Crypto Weekly Wrap: 22nd November 2024

Bitcoin Approaches $100k: A Historic Milestone in the Making

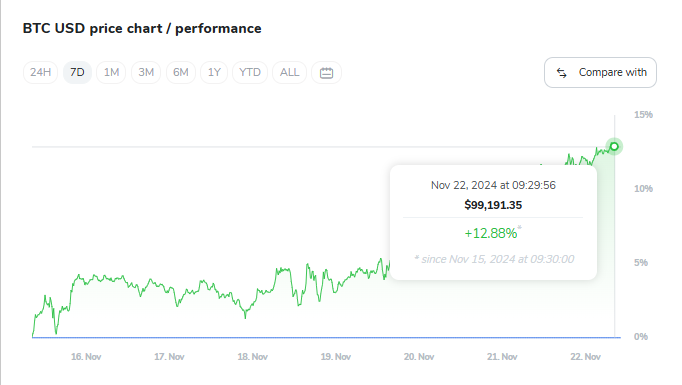

Bitcoin (BTC) continues its impressive rally, reaching new all-time highs (ATH) and setting its sights on the much-anticipated $100,000 milestone. After surpassing $90,000 on November 13, Bitcoin climbed further to $99,000 on November 22, demonstrating remarkable momentum. Industry experts believe that this milestone is not just a psychological target but also a reflection of Bitcoin's growing maturity as a financial asset. The convergence of favourable macroeconomic conditions, increased institutional adoption, and a maturing market structure is creating a strong foundation for Bitcoin's continued growth.

