Crypto Weekly Wrap: 13th September 2024

The cryptocurrency market has been buzzing with activity in recent weeks, driven by various events and trends that have caught the attention of investors and analysts alike. From the potential start of a new Bitcoin (BTC) bull run to significant developments with altcoins like Shiba Inu (SHIB) and Ripple (XRP), here is a closer look at what's happening in the crypto world.

Bitcoin's Bullish Indicators: Exchange Reserves and Stablecoins

Bitcoin may be on the verge of a substantial bull run, driven by two main factors: declining exchange reserves and rising stablecoin reserves. The amount of Bitcoin stored on exchanges has decreased significantly, with the netflow primarily showing outflows. Historically, such patterns have been precursors to price increases, as they reduce the immediate selling pressure on the market. For example, in late 2020 and early 2023, similar declines in exchange reserves preceded Bitcoin's surge to new all-time highs. While the timing of these bullish developments may vary, they indicate a positive outlook for BTC in the coming months.

On the other hand, the rising stablecoin reserves on exchanges are another bullish signal. Stablecoins serve as readily available capital for investors to enter the market quickly. CryptoQuant reported that just before Bitcoin's recent $4,000 rally, around $300 million worth of stablecoins entered exchanges, highlighting strong buying interest. As these reserves continue to grow, they could provide the necessary fuel for the next upward price movement in the cryptocurrency market.

