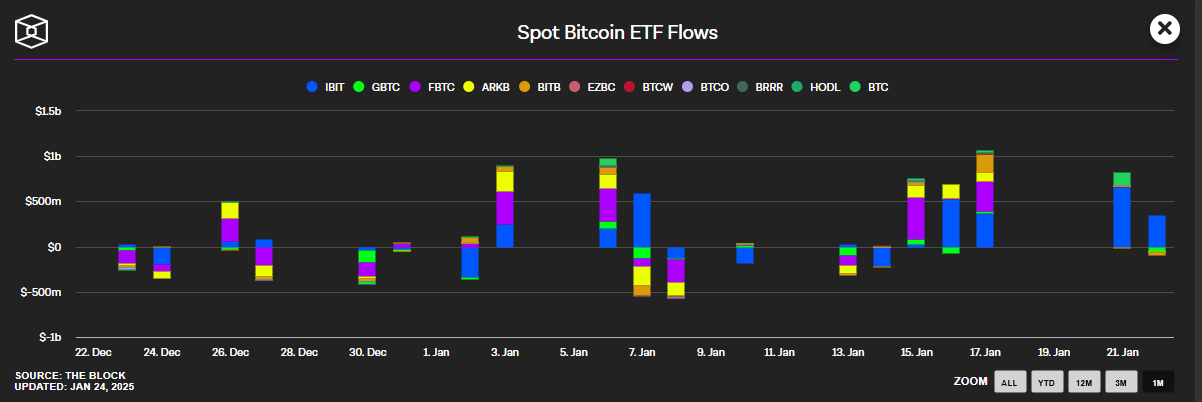

Bitcoin ETFs continue to dominate capital inflows, with $802 million added in a single day. These products offer an accessible entry point for retail and institutional investors, driving broader market adoption. Analysts expect these ETFs to remain central to the market’s growth, with altcoin-based ETFs expanding diversification opportunities for investors.

Source: TheBlock

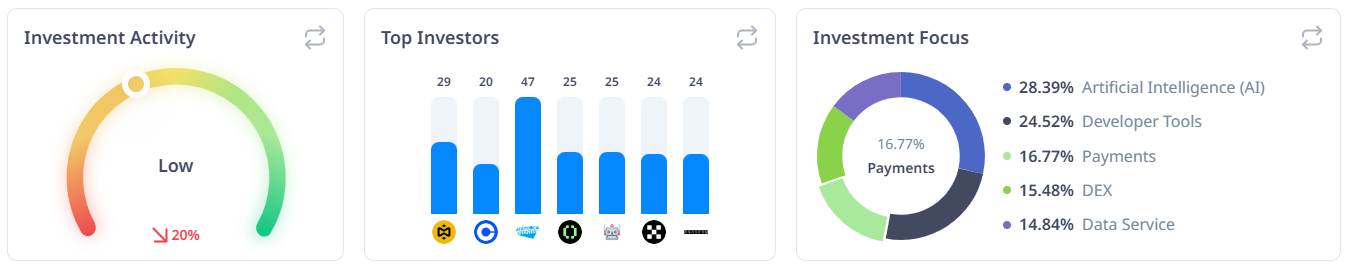

Venture Capital Faces Shifting Dynamics

Crypto venture capital (VC) funding is poised for a modest rise in 2025, though JPMorgan analysts predict it will fall short of the 2021-2022 peaks. The rise of community-driven platforms like Echo and the growing dominance of institutional players like BlackRock are reshaping the funding landscape. These trends make it harder for traditional VCs to secure deals with promising startups, particularly as projects prioritize decentralization and regulatory safety.

High interest rates and the popularity of crypto ETFs further siphon capital away from early-stage ventures. Despite these challenges, analysts emphasize that VCs are increasingly focused on projects with tangible user adoption and scalable technologies. This shift reflects the maturing of the market, as investors prioritize sustainable growth over short-term returns.

