Ripple’s Latest Developments and Technical Analysis: RLUSD Launch and XRP’s Future Potential

Ripple Unveils RLUSD Stablecoin on Multiple Blockchains

Ripple has made headlines by officially launching its new stablecoin, Ripple USD (RLUSD), which integrates seamlessly with the XRP Ledger (XRPL) and Ethereum blockchain. RLUSD is designed to raise the standards for stablecoins, prioritizing utility, compliance, and efficiency in the payments space. Ripple’s RLUSD aims to offer unmatched utility by facilitating fast, cost-effective cross-border payments while maintaining regulatory clarity. The stablecoin's interoperability with both XRPL and Ethereum networks enhances its accessibility, enabling users to leverage it within decentralised finance (DeFi) platforms, traditional payments, and liquidity pools. This dual-chain strategy positions Ripple USD as a highly versatile stablecoin that caters to growing demands for stability and scalability in digital payments.

Source: X

The integration with the Ethereum ecosystem highlights Ripple's efforts to align with mainstream blockchain networks, ensuring RLUSD can compete with established stablecoins like USDT and USDC. Ripple’s move reflects a larger strategy to expand its role in both institutional and retail crypto sectors. The global launch on Tuesday signifies Ripple's ambition to establish RLUSD as a key player in the digital payment industry.

RLUSD and Its Potential Impact on XRP

The launch of RLUSD on December 17 has triggered speculation about its impact on Ripple’s native cryptocurrency, XRP. RLUSD’s utility as a compliant, fast stablecoin may generate significant demand for the XRP Ledger, further driving XRP’s adoption. Stablecoins play a vital role in improving liquidity and facilitating seamless transactions across platforms, and RLUSD could serve as a bridge asset within Ripple’s growing payment solutions. We believe that RLUSD will bolster institutional confidence in Ripple’s ecosystem, especially in light of its global regulatory focus.

XRP’s unique role as a liquidity tool for cross-border payments aligns with RLUSD’s purpose, potentially creating a synergistic effect that enhances the efficiency of RippleNet and the XRPL. With increasing adoption, XRP’s price may benefit indirectly as RLUSD transactions generate demand for the underlying blockchain infrastructure. This alignment solidifies Ripple’s position as a leader in the payment solutions industry while paving the way for sustained growth.