Ethereum and other Altcoin Movements: SHIB and XRP Under the Spotlight

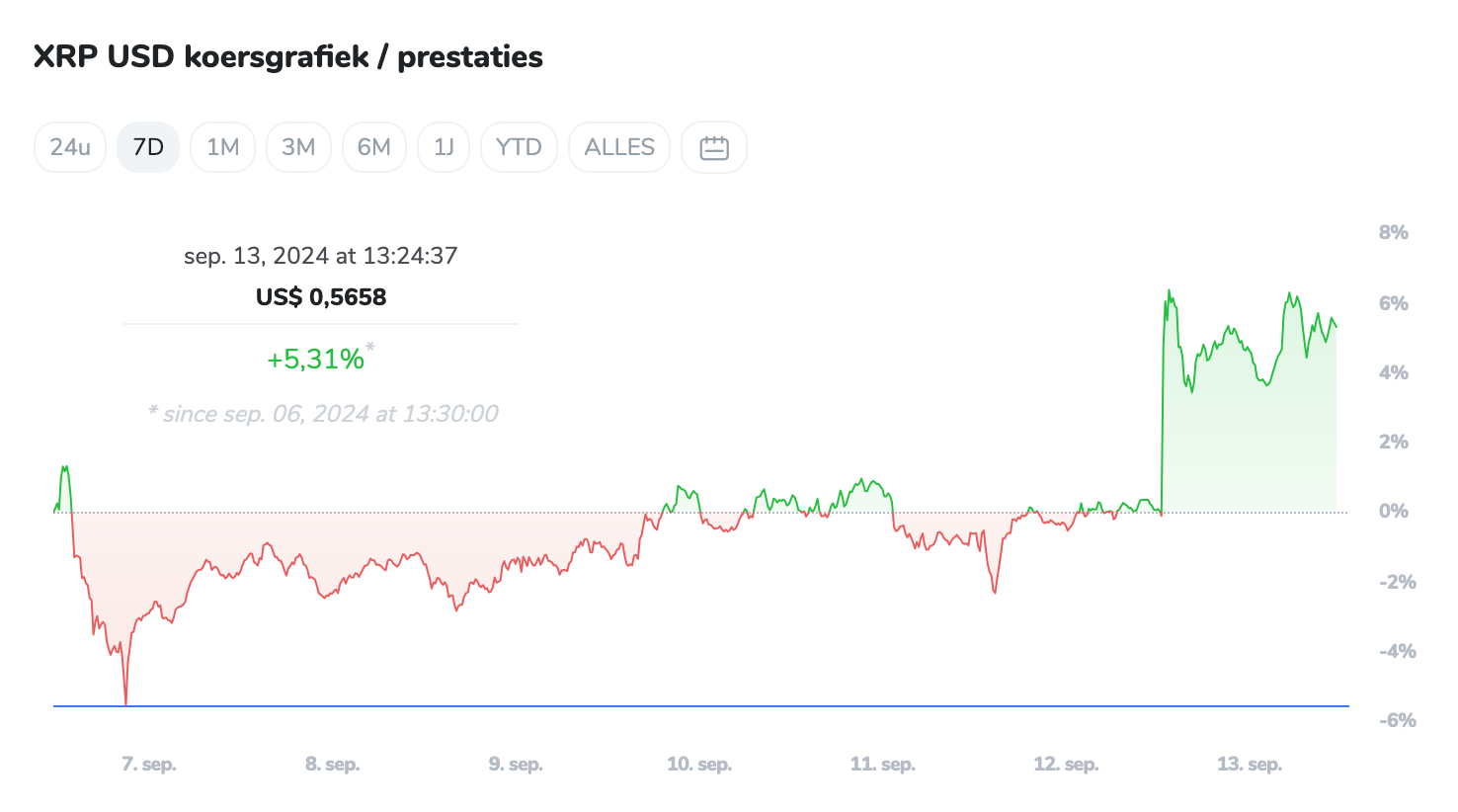

Beyond Bitcoin, other cryptocurrencies have shown varied movements in the market. Ethereum (ETH) experienced a surge in wallet creations, reaching a four-month high, suggesting increased network utility and potential price gains. Meanwhile, Shiba Inu’s layer-2 solution, Shibarium, witnessed increased activity, with a 91% jump in daily transactions, which may positively impact SHIB’s price. XRP, Ripple's native token, is predicted by analysts to enter a bull run, potentially mirroring the explosive growth seen in late 2017. These developments across different altcoins indicate that the broader crypto market remains active and dynamic, with various assets showing unique growth drivers and investor interest.

