October in Review: Key Developments in the Crypto Market

Bitcoin Surges Above $70,000 Amid Institutional Inflows and Election Optimism

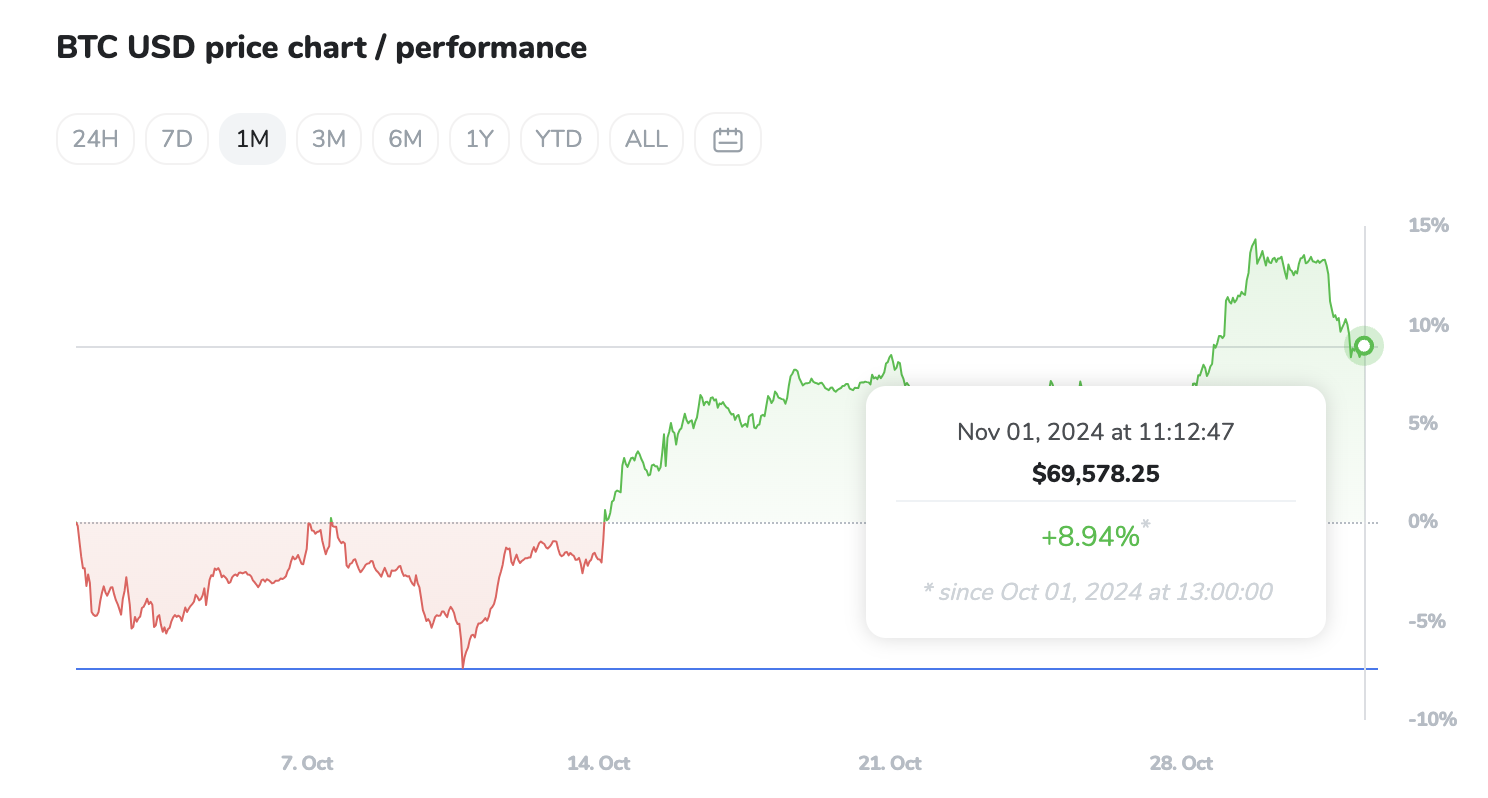

Bitcoin has recently surged past the $70,000 mark, and despite the recent 3% dip in the last 24 hours, marking an impressive 11% increase in October. This rise has been fueled by significant institutional investments through U.S. spot ETFs, indicating a strong vote of confidence from traditional investors. As the U.S. presidential election approaches, candidate Donald Trump’s pro-Bitcoin stance has added further momentum to Bitcoin’s price action. Investors are speculating that, if elected, Trump could bring favourable regulatory changes to the cryptocurrency sector, which could streamline adoption and support growth. This political backdrop, coupled with substantial capital inflows from institutional investors, has pushed Bitcoin into a more bullish territory. The recent developments suggest that the market views Bitcoin as more than just a speculative asset; it’s increasingly seen as a long-term hold with substantial upside potential.

2024 Election Forecast

Source: Polymarket

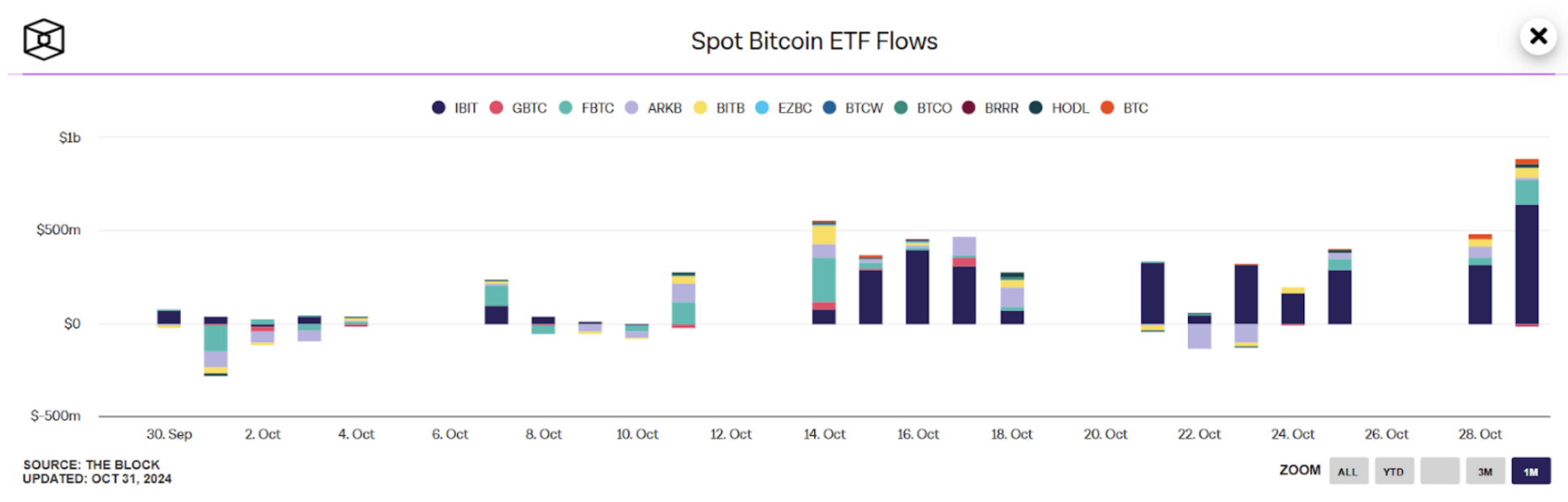

Record-Breaking ETF Inflows Drive Bitcoin Momentum

October has been an unprecedented month for Bitcoin ETFs, with U.S.-based funds seeing record-breaking inflows. Just this past Tuesday, $870 million entered Bitcoin ETFs, marking the third-highest daily inflow on record and demonstrating the mounting interest from traditional finance. BlackRock’s IBIT led the inflows, securing $629 million, which pushed overall ETF trading volumes to their highest levels since March. As a result, U.S. spot ETFs have amassed nearly $4 billion in October, highlighting the enduring appetite among investors who prefer the structured and regulated format of ETFs for crypto exposure. Notably, there has been only one day of outflows, suggesting that investors are holding steady despite market fluctuations. The combination of regulatory support and demand from investors for Bitcoin ETFs is now a driving force behind Bitcoin's price appreciation and could pave the way for even more institutional adoption.

Source: TheBlock

Satoshi Nakamoto’s Rumoured Identity Reveal

The 16th anniversary of Bitcoin’s whitepaper publication on October 31 has reignited public curiosity about its enigmatic creator, Satoshi Nakamoto. A recent press release announced a planned reveal of Satoshi’s identity through a live demonstration, an event that has generated considerable buzz. However, scepticism persists in the crypto community, with many quick to point out the numerous past claims regarding Nakamoto’s identity that turned out to be unsubstantiated. The organisers claim that mounting legal pressures have prompted Satoshi to come forward, but this announcement follows a long list of similar claims, all of which failed to prove legitimate. The question of Nakamoto’s true identity continues to capture public interest, with the mystery adding a unique allure to Bitcoin’s history and cultural significance. Whether true or not, the event is an interesting addition to Bitcoin lore, and any legitimate discovery would likely further cement Bitcoin’s legacy in the digital asset space.

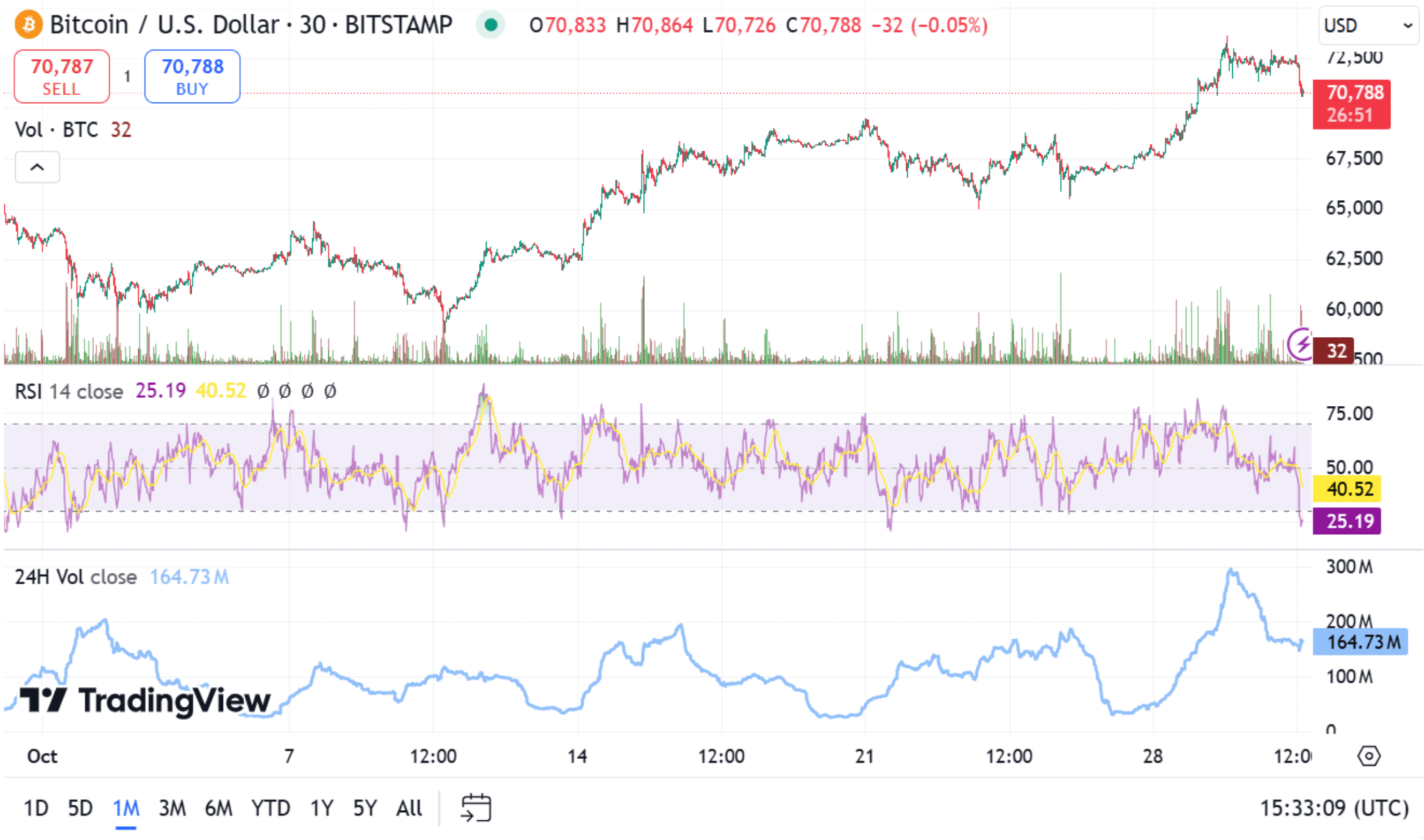

Bitcoin Technical Analysis

Bitcoin’s recent price action has been marked by a strong uptrend tempered by critical support and resistance levels. Currently trading at $70,769, BTC/USD now faces resistance at $73,355, with potential target at $74,857. Immediate support levels are seen at $71,852 and further down at $70,350, with the 50-day Exponential Moving Average (EMA) near $69,110 providing additional downside protection.

Technical indicators reveal a mix of short-term caution and long-term optimism. After the recent dip, Relative Strength Index (RSI) signalling oversold conditions at levels of 25. Bitcoin’s sustained bullish pressure suggests that a consolidation phase may precede further gains. While any drop below $70,000 could lead to a further correction, Bitcoin’s resilience above key levels shows strong potential for continued upward movement as market fundamentals remain favourable.

Source: TradingView

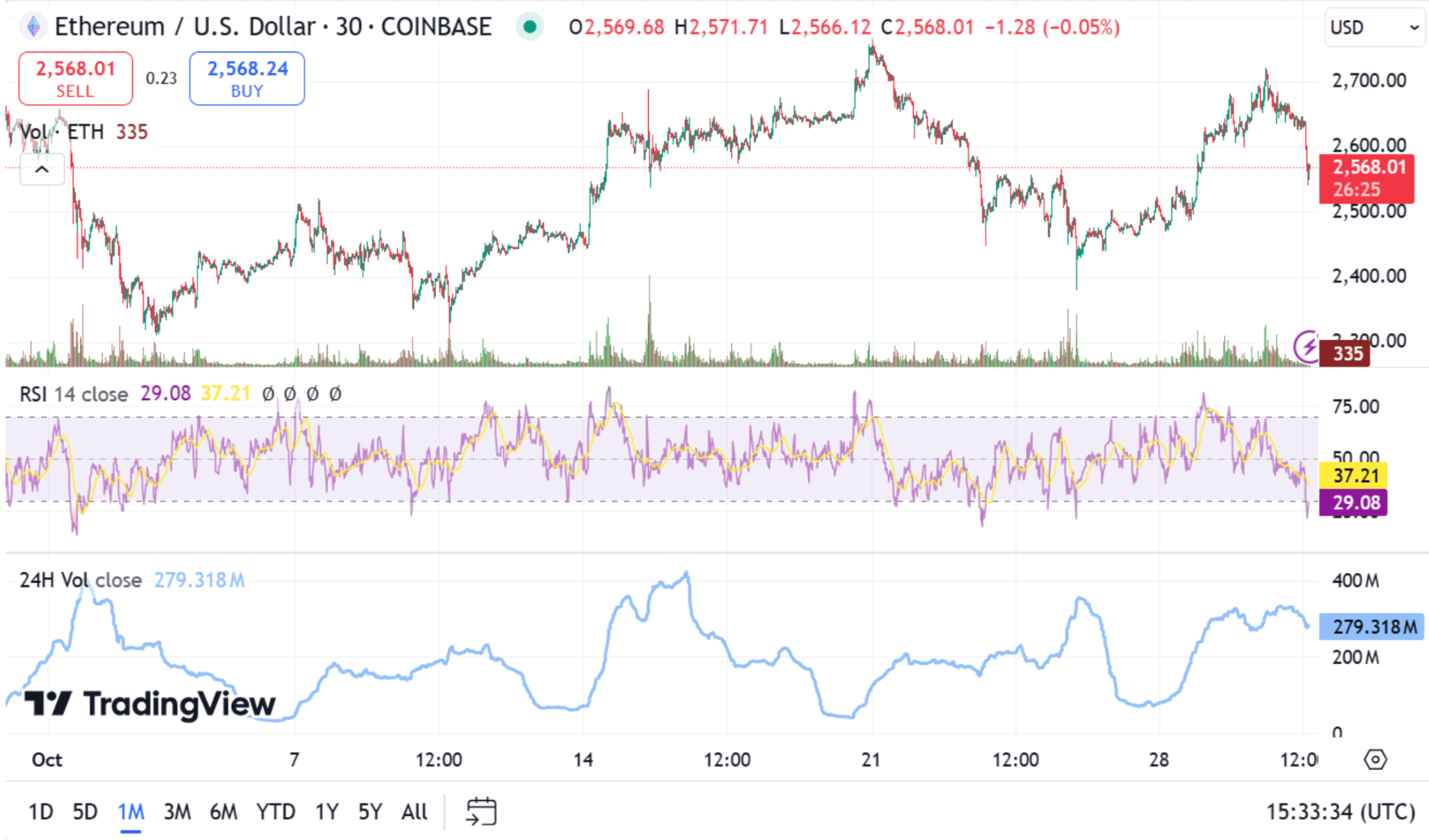

Ethereum Price Analysis

Ethereum is currently navigating a critical phase, testing the support level at $2,500 amidst increasing market volatility. A break below this support could lead ETH to further declines, targeting $2,350, highlighting the importance of stability at this threshold.

However, on a more optimistic note, Ethereum has shown resilience, recently bouncing from a multi-month descending channel’s midline around $2,400. This upward move has brought Ethereum close to the 100-day moving average, where breaking through could signal a fresh bullish trend, potentially targeting $2,900. The ETH futures market funding rates are in positive territory, suggesting an optimistic outlook among traders, though they remain below the highs seen in March, indicating room for growth in bullish sentiment. To reinforce a sustainable uptrend, an increase in funding rates would signal intensified buying interest, potentially helping Ethereum reclaim and hold higher price levels as it aims for a continued rally.

Source: TradingView

Institutional Interest and Global Factors Influencing Bitcoin’s Growth

Institutional interest in Bitcoin has surged, driven by favourable macroeconomic conditions and political factors, including the upcoming U.S. election. This interest is reflected in the record-high holdings of U.S. Bitcoin ETFs, which now stand at an unprecedented $66 billion, underscoring Bitcoin’s growing appeal as an inflation hedge and investment asset. With influential players like BlackRock and Fidelity leading Bitcoin ETF inflows, institutional demand is now double that of retail investors, suggesting an essential shift in the asset’s adoption. Factors such as ongoing Federal Reserve rate cuts and the possibility of a Trump-led administration could continue to support Bitcoin’s price. Given Bitcoin’s historical strength in Q4, especially in post-halving years, many believe it could soon break new all-time highs. This combination of strong institutional support and favourable macroeconomic conditions highlights Bitcoin’s emergence as a stable, long-term financial asset that is increasingly recognized within traditional finance.

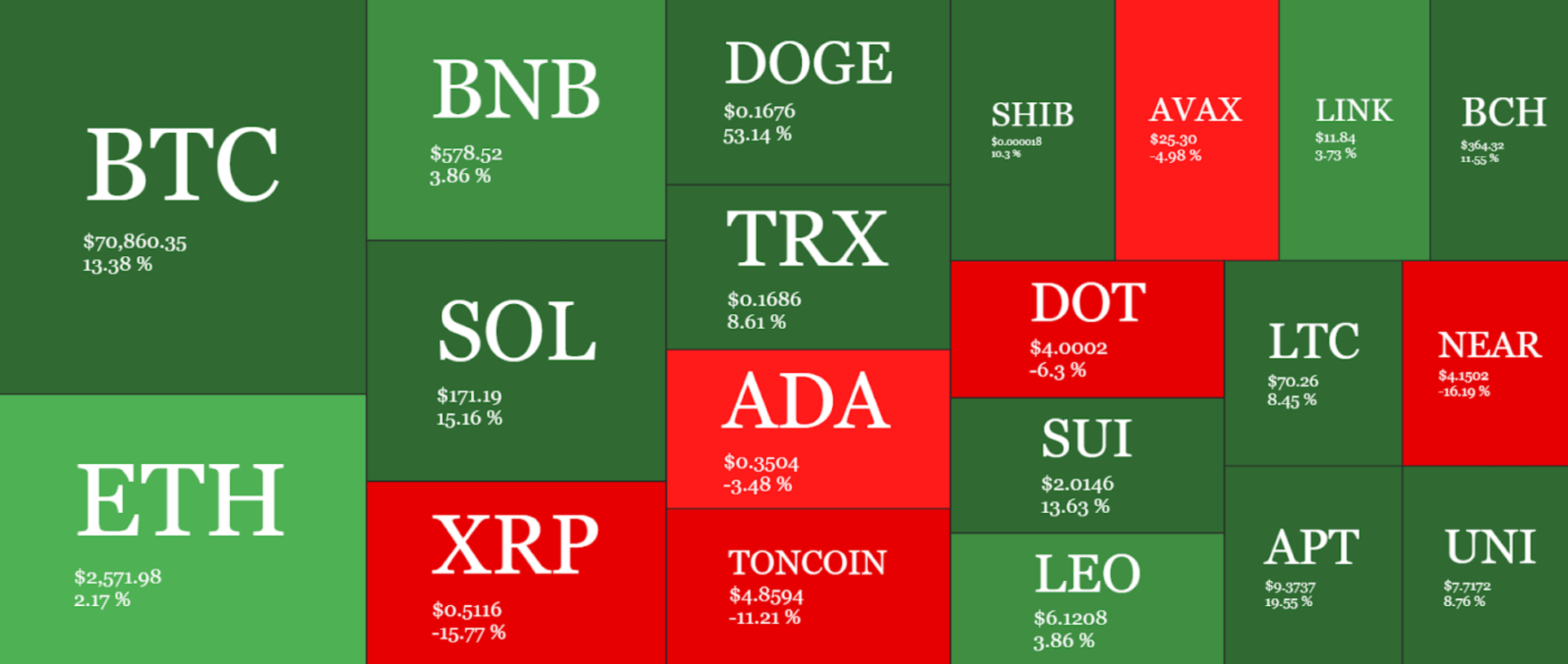

Altcoins in October

October saw a resurgence of interest in altcoins as several notable tokens displayed significant momentum. Coins like Solana (SOL), which was at its highest since the end of July, and Shiba Inu (SHIB), which climbed to its strongest position in over a month, captured investor attention. SHIB’s growth was driven partly by the rising activity on its Shibarium layer-2 network, which saw a 13,500% increase in daily transactions, marking a new phase of utility for the token beyond its meme origins.

Other altcoins like SUI and DOGE also showed resilience, while Polygon (MATIC) benefited from increased institutional interest due to its scalability solutions. This altcoin rally underscores growing diversification in the crypto space, as investors seek options beyond Bitcoin in anticipation of broader adoption and unique project use cases.

October Heatmap

Source: QuantifyCrypto

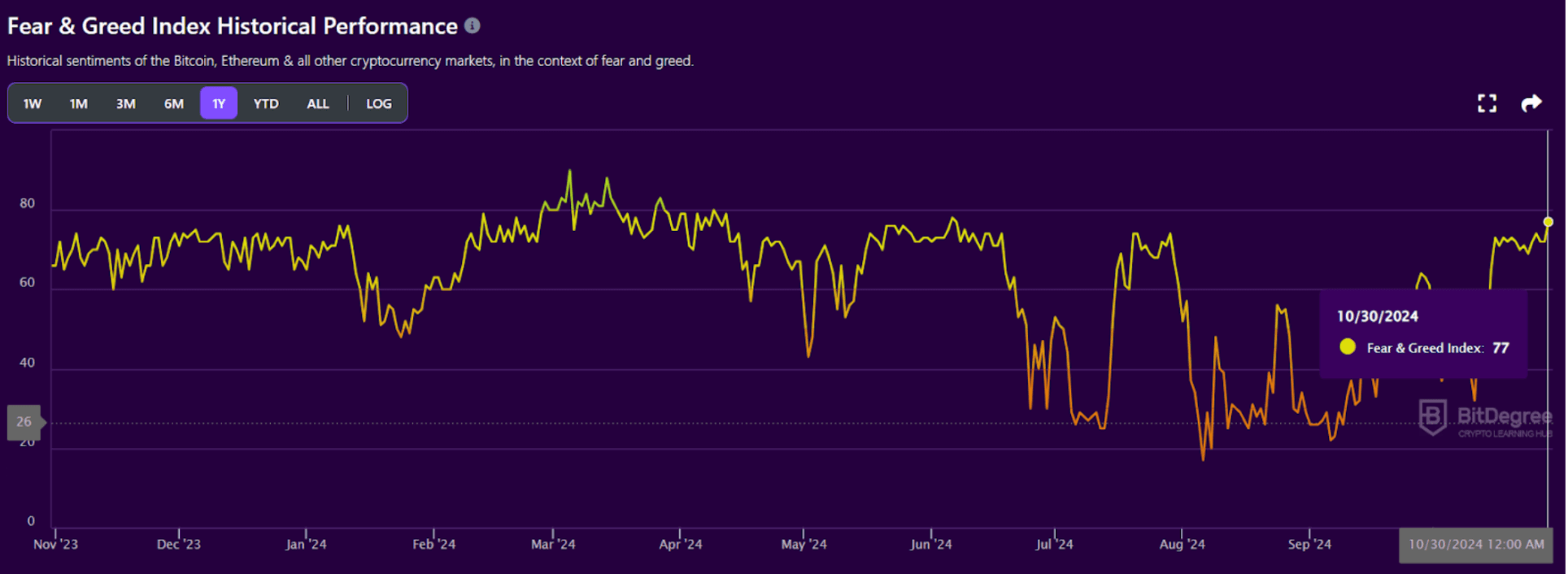

Additionally, the Fear and Greed Index for crypto reached 77, signalling strong market optimism. Extreme greed may indicate an overbought market, where prices are high, signalling a possible time to sell or take profits. Traders can combine the index with other technical indicators to confirm trends, using it as a guide to manage risk and avoid emotional trading decisions based on short-term market sentiment.

Source: BitDegree