Crypto Weekly Wrap: 15th November 2024

Bitcoin’s New All-Time High and Market Sentiment

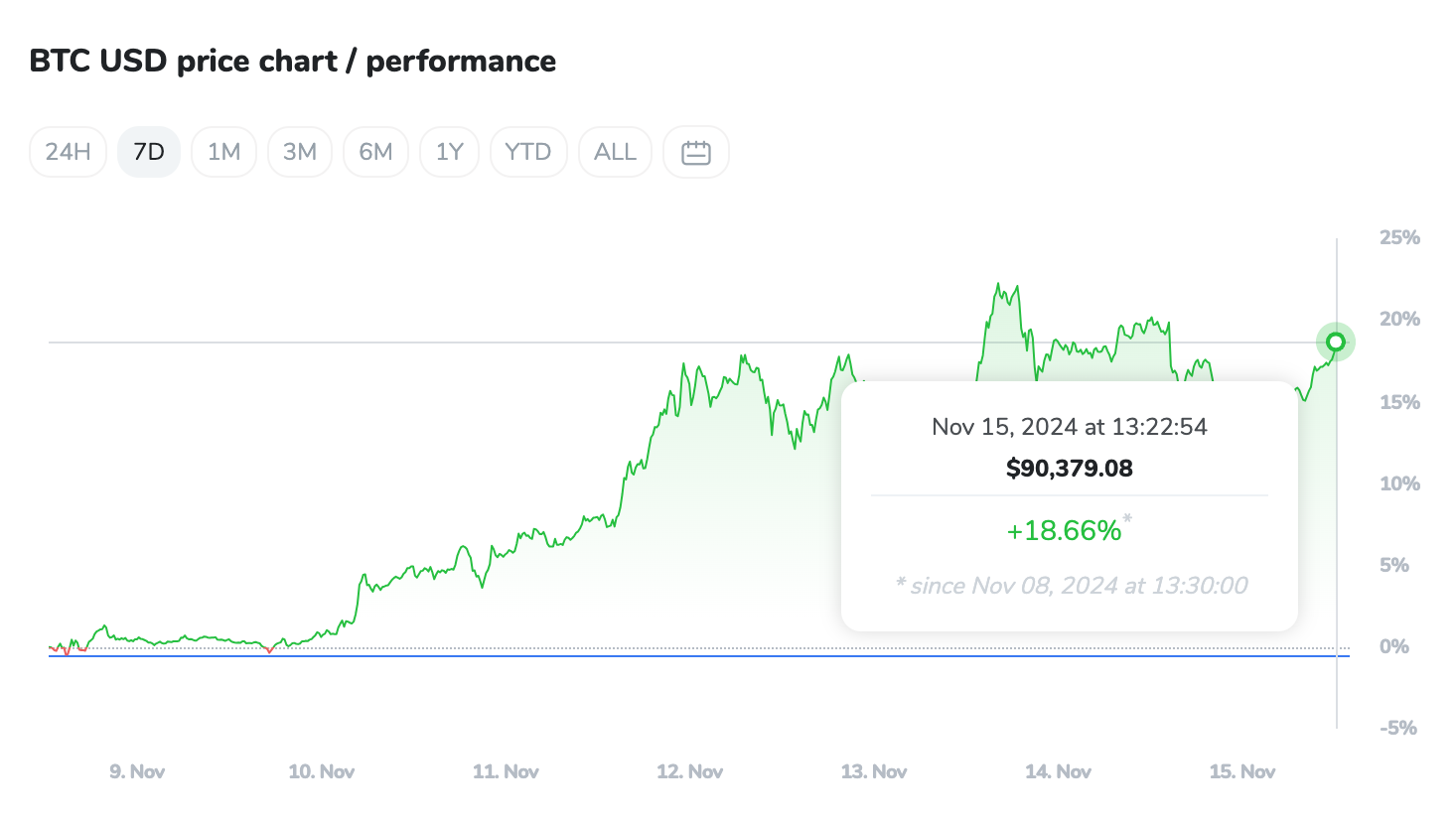

Bitcoin (BTC) has once again captured the spotlight, reaching a new all-time high (ATH) above $90,000. This impressive surge is part of a broader rally in the cryptocurrency market, which has seen positive momentum following key developments in the U.S. political landscape. Investor confidence has been bolstered by the reelection of Donald Trump, whose crypto-friendly stance has created optimism about potential favourable regulatory changes. The market response has been swift, with Bitcoin leading the charge alongside strong performances from other major assets like XRP and Dogecoin.

