Crypto Weekly Wrap: 13th December 2024

Ethereum’s Potential Rally Toward $5,000

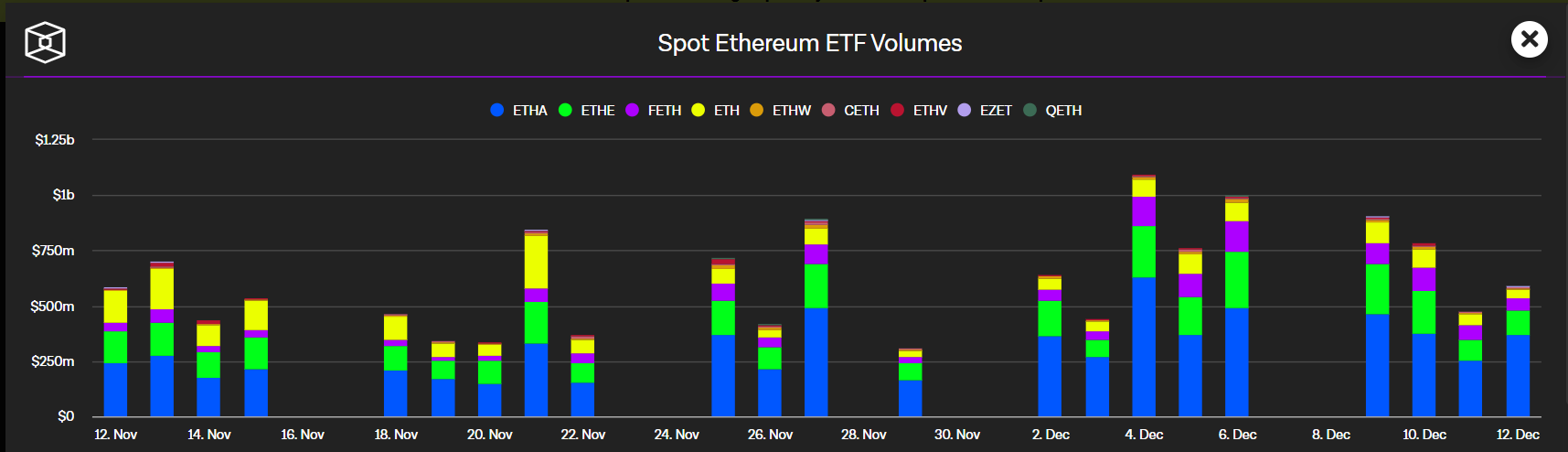

Ethereum (ETH) is poised for a potential rally beyond the $5,000 mark. Currently trading below $4,000, Ethereum is benefiting from heightened institutional interest, particularly through spot ETFs. Since their U.S. debut in July 2024, Ethereum ETFs have accumulated 3.41 million ETH, reflecting growing confidence among investors. Deflationary mechanisms, such as increased ETH burning due to network activity, have tightened supply, setting the stage for price appreciation. With total daily transactions now ranging between 6.5 and 7.5 million, Ethereum’s network activity underscores its evolving role as a foundational layer for decentralised applications, smart contracts, and DeFi. Analysts suggest ETH’s realised price indicates an upper limit of $5,200, making the current dynamics favourable for a breakout.

