SUI: Latest Developments, Market Trends, and Technical Analysis

The SUI blockchain has emerged as one of the most promising Layer-1 networks, offering groundbreaking scalability and efficiency. With its rapid growth, increasing adoption, and recent price volatility, SUI continues to capture the attention of investors and developers alike. However, the network has also faced challenges, including a major $29 million exploit, highlighting the need for improved security measures. In this article, we will cover the latest SUI news, market developments, and an in-depth technical analysis of its price trends.

SUI's Market Growth and the $4 Price Zone Challenge

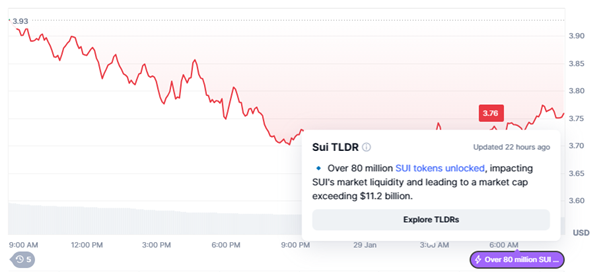

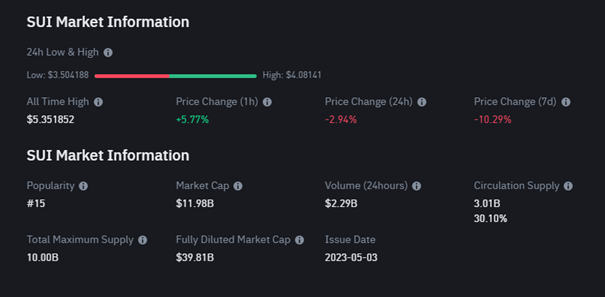

One of the key price levels for SUI remains the $4 zone. This level aligns with a Fair Value Gap (FVG), making it a crucial area for maintaining the token’s bullish trajectory. If SUI holds above $4, it could serve as a launchpad for a rally toward the $10–$20 range. However, if the price drops below $4, it could signal a larger correction, potentially leading to a pullback toward the $3.50 support level. This makes the upcoming price action around $4 a decisive factor for SUI’s medium-term future.

Source: CoinMarketCap

SUI Reaches 50 Million Accounts: A Sign of Adoption

SUI’s ecosystem continues to expand, with the network recently surpassing 50 million registered accounts. This milestone highlights its rapid adoption and increasing user engagement. The growing number of users is a crucial metric for blockchain projects, as it often correlates with higher transaction volumes and increased demand for the native token.

Source: CoinMarketCap

With a larger user base, SUI is also attracting more developers, which enhances the blockchain’s utility. More developers mean more decentralized applications (dApps), which in turn increases the demand for SUI tokens. However, while adoption is growing, scalability remains a key challenge. If the network can sustain its expansion without congestion or high fees, it will strengthen its long-term prospects. On the other hand, scalability issues could hinder further growth and lead to short-term price volatility.

Source: X

The impact of SUI’s adoption is also evident in its NFT sector, with notable collections like Egg ($4.3M market cap), Rootlets ($3.7M), and Prime Machin ($2.6M). The presence of multiple high-value NFT collections signals strong investor interest, similar to the NFT boom seen in 2021.

SUI’s Price Recovery and Whale Activity

SUI has been experiencing high volatility in recent weeks, with its price declining by 25% in just five days. After dropping below the $4 support level, SUI entered a demand zone around $3.50, which has historically triggered buying activity. The past three times SUI entered this zone, it saw sharp rebounds, indicating strong support.

Amid this price action, SUI’s 24-hour trading volume surged by 185% to $1.7 billion, reflecting renewed interest from traders. Additionally, whale activity has increased, suggesting that large investors are accumulating SUI at current levels. If whales continue accumulating, it could provide a strong foundation for a price recovery.

Despite the recent bearish trend, historical patterns indicate that SUI may be setting up for a potential rally. The token’s resemblance to Bitcoin’s 2017 bull run suggests that this correction could be temporary, paving the way for another strong move upward.

Source: Binance

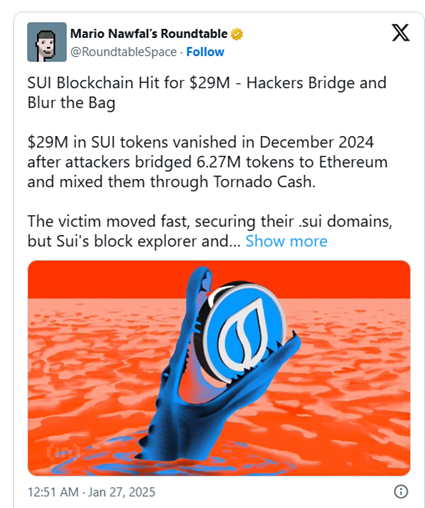

Security Concerns: $29 Million SUI Exploit

While SUI has demonstrated impressive growth, it recently suffered a major security breach that led to the theft of $29 million worth of SUI tokens. According to blockchain investigator ZachXBT, the attackers targeted a large holder, moving stolen funds through Ethereum and using Tornado Cash to obscure their transactions.

