Stellar (XLM): Riding High on Regulatory Shifts and Network Growth

Stellar (XLM) has been gaining significant momentum in recent months, driven by favorable regulatory developments and technological advancements within its ecosystem. Following Donald Trump’s election victory and the impending departure of SEC Chair Gary Gensler, investor optimism has surged for blockchain networks like Stellar. Such developments would pave the way for Stellar to operate in a more supportive environment, potentially unlocking new institutional interest.

Analysts predict that Stellar’s strategic collaborations and advancements in cross-border remittances position it as a major player in the blockchain payments industry, competing directly with Ripple (XRP). This alignment of regulatory and technological factors could catapult Stellar to new heights, solidifying its reputation as a transformative force in the financial technology space.

Source: DefiLlama

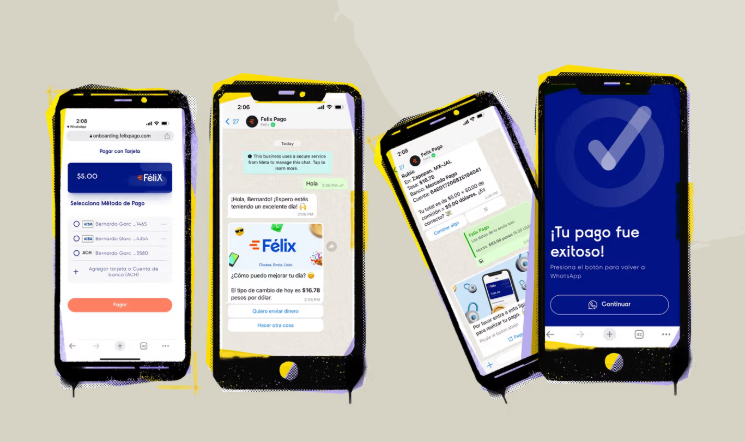

Strategic Partnerships and Advancements in Remittances

Stellar's partnerships with Félix and Bitso have revolutionized the remittance industry by leveraging blockchain technology and stablecoins like USDC. These collaborations enable faster, cheaper, and more secure money transfers. The use of blockchain technology addresses critical inefficiencies in traditional remittance systems, such as high fees and slow transaction times, which disproportionately affect underserved populations. By tackling these challenges head-on, Stellar has cemented its role as a leader in cross-border financial solutions. Beyond remittances, Stellar’s infrastructure has attracted attention from institutional players, including WisdomTree and Circle, who utilize the network for tokenization and financial innovation. These developments highlight Stellar’s ability to bridge traditional finance and blockchain ecosystems, demonstrating its potential to drive widespread adoption across various sectors.

Source: Stellar

Passkeys: Simplifying Blockchain for Widespread Adoption

Blockchain technology's potential to revolutionize industries is undeniable, but its adoption has been hindered by complex user experiences, particularly for newcomers transitioning from Web2. Passkeys, a groundbreaking innovation, aim to bridge this gap by offering a secure and user-friendly authentication mechanism. Unlike traditional private key and passphrase systems, which require meticulous management and raise fears of irreversible loss, passkeys simplify interactions with blockchain platforms. They allow users to authenticate and sign transactions seamlessly through biometrics or device PINs, enhancing both security and usability. Stellar's integration of passkey support at the protocol level further underscores its commitment to user adoption. By eliminating the layers of complexity typically associated with blockchain operations, passkeys represent a major step forward in making decentralized applications more accessible to the general public.