Source: QuantifyCrypto

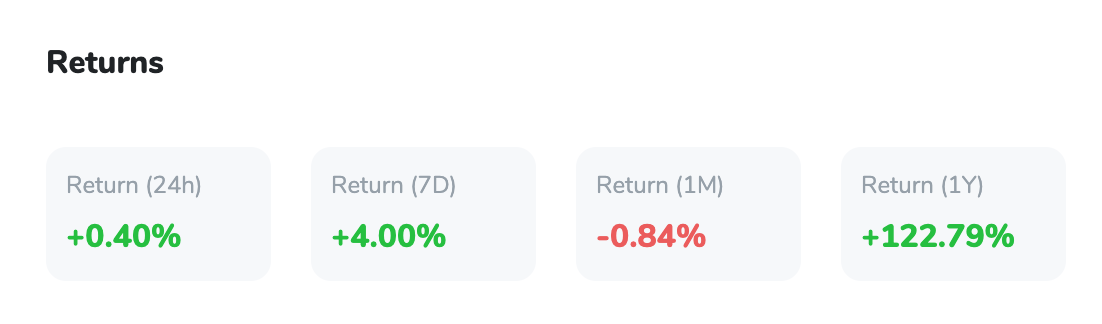

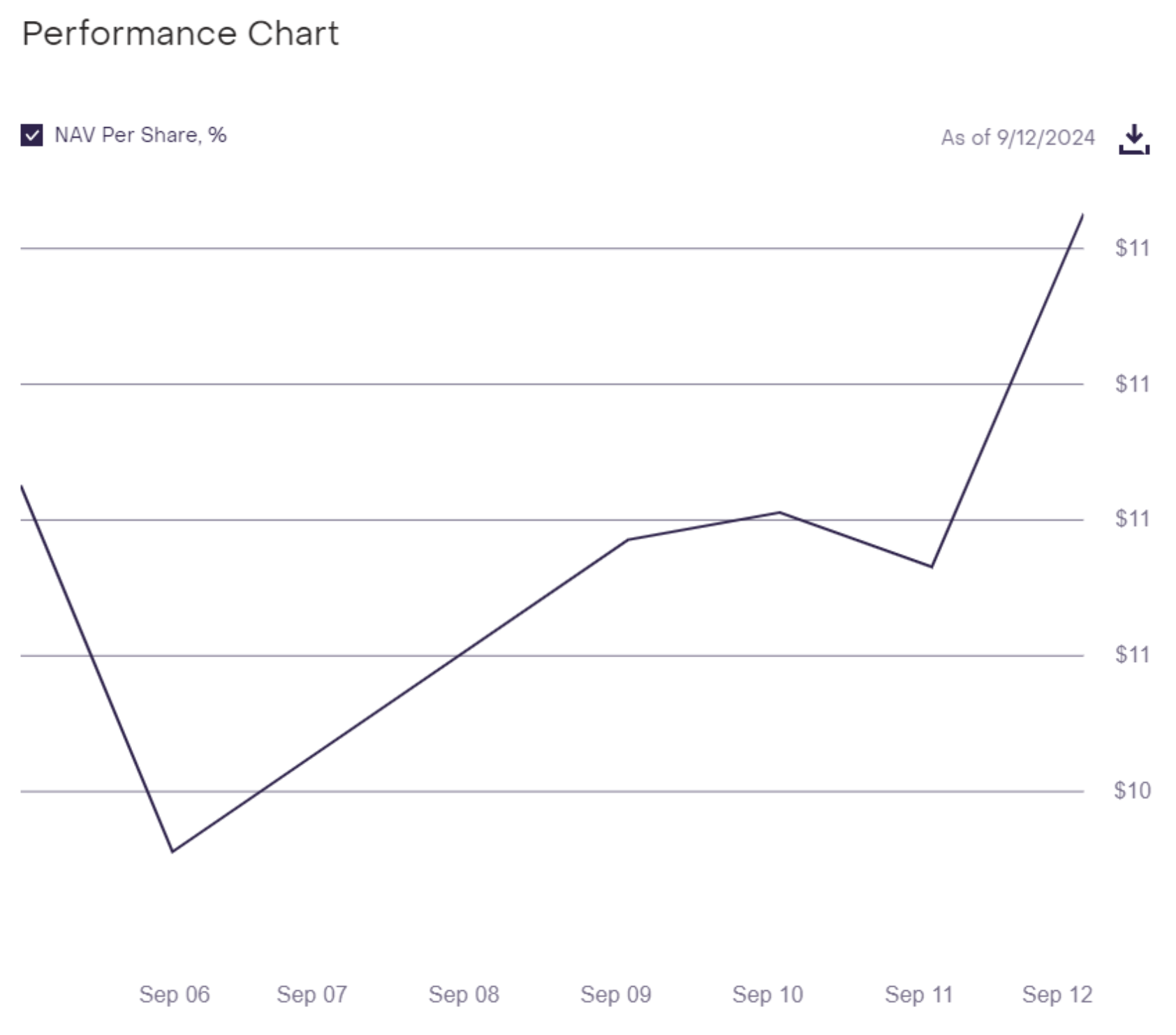

Grayscale's New XRP Trust Signals Growing Institutional Confidence

Grayscale's decision to launch a new XRP Trust in the U.S. marks a turning point for the cryptocurrency, following Ripple's recent legal victory against the SEC. The closed-end fund will give accredited investors direct exposure to XRP, potentially setting the stage for a future spot XRP exchange-traded fund (ETF) in the U.S. This development is viewed as a sign of renewed confidence in XRP, given its utility in facilitating fast and cost-effective cross-border payments. By reintroducing the trust, Grayscale is not only navigating regulatory clarity but also potentially paving the way for increased institutional adoption and capital inflows into the XRP market.

Source: Grayscale

eToro Reaches Settlement with SEC and Limits Crypto Offerings

eToro, a popular trading platform, has agreed to pay a $1.5 million settlement to the U.S. Securities and Exchange Commission (SEC) for allegedly operating as an unregistered broker and facilitating trades in certain crypto assets considered securities. As part of the settlement, eToro will cease trading most cryptocurrencies for U.S. customers, limiting its offerings to Bitcoin (BTC), Bitcoin Cash (BCH), and Ethereum (ETH). The company stated that this change will minimally impact customers, as only about 3% of the crypto assets on its platform by dollar value will be affected. eToro’s CEO, Yoni Assia, emphasised that the settlement allows the company to focus on providing innovative products in the U.S. market while adhering to regulatory requirements. The SEC’s action is part of a broader crackdown on crypto firms that are seen as violating federal securities laws.

Outflows and Market Sentiment: Bitcoin and Ethereum Experience Turbulence

The crypto market has recently faced some turbulence, with significant outflows from digital asset investment products. Over the past week, outflows totaled $726 million, matching the largest recorded outflows from March this year. Bitcoin was particularly affected, with $643 million in outflows, reflecting cautious investor sentiment amid macroeconomic uncertainty. Ethereum also faced outflows of $98 million, mainly from the Grayscale Ethereum Trust.

Source: Coinmarketcap

However, despite the negative sentiment, some market participants remain optimistic. European markets showed inflows, with Germany and Switzerland leading the way. Meanwhile, Solana (SOL) saw the highest inflows among all assets, suggesting that investors are still interested in certain digital assets. As the market awaits key economic data, such as the upcoming Consumer Price Index (CPI) report, many are looking for signs of stabilisation and potential opportunities for growth.

Technical Analysis: Bitcoin's Price Movement and Key Indicators

Bitcoin's recent price action has been marked by volatility, but several technical indicators provide insights into where the market might head next. After dropping to a low of under $53,000, Bitcoin rebounded to above $57,000, demonstrating a positive response to recent market conditions. However, the cryptocurrency briefly touched $58,000 before experiencing a minor pullback, indicating that the market remains sensitive to macroeconomic factors.

From a technical perspective, Bitcoin is showing signs of strength but faces resistance at the $60,000 level. The Relative Strength Index (RSI) is currently approaching the overbought territory, suggesting that a short-term correction could occur as traders take profits. The Average Directional Index (ADX), which measures trend strength, indicates a strong uptrend but shows signs of potential consolidation before the next upward move.

Source: TradingView

The moving averages also provide critical insights. Bitcoin is trading above its 50-day moving average, which is a bullish signal. However, it remains below its 200-day moving average, suggesting that the market needs more sustained upward momentum to confirm a longer-term bullish trend. If Bitcoin can break above the $60,000 resistance level and maintain its position, it could pave the way for further gains. Conversely, failure to break through this level may result in additional sideways trading or even a temporary decline.

Conclusion: A Market Poised for Potential Gains

Overall, the cryptocurrency market is currently in a state of flux, with both bullish and bearish indicators at play. While Bitcoin shows signs of a potential bull run, supported by declining exchange reserves and growing stablecoin reserves, the broader market remains cautious amid economic uncertainty. Meanwhile, developments in altcoins like SHIB and XRP provide additional avenues for growth. As technical indicators suggest a mixed short-term outlook, investors will need to keep a close eye on market trends and macroeconomic events to make informed decisions.