Source: TradingView

Source: TheBlock

Spot Bitcoin ETFs: Institutional Game-Changers

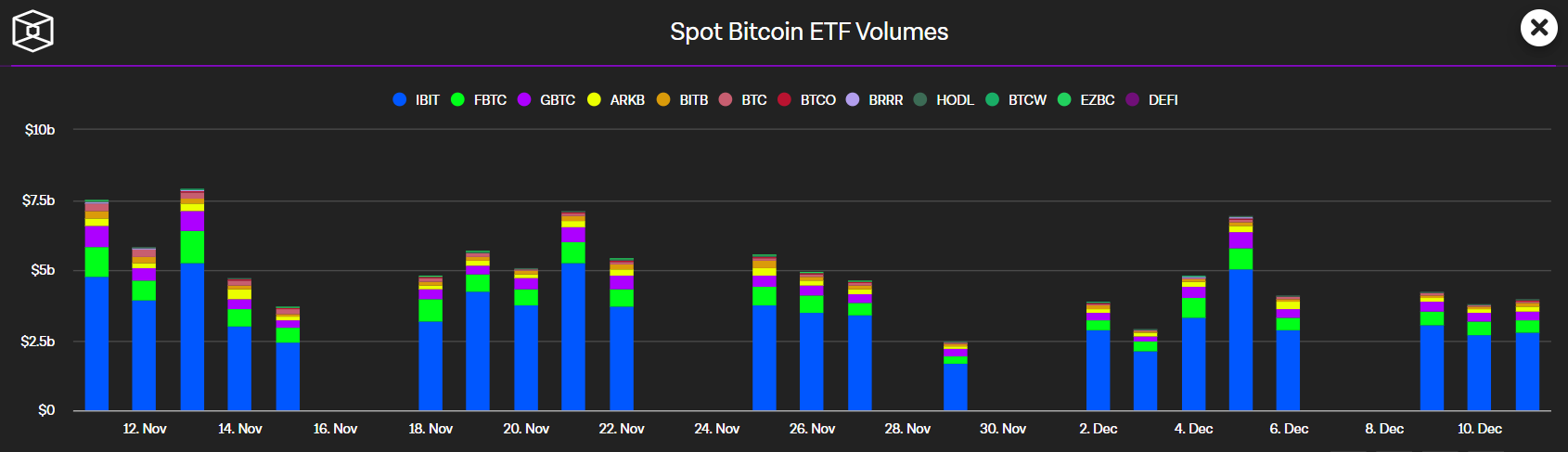

The rise of U.S. spot Bitcoin ETFs marks a significant milestone in the integration of cryptocurrency into mainstream financial markets. Surpassing 500,000 BTC in cumulative net inflows within less than a year, these ETFs have absorbed over 2.5% of Bitcoin's circulating supply, underscoring their growing appeal among institutional and retail investors. Leading the charge, BlackRock’s IBIT spot Bitcoin ETF has amassed over 520,000 BTC, outpacing traditional financial products like its iShares Gold Trust. This trend reflects a shift in investment preferences as "smart money" increasingly aligns with Bitcoin’s potential as a digital store of value. Moreover, the milestone highlights the transformative impact of ETFs on Bitcoin's market dynamics, offering a regulated and accessible pathway for large-scale investment while reinforcing Bitcoin’s position as a key asset in the financial ecosystem.

Source: TheBlock

Dogecoin’s Resurgence: $0.50 in Sight

Dogecoin (DOGE) is displaying signs of a potential rally, with analysts predicting a move toward $0.50. Despite consolidating between $0.35 and $0.44, the meme-based cryptocurrency has maintained strong investor interest. Dormant DOGE coins are returning to circulation, a bullish signal that often precedes price spikes. Historical trends indicate that Dogecoin’s recent consolidation could mirror previous bullish patterns, potentially setting the stage for another uptrend. A breakout above $0.50 would signify renewed momentum, attracting both retail and institutional players.

Source: TradingView

Trump’s Crypto Ambitions Aim to Cement U.S. Leadership

President-elect Donald Trump has vowed to make the United States a global leader in cryptocurrency during his upcoming term, signaling a significant shift in federal policy toward digital assets. Speaking at the New York Stock Exchange, Trump emphasized the need to stay ahead of countries like China by embracing and advancing blockchain technology. His proposal for a strategic Bitcoin reserve exemplifies this commitment, aiming to secure the nation's dominance in the evolving financial landscape. This marks a stark departure from the current administration’s strained relationship with the crypto industry, offering a sense of optimism to investors and innovators. By positioning the U.S. as a hub for crypto development, Trump aims to attract investment, foster innovation, and redefine the role of digital currencies in global markets.

Trump speaks at a Bitcoin conference in Nashville in July. Source: BBC

World Liberty Financial: A DeFi Pioneer

World Liberty Financial (WLFI), a Trump-backed DeFi project, is carving out its position in the cryptocurrency market with innovative strategies. The project has amassed $73 million in crypto assets, with Ethereum making up a dominant $50 million of its holdings. By converting stablecoins to ETH through platforms like CoW Swap, WLFI signals its commitment to deeper integration with the crypto economy and its confidence in Ethereum as a reserve asset. Additionally, the project has executed over 146 swaps to optimize fund allocation, further reflecting its strategic agility. Despite falling short of its initial $300 million fundraising goal, WLFI has raised a respectable $55 million since launching its token sale. Designed to cater to accredited investors, WLFI aims to drive DeFi adoption while strengthening America's leadership in blockchain innovation, aligning perfectly with Trump’s vision of making the U.S. a crypto powerhouse.

Source: X

Crypto Market Gains Momentum

The global cryptocurrency market has surged by 4%, driven by Bitcoin’s stability above $100,000 and positive CPI data from the U.S. The market’s recovery has been buoyed by optimism surrounding lower interest rates, which could enhance liquidity and attract risk-on investments. Altcoins like Ethereum, Dogecoin, and Chainlink have also rallied, signalling renewed investor confidence. This growth follows a turbulent period marked by profit-taking and selling pressure. Analysts predict continued upward momentum, with Bitcoin potentially reaching $120,000 to $140,000 in the coming months. The market’s resilience highlights the growing acceptance of cryptocurrencies as a mainstream financial asset.

Source: X

Technical Outlook: Bitcoin’s Consolidation Above $100K

Bitcoin’s technical setup suggests a cautiously optimistic outlook. The cryptocurrency is consolidating after breaking out of a symmetrical triangle pattern, with key resistance levels at $101,930, $103,700, and $106,500. On the downside, support lies at $99,750, $98,850 (aligned with the 50-day EMA), and $97,800. The RSI currently stands at 49, indicating neutral momentum, though signs of exhaustion are emerging. A sustained break above $101,930 could pave the way for further gains, while a drop below $99,550 may prompt a retest of lower support levels. Bitcoin’s ability to maintain its position above $100,000 will depend on broader market sentiment and upcoming macroeconomic developments. This pivotal moment will likely set the tone for its next major move.

Source: TradingView