Source: Stellar

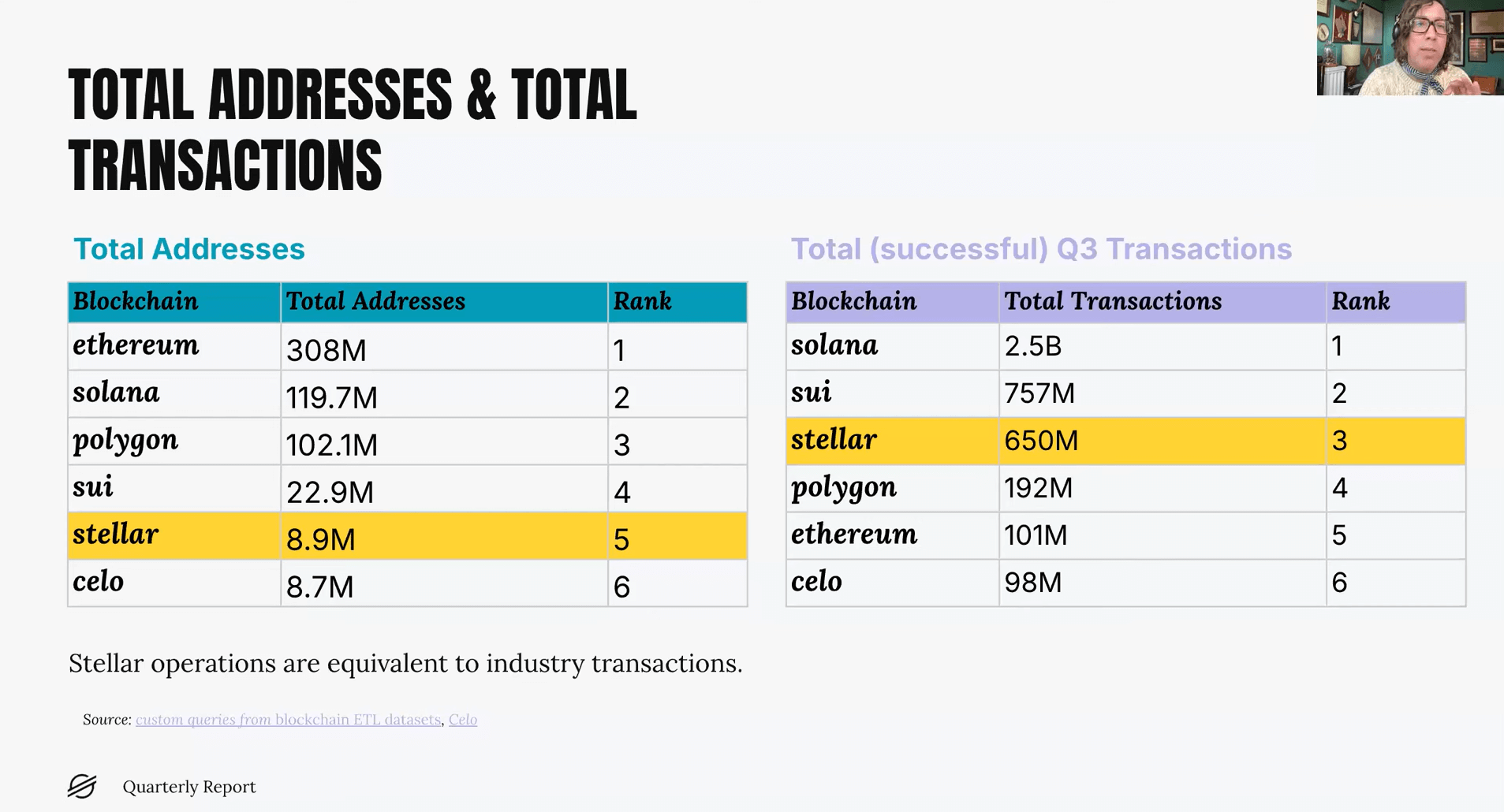

Stellar Development Foundation Q3 2024 Highlights: A Transformative Quarter

The Stellar Development Foundation (SDF) released its Q3 2024 report, showcasing significant advancements that highlight the network's growing influence in the blockchain ecosystem. Stellar reached a milestone of over 9 million addresses, emphasizing its expanding user base and adoption. The Enterprise and Matching Fund made strategic investments of over $5 million, supporting innovative newcomers and established ecosystem partners driving the next generation of financial services.

Key technical updates include Stellar Core version 6.0, which attracted a record number of submissions, and progress on Protocol 21, introducing BLS functionality for enhanced security and privacy. Interoperability within the ecosystem expanded as Stellar became tracked by Messari and DefiLlama, enhancing visibility and fostering ecosystem integration.

Source: Stellar

On the enterprise front, Franklin Templeton’s Benji investment platform, built on Stellar, reached an all-time supply high of $450 million, demonstrating the platform's robust financial integration capabilities. Stellar wallets also saw innovative feature rollouts, such as bill pay functionalities and user-friendly improvements, reflecting growing utility in everyday financial services.

The quarter concluded with the successful Meridian conference in London, gathering nearly 700 attendees to discuss Stellar's impact on modern financial solutions.