Known for his supportive views on cryptocurrency, Trump’s return to the White House has raised expectations for a more favourable regulatory environment. His administration has pledged to reduce barriers for crypto innovation, signalling a potential boost for digital assets. Additionally, Trump’s campaign embraced cryptocurrency donations, further highlighting his commitment to integrating digital assets into the broader financial ecosystem. This political shift, combined with the recent approval of spot Bitcoin ETFs, has provided a strong foundation for the latest price rally.

Bitcoin ETFs Drive Institutional Investment Surge

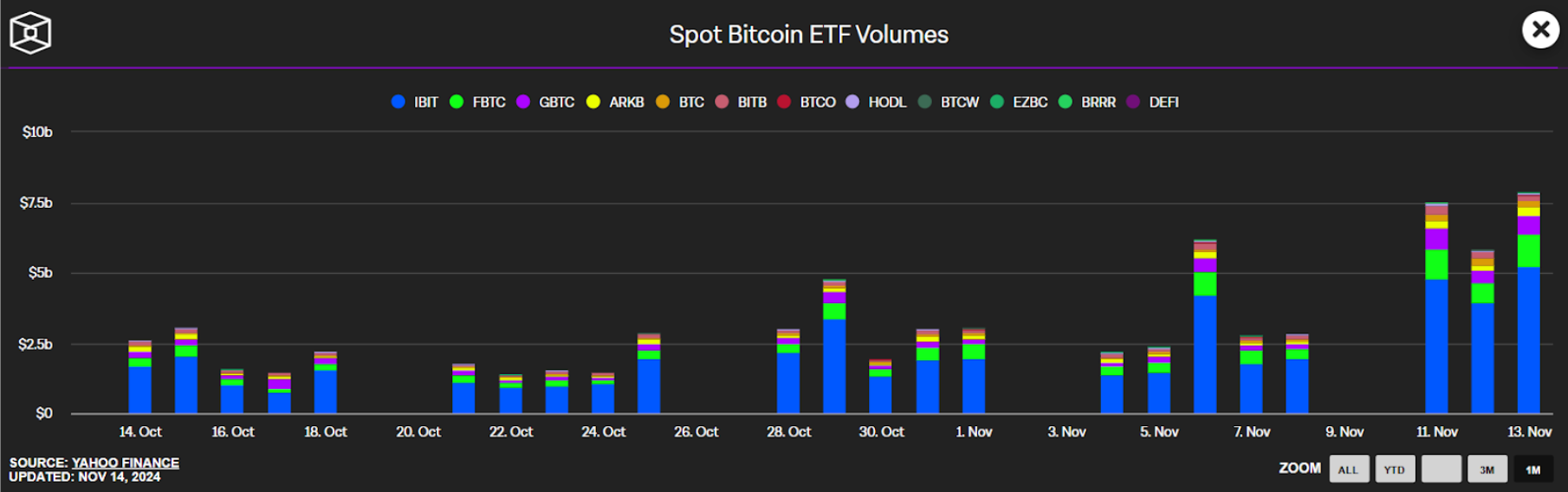

Another critical factor behind Bitcoin’s price rally is the strong demand from institutional investors, driven by the launch of multiple spot Bitcoin ETFs. These ETFs have simplified access to Bitcoin for traditional investors, allowing for significant capital inflows. On November 12, the nine U.S.-based spot Ether ETFs saw a combined net inflow of $135.9 million, following a record-breaking $295 million inflow the day before. This surge in institutional participation has contributed to the heightened demand for Bitcoin, pushing the price into uncharted territory.

The ETF approval has also been seen as a major win for the crypto market, offering a new level of legitimacy and attracting interest from conservative investors who were previously hesitant to enter the space. The increased accessibility provided by these financial products has set the stage for sustained growth, as more institutional funds flow into the market.

Source: TheBlock

Profit-Taking and Market Correction: What’s Next for Bitcoin?

