Crypto Weekly Wrap: 20th September 2024

Key Highlights

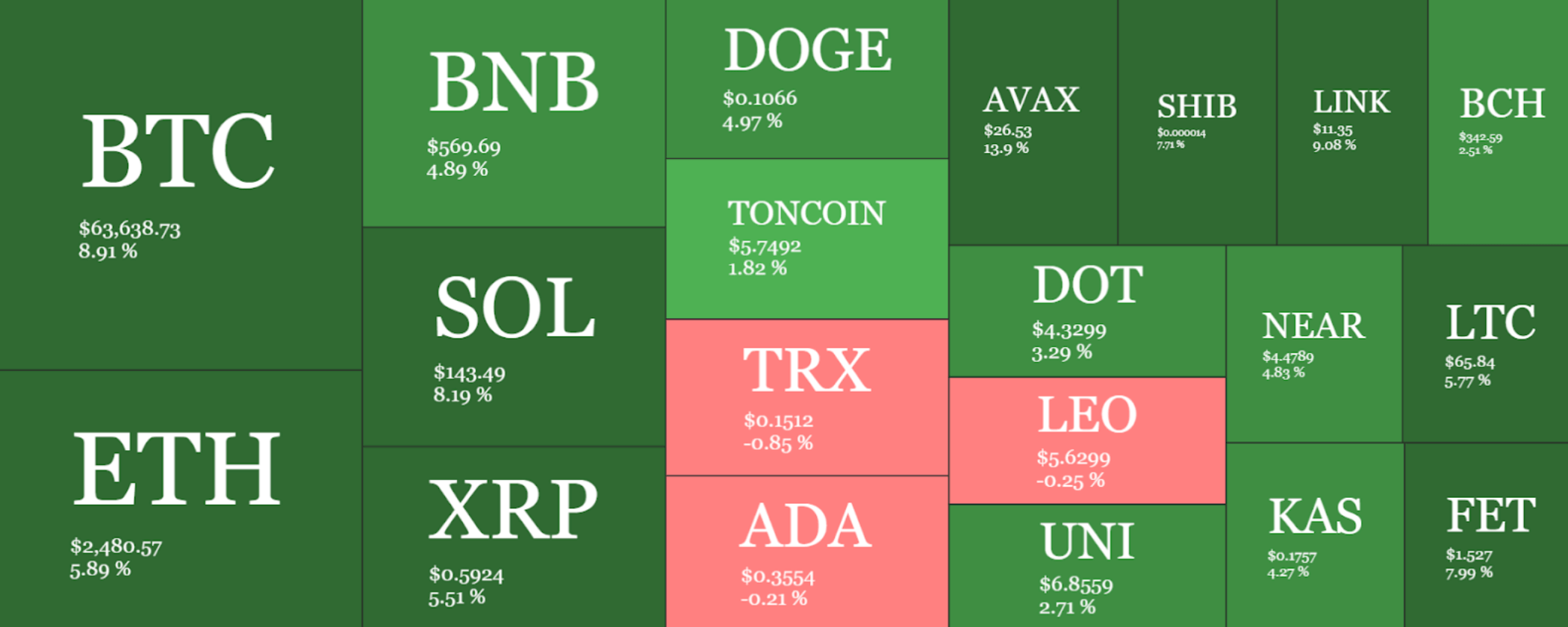

The crypto market is buzzing with several noteworthy events. Bitcoin continues to maintain its strong position around the $63,000 mark, while altcoins like Ethereum and XRP are seeing slight price fluctuations. Market participants are paying close attention to the upcoming Fed rate decision, which could impact the trajectory of cryptocurrency prices. Regulatory news is also making waves, with increasing scrutiny from U.S. authorities on several crypto firms, creating uncertainty in the market. Despite the regulatory pressure, crypto adoption and institutional interest are on the rise, especially in Europe, where DZ Bank's latest move to expand access to digital assets has been making headlines.

Source: Quantifycrypto

In the altcoin space, developments in the world of decentralised finance (DeFi) and blockchain innovation are fueling interest. Ripple's ongoing regulatory challenges with the SEC remain a focal point for the market, but Ripple continues to push forward with new initiatives. Notably, projects within the DeFi ecosystem and layer-2 scaling solutions for Ethereum are gaining traction, with many investors and developers focusing on these trends as potential growth areas for the crypto market.

