Chainlink (LINK) Price Analysis: Market Trends and Future Outlook

Chainlink’s Market Performance in Early 2025

Chainlink (LINK) concluded 2024 with strong momentum, reaching a peak of $30.94 in December before experiencing a significant 40% correction. Despite the drop, bullish patterns emerged in January 2025, suggesting a potential reversal. LINK’s breakout from a descending wedge pattern—a bullish technical indicator—suggests that it could be on track for further gains. If LINK maintains upward momentum, it could test the $37.11–$38.52 range, with a more optimistic target of $49–$51.36 should the rally continue. However, market conditions remain uncertain, with LINK experiencing fluctuations based on macroeconomic trends.

Key Partnerships and Ecosystem Growth

Beyond technical indicators, Chainlink’s ongoing strategic partnerships and ecosystem expansions continue to bolster its position. A key development includes its collaboration with BX Digital and BX Swiss, two prominent branches of a top European exchange, to bring on-chain pricing data for Swiss-based equities. Additionally, Chainlink has onboarded 12 new projects into its blockchain protocols, reinforcing its influence in the DeFi and smart contract industries. These integrations help establish Chainlink as a core infrastructure provider for decentralized finance, ensuring long-term utility and adoption.

Source: Chain.link

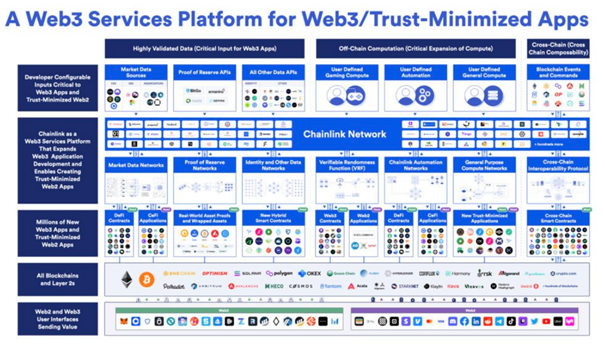

Chainlink’s Expanding Role in Web3

While short-term price fluctuations persist, Chainlink’s role in Web3 infrastructure remains critical. The network has been expanding integrations with major blockchain projects, including Bitlayer, the first Bitcoin Layer-2 solution on the Lightning Network. This integration enhances secure cross-chain communication, strengthening Chainlink’s Cross-Chain Interoperability Protocol (CCIP). Additionally, Chainlink has partnered with Scroll mainnet to provide real-time oracle services at reduced costs. These advancements position Chainlink as a cornerstone of the Web3 revolution, helping secure and verify data for decentralized applications.

Source: blog.chain.link

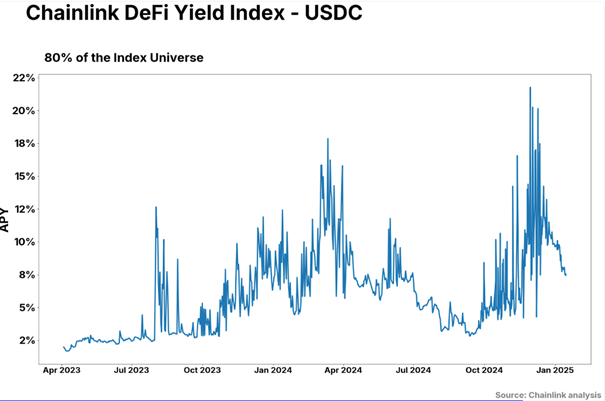

Chainlink’s Move Toward Becoming a Benchmark Index Provider

As the largest blockchain oracle provider, Chainlink is also positioning itself as a leading index provider for the cryptocurrency industry. It launched the DeFi Yield Index (CDY Index), which offers real-time lending rate data from decentralized finance platforms. This initiative highlights Chainlink’s ambition to standardize financial data for both institutional and retail investors. According to industry reports, the crypto index market could generate significant revenue, mirroring traditional finance indices such as the Nasdaq Crypto Index and the CoinDesk Market Index. Chainlink’s CDY Index aims to fill a crucial gap by providing transparent and verifiable financial benchmarks for the DeFi space.

Source: blog.chain.link

Chainlink’s Technical Analysis and Market Trends

Chainlink (LINK) has been facing heightened volatility, with its price currently sitting at $19.68, reflecting a 0.25% decline in the past 24 hours. The recent downturn follows a broader market correction, though LINK remains above critical support levels.

Key Support and Resistance Levels

Support Levels: $19.00, with stronger support near $18.00 if selling pressure increases.

Resistance Levels: $20.50–$22.00, with a major hurdle at $23.65 if bulls regain control.

Technical Indicators and Market Sentiment

Several technical indicators provide insights into LINK’s current trajectory:

RSI (Relative Strength Index): At 51.07, LINK is hovering in neutral territory, suggesting a lack of strong momentum in either direction.

Moving Averages: LINK is trading below the 20-day and 50-day SMAs, indicating a bearish trend. A decisive move past $22.00 would be needed to regain bullish momentum.

Volume Trends: 24-hour trading volume is at 72.78 million, showing a decline in liquidity, which could lead to continued price swings.

Future Outlook

If LINK manages to break past $22.00, it could aim for $25.00–$26.00 in the short term. However, failure to hold $19.00 could trigger a drop toward $18.00, with further downside risk toward the $15.56 support zone. Traders should watch for confirmation signals before entering positions.

Source: TradingView

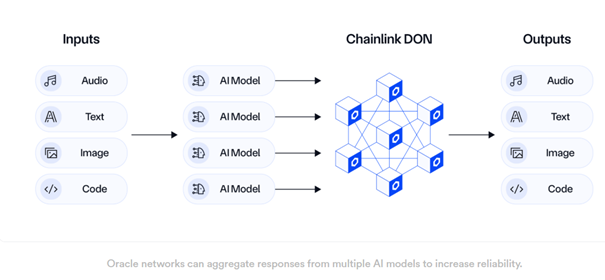

Chainlink’s AI and Blockchain Innovations

Chainlink continues to evolve by integrating artificial intelligence (AI) with decentralized oracles. Its new AI-powered machine learning algorithms enhance data accuracy, fraud detection, and automated contract execution. Chainlink has also secured key partnerships with Google Cloud and SWIFT, strengthening its role as a leader in AI-powered blockchain solutions. As blockchain applications become increasingly reliant on real-time data, Chainlink’s AI-enhanced infrastructure will likely play a crucial role in shaping the future of decentralized networks.

Source: blog.chain.link

Conclusion: Chainlink’s Outlook for 2025

Despite recent volatility, Chainlink remains one of the most influential blockchain projects in the crypto space. Its ability to provide real-time financial data, power Web3 applications, and facilitate secure cross-chain communication ensures its long-term viability. If market sentiment improves and technical resistance levels are broken, LINK could reclaim higher price ranges. However, investors should remain cautious, watching for confirmation signals before entering new positions.