Despite the bullish sentiment, analysts are cautious about a potential market correction. According to data from Glassnode, over 95% of the circulating Bitcoin supply is currently in profit, a sign of euphoria that typically precedes a pullback. Historically, such phases last around 22 days before profit-taking leads to a correction. Currently, Bitcoin has held its high-profit level for 12 consecutive days, suggesting that while market sentiment remains strong, a short-term cooling-off period could be imminent.

Profit realisation has reached $20.4 billion during this new ATH phase, still below the historical peak of $30 billion to $50 billion seen in previous cycles. This indicates there might be room for additional gains before demand exhaustion sets in. However, the increasing levels of realised profit suggest that some investors may begin to lock in their gains, potentially leading to increased volatility.

Technical Analysis: Bitcoin Holds Strong Support Levels

From a technical analysis standpoint, Bitcoin is currently trading around $89,500, showing strong support within an upward channel. The Relative Strength Index (RSI) is at 59, indicating moderate bullish momentum. This RSI level suggests there is room for further upside before the asset enters overbought territory. The key support levels to watch are at $88,440 and $86,280, with the 50-day Exponential Moving Average (EMA) providing additional support around $88,400.

Source: TradingView

On the resistance side, Bitcoin faces immediate resistance at $91,280. If this level is breached, the next major resistance is at $93,320. Breaking through these barriers could pave the way for another leg up, potentially pushing the price toward $95,000. However, if Bitcoin fails to hold above the $88,000 support, it may see a pullback, testing lower levels around $86,000. Overall, the technical indicators point to a strong upward trajectory, but traders should remain cautious of potential corrections given the recent rally.