Trump Buys Burgers with Bitcoin: Crypto Adoption in the Spotlight

In a notable moment for cryptocurrency adoption, former U.S. President Donald Trump made headlines by purchasing burgers with Bitcoin at NYC’s crypto-friendly pub, Pubkey. The event has sparked discussions on the increasing mainstream acceptance of Bitcoin and other cryptocurrencies. Trump, who has previously voiced scepticism about Bitcoin, appears to be softening his stance as digital currencies become more integrated into everyday transactions. Events like this serve to boost public interest and confidence in using Bitcoin for everyday payments, reinforcing its potential as a legitimate medium of exchange, not just a store of value.

Source: Bloomberg (Photographer: Spencer Platt/Getty Images)

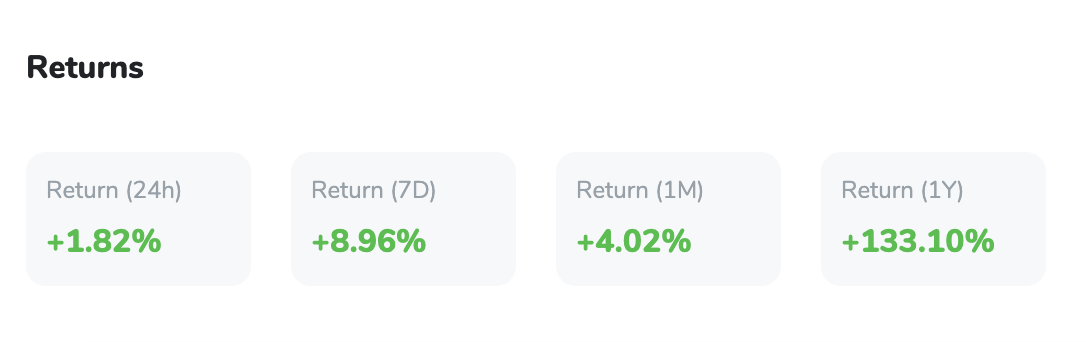

Bitcoin Breaks $63K: Traders Eye Next Steps

Bitcoin recently surged past the $63,000 mark, catching the attention of traders and analysts alike. This rally followed news of the Federal Reserve’s decision to cut interest rates, which has historically had a positive impact on Bitcoin prices as investors seek alternatives to fiat currencies. Market sentiment remains bullish, with many traders eyeing the next significant resistance level at $64,000. However, some caution that Bitcoin’s rapid rise could also invite profit-taking, which may lead to a short-term pullback before resuming the upward trend. The next few days will be crucial for BTC’s price trajectory as the market reacts to macroeconomic factors and trading momentum.

SEC vs. Coinbase: A Legal Battle Over Crypto Regulations

In the ongoing legal battle between the U.S. Securities and Exchange Commission (SEC) and Coinbase, new court documents have surfaced regarding the discovery process. This case, which revolves around whether certain crypto assets should be classified as securities, has the potential to shape the regulatory landscape for the entire crypto industry. Coinbase has maintained that its listed assets do not fall under the SEC’s jurisdiction, while the SEC argues that many of them should be subject to stricter regulations. The outcome of this legal battle will likely have far-reaching implications for crypto exchanges and could set important precedents for future regulatory decisions in the U.S.

