Crypto Weekly Wrap: 20th December 2024

Federal Reserve Stance: Powell’s Remarks on Bitcoin Ownership

Federal Reserve Chair Jerome Powell reaffirmed that the central bank cannot hold Bitcoin, citing legal restrictions under the Federal Reserve Act. He dismissed calls for law changes, emphasizing that Congress, not the Fed, must decide on the matter. Powell’s remarks came in response to President-elect Donald Trump’s proposal for a strategic Bitcoin reserve, which has ignited significant debate in financial circles. The Fed’s cautious stance contrasts with Trump’s vision of positioning the U.S. as a global leader in digital assets, highlighting a divergence in governmental approaches to crypto. As regulatory discussions continue, clarity on Bitcoin’s role in national strategy could reshape both market dynamics and institutional adoption.

Source: eu.usatoday.com

Crypto Market Faces Broad Decline

The cryptocurrency market continues its downward trend, with global market capitalization dropping 4.7% in the last 24 hours to $3.68 trillion. Trading volumes remain high at $333 billion, but only 5 of the top 100 coins posted gains. Among the major cryptocurrencies, AVAX experienced the steepest decline, falling 26.39% to $39.44, while Bitcoin and Ethereum also saw significant losses, down 1.89% and 10.22%, respectively. This broad market correction reflects a cautious sentiment among investors amidst ongoing volatility.

Weekly Heatmaps

Source: QuantifyCrypto

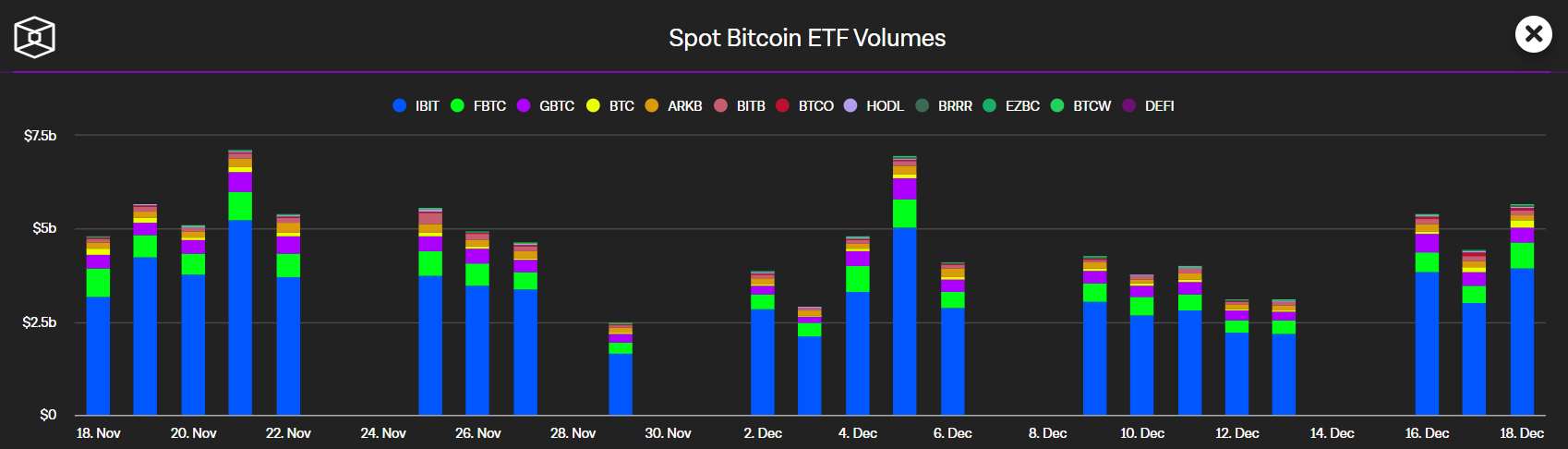

Spot ETFs Continue to Attract Investment

Bitcoin and Ethereum spot ETFs have witnessed consistent inflows over the past two weeks, marking a period of sustained investor confidence. On Wednesday, Bitcoin spot ETFs alone saw $275 million in net inflows, while Ethereum ETFs logged their 18th consecutive day of positive movement. These inflows demonstrate that institutional interest in cryptocurrencies remains strong despite recent market fluctuations. By offering a simplified and regulated way to access digital assets, spot ETFs are removing barriers for traditional investors and increasing overall market liquidity. Analysts suggest that these ETFs could act as a gateway for broader adoption, potentially paving the way for additional cryptocurrency-backed financial products in the future.