Source: CryptoRank

World Liberty Financial’s Token Sale and Trump’s Crypto Agenda

World Liberty Financial (WLFI), a decentralized finance platform backed by Donald Trump, has completed a successful token sale, raising $300 million through the release of 20% of its supply. Following overwhelming demand, the project opened an additional block of tokens at a 230% price increase, raising another $250 million. Investors, including Tron’s Justin Sun, have significantly increased their stakes, underscoring growing confidence in Trump-backed crypto initiatives.

Trump’s crypto policies are poised to make a significant impact. His administration plans to repeal restrictive regulations introduced under the Biden era and prioritize crypto-friendly executive orders. The proposed “strategic Bitcoin reserve” aligns with this vision, positioning the U.S. as a leader in digital asset adoption and innovation.

Source: X

MiCA Regulation Shakes Up the European Market

Europe’s landmark Markets in Crypto-Assets (MiCA) regulation, implemented in December 2024, is reshaping the crypto landscape. Boerse Stuttgart became the first German crypto provider to secure a MiCA license, paving the way for regulated services across the EU. MiCA promotes transparency, investor protection, and market harmonization, offering companies a unified framework for compliance.

However, the new regulations have also sparked concerns about their impact on innovation. Experts warn that stricter compliance requirements could stifle smaller projects and push companies toward mergers and acquisitions. The stablecoin market, in particular, is undergoing significant shifts, with Coinbase delisting Tether (USDT) due to compliance concerns. Despite these challenges, MiCA represents a step forward in legitimizing the European crypto market.

Bitcoin Technical Analysis: Navigating Volatility

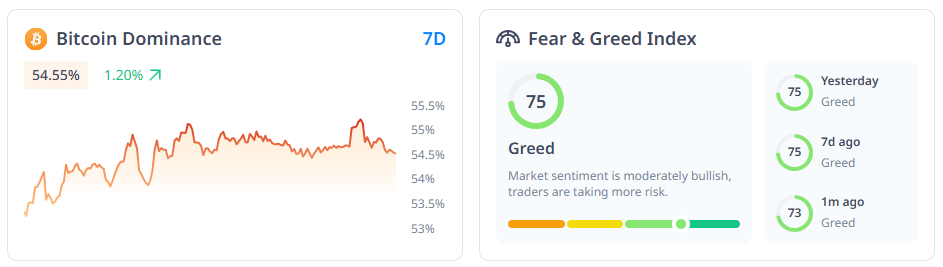

Bitcoin continues to dominate headlines, trading within a tight range following its high of $109,356 on inauguration day. Recent profit-taking and caution have contributed to subdued price action, with Bitcoin fluctuating between $100,000 and $109,000. Bitcoin recently broke out of a symmetrical triangle pattern, signaling a potential rally to $115,000 based on the triangle's measured move.

Volatility measures indicate a major price move could be imminent. On-chain data shows tightening 60-day price ranges, often preceding significant market shifts. Support levels at $104,000 and $103,000 are critical, while resistance near $109,000 must be cleared for a sustained rally. The upcoming Federal Reserve meeting and Trump’s potential crypto announcements are likely to serve as catalysts for Bitcoin's next move.

Source: TradingView

Expanding Horizons: Beyond Bitcoin

While Bitcoin remains the focal point of the market, altcoins and new initiatives are broadening the crypto ecosystem. Ethereum’s dominance in decentralized finance (DeFi) and non-fungible tokens (NFTs) continues to grow, with Layer-2 scalability solutions driving adoption. Solana is making strides in AI-powered applications, while Dogecoin gains traction following its association with the U.S. Department of Government Efficiency.

Meanwhile, the rise of environmentally conscious cryptocurrencies highlights the market’s growing focus on sustainability. Innovations like Proof of Stake (PoS) and renewable energy mining are gaining traction, appealing to a new generation of investors. As the crypto market matures, these developments demonstrate its potential to disrupt traditional systems while addressing modern challenges.

Source: CryptoRank

Conclusion: A Market in Transition

The crypto market is navigating a transformative phase, shaped by regulatory changes, institutional adoption, and technological advancements. Bitcoin remains a cornerstone, but the growing prominence of altcoins, community-driven funding models, and sustainability initiatives signal a broader evolution. As governments, institutions, and investors adapt to this dynamic environment, the future of crypto holds immense promise for innovation and financial inclusion.