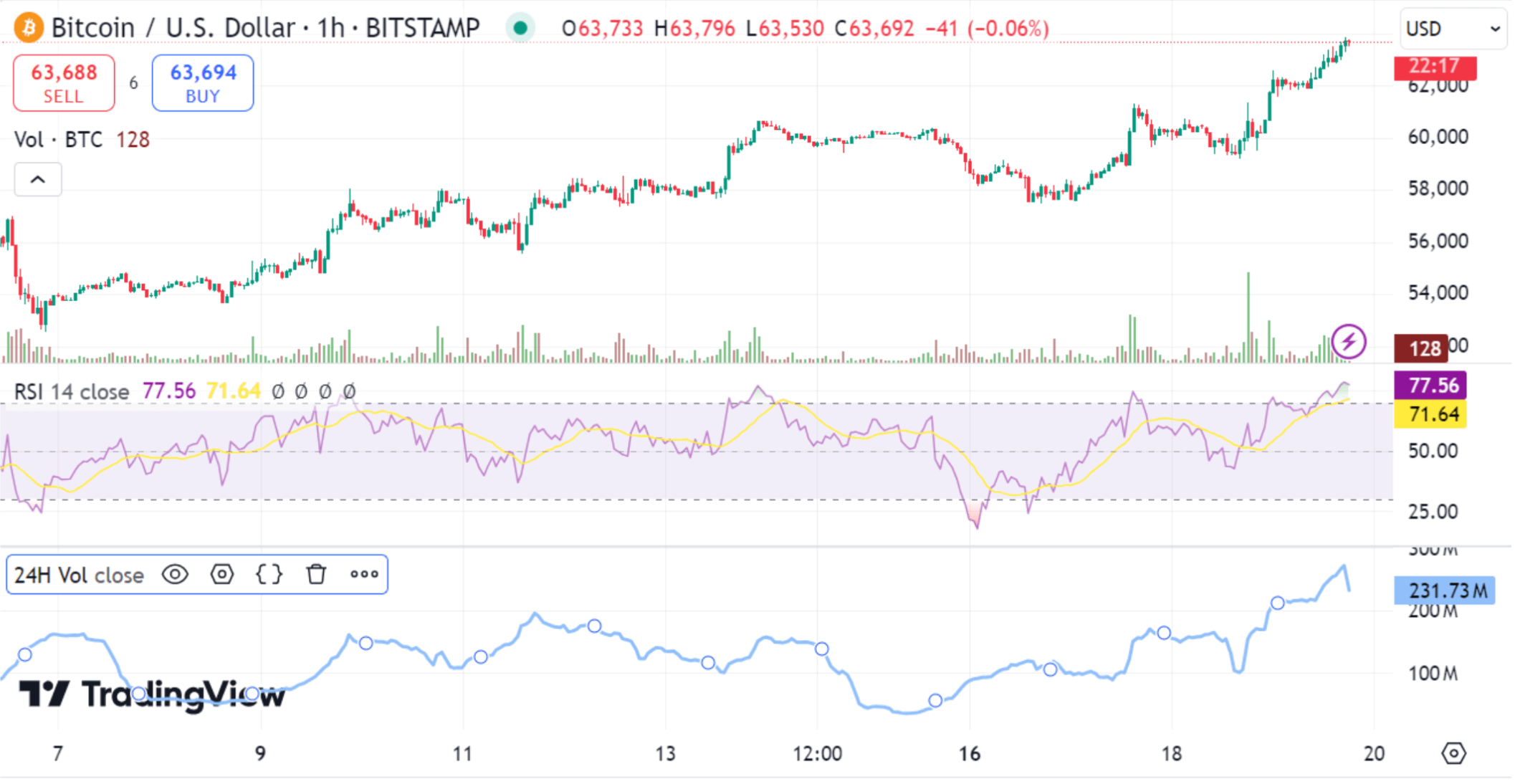

Bitcoin Technical Analysis: Key Levels and Indicators

Bitcoin’s recent price movements have been a focal point, with several key indicators suggesting that further gains could be on the horizon. After breaking through the crucial resistance level at $62,000, Bitcoin is now eyeing the next significant resistance at $64,000. If BTC can successfully close above this level, it could signal a continuation of the current bullish trend, potentially pushing the price toward the $70,000 mark in the medium term.

One of the key technical indicators traders are watching is the Relative Strength Index (RSI), which currently sits near 78. This suggests that Bitcoin's price has risen rapidly, potentially indicating that a correction or pullback might be due as traders may look to take profits. However, it’s also possible that the price can continue rising in the short term, particularly in strong bullish market conditions. Nonetheless, this level of RSI serves as a warning that the asset may be overvalued in the short term, and the market could see a reversal or consolidation. Additionally, the Moving Average Convergence Divergence (MACD) indicator remains in bullish territory, further supporting the case for continued upward momentum.

Support levels for Bitcoin are currently observed around the $60,000 range, which has proven to be a strong area of buying interest. Should Bitcoin fail to break through the $64,000 resistance, it’s possible that a short-term retracement could occur, bringing the price back to test the $60,000 support zone. However, given the overall market sentiment and the broader macroeconomic environment, most analysts expect any dips to be temporary, with Bitcoin likely to continue its upward trend in the near term.