Source: Stellar

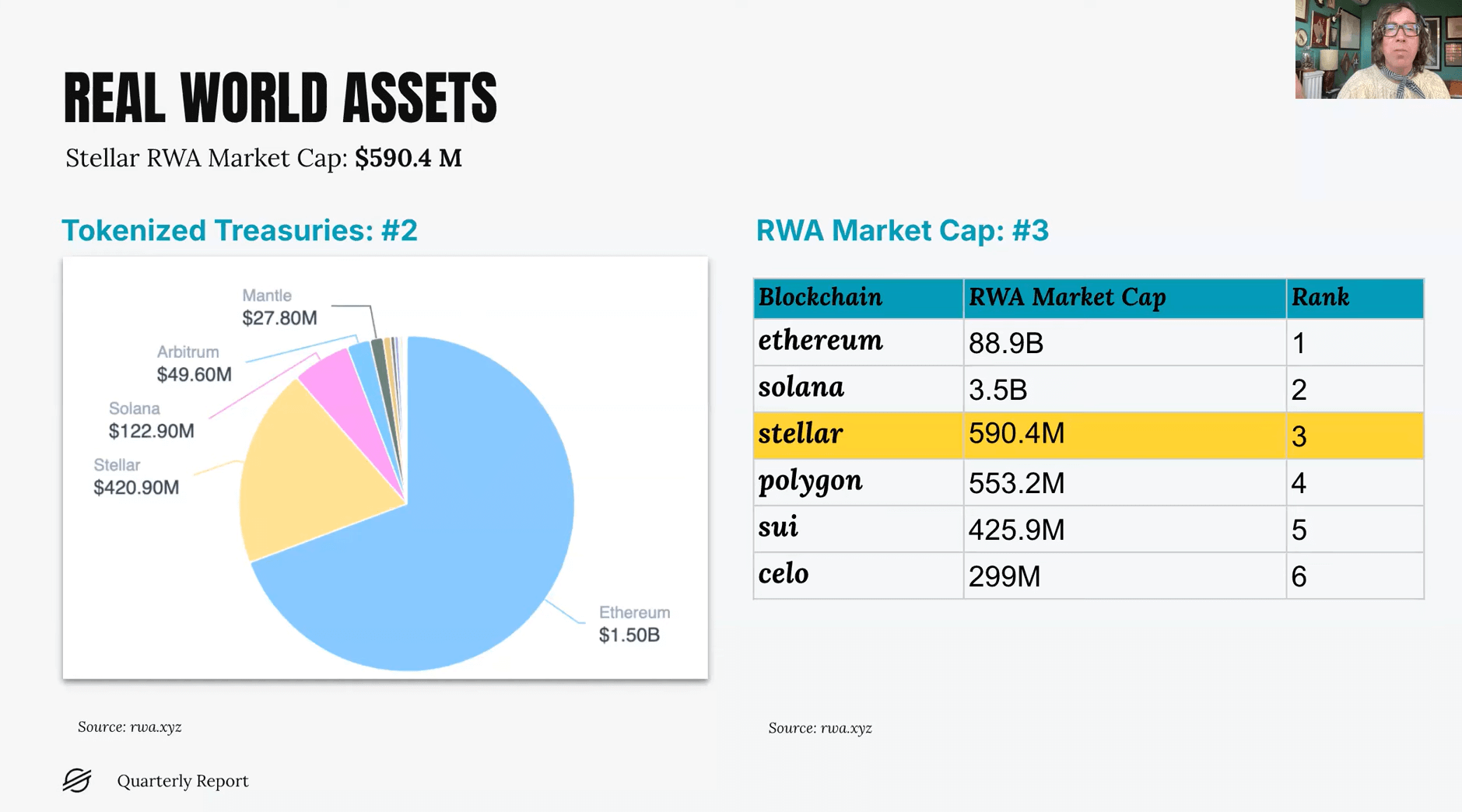

XLM ETF Anticipation and Market Impact

The possibility of a spot Stellar (XLM) ETF approval in 2025 has generated significant excitement among institutional and retail investors alike. Canary Capital and other firms have already submitted filings, signaling a growing interest in XLM as an institutional-grade asset. An approved ETF would provide traditional investors with a regulated and accessible pathway to engage with Stellar, likely increasing its adoption and liquidity. Analysts argue that such regulatory clarity and accessibility could transform XLM into a mainstream asset, spurring further innovation within its ecosystem. Additionally, the anticipated ETF approval could mark the beginning of a broader wave of institutional participation, with XLM poised to become a key player in the tokenization of real-world assets. This integration of traditional finance and blockchain technology underscores Stellar’s long-term value proposition and its role in shaping the future of decentralized financial systems.

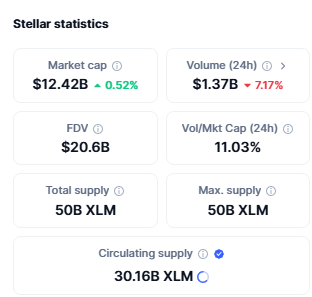

Source: Coinmarketcap

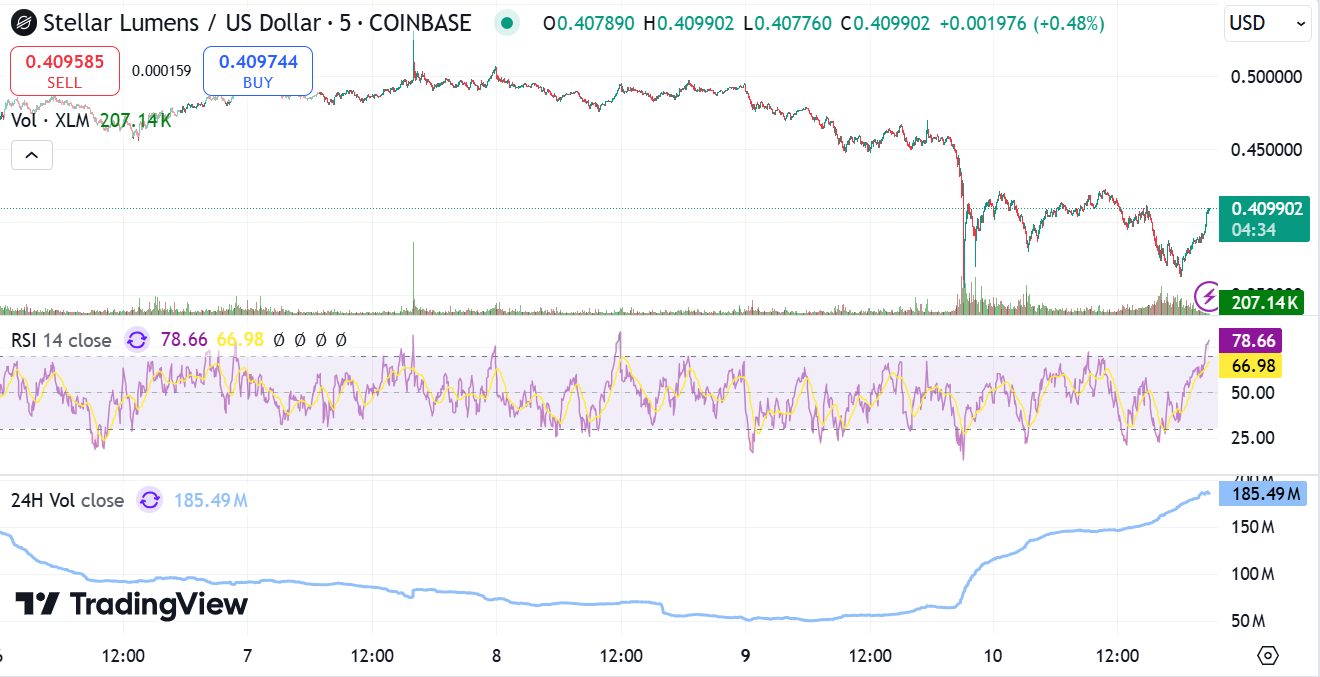

Market Performance and Recent Price Movements

Stellar has seen remarkable price action, with XLM surging 450% year-to-date, showcasing its resilience in the volatile crypto market. Although the token recently corrected to $0.43, such pullbacks are typical following extended rallies, offering opportunities for consolidation and renewed momentum. This correction reflects broader market dynamics, including profit-taking and technical mean reversion, which are common during periods of substantial price increases. Despite this short-term volatility, Stellar’s fundamentals remain strong, driven by robust network adoption and strategic partnerships. The token’s ability to attract both retail and institutional interest underscores its potential for long-term growth. Stellar’s commitment to addressing real-world challenges, such as cross-border payments and financial inclusion, ensures its relevance in the rapidly evolving digital economy.

Technical Analysis: Bullish Patterns and Price Targets

Stellar's price charts reveal multiple bullish patterns, indicating the potential for further upward momentum. Recent analysis identifies a symmetrical triangle and falling wedge patterns, both of which are considered strong indicators of a breakout. A successful breakout could propel XLM towards its $0.90 target, representing a significant gain from its current levels. Support at $0.42 and resistance at $0.515 serve as critical thresholds, ensuring a balanced trading environment as the token consolidates. The 50-day EMA acts as a foundation for price stability, while the MACD suggests the possibility of a bullish crossover in the near future. These technical indicators align with Stellar’s broader narrative of growth and adoption, reinforcing its position as a key asset in the blockchain space. A confirmed breakout could attract more traders, driving both volume and price appreciation as Stellar navigates a promising market landscape.

Source: TradingView

Future Outlook: XLM’s Path to $0.90 and Beyond

As the cryptocurrency market matures, Stellar’s growth trajectory continues to capture the attention of investors and analysts alike. The token’s potential to reach $0.90 in the near term is bolstered by strong fundamentals, favorable regulatory developments, and promising technical indicators. Stellar’s ability to address real-world financial challenges, combined with its innovative ecosystem, makes it a standout contender in the blockchain industry. The anticipated approval of a Stellar ETF and the network’s increasing adoption for tokenization solutions are expected to drive further growth. While challenges remain, including market volatility and competition, Stellar’s strategic focus on innovation and financial inclusion positions it for sustained success. With its robust infrastructure and clear vision, Stellar is well-equipped to navigate the complexities of the digital economy, offering long-term value to its users and stakeholders.