January in Review: Key Developments in the Crypto Market

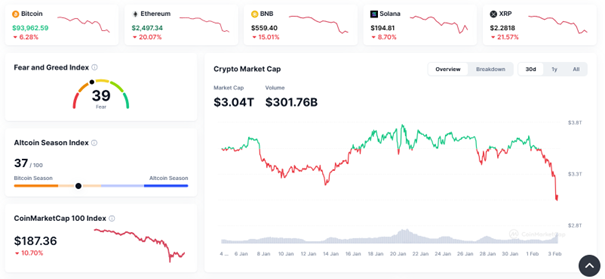

The first month of 2025 has been a rollercoaster ride for the cryptocurrency market, featuring significant price fluctuations, regulatory shifts, and major industry developments. From Bitcoin’s record-breaking monthly close to XRP’s highest-ever closing price, January was packed with crucial events that shaped the crypto landscape.

However, not all assets fared well. According to the latest heatmap, Ethereum (ETH) dropped by a staggering 17.74%, reflecting investor uncertainty despite bullish narratives around its long-term potential. Dogecoin (DOGE) saw a sharp 26.46% decline, potentially due to profit-taking following the excitement around Musk’s government-backed DOGE project. Meanwhile, Cardano (ADA) and Avalanche (AVAX) plummeted by 25.72% and 32.45%, respectively, suffering some of the most significant losses among major altcoins.

Other notable declines include Shiba Inu (SHIB) falling by 34.15% and Polkadot (DOT) dropping 33.8%.

Monthly Heatmaps

Source: QuantifyCrypto

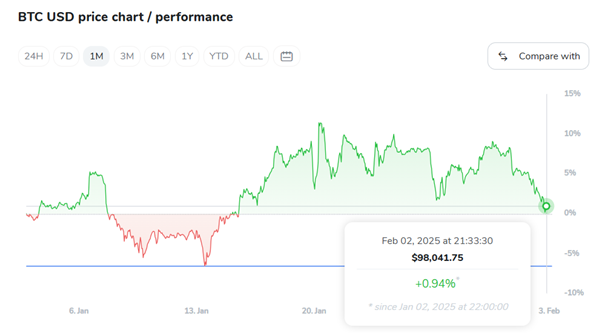

Bitcoin Struggles to Maintain $100K Amid Market Fluctuations

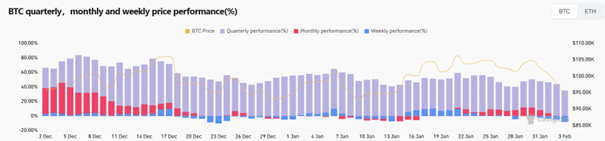

Bitcoin (BTC) experienced significant volatility throughout January but ultimately closed the month near its opening price. As seen in the chart, BTC started the month around $98,000, dipped below $90,000 mid-month, and later recovered, surpassing $100,000 at certain points. However, despite several rallies, Bitcoin failed to sustain levels well above $100,000 and ultimately closed at $98,041.75 on February 2, representing only a 0.94% increase since the start of January.

The market’s ups and downs were driven by various macroeconomic events, including the Federal Reserve’s decision to hold interest rates steady, which initially triggered a BTC dip before a quick rebound. Additionally, institutional demand and ETF inflows provided moments of strength, but profit-taking and broader economic concerns kept Bitcoin from making a definitive breakout. While Bitcoin remains in a bullish long-term trend, its inability to sustain new all-time highs above $109,000 suggests market caution going into February.

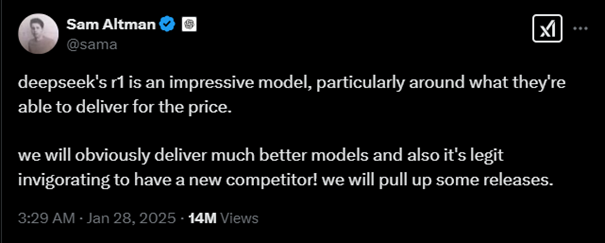

DeepSeek’s AI Revolution and its Impact on Crypto Markets

One of the most unexpected market-shaking events of January was the emergence of DeepSeek, a Chinese AI company that launched its R1 model. The announcement sent shockwaves through global tech stocks, causing Nvidia’s shares to plummet by 17%, marking one of the largest single-day losses in its history.

Crypto markets weren’t spared either. Bitcoin dropped by several thousand dollars within hours, dipping below $98,000 before rebounding. Altcoins mirrored Bitcoin’s movements, experiencing sharp corrections followed by recoveries. DeepSeek’s model challenges the long-held dominance of AI companies that require expensive high-powered GPUs, potentially disrupting AI-based cryptocurrencies that rely on Nvidia’s hardware. Despite the turmoil, DeepSeek’s breakthrough could lead to long-term innovation in both AI and blockchain sectors.

Source: X

XRP Records Highest Monthly Closing in History

XRP investors had reason to celebrate in January as the asset recorded its highest-ever monthly closing price of $3.0359. This milestone came after XRP briefly surged to $3.39 on January 16, coming close to its 2018 all-time high (ATH). However, market sentiment has shifted dramatically, with XRP plummeting -20.59% in the last 24 hours, now trading at $2.68.