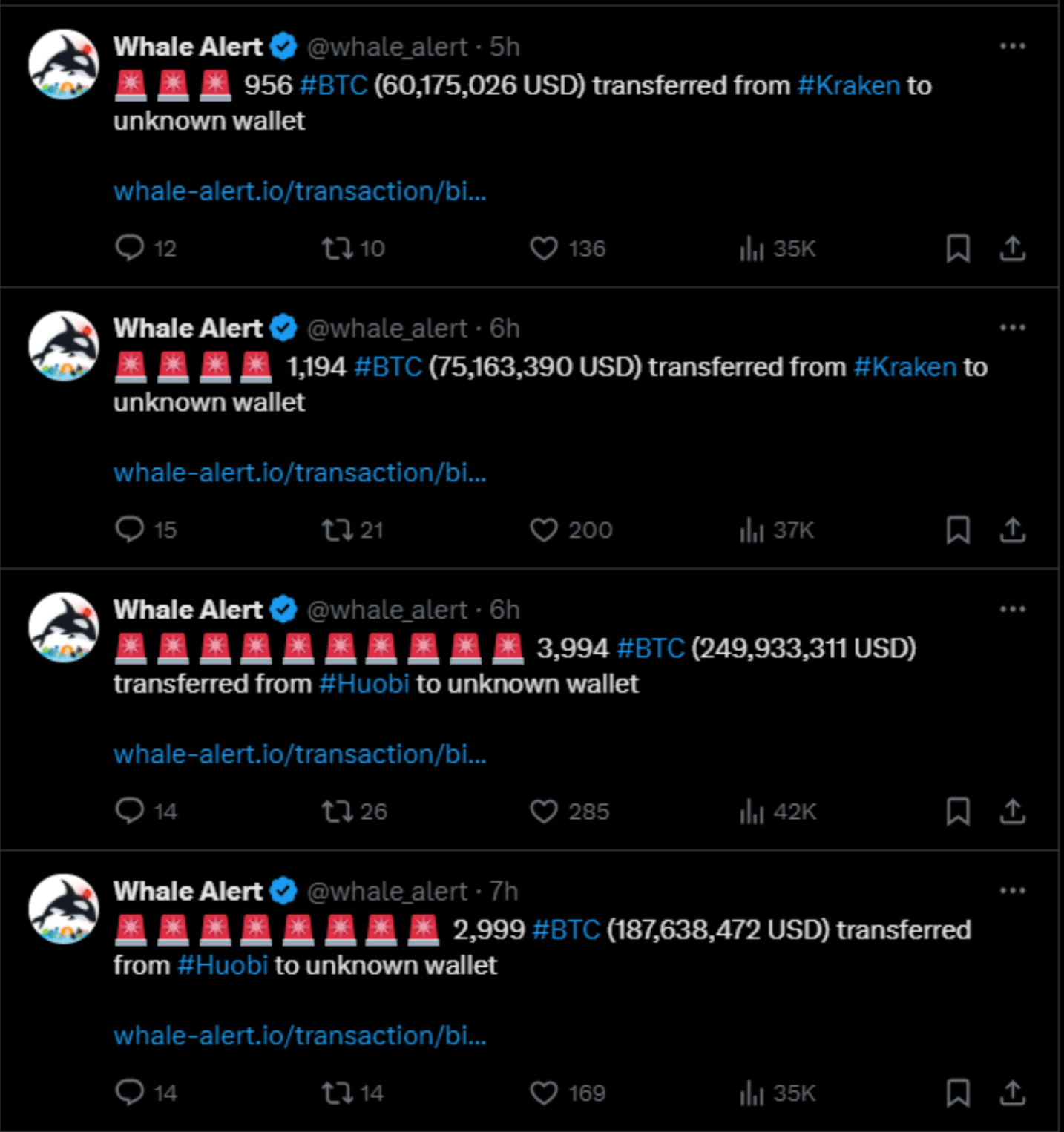

The recent surge in whale activity—large-scale Bitcoin holders—further underscores the strong demand for BTC at these levels. On-chain data shows a significant increase in the number of transactions involving large amounts of Bitcoin, indicating that institutional investors remain confident in Bitcoin’s long-term potential. If this trend continues, it could provide the fuel needed for Bitcoin to break through the $64,000 resistance and head toward new all-time highs.

Source: X

DZ Bank Partners with Börse Stuttgart Digital to Expand Crypto Access

In a significant development for the institutional adoption of cryptocurrencies, DZ Bank, one of Germany’s largest financial institutions, has partnered with Börse Stuttgart Digital to offer crypto services to its 700 affiliated banks. This collaboration will enable DZ Bank to provide its vast network of regional banks with access to a range of digital assets, including Bitcoin and Ethereum, marking a major step forward in the integration of crypto into traditional finance. The partnership highlights the growing demand for crypto solutions within the banking sector, particularly in Europe, as financial institutions seek to meet the rising interest from both retail and institutional clients in digital assets. This move is expected to further legitimise cryptocurrency investments in Germany and could pave the way for similar initiatives across Europe.