Market Expectations Surrounding RLUSD

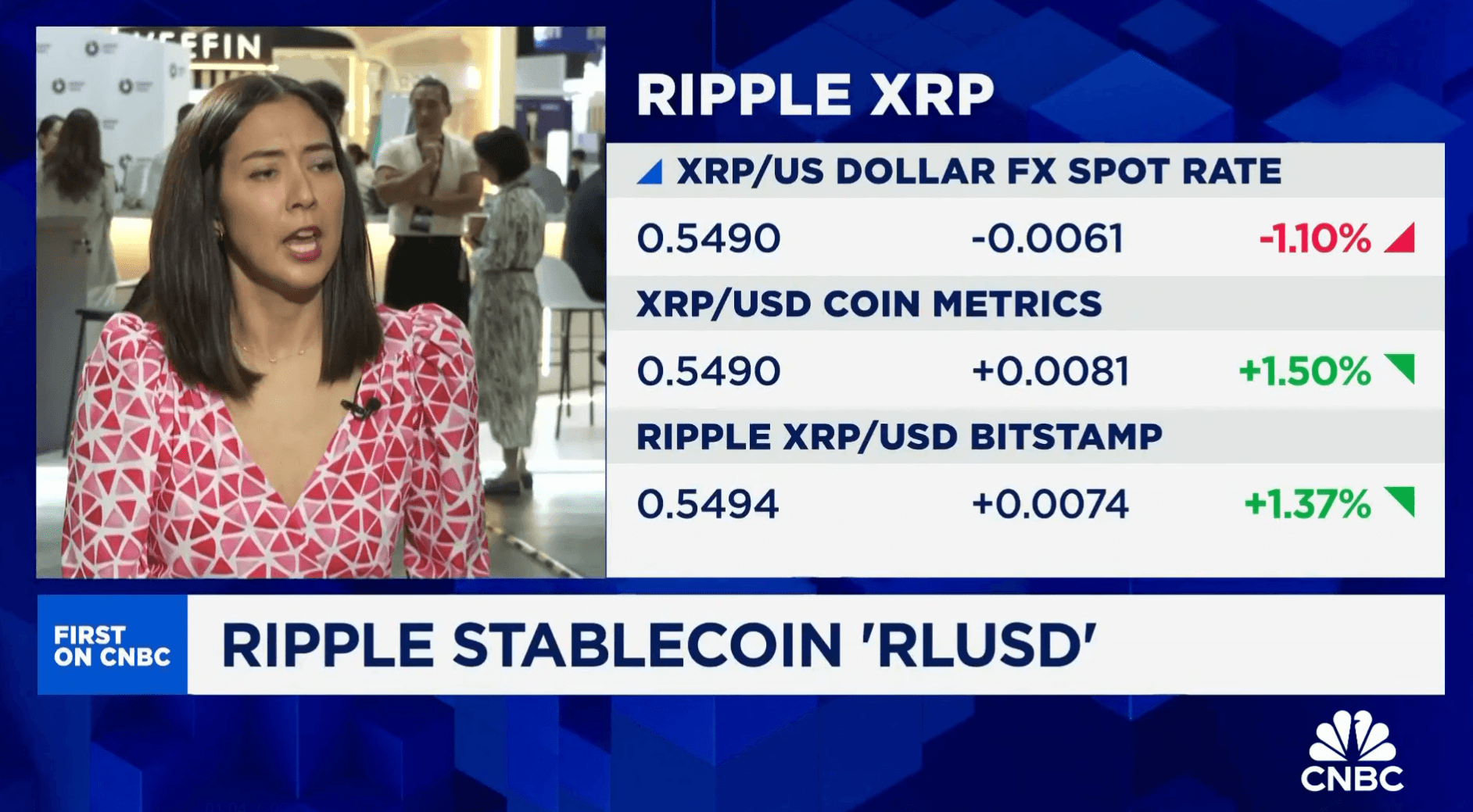

The launch of RLUSD has been met with enthusiasm, with investors closely watching its adoption and market performance. CNBC highlights RLUSD’s role in bridging traditional finance and blockchain technology, targeting institutions that require compliant, stable solutions for cross-border transactions. Ripple has prioritised RLUSD’s regulatory framework, ensuring compliance with global standards—a critical factor for widespread institutional adoption.

Source: CNBC

Investors expect RLUSD’s debut to attract liquidity from both traditional financial institutions and DeFi platforms, positioning Ripple as a top competitor in the stablecoin space. Ripple’s focus on utility and transparency has set it apart from competitors, providing confidence to users and regulators alike. If RLUSD gains significant traction, it could become a driving force behind Ripple’s ecosystem growth, generating momentum for XRP in the broader crypto market.

XRP’s December Momentum and Growing Confidence

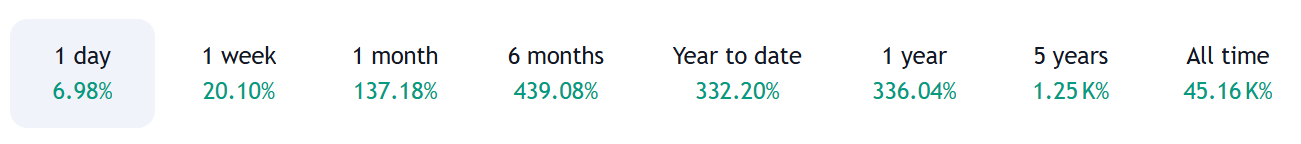

XRP has demonstrated strong momentum throughout December 2024, fuelled by the anticipation surrounding RLUSD’s launch and broader bullish sentiment in the market. XRP has seen a 22% price increase over the past month, with analysts attributing this growth to Ripple’s expanding partnerships and increasing use case adoption. Investor sentiment remains positive as Ripple continues to position itself as a dominant player in global payments.

The launch of RLUSD adds further excitement, with predictions that it could serve as a catalyst for renewed institutional interest in XRP. Ripple’s focus on enabling compliant solutions for financial institutions has reinforced trust in its ecosystem, creating a positive outlook for XRP’s long-term potential. As regulatory clarity improves, Ripple’s ecosystem growth and new developments like RLUSD could drive further upward price movements.

Ripple (XRP) Technical Analysis: Bullish Breakout Ahead?

Ripple (XRP) is currently trading at $2.6764, showing strong signs of consolidation as investors anticipate further momentum from RLUSD’s launch. Over the past month, XRP has surged through critical resistance levels, reflecting increased buying pressure and a bullish outlook. A breakout above the symmetrical triangle pattern signals the potential for further gains, with targeting $2.85 and $3.00 as key price levels in the near term.