Source: TheBlock

Source: TheBlock

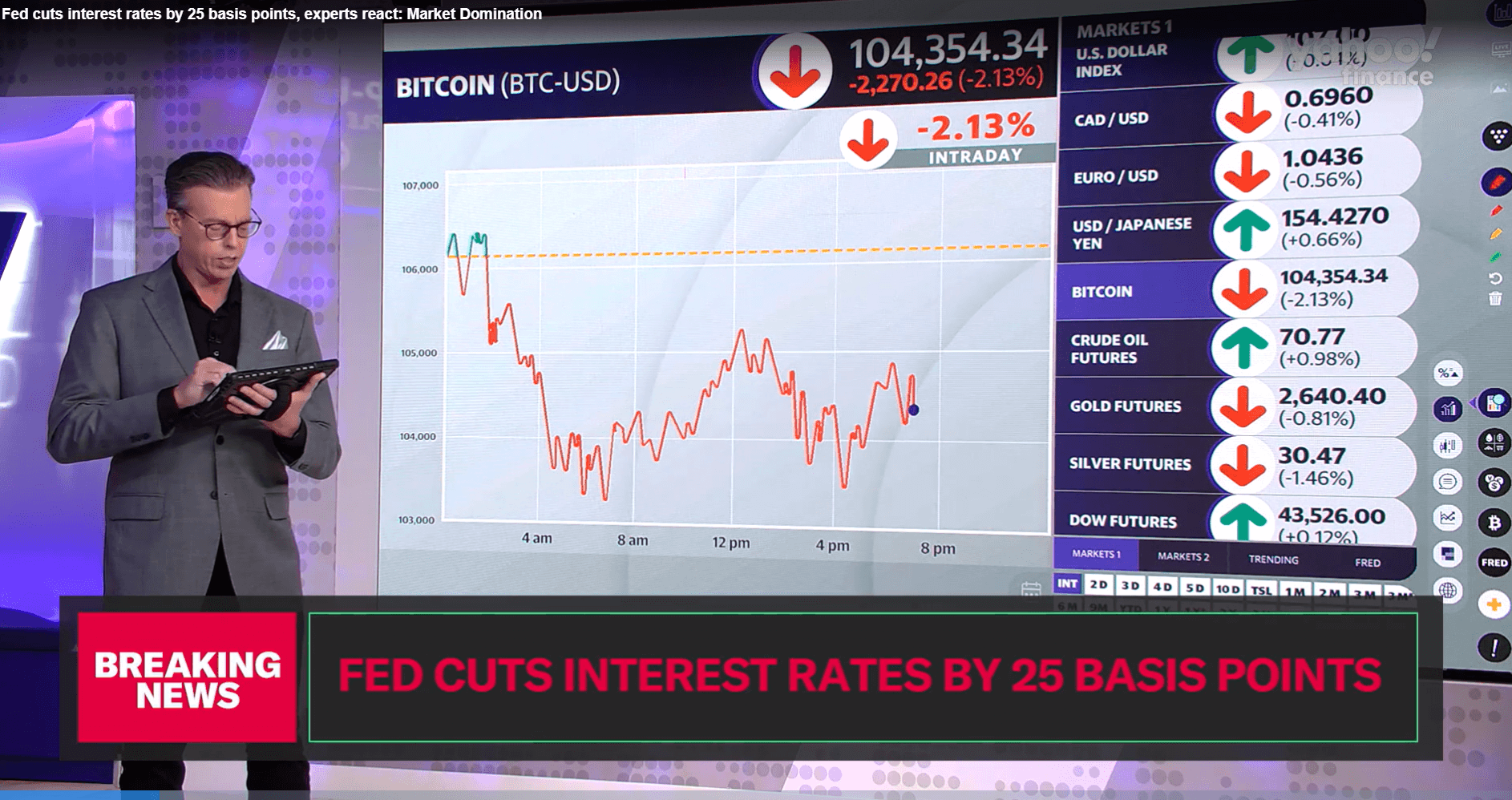

Impact of Fed Rate Cuts on Bitcoin Prices

Bitcoin’s price fluctuations have been closely tied to the Federal Reserve's monetary policy, particularly its recent rate cuts. The central bank's decision to reduce rates by 25 basis points this week initially triggered a sell-off, pushing Bitcoin’s price below $100,000. Fed’s cautious stance on future rate cuts has created mixed signals for risk assets, influencing both traditional markets and crypto. This interplay between monetary policy and digital asset valuations underscores Bitcoin's evolving role as a macroeconomic hedge, especially as investors seek alternatives to mitigate financial risks.

