Celestia (TIA) Latest Developments, Market Trends, and Technical Analysis

Celestia (TIA): Market Trends, Innovations, and Future Prospects

Celestia's Strong Performance in 2024

Celestia has demonstrated impressive growth in 2024, marking a pivotal year for the modular blockchain project. The company reported a 7.5% year-on-year revenue increase, driven by the rising demand for its advanced blockchain and technology solutions. Additionally, EBITDA surged by 40%, highlighting improved operational efficiency and strong product adoption. These financial achievements have positioned Celestia well for further expansion and reinvestment in the rapidly evolving blockchain ecosystem.

The company’s innovation-focused approach led to several technological breakthroughs, including the launch of GaN-based SSPAs in the DBS band and compact electronic multibeam gateways. These advancements reinforce Celestia’s leading role in modular blockchain architecture and multi-orbit satellite communication technology. With a continued focus on research and development, Celestia is well on track to establish itself as a long-term player in the blockchain and broader tech industries.

Source: Coinmarketcap

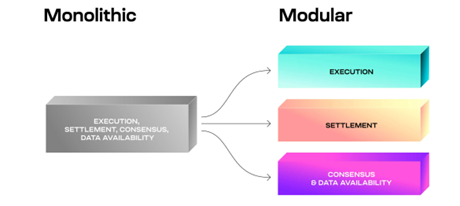

Modular Blockchain Expansion and Celestia's Role

In 2024, modular blockchain adoption surged, with top Layer 2 projects like Aevo, Lyra Finance, Hypr Network, Orderly Network, Eclipse, and Public Goods Network leveraging Celestia for data availability. One of the most significant milestones was the introduction of Astra, a high-throughput Stargaze Layer 2 that integrates Celestia for data availability while using Stargaze L1 for liquidity and routing. Another key development was Forma, the first sovereign rollup built on Celestia, powered by Astria’s Sequencing Layer.

In November 2024, Eclipse debuted its public mainnet, integrating Solana's speed with Ethereum's liquidity, while relying on Celestia for data availability. This innovation enhanced efficiency and scalability across ecosystems. Following its mainnet launch, Eclipse contributed to a record-breaking data surge on Celestia in December, demonstrating the growing demand for modular blockchain architectures.

Celestia’s modular approach separates consensus from execution, offering scalability, reduced congestion, and enhanced security. This design simplifies blockchain development, allowing projects to deploy custom-built chains efficiently. As decentralised applications (dApps) and smart contracts continue to expand, modular blockchain frameworks like Celestia are poised to reshape the future of blockchain technology.

Source: Celestia

Celestia Expands Liquid Staking with MilkyWay and Stride

Liquid staking has become a significant part of Celestia's staking ecosystem, providing TIA holders with new ways to participate in securing the network while maintaining liquidity. MilkyWay, Celestia’s first liquid staking solution, saw rapid adoption upon its launch in December 2023, with over $1.2 million in milkTIA issued within the first 12 hours and its Osmosis pool surpassing $1.4 million. By the end of 2024, liquid staking through MilkyWay had grown to a staggering $11 billion in total value locked (TVL). Following MilkyWay’s success, Stride launched its own liquid staking solution for TIA on February 1, 2024, amassing a TVL of $6.24 million throughout the year. With these two protocols expanding Celestia’s staking infrastructure, the network is further enhancing capital efficiency and decentralized participation, reinforcing its position as one of the most staked chains in the Cosmos ecosystem.

Source: Everstake

Future Price Predictions for TIA (2025-2030)

Celestia’s price outlook remains dynamic, with bullish and bearish projections shaping its long-term potential. Based on current market trends and technical indicators, here’s a forecast for TIA’s future performance:

2025: If adoption continues to expand, TIA could reach $7.50, but a failure to maintain strong demand may lead to a correction toward $2.50.

2026: Analysts expect TIA to trade between $3.36 and $9.26, with an average price of $6.31 if modular blockchain adoption accelerates.

2027: As Celestia’s scalability solutions gain traction, prices could fluctuate between $4.12 and $11.98, depending on broader market conditions.

2028: If institutional and developer adoption grows, Celestia could target $14.63, with an average price near $10.06.

2029-2030: By 2030, if Celestia solidifies its position as a leading blockchain infrastructure, TIA could potentially reach $20.52, provided sustained adoption and bullish market cycles.

Despite Celestia's strong fundamentals, market volatility, macroeconomic conditions, and regulatory shifts will play critical roles in shaping TIA’s price trajectory. Investors should remain cautious and track key resistance and support levels for potential trend reversals.

Celestia (TIA) Technical Analysis: Price Rebound or Another Pullback?

Celestia (TIA) has shown signs of recovery, currently trading at $3.767, marking a recent uptrend after a prolonged downtrend. Despite a -0.50% daily decline, the price has rebounded from its previous low, approaching key resistance levels that will determine its next move.