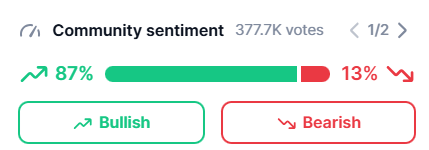

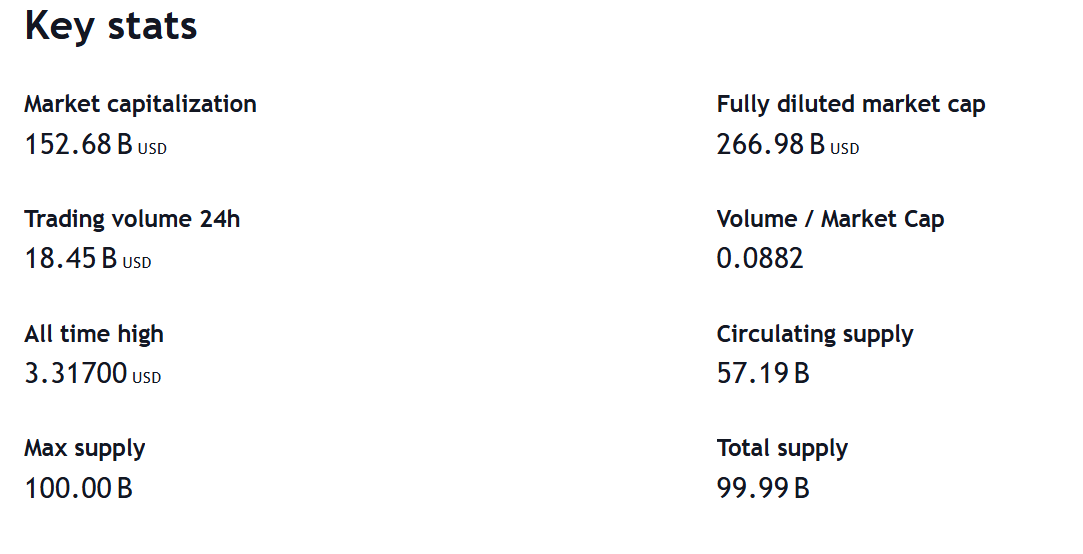

Source: Coinmarketcap

The Relative Strength Index (RSI) is at 52.14, suggesting neutral-to-bullish momentum with ample room for upward movement before entering overbought conditions. Meanwhile, the 50-day Exponential Moving Average (EMA) provides robust support at $2.50, reinforcing XRP’s upward trajectory. A sustained close above the immediate resistance at $2.80 could act as a catalyst, pushing the price toward the significant psychological level of $3.00, especially as RLUSD adoption accelerates.

Source: TradingView

On-chain metrics continue to signal positive trends, with increased whale accumulation and rising network activity on the XRP Ledger. Failure to hold above $2.60 could lead to a retest of support at $2.50, but overall sentiment remains bullish. Ripple’s expanding ecosystem, regulatory progress, and RLUSD’s integration provide strong fundamentals, positioning XRP for a sustained rally as investor confidence builds.

Ripple’s Regulatory Focus and Market Positioning

Ripple’s emphasis on regulatory compliance continues to be a defining factor in its strategy for long-term growth. RLUSD’s design prioritises transparency and alignment with global regulatory frameworks, making it an appealing solution for financial institutions. Ripple has proactively worked with regulators to ensure RLUSD operates within established guidelines, setting a new standard for stablecoins.

Source: Coinmarketcap

By focusing on compliance, Ripple strengthens its market positioning and builds trust with both institutional investors and partners. This regulatory advantage could provide Ripple with a competitive edge as more jurisdictions introduce stablecoin regulations. RLUSD’s compliant design, combined with Ripple’s growing partnerships, reinforces the company’s leadership in the blockchain-based payments sector, creating positive ripple effects for XRP.

Future Outlook: Will RLUSD Drive XRP to New Highs?

With RLUSD officially launching on December 17, investors and analysts are optimistic about Ripple’s ability to leverage this development to drive ecosystem growth. If RLUSD gains widespread adoption, it could catalyse increased network activity on the XRP Ledger, benefiting XRP as a utility token. XRP could rally as high as $4.85 in the long term if RLUSD proves successful and Ripple’s ecosystem continues to expand.

Source: TradingView

Source: TradingView

Ripple’s strategic focus on stablecoin solutions, institutional partnerships, and regulatory clarity positions it well for sustained growth in 2025. While XRP remains below its all-time high of $3.84, we believe the combined momentum from RLUSD, market confidence, and broader crypto adoption could push XRP to retest and surpass these levels. Investors will closely monitor RLUSD’s early adoption metrics as a leading indicator of Ripple’s growth potential.

Conclusion

Ripple’s latest development, the RLUSD stablecoin, marks a significant milestone in the company’s efforts to dominate the blockchain payments industry. By combining regulatory compliance, utility, and interoperability across leading blockchain networks, RLUSD sets a new standard for stablecoins. This development has generated substantial optimism for Ripple’s ecosystem, with XRP poised to benefit from increased adoption and network activity. With a promising technical outlook and growing investor confidence, Ripple and XRP appear ready to capitalise on the opportunities ahead in 2024 and beyond.