This exploit raises serious concerns about blockchain security, particularly for newer networks like SUI. The incident highlights the vulnerabilities that emerging projects face as they scale. Without robust security measures, these networks can become prime targets for hackers. The difficulty in tracing stolen funds further complicates the situation, emphasizing the need for advanced on-chain analytics and security protocols.

SUI’s development team has acknowledged the issue and plans to implement enhanced security measures. Moving forward, the network’s ability to address these vulnerabilities will be crucial in maintaining investor confidence.

Source: TronWeekly, X

Technical Analysis: SUI’s Price Reversal and Future Outlook

Recent Price Action

SUI has been in a corrective phase, dropping from $4.65 to $3.49 in a five-day bearish trend. However, a significant recovery is now underway, with the token rebounding to $3.94 and forming a potential Morning Star pattern on the daily chart. This pattern suggests a possible trend reversal, indicating that bullish momentum is returning.

The 100-day EMA has acted as a strong support level, preventing further downside movement. SUI also bounced from the 61.8% Fibonacci retracement level, reinforcing the idea that this price zone could serve as a bottom.

Source: TradingView

Key Resistance and Support Levels

Support Levels: $3.50 (demand zone), $3.46 (61.8% Fibonacci)

Resistance Levels: $4.19 (78.6% Fibonacci), $5.00 (psychological level)

For SUI to regain bullish momentum, it must break and close above $4.19. This would confirm the reversal and set the stage for a potential rally toward $5. Conversely, if SUI fails to hold above $3.50, it could trigger another wave of selling pressure, possibly leading to a deeper correction.

Indicators and Momentum

RSI (Relative Strength Index): RSI is currently moving sideways, signaling indecision. If it turns upward, it would confirm a bullish breakout.

MACD (Moving Average Convergence Divergence): The MACD remains in the red, indicating that downward momentum is still present. However, a bullish crossover could occur if the price stabilizes above $4.

Moving Averages: The 20 and 50 EMA are on the verge of a bearish crossover. If SUI maintains its recovery, this crossover may be avoided, allowing bulls to regain control.

Source: TradingView

Outlook

If SUI successfully holds the 100-day EMA and clears the 78.6% Fibonacci resistance at $4.19, it could reclaim the $5 level and set its sights on higher targets. However, traders should watch for confirmation candles before entering long positions. The coming days will be crucial in determining whether SUI’s bullish trajectory resumes or if further consolidation is needed.

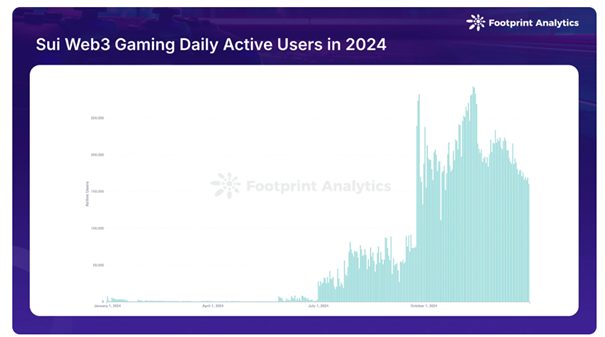

Web3 Gaming and SUI’s Future Potential

SUI has positioned itself as a leading blockchain for Web3 gaming, leveraging its high-performance architecture and Move programming language. With over 65 gaming studios building on SUI and 70 new games set for release in 2025, the network is establishing itself as a major player in the gaming sector.

One of SUI’s standout features is zkLogin, which allows players to log in with their existing Web2 credentials (Google, Facebook) while maintaining Web3 security. Additionally, sponsored transactions enable developers to cover gas fees for users, making onboarding seamless.

These innovations are crucial in attracting mainstream gamers to blockchain-based gaming. As gaming remains one of the most promising sectors in crypto, SUI’s focus on this niche could drive long-term adoption and demand for its native token.

Source: CoinGecko

Conclusion: SUI’s Path Forward

SUI’s recent developments highlight both its growth potential and challenges. While its rapid adoption, strong NFT market, and Web3 gaming expansion are promising, security concerns remain a critical issue. The recent $29 million exploit underscores the need for stronger safeguards as the network scales.

From a price perspective, SUI’s recovery from the demand zone suggests that bullish momentum could return, but key resistance levels must be cleared for sustained upside movement. Traders should monitor the $4.19 and $5.00 levels closely, as breaking above these zones would confirm a renewed uptrend.

As the crypto market continues to evolve, SUI remains a project to watch, with its Layer-1 infrastructure and gaming ecosystem positioning it as a potential leader in the blockchain space.