Source: finance.yahoo.com

Bitcoin Technical Analysis: Navigating Volatility

Bitcoin is currently trading at $98,471, with the $96,846 level acting as a critical support floor. Additionally, the 20-day exponential moving average (EMA) has provided short-term support, bolstering market confidence during periods of price dips. Resistance lies at $105,236, marking a key level for bullish momentum. The Relative Strength Index (RSI) is below overbought levels, leaving room for further upward movement, but caution is warranted due to potential cooling periods. Support levels include $96,846, $94,400, and $90,000, with each serving as a buffer against further declines. While some analysts predict short-term volatility, the overall sentiment remains optimistic, with institutional inflows supporting Bitcoin’s upward trajectory. Traders are advised to monitor volume trends closely; increased volume during upward movements could signal a new bullish phase.

Source: TradingView

Dogecoin Defends Key Support Levels

Dogecoin has maintained its position above the critical $0.30 support level despite a 13% dip following the Federal Reserve’s recent announcement. This threshold has proven to be a pivotal point, with bullish traders defending it against downward pressure. Market analysts highlight $0.40 as the next major resistance level, with $1 remaining the long-term target for Dogecoin enthusiasts. The meme coin’s price dynamics continue to be influenced by social media trends and endorsements, contributing to its characteristic volatility. While short-term retracements remain possible, Dogecoin’s resilience suggests that it could regain momentum as investor confidence rebuilds. Its role as a speculative yet popular asset ensures it will remain a focal point in the cryptocurrency market.

Source: TradingView

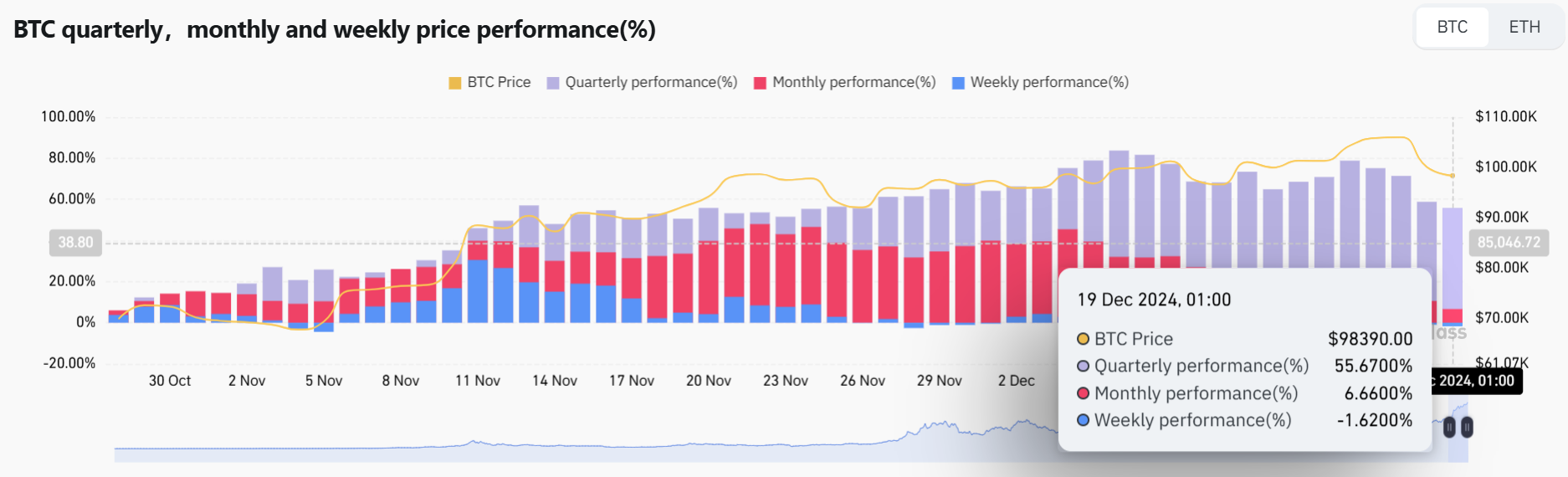

Future Outlook for Bitcoin

Bitcoin’s future remains promising, with predictions of a $180,000 price peak by Q3 2025. This bullish outlook is supported by increased institutional adoption, regulatory advancements, and growing confidence in Bitcoin as a long-term store of value. While short-term volatility is inevitable, Bitcoin’s fundamentals, including its fixed supply and integration into traditional financial systems, provide a robust foundation for sustained growth. As more ETFs gain approval and regulatory clarity improves, Bitcoin’s position as a dominant digital asset will likely strengthen further. Investors are encouraged to stay informed about market developments, as the convergence of innovation and regulation continues to shape the cryptocurrency landscape.

