Solana's Latest Developments and Technical Analysis

Content:

- Solana Co-founder Sued Over Staked SOL Rewards

- Solana's Dominance in DEX Trading Volumes

- Declining On-Chain Activity Raises Concerns

- Solana’s Total Value Locked Reaches New Highs

- Technical Analysis: SOL Faces Critical Resistance

- Solana’s Restaking and MEV Revenues Surge

- Outlook: Solana’s Path Ahead

A lawsuit filed in San Francisco’s Superior Court on December 24 has brought attention to the personal and financial disputes involving Solana co-founder Stephen Akridge. Elisa Rossi, his ex-wife, accuses Akridge of secretly earning millions in staking rewards from SOL tokens she claims are hers.

The lawsuit alleges that while their March divorce agreement divided SOL ownership, Akridge manipulated the wallet setup to retain control over the tokens, allowing him to continue staking and collecting rewards without Rossi’s consent.

Source: Cryptopolitan

This high-profile case highlights the challenges of navigating asset ownership in cryptocurrency during legal disputes. Rossi’s claims suggest significant amounts are at stake, as Solana’s staking mechanism generates valuable rewards. The broader implications of this case could influence how crypto assets are handled in legal proceedings, especially given the industry’s lack of standardized regulations.

Solana continued its impressive run in the decentralized exchange (DEX) space in December 2024, achieving over $100 billion in monthly DEX trading volume for the second consecutive month. This remarkable performance surpassed that of Binance Smart Chain (BSC) and Ethereum, which recorded $91.4 billion and $84.1 billion, respectively.

Solana's efficiency and scalability make it an appealing choice for DEX users, solidifying its position as a top contender in the DeFi ecosystem.

Source: DefiLlama

This performance reflects growing confidence in Solana’s network capabilities, particularly as the blockchain proves its ability to handle high-volume transactions efficiently. With more users migrating to Solana-based platforms, the network is positioned to continue its dominance in the decentralized finance sector.

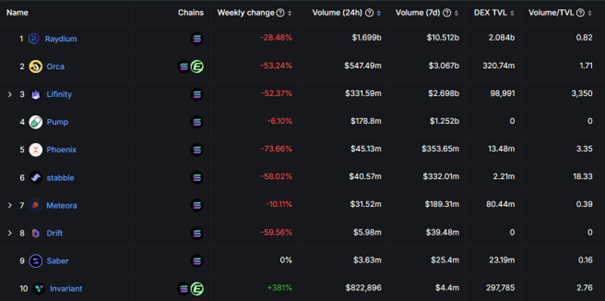

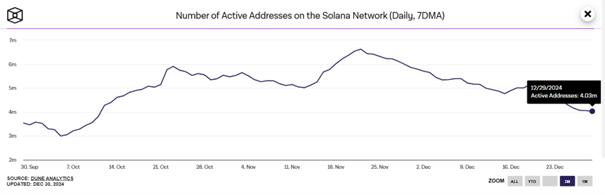

Despite its successes in DEX trading, Solana experienced a 30% decline in network activity over the past week. Weekly volumes across Solana-based decentralized applications (DApps) dropped significantly, with notable declines for Orca, Phoenix and Raydium. These metrics underline the challenges the blockchain faces in maintaining consistent engagement among users and developers.

Solana’s ecosystem has been heavily reliant on the popularity of memecoins, but poor performance from assets like Popcat and BONK has dampened on-chain activity. While the broader cryptocurrency market remained relatively stable, Solana’s underperformance in network activity signals the need for sustained innovation and utility within its ecosystem.

Source: TheBlock

One bright spot for Solana in December was its surge in Total Value Locked (TVL), which hit a two-year high of 45 million SOL, a 16% increase over the past month. Key contributors to this growth included platforms like Binance Staked SOL, Jupiter, Drift, and Orca. These increases highlight growing confidence in Solana’s DeFi ecosystem, even amid broader market challenges.

Source: DefiLlama

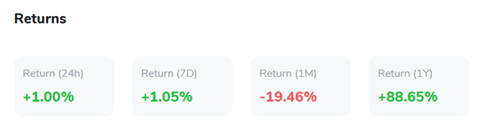

The rising TVL reflects increased user trust in Solana’s staking and liquidity solutions. However, the disconnect between on-chain activity and SOL’s market price—down 19.5% over the past 30 days—points to potential barriers in translating network success into price performance. As Solana continues to enhance its ecosystem, it will be crucial to align these metrics to maintain investor confidence.

Solana’s native token, SOL, is currently trading near $195, facing resistance after multiple failed attempts to sustain levels above $200. A 30% drop in weekly DApp volumes, coupled with declining interest in memecoins, has added to bearish pressure.

Despite these challenges, derivatives data suggests resilience, with a neutral-to-bullish annualized premium of 10% on SOL futures contracts.

Source: TradingView

Key technical levels for SOL include support at $185, which has shown strength in recent trading sessions, and resistance at $200. The RSI indicates moderate bullish momentum, hovering in neutral territory.

SOL's ability to break above $200 could signal a reversal, potentially targeting $215 in the short term. However, failure to maintain support at $185 might open the door for further declines toward $175. With whales and market makers maintaining a cautiously optimistic stance, SOL’s near-term price trajectory remains a critical focus for traders.

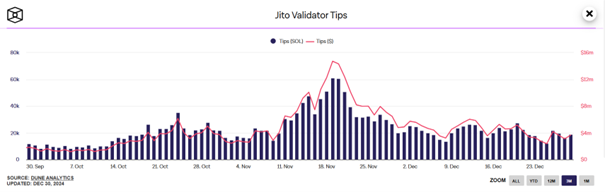

Restaking has emerged as a significant driver of growth for Solana’s network. In December, Solana’s staking pool Jito generated over $100 million in revenue from priority fees and tips, reflecting a growing trend in Maximum Extractable Value (MEV) strategies. These strategies allow validators to prioritize specific transactions, maximizing their earnings.

Source: TheBlock

The rising adoption of restaking underscores the increasing sophistication of Solana’s DeFi ecosystem. Validators have leveraged MEV strategies to achieve consistent monthly revenue growth, with November marking a peak of $210 million. This momentum not only highlights Solana’s efficiency but also sets a strong foundation for continued adoption and innovation within its network.

As 2024 concludes, Solana finds itself at a pivotal juncture. While challenges such as declining on-chain activity and price dips persist, the network’s successes in DEX trading, TVL growth, and restaking revenues underscore its potential for long-term success. The introduction of new innovations and strategic partnerships will be critical in addressing current weaknesses and driving sustained growth.

With the continued expansion of Solana’s ecosystem and the potential for recovery in its token’s price, 2025 could mark a transformative period for the blockchain. Balancing network activity, user engagement, and price performance will remain essential as Solana aims to solidify its position as a leader in the DeFi and blockchain spaces.