Resistance and Support Levels

Primary Resistance: TIA is nearing the $3.80 resistance level. If it breaks above this, a rally towards $4.00-$4.50 could unfold, strengthening bullish sentiment.

Immediate Support: The $3.20-$3.40 range has provided a solid base for the recent bounce. If TIA fails to maintain its upward trajectory, a retest of $3.00 could occur.

Critical Support: If bearish pressure increases, the next significant support lies at $2.50. A break below this could push the price further down toward $1.60, a historically strong demand zone.

Relative Strength Index (RSI) & Market Momentum

The RSI currently sits at 72.89, indicating that TIA is approaching overbought territory. This suggests that while momentum is bullish, a potential pullback or consolidation may occur before further gains.

Market volume is increasing, with 12.43 million in 24-hour trading volume, signaling renewed investor interest.

Potential Outlook

If TIA successfully breaks $3.80, buyers could push the price toward $4.50 and beyond.

However, if resistance holds, profit-taking may lead to a retest of lower support zones.

Overall, Celestia is at a pivotal level, with both bullish and bearish scenarios in play. Traders should watch for a decisive move above resistance or a rejection that could lead to another downside test.

Source: TradingView

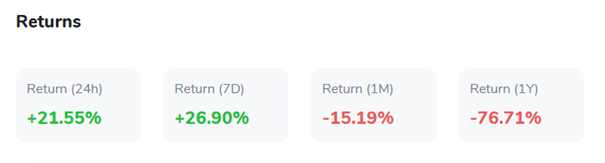

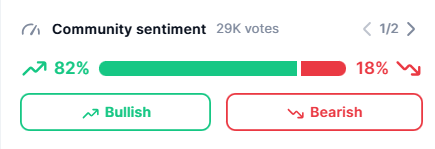

Market Sentiment: Investors on Edge

Investor sentiment around Celestia remains divided, with some traders eyeing long-term potential while others remain cautious due to short-term volatility. The recent 60% drop from its January peak has raised concerns, yet the overall market interest in modular blockchain solutions remains strong.

Celestia’s trading activity has seen a notable increase, with investors closely monitoring resistance levels and potential breakout patterns. If institutional adoption grows and network improvements continue, sentiment may shift in favour of higher price targets in the coming months.

Source: Coinmarketcap

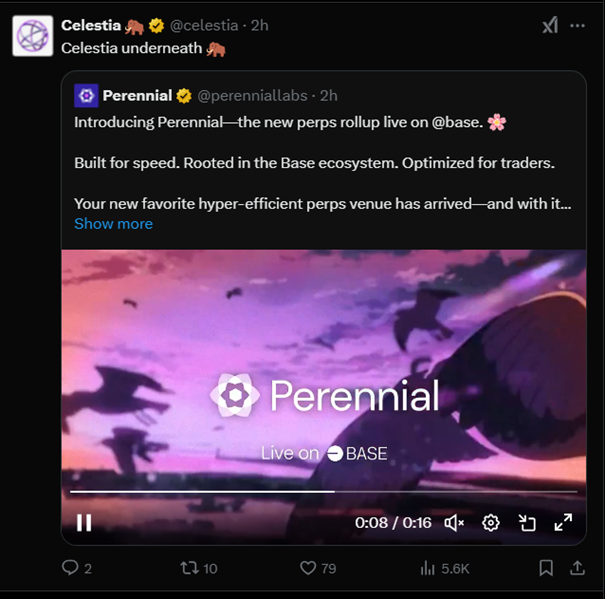

Celestia's Active Presence at ETHDenver

ETHDenver will also serve as a key networking and collaboration hub for blockchain enthusiasts, developers, and investors interested in modular blockchain technology. Celestia’s presence at the event highlights its growing influence in the blockchain space, with various activities designed to engage the community. From hands-on development at the Hacker House to discussions at Modular Day, participants will gain insights into Celestia’s scalability solutions and data availability innovations. The Mammoth Hunt NFT challenge adds an element of gamification, while Provable Denver will showcase advancements in off-chain computation. With $10K in prizes available for top projects, ETHDenver is set to be an exciting opportunity for builders and innovators to explore Celestia’s ecosystem.

Source: X

Final Thoughts: Is Celestia a Strong Investment?

Celestia’s modular blockchain architecture positions it as a potential game-changer in the blockchain space. Its unique scalability solutions offer a fresh alternative to traditional blockchain models, making it attractive for developers seeking customisable and efficient blockchain infrastructure.

However, the token’s volatile price movements, resistance struggles, and uncertain regulatory landscape make it a high-risk, high-reward investment. Investors should carefully monitor key technical levels and broader market trends before making a decision.

With Celestia’s continued focus on innovation, strong financial performance, and increasing market presence, it remains a project to watch in the evolving crypto space. If adoption accelerates, TIA’s price could see substantial growth, but the journey will likely be volatile along the way.

Source: X