Source: CoinGlass

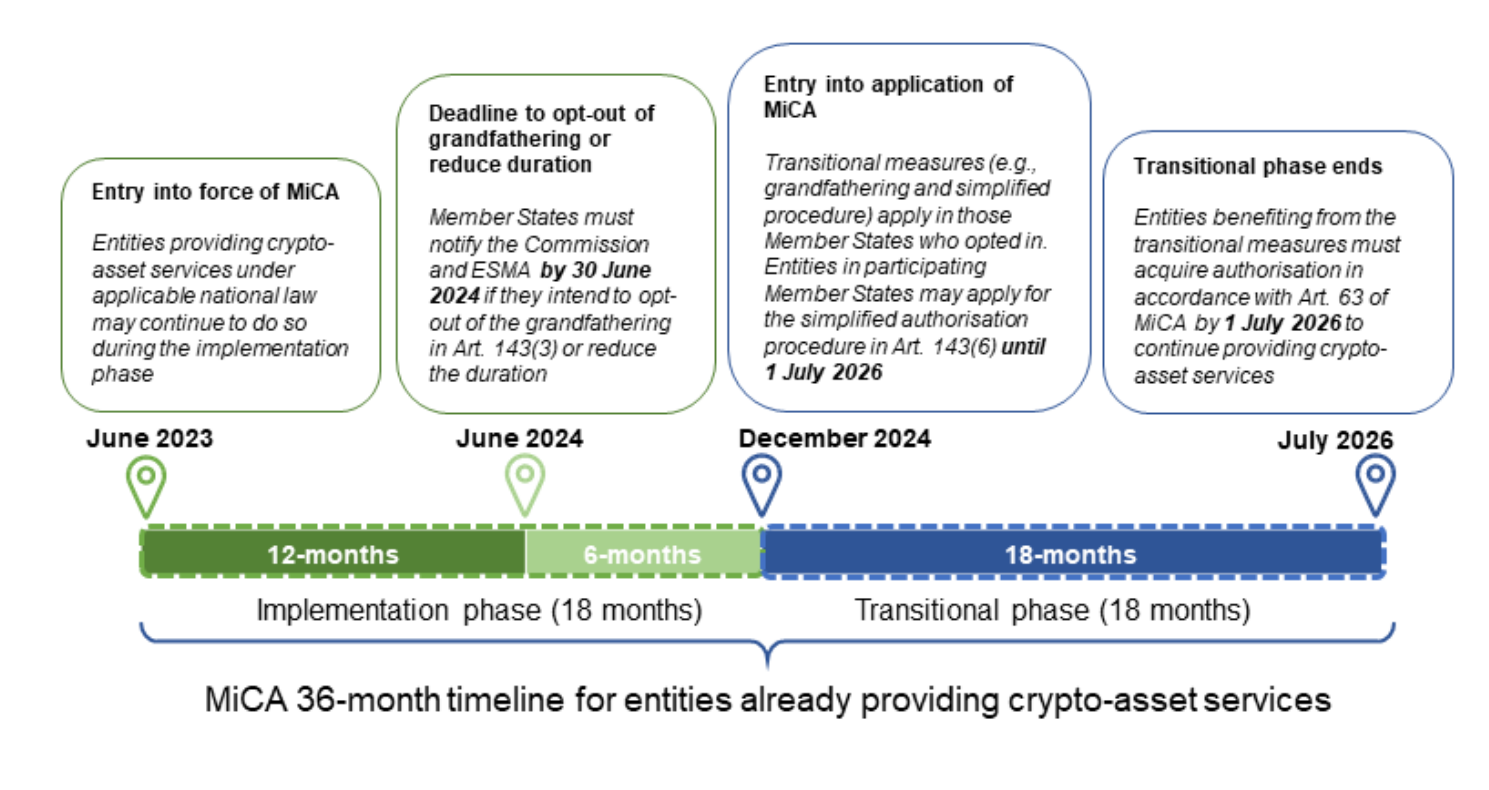

MiCA: A Regulatory Milestone for European Crypto Markets

The Markets in Crypto-Assets (MiCA) regulation is setting a new standard for cryptocurrency governance in Europe, aiming to enhance transparency, consumer protection, and financial stability. Effective from June 2024 and fully implemented by December 2024, MiCA establishes clear rules for stablecoins, utility tokens, and crypto-asset service providers. The framework has already influenced market dynamics, with MiCA-compliant stablecoins such as EURC, EURCV, and EURI capturing 91% of the European market share. By fostering a secure and regulated environment, MiCA not only attracts institutional investors but also bridges the gap between traditional finance and the digital asset ecosystem. As Europe solidifies its leadership in regulatory innovation, MiCA serves as a potential blueprint for other regions looking to balance crypto innovation with oversight.

Source: ESMA