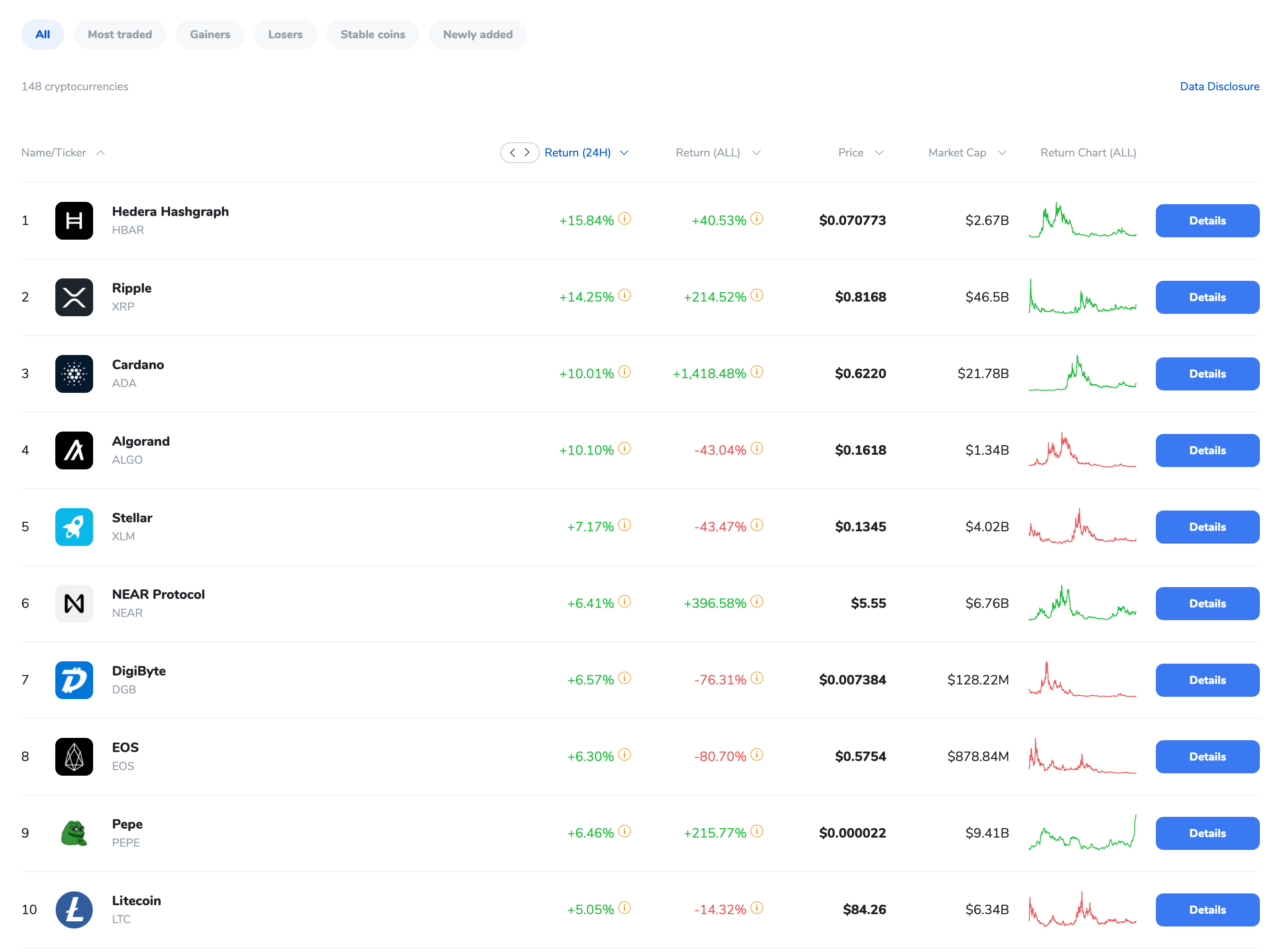

Broader Market Trends: Altcoins and Regulatory Developments

The broader cryptocurrency market has followed Bitcoin’s lead, with notable gains in major altcoins. XRP, for instance, appreciated by 14.25% in the last 24 hours, buoyed by speculation over favourable legal outcomes in its ongoing SEC case. Dogecoin also rallied, driven by news of Elon Musk’s involvement in the new administration.

Regulatory developments are also playing a significant role in shaping market dynamics. The potential reshuffling of key regulatory positions, including the SEC chairman, could result in a more supportive environment for digital assets. The crypto industry is hopeful that Trump’s administration will push for clearer and more favourable regulations, which could remove significant barriers for growth and adoption.

Solana’s Impressive Rally and Growing Institutional Interest

Solana (SOL) has been one of the standout performers in the recent crypto market rally, showing a strong uptrend as it targets the $230 mark. The bullish momentum is driven by several factors, including increased institutional interest and optimism around potential regulatory changes, especially with the recent pro-crypto stance of the new U.S. administration. Solana's ecosystem continues to expand with notable developments in DeFi, AI-related projects, and tokenized real-world assets (RWAs). The growing interest in Solana ETFs and increased Total Value Locked (TVL) within the network further solidify its position as a top contender in the crypto space, making it a favourite among both retail and institutional investors.

Source: TradingView

XRP Gains Momentum Amid Regulatory Hopes

XRP has seen a notable price increase, up by 14.25% in the past 24 hours as optimism builds around potential regulatory changes in the U.S. With Donald Trump’s reelection, investors are speculating that a more crypto-friendly environment could bring a swift resolution to Ripple’s ongoing legal battle with the SEC. The increase in token burns via the XRP Ledger and rising trading volume have also contributed to the bullish sentiment, suggesting growing accumulation by investors. Analysts are now forecasting that XRP could break above the crucial $1.7 mark, driven by a combination of favourable market conditions and potential legal clarity.

Source: TradingView

Dogecoin Skyrockets on Elon Musk’s Political Involvement

Dogecoin (DOGE) has seen a renewed surge, doubling its price in the past week, driven largely by news of Elon Musk's involvement in the new U.S. administration. Musk, a longtime supporter of Dogecoin, is expected to head the newly formed Department of Government Efficiency (DOGE), focusing on reducing regulatory hurdles. His influence and outspoken support for Dogecoin have boosted market sentiment, with the community speculating that the meme coin could hit $10 by the U.S. Presidential Inauguration Day in 2025. The combination of Musk’s endorsement and anticipated regulatory support has solidified Dogecoin’s status as a favourite among retail investors, setting the stage for significant price gains.

Source: TradingView

Conclusion: Bitcoin’s Path Ahead

Bitcoin’s recent performance highlights its resilience and the renewed confidence of investors. The combination of political support, institutional inflows from ETFs, and strong technical indicators suggests that the asset has room for further growth. However, the market remains cautious of a possible correction, especially given the high levels of realised profit. As long as Bitcoin maintains its support above $89,000 and breaks through key resistance levels, the bullish momentum is likely to continue. Traders should keep an eye on upcoming regulatory announcements and broader market trends, as these factors will play a crucial role in determining Bitcoin’s trajectory in the coming weeks.