Crypto Weekly Wrap: 18th October 2024

Bitcoin Price Nears $68,000 Amid Bullish Sentiment

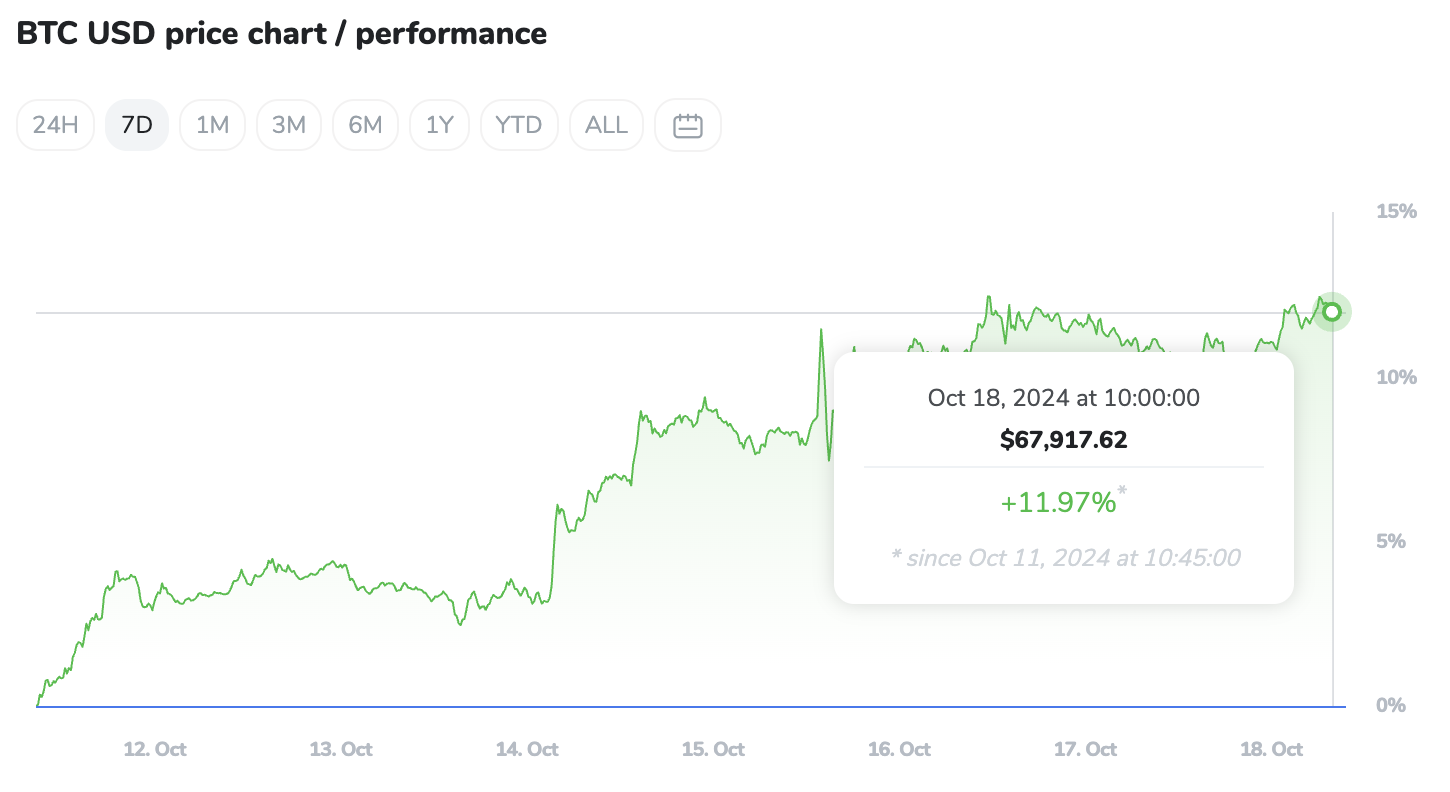

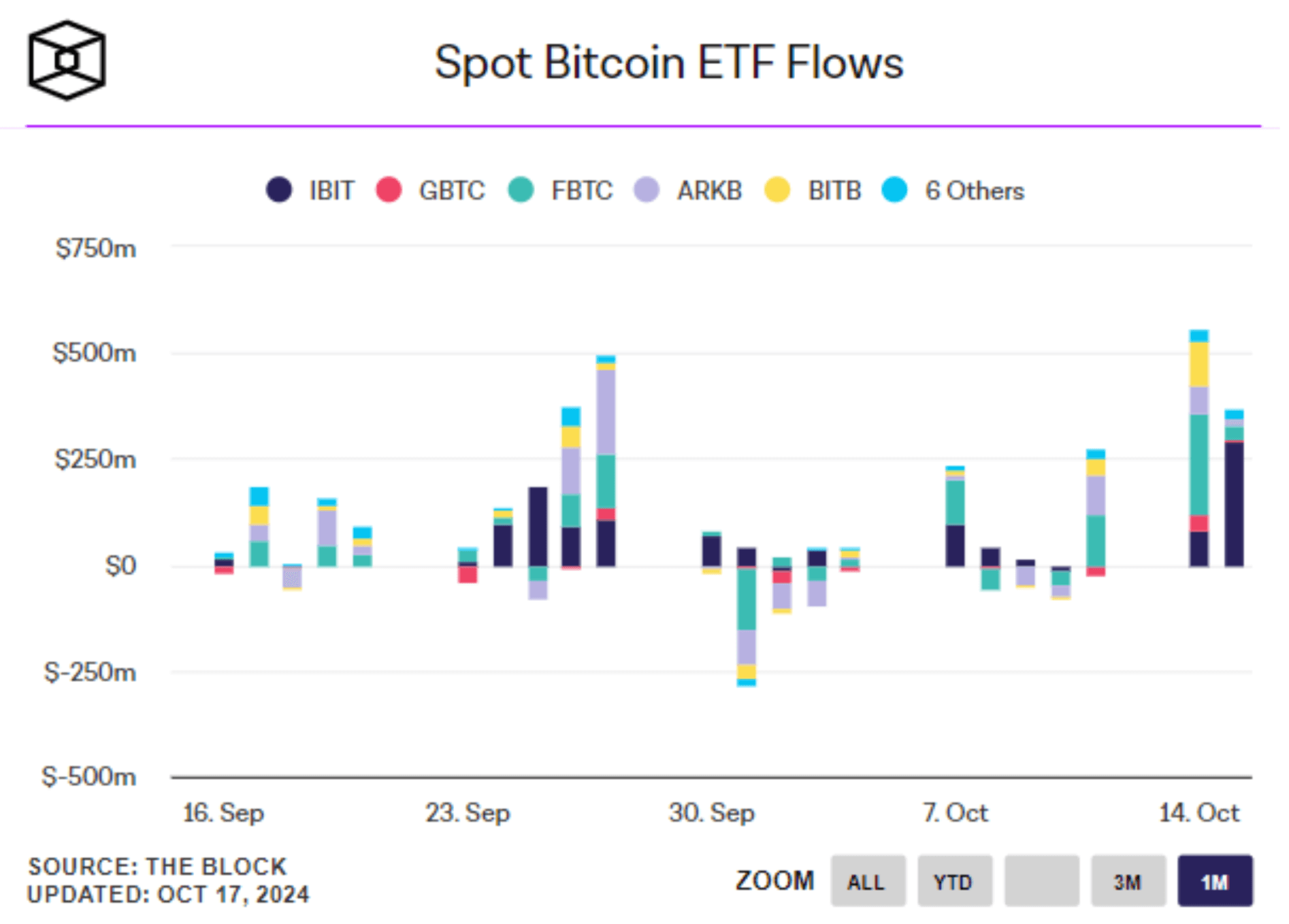

Bitcoin (BTC) continues its upward trajectory, approaching the $68,000 mark with a recent increase of 1%. This rise reflects strong market sentiment driven by institutional interest and favourable political factors. Donald Trump’s vocal endorsement of cryptocurrency and his declaration that “crypto is the future” have played a significant role in Bitcoin’s climb. The broader market is also being bolstered by expectations of pro-crypto legislation under a potential Trump administration. Institutional inflows into Bitcoin ETFs have surpassed $19 billion, indicating that major financial players are increasing their exposure to the cryptocurrency market, further pushing Bitcoin toward new highs.