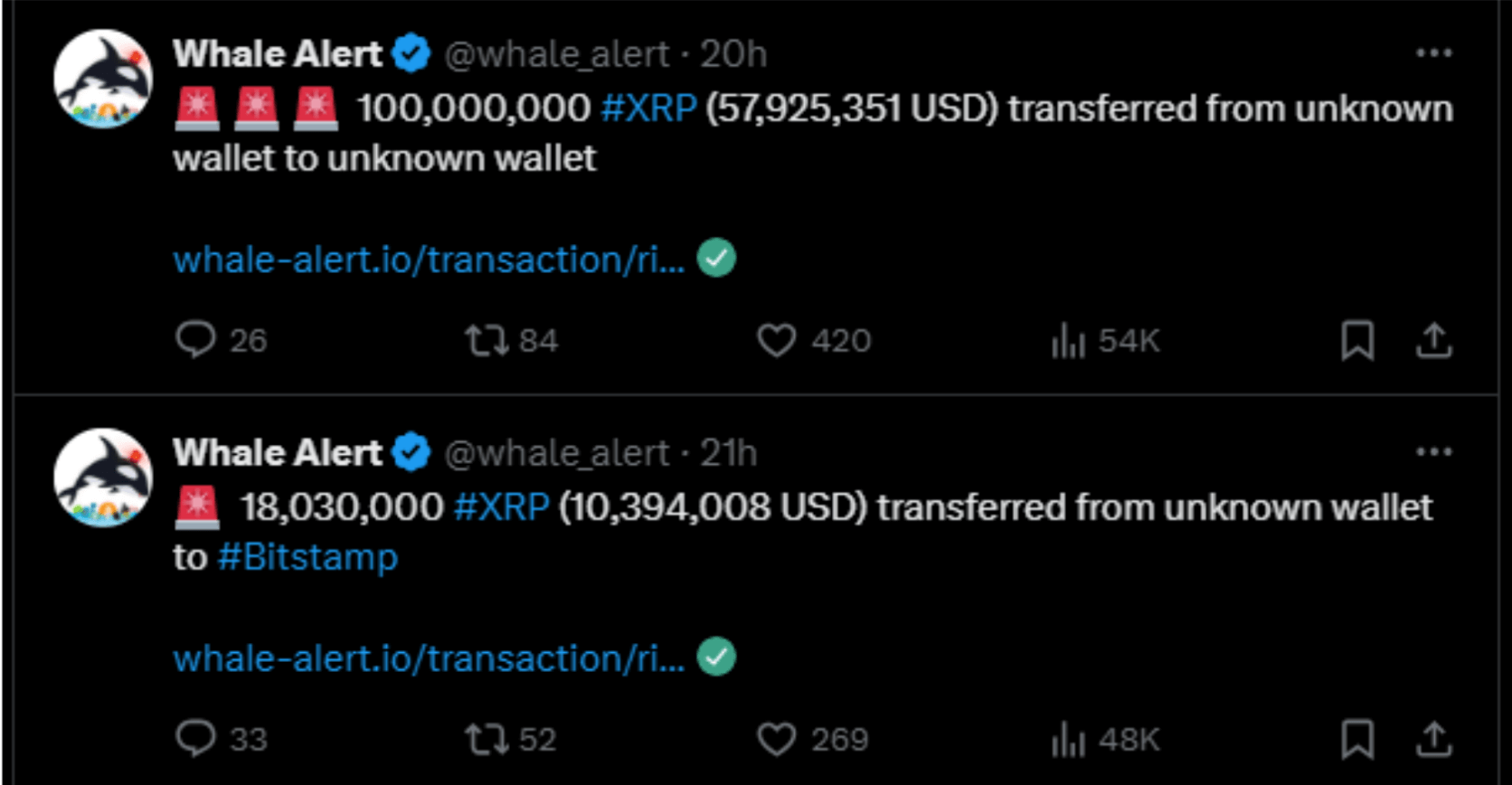

Ripple Transfers 100 Million XRP Amid Regulatory Scrutiny

Ripple is again in the spotlight after transferring 100 million XRP tokens amidst ongoing regulatory scrutiny. The transaction, which took place amid Ripple’s ongoing legal battle with the SEC, has raised questions about the company’s strategy. Ripple has been under heavy regulatory pressure for its sale of XRP, with the SEC alleging that these sales constitute an unregistered securities offering. Despite this, Ripple continues to conduct large transactions and maintain its position in the market.

The move is seen as part of Ripple’s efforts to maintain liquidity and continue operations while navigating its legal challenges. Some analysts speculate that the large transfer may be related to preparations for future use cases, such as cross-border payments, or could be a strategic decision to safeguard its assets amidst legal uncertainties. This development comes as Ripple’s case with the SEC remains unresolved, keeping the crypto community on high alert for any updates that could affect XRP’s market price and the broader crypto market.

Source: X