February in Review: Key Developments in the Crypto Market

February Crypto Market Overview: Volatility, Losses, and Key Developments

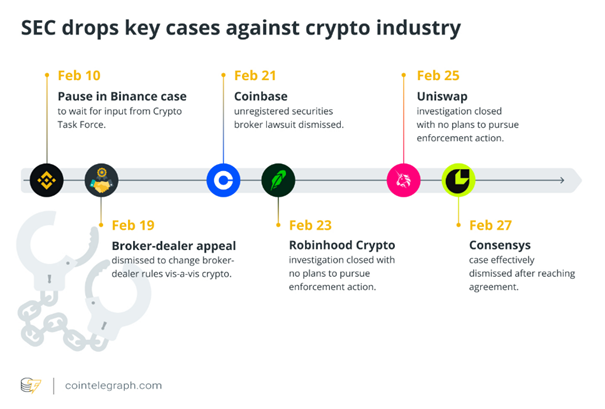

February was a pivotal month for crypto, marked by regulatory shifts, Bitcoin decentralization, and security concerns. The SEC dropped six major cases, including those against Coinbase and Uniswap, signaling a more crypto-friendly stance with its new Crypto Task Force. Meanwhile, Bitcoin’s decentralization strengthened, with China’s hashrate share dropping to 14%, and 70% of BTC now owned by individuals.

Five U.S. states rejected Bitcoin reserve legislation despite growing institutional interest, even as Trump pushed for a national crypto reserve. Security risks dominated headlines with the largest crypto hack in history, as North Korea’s Lazarus group stole $1.4 billion in ETH from Bybit, surpassing all 2024 hacks combined.

Additionally, meme coin mania cooled, with daily issuances on Solana dropping to 40,000—the lowest since December. Political-themed meme coins tied to Trump and Melania lost traction, and concerns over their speculative nature increased after a trader’s tragic live-streamed suicide on Feb. 22. In response, the SEC launched a unit to monitor meme coins and emerging tech.

Despite challenges, February saw positive strides in regulation and Bitcoin adoption, setting the stage for evolving market trends and potential policy shifts in the coming months.

Source: CoinTelegraph

Bitcoin ETF Inflows Resume After Streak of Outflows

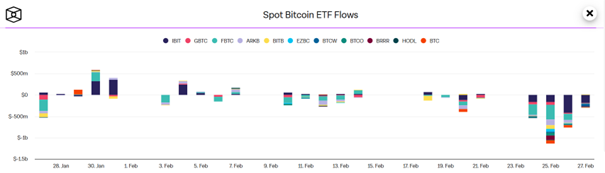

After eight consecutive days of outflows, spot Bitcoin ETFs recorded a net inflow of $94.34 million on February 28, marking a potential shift in sentiment. This follows a period of heavy capital exits, including a staggering $754.53 million outflow on February 26—one of the largest since Bitcoin ETFs were approved.

Key ETF Developments

The total net inflows across all spot Bitcoin ETFs now stand at $36.94 billion, with total net assets reaching $95.38 billion.

Fidelity’s FBTC led the recovery, adding $176.03 million, followed by Ark Invest’s ARKB, which added $193.70 million.

BlackRock’s IBIT, however, suffered a net outflow of $244.56 million, while Grayscale’s GBTC saw another $33.28 million in exits.

Despite the recent inflows, market analysts caution that a sustained trend of positive ETF flows is needed to confirm a full bullish reversal. The Crypto Fear & Greed Index, which fell to “Extreme Fear” at a score of 10, suggests that sentiment remains fragile.

Source: TheBlock

BlackRock’s Institutional Bitcoin Integration: A Long-Term Bullish Signal?

Despite ETF outflows and price volatility, BlackRock made a significant move by integrating Bitcoin ETFs into its $150 billion model portfolios. This marks a shift in institutional investment strategies, as the firm now allows 1%–2% BTC exposure in diversified asset portfolios.

Why This Matters:

Institutional investors rely on model portfolios, meaning even a small BTC allocation could drive billions in inflows over time.

BlackRock’s decision follows growing demand for alternative assets amid concerns over traditional market stability.

The firm emphasizes Bitcoin’s role in portfolio diversification, noting that exceeding 2% exposure would significantly increase volatility risk.

This move validates Bitcoin as an investable asset class and could pave the way for other financial giants to follow suit, potentially leading to long-term price appreciation.

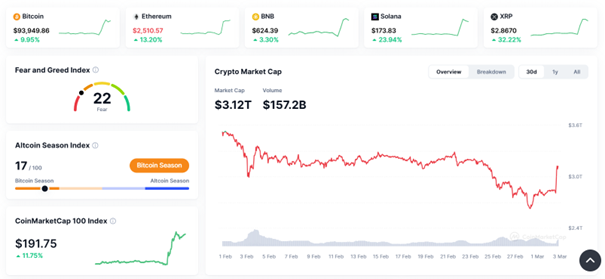

Bitcoin Price Action: A Recovery in Sight?

Bitcoin ended its downward streak with a 10% surge, triggered by Trump’s announcement of a Crypto Summit on March 7. The news fueled hopes for regulatory clarity and potentially favourable policies toward digital assets. However, macroeconomic concerns still loom.

Factors Influencing Bitcoin’s Price

Trade Tensions: Trump reaffirmed tariffs on Mexico, Canada, and China, strengthening the U.S. dollar and making risk assets like Bitcoin more volatile.

Inflation & Fed Policy: The latest Personal Consumption Expenditures (PCE) report showed inflation at 2.5% annually, lowering expectations of near-term rate cuts by the Federal Reserve.

ETF Flows: Recent inflows suggest that institutional interest remains intact, but further sustained demand is required to confirm a bullish breakout.

Source: CoinMarketCap

Bitcoin Technