November in Review: Key Developments in the Crypto Market

November's Crypto Market Surge

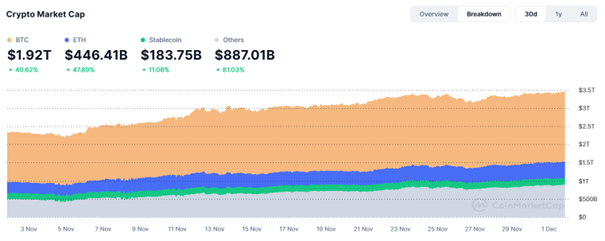

The cryptocurrency market experienced a remarkable surge in November, characterized by substantial growth, increased trading volumes, and heightened investor activity. Bitcoin (BTC) continued its upward trajectory, nearing the $100,000 milestone, while Ethereum (ETH) and Solana (SOL) demonstrated robust performance, reinforcing their significance within the ecosystem.

Altcoins, including XRP and Cardano (ADA), participated in the bullish rally, driven by favorable regulatory developments, expanding use cases in decentralized finance (DeFi), and real-world asset tokenization.

Source: QuantifyCrypto

Smaller, innovative tokens, such as meme coins on the SUI blockchain, also saw impressive gains, with a 30% increase in market capitalization reflecting the narrative-driven enthusiasm among investors. The total market capitalization surged significantly, underscoring growing confidence in the market and interest from institutional players through developments like ETF launches.

This November rally not only highlights the diversification of assets but also reflects the resilience and maturing landscape of the crypto ecosystem as it continues to capture mainstream and institutional relevance on a global scale.

Source: Coinmarketcap

Bitcoin's Climb Toward $100,000

Bitcoin remains the focal point of the cryptocurrency market, maintaining strong momentum despite a 3.37% pullback over the past week. Trading at $97,200, BTC continues to push against key resistance levels near the $100,000 psychological barrier, a milestone anticipated to bring heightened market activity.

Analysts suggest that Bitcoin's current trajectory aligns with historical Fibonacci channels, which have historically predicted long-term price peaks and trends. These channels indicate the possibility of BTC reaching $150,000 by mid-2025, reflecting the bullish sentiment permeating the market.

With increasing institutional adoption, favorable regulatory signals, and growing trust in Bitcoin as a store of value, its long-term outlook remains overwhelmingly positive.

Bitcoin Technical Analysis: Steady Growth Amid Resistance

Bitcoin's technical outlook points to a phase of consolidation as the market anticipates its next decisive move. Currently trading at $97,188, BTC is testing significant resistance levels at $99,855, $101,150, and $102,382, which will be key to watch for a potential breakout. On the downside, support levels at $97,766 and $94,646 provide a safety net, buffering against potential pullbacks and maintaining market stability.

The Relative Strength Index (RSI) at 52.88 reflects a neutral market sentiment, signaling balanced buying and selling pressures, and leaving the door open for either upward or downward price action. The Moving Average Convergence Divergence (MACD) indicator remains flat, highlighting a momentary pause in momentum.

Despite the current consolidation, the overarching bullish trend and historical price behavior suggest Bitcoin could soon challenge and surpass the $100,000 psychological barrier, potentially paving the way for sustained growth into 2025.

Source: TradingView

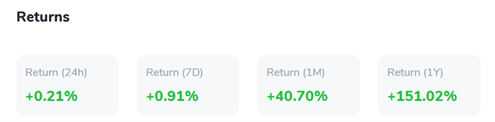

Altcoin Rally: Solana and Cardano Shine

Altcoins experienced substantial gains in November, with Solana (SOL) and Cardano (ADA) outperforming many peers. Solana surged by over 42%, buoyed by record trading volumes on decentralized exchanges (DEXs) and its ability to handle high transaction throughput at minimal cost. These factors highlight Solana’s scalability and growing ecosystem, making it a favored platform for developers and traders alike.

Source: TradingView

Cardano, on the other hand, saw its price rise to $1.08, with 88% of its circulating supply now in profit, reflecting robust market momentum. Analysts believe that if ADA holders resist the temptation to sell, the coin could surpass $1.15 and maintain its bullish trajectory, solidifying its position as a leading blockchain for innovation and financial inclusion.

Source: TradingView

Source: TradingView

XRP’s Continued Momentum

XRP has been on an impressive run, recently reaching a multi-year high of $2.3 amid strong investor confidence and institutional interest. Ripple's developments, including the tokenization of real-world assets and partnerships with financial institutions, have positioned XRP as a key player in the evolving digital payments landscape. Its resilience and bullish performance reflect its growing role in transforming cross-border transactions by offering faster, low-cost alternatives to traditional payment systems.

This has significant implications for global finance, as XRP's adoption continues to grow among banks and payment providers, particularly in regions with inefficient or costly banking infrastructures.

Source: TradingView

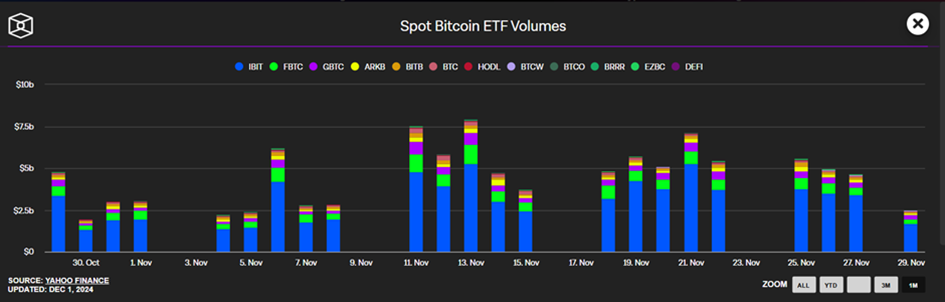

Spot Bitcoin and Ether ETFs Make Waves

November marked a significant milestone in the adoption of crypto-focused investment vehicles, with Bitcoin and Ether spot ETFs recording massive inflows. Bitcoin ETFs surpassed $102 billion in cumulative market capitalization, reflecting strong demand from retail and institutional investors.

Meanwhile, Ether ETFs achieved a record daily inflow of $332.9 million on November 29, signaling growing interest in Ethereum's potential beyond Bitcoin. BlackRock led the charge with its iShares Ethereum Trust (ETHA), contributing $250.4 million in a single day and helping Ether ETFs outperform Bitcoin ETFs for the first time.

These developments underline the growing role of ETFs in bridging traditional finance and the crypto market, offering investors a regulated pathway to gain exposure to digital assets.

Source: TheBlock

Regulatory Changes and Their Impact on Crypto

The regulatory landscape for cryptocurrencies underwent significant shifts in November, creating a more optimistic environment for digital asset adoption. The announcement of SEC Chair Gary Gensler’s resignation, set to coincide with President-elect Donald Trump’s inauguration, has fueled speculation about a more crypto-friendly regulatory framework. Trump’s pro-crypto stance and promises to reduce regulatory burdens on digital assets have raised hopes for clear and supportive guidelines in the United States.

Analysts anticipate the new administration may prioritize crypto-friendly policies, including stablecoin legislation and simplified registration processes for crypto companies. These changes could attract more institutional participation, fostering innovation while addressing longstanding concerns around compliance and security. As the regulatory framework evolves, the crypto market stands to benefit from increased investor confidence and broader mainstream adoption.

Vancouver’s Bitcoin-Friendly Plans

Vancouver is positioning itself as a Bitcoin-friendly city, with Mayor Ken Sim introducing a motion to include Bitcoin in the city’s investment portfolio. This initiative aims to modernize the city’s financial framework while leveraging Bitcoin’s potential as a strategic asset to preserve purchasing power amidst economic volatility.

By diversifying the city’s financial holdings with Bitcoin, Vancouver seeks to align itself with the global shift toward decentralized finance, potentially setting an example for other municipalities to adopt blockchain-based strategies for economic growth and stability. If approved, this move could enhance the city’s reputation as a hub for technological innovation and financial modernization.

Vancouver Mayor Ken Sim

Source: GlobalBC

Market Outlook: Momentum and Potential Challenges

As we approach the end of 2024, the cryptocurrency market is poised for further growth, driven by a combination of bullish sentiment, increasing adoption, and favorable macroeconomic conditions.

While Bitcoin continues to lead the rally, altcoins like Ethereum, Solana, and Cardano are carving out significant niches in DeFi, real-world asset tokenization, and smart contract functionality. However, challenges such as market volatility, profit-taking by investors, and external economic pressures remain potential roadblocks.

Regulatory clarity and institutional participation will play crucial roles in shaping the market's trajectory, making this an exciting yet unpredictable phase for crypto enthusiasts. Investors are advised to monitor key resistance and support levels while keeping an eye on macro trends that could influence the next major market move.

Source: Coinmarketcap