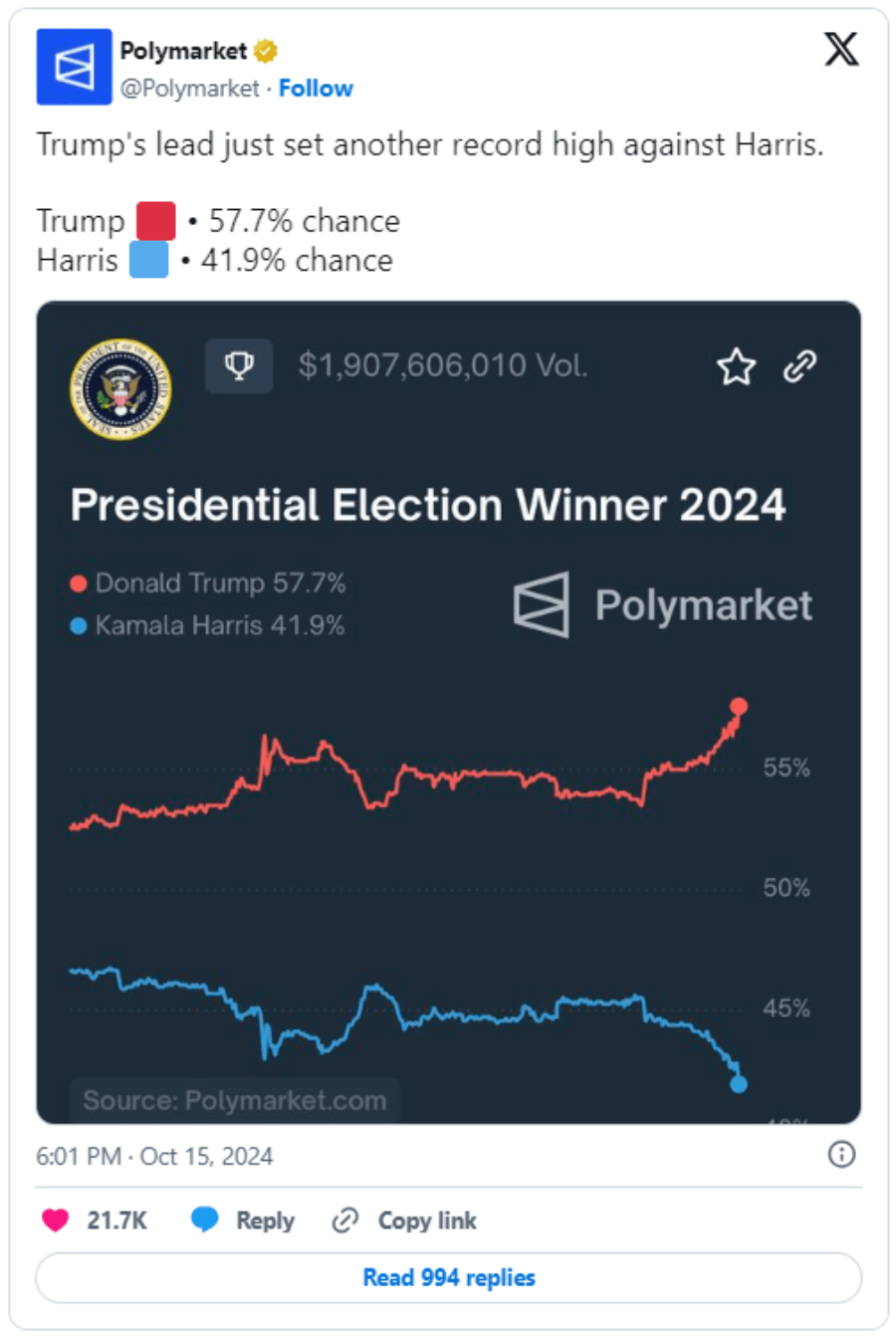

The momentum is expected to continue as the U.S. presidential election approaches, with Trump seen as a more crypto-friendly candidate compared to Kamala Harris. Analysts are predicting that Bitcoin could soon break through its next resistance level at $70,100, especially if institutional demand and positive sentiment persist. The recent forecasts by Standard Chartered also contribute to the optimistic outlook for Bitcoin, which is nearing all-time highs.

Source: The Block

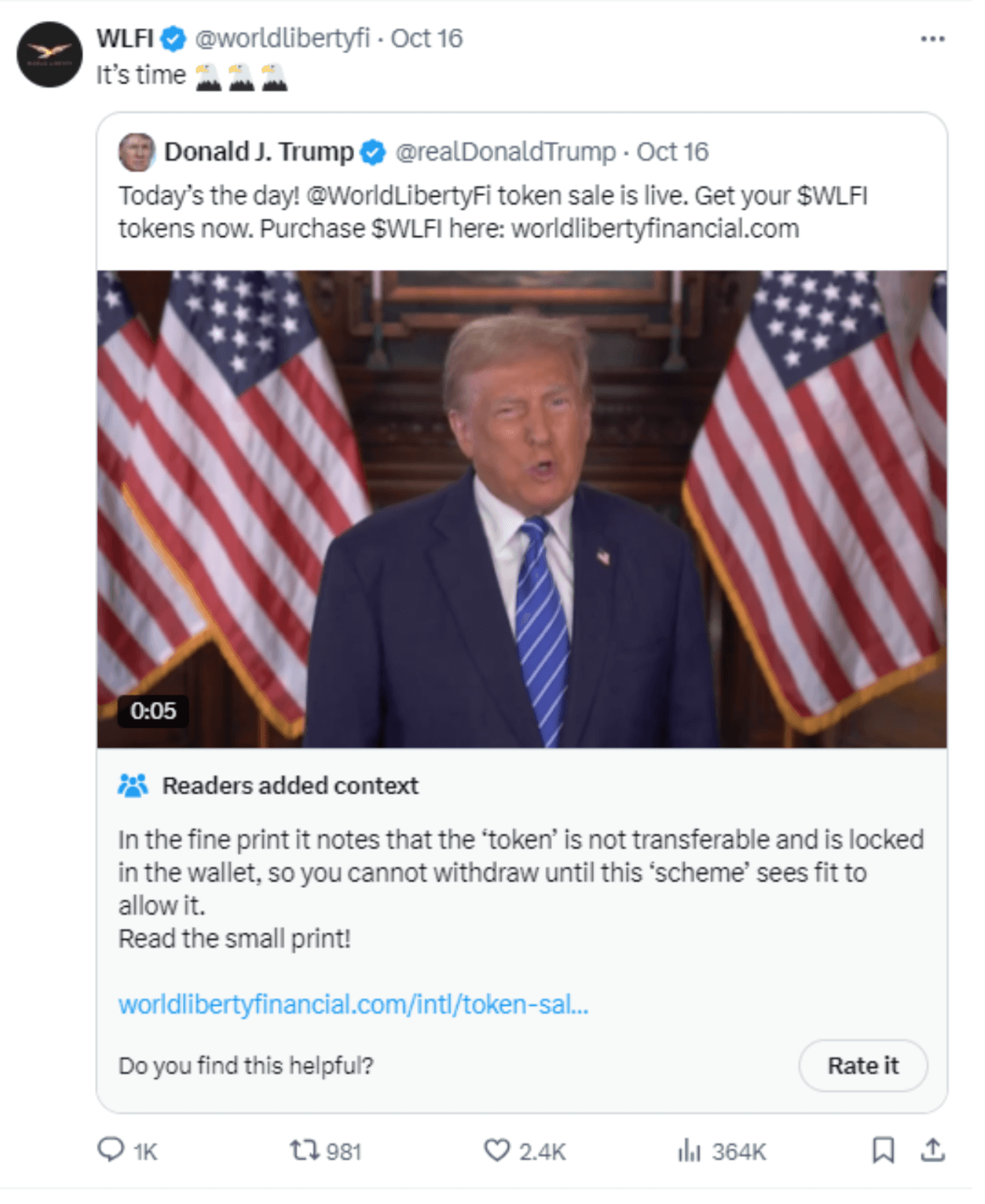

Trump’s Cryptocurrency Push and Its Impact on Bitcoin

Donald Trump’s recent move to endorse cryptocurrency and unveil his own digital token has had a profound impact on Bitcoin’s price surge. His announcement not only raised the profile of the entire crypto market but also fueled speculation about future regulatory changes that could benefit digital assets. Trump’s growing popularity among pro-crypto voters and investors has contributed to Bitcoin’s strength, with many anticipating that his return to the White House could lead to favourable legislation for the crypto industry.

Source: X

Trump’s position has been especially well-received by institutional investors, as seen in the rise of inflows into Bitcoin-related financial products. With analysts predicting that Bitcoin could breach $70,000 and possibly reach new record highs, Trump’s pro-crypto stance is adding significant upward pressure on the asset. Investors are closely watching how this political support, combined with growing institutional interest, will shape Bitcoin’s price in the coming months.

Grayscale’s Push for Multi-Crypto ETFs

Grayscale has filed with the SEC to convert its $524 million Digital Large Cap Fund into an exchange-traded fund (ETF). This fund includes a mix of top cryptocurrencies like Bitcoin, Ethereum, Solana, XRP, and Avalanche. The move is part of Grayscale’s broader strategy to expand investment opportunities in the cryptocurrency market and make it easier for traditional investors to access digital assets.

This follows Grayscale’s successful conversions of its Bitcoin and Ethereum trusts into ETFs, indicating a shift in the regulatory landscape. The introduction of more crypto ETFs is expected to increase demand for underlying assets, including Bitcoin. Although the market is still awaiting further SEC rulings, Bitcoin’s price has remained stable around $67,980, with many speculating that the approval of more spot ETFs could trigger a significant price rally.

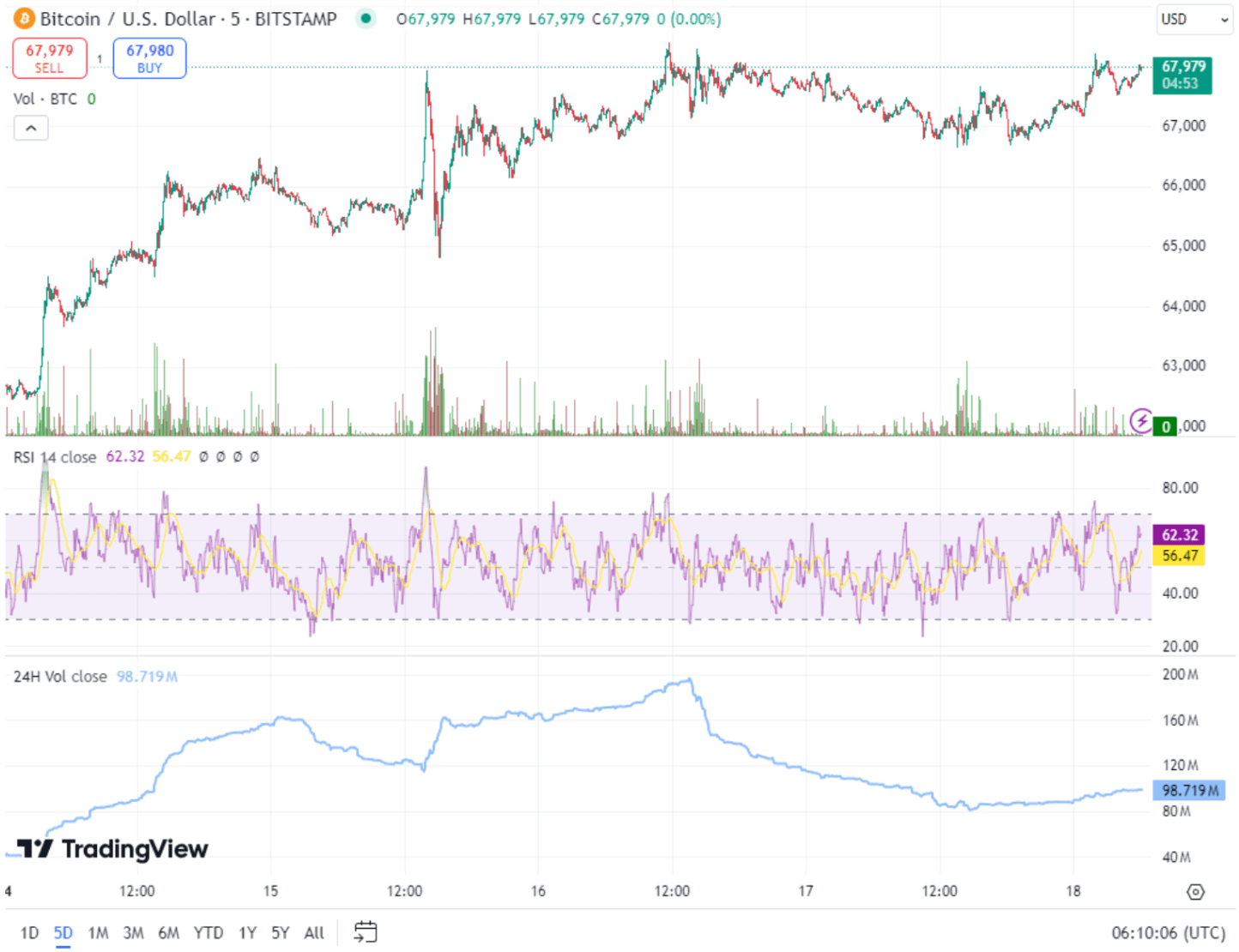

Bitcoin Technical Analysis: Bullish Momentum Continues

From a technical perspective, Bitcoin is showing strong bullish signals as it trades near $68,000. The asset is currently moving within a rising channel, with key support levels at $65,200 and $64,400, and resistance at $68,120. A break above $68,120 could push Bitcoin toward $69,000 and potentially to $70,000 if the bullish momentum continues. However, the Relative Strength Index (RSI) is currently at 62, indicating that Bitcoin is in overbought territory, which could signal a period of consolidation or a potential pullback.

Source: TradingView

The 50-day Exponential Moving Average (EMA) is positioned at $64,000, acting as dynamic support as Bitcoin trades comfortably above this level. A breach of $66,400 could lead to a retracement toward $65,200, but as long as Bitcoin stays within its ascending channel, the bullish trend remains intact. Investors should watch for any potential shifts in sentiment, especially with the RSI indicating overbought conditions.

Kamala Harris’ Ambiguous Stance on Crypto Regulation

While Donald Trump has been vocal about his support for cryptocurrency, Kamala Harris has remained vague on her plans for the industry. In a recent speech, Harris avoided providing specifics on her much-anticipated crypto regulatory framework, despite earlier promises. Her campaign has stated that she intends to introduce protections for digital assets, but her focus has been more on broader economic policies aimed at undecided voters.

Source: X

Although Harris has expressed interest in new technologies and their ability to expand access to financial services, her stance on cryptocurrency remains unclear. This ambiguity contrasts sharply with Trump’s clear pro-crypto agenda, which could be a deciding factor for voters and investors as the election draws near. The market is closely monitoring both candidates, with Trump’s candidacy seen as more favourable for the cryptocurrency industry.

Dogecoin Shows Strength Amid Whale Activity

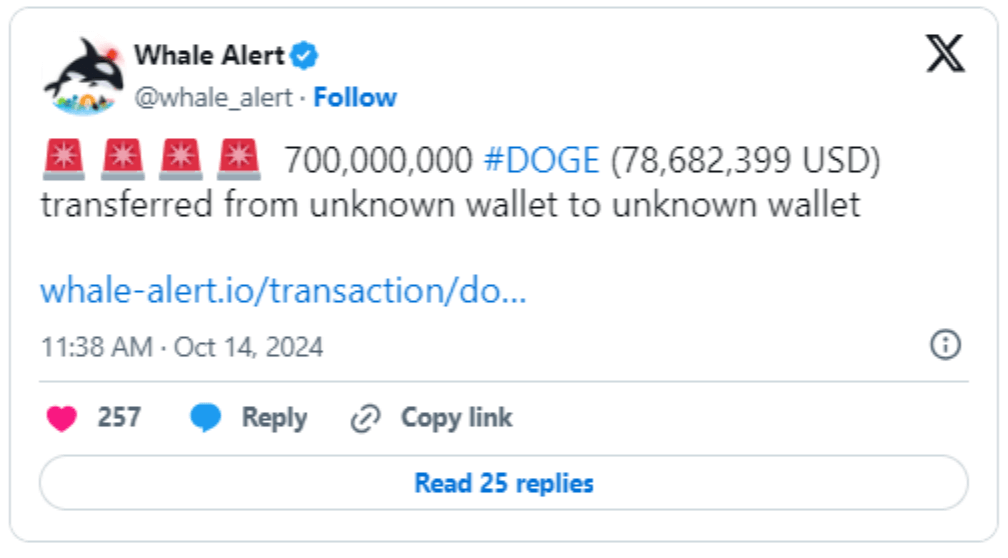

Dogecoin (DOGE) has been displaying resilience, recently holding strong around $0.134 after a large transfer of 700 million DOGE, worth over $78 million, sparked investor speculation. The meme coin has been moving in line with the broader crypto market and, with increased whale activity, is showing signs of a potential breakout. If the broader market continues its upward trend, DOGE could see significant gains, with some investors eyeing a potential 3x return from current levels.

Source: X

Source: TradingView

Institutional Interest and Bitcoin’s Path Forward

Institutional interest in Bitcoin continues to rise, with inflows into Bitcoin ETFs surpassing $19 billion. This surge in demand from institutional players is a key driver of Bitcoin’s recent price action, and analysts believe that this trend will continue, especially if more spot ETFs are approved by regulators. Additionally, the upcoming U.S. election, combined with positive market sentiment, is creating a favourable environment for Bitcoin to reach new highs.

The recent forecasts from major financial institutions, along with rising demand from institutional investors, are contributing to Bitcoin’s bullish outlook. With support levels holding strong and resistance levels being tested, the market is optimistic about Bitcoin’s future performance. Investors are eyeing key levels at $69,000 and $70,000, and if Bitcoin can break through these barriers, the asset could be on its way to setting new all-time highs.