The sharp decline follows a broader market pullback, with profit-taking and declining active wallet addresses contributing to the downturn. While bullish sentiment had been fueled by SEC Chair Gary Gensler’s resignation and expectations of a more crypto-friendly Trump administration, XRP’s price action suggests a period of consolidation.

Additionally, XRP’s integration into institutional finance through the Ripple-USD (RLUSD) stablecoin continues to support its long-term utility. However, analysts remain divided on the asset’s next move. Some predict a potential breakout to $4.60, citing long-term adoption trends, while others warn that if selling pressure persists, a further correction toward $2.20 could be imminent. The coming days will be crucial in determining whether XRP can stabilize or if the downtrend will deepen.

Source: TradingView

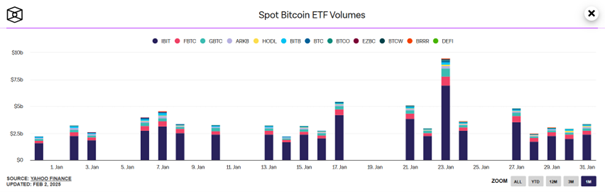

Crypto ETFs Gain Momentum Amid Regulatory Approvals

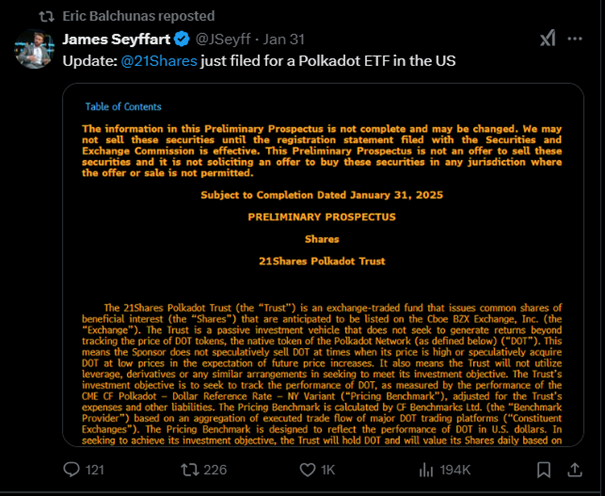

January also saw a surge in crypto ETF filings and approvals. The SEC granted initial approval to NYSE Arca to list and trade Bitwise’s hybrid Bitcoin and Ether ETF, a significant milestone in the industry. Other filings, including those for Litecoin (LTC) and Polkadot (DOT) ETFs, signal increasing institutional interest in alternative digital assets.

Source: TheBlock

Market analysts believe that the new U.S. administration’s positive stance on crypto will accelerate ETF approvals. With institutional demand rising, these ETFs are expected to play a crucial role in broadening cryptocurrency adoption in traditional finance.

Source: X

Bitcoin Technical Analysis: Resistance and Support Levels

Bitcoin is currently trading at $97,768, experiencing a downward trend after failing to sustain momentum above the $100,000 mark. The latest market data shows increased volatility, with BTC hitting an intraday low of $97,727 and a high of $97,915.

Key Resistance and Support Levels

Resistance: The first resistance zone stands at $100,000, with further obstacles at $104,000–$105,000. A breakout above these levels could push BTC toward $109,000, the previous all-time high (ATH).

Support: The immediate support levels lie between $97,500–$98,000. If Bitcoin breaks below this, the next critical zone to watch is $95,000.

Source: TradingView

Indicators & Market Sentiment

RSI (Relative Strength Index): Currently at 56.89, signaling that Bitcoin is in a neutral zone but approaching overbought conditions. Short-term corrections could follow.

MACD (Moving Average Convergence Divergence): The chart suggests a bearish crossover, meaning downward pressure may persist in the near term.

24H Trading Volume: 837.91 million, showing a slight increase, indicating renewed market activity but not yet confirming a bullish reversal.

Outlook

If Bitcoin successfully reclaims the $100,000 level and holds above it, we could see another attempt at $104,000–$105,000. However, failure to stay above $97,500 could increase selling pressure, driving BTC toward $95,000 or lower. Institutional demand through ETF inflows remains a key factor to watch, as it has played a crucial role in keeping BTC’s price relatively stable despite broader market fluctuations.

What’s Next for Crypto in February?

Historically, February has been a strong month for Bitcoin, with positive returns in 10 of the past 12 years. Market analysts predict continued bullish momentum, especially as Trump’s administration explores adding Bitcoin to U.S. reserves. Institutional interest remains high, with more ETF products expected to launch in the coming months.

Source: CoinMarketCap

For XRP, analysts anticipate a potential breakout if bullish momentum persists. Ethereum’s underperformance relative to Bitcoin has raised concerns, but long-term fundamentals remain strong, with ETH’s transition to proof-of-stake attracting institutional investors.

Altcoins like Solana, Polkadot and Litecoin could see increased volatility as ETF filings progress. Meanwhile, AI-related crypto tokens may face continued uncertainty as DeepSeek reshapes the AI landscape.

Source: CoinGlass

Conclusion: A Historic Start to 2025

January 2025 was anything but quiet for crypto markets. From Bitcoin’s six-digit milestone to XRP’s record monthly close and groundbreaking developments in AI, the industry has entered the year with unprecedented momentum.

As February unfolds, traders and investors will be watching key resistance levels, ETF approvals, and macroeconomic trends for signals on the next big move in the digital asset space. One thing is certain—2025 is shaping up to be a defining year for cryptocurrency adoption and regulation.