The Role of High Volatility and Changing Market Profiles

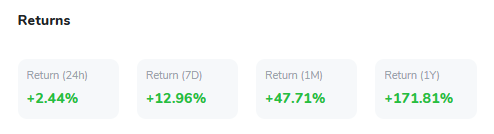

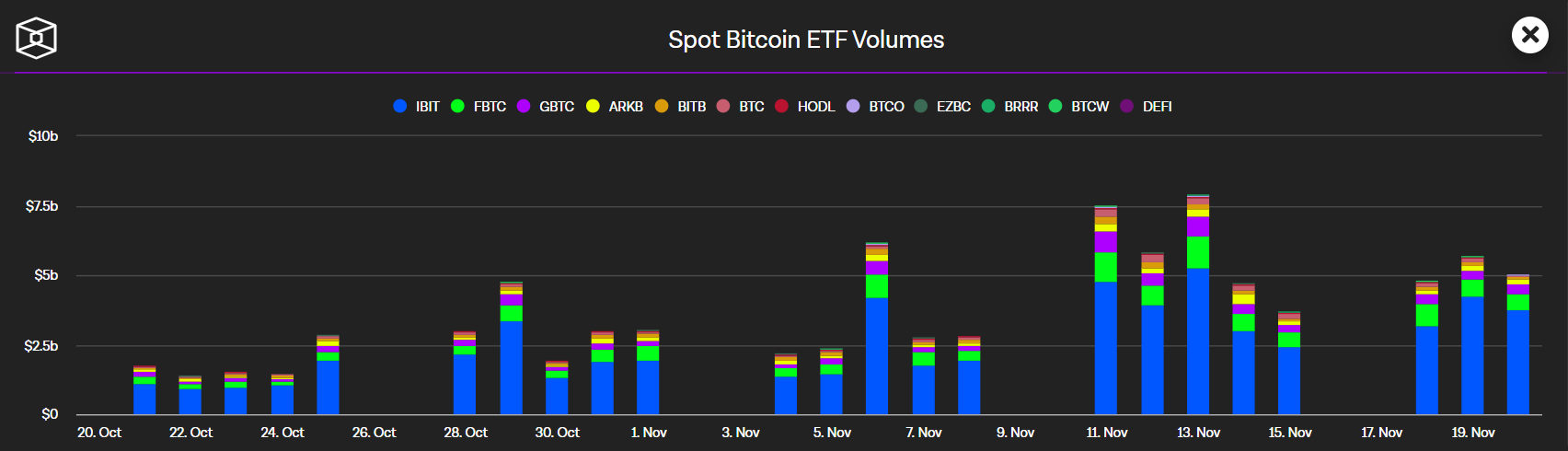

As Bitcoin approaches the $100,000 milestone, volatility has surged back to around 60%, reflecting the intensified market activity and heightened investor engagement. Over the past 18 months, institutional players have significantly entered the market, helping to temper speculative trading during quieter periods. However, the current bullish rally, fueled by institutional inflows and the approval of spot ETFs, has reignited sharp price swings.

Bitcoin’s ease of transferability and decentralised nature remain pivotal factors in its growing adoption. The resurgence in volatility indicates an active market with both retail and institutional participants responding to macroeconomic trends and speculative opportunities. Despite the high volatility, the broader market profile continues to shift toward maturity, with professional market makers and longer-term investment strategies balancing out impulsive trading behaviours. This dynamic underscores Bitcoin's dual identity as both a speculative asset and a recognized store of value, capable of weathering the ebbs and flows of market cycles.

Source: TheBlock

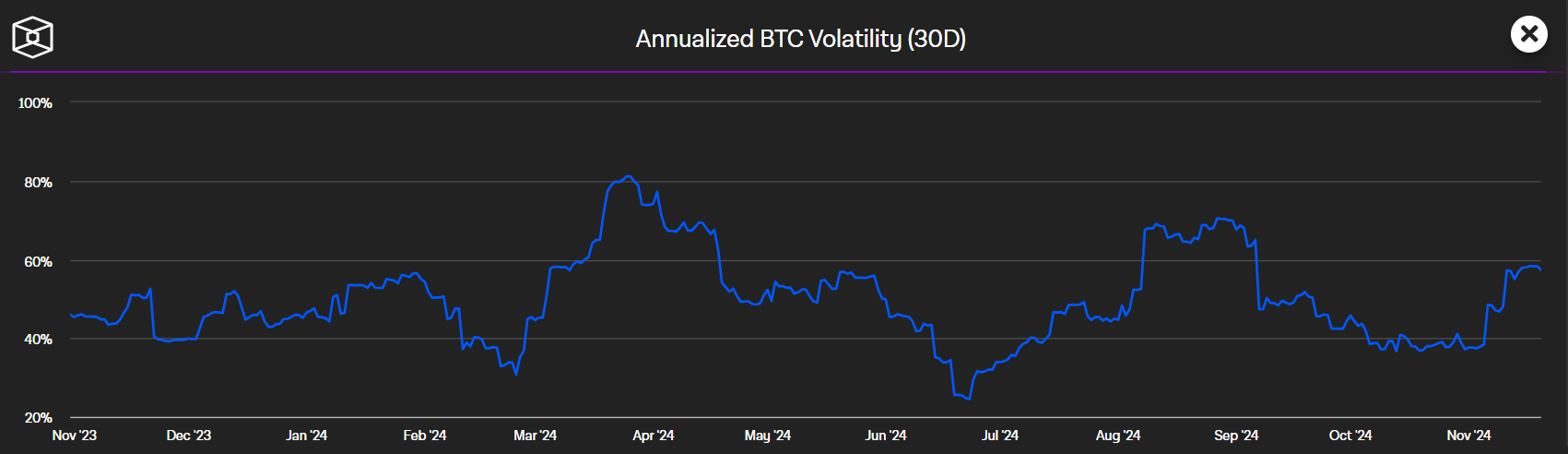

What $100k BTC Means for Investors

Reaching $100,000 will have varying implications for institutional and retail investors. For institutional players, this milestone represents validation of Bitcoin’s potential as a strategic asset, encouraging broader adoption and integration into traditional portfolios. Many financial institutions have already begun allocating small portions of their portfolios to cryptocurrency, and a $100,000 Bitcoin could set a new baseline for digital asset investments.

For retail investors, however, the psychological impact of a six-figure BTC is likely to amplify the fear of missing out (FOMO), driving additional buying pressure. This milestone could catalyse a transformative shift in how cryptocurrencies are viewed within the broader financial system. The growing market maturity, coupled with institutional frameworks, suggests that $100,000 may serve as a stepping stone rather than a peak.

Source: Coinmarketcap

Technical Analysis: BTC Targets $100k with Strong Momentum

From a technical perspective, Bitcoin is demonstrating robust bullish momentum as it inches closer to $100,000. The asset is currently trading around $98,000, supported by strong buying interest at key levels. On the daily chart, BTC is maintaining an upward trend within a bullish channel, with immediate support at $95,000 and additional support at $93,500 provided by the 50-day Exponential Moving Average (EMA).

Source: TradingView

The Relative Strength Index (RSI) is at 51, indicating neutral conditions with room for further gains before entering overbought territory. Key resistance levels to watch are at $100,000 and $100,500. Breaking through these could pave the way for a decisive move to $110,000 and beyond.

Open interest in BTC contracts has surged to $63 billion, reflecting heightened market activity. While the technical indicators suggest strong momentum, short-term profit-taking around the $100k level could lead to brief corrections. However, these pullbacks are likely to be less severe than in previous cycles due to the increasing sophistication of market participants.

The Broader Impact of Institutional Adoption

Institutional adoption is playing a pivotal role in Bitcoin's current bull run. Spot ETFs in the U.S. have collectively surpassed $100 billion in assets under management, accounting for 5.4% of Bitcoin’s total market capitalization. BlackRock’s IBIT leads the pack with $45.4 billion in assets, followed by Grayscale’s GBTC at $20.6 billion. These funds provide institutional investors with a secure and regulated way to invest in Bitcoin, significantly boosting demand.

Source: TheBlock

MicroStrategy, recently announced plans to raise $2.6 billion to continue acquiring BTC. This move reflects growing confidence among traditional institutions in Bitcoin’s long-term potential. As more companies integrate Bitcoin into their balance sheets and investment portfolios, the asset's price trajectory is likely to remain upward.

Dogecoin: Riding the Waves of Hype and Optimism

Dogecoin (DOGE) remains a focal point in the altcoin space, fueled by its cult-like following and the support of high-profile figures like Elon Musk. Despite recent volatility, DOGE has surged significantly over the past month, with a 163% increase driven by Musk’s active promotion and association with the crypto-friendly policies of President-elect Donald Trump. While its price recently slowed to $0.38 after touching a three-year high of $0.43, the momentum behind Dogecoin is far from over. Speculation around Musk’s involvement in the Department of Government Efficiency (D.O.G.E.) continues to energise the community, highlighting DOGE’s unique position as both a meme coin and a symbol of decentralised enthusiasm. Analysts caution, however, that Dogecoin’s notorious volatility means pullbacks are to be expected, even amid its broader bullish trend.

Source: TradingView

Altcoins: Mixed Fortunes and Emerging Opportunities

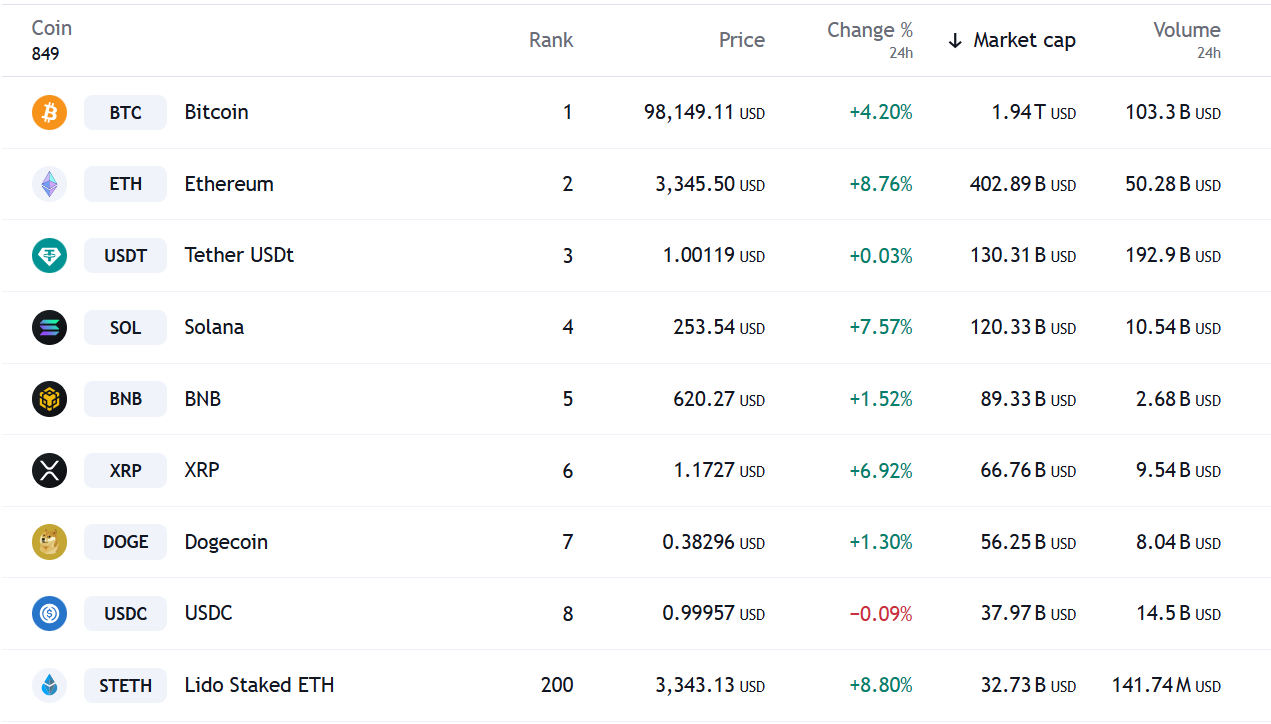

The altcoin market is showing a mixed bag of performances as Bitcoin approaches the $100,000 milestone. Ethereum (ETH), the second-largest cryptocurrency, has seen a 8.76% rise, trading at $3,346, reflecting broader market fluctuations. Conversely, Ripple (XRP) has climbed by 7% to $01.1727, driven by positive sentiment around its ongoing legal battle with the SEC. Solana (SOL) continues to attract attention, surging on institutional interest and its growing ecosystem, while Cardano (ADA) struggles, falling nearly 10% to $0.53897. Other altcoins, including Shiba Inu (SHIB) and Avalanche (AVAX), are experiencing moderate volatility, with investors keeping a close eye on upcoming developments. As Bitcoin sets the pace, the altcoin market remains dynamic, offering both challenges and opportunities for traders and long-term holders.

Coin Overview by Market Cap

Source: TradingView

SEC Chair Gary Gensler to Step Down, Raising Pro-Crypto Hopes

Gary Gensler, the current Chair of the SEC, has announced his resignation effective January 20, 2025, aligning with the beginning of President-elect Donald Trump’s term. Gensler, whose tenure was marked by a firm regulatory stance on cryptocurrencies, will leave behind a legacy of increased oversight and enforcement actions against major players like Coinbase and Binance. While he maintained that most cryptocurrencies qualify as securities, his approach has faced criticism from the crypto industry for being overly stringent and unworkable. Gensler’s departure signals a potential shift in the regulatory landscape, as Trump’s pro-crypto administration has promised a friendlier approach to digital assets. This development could pave the way for more progressive policies, increasing optimism among industry stakeholders about the future of crypto regulation in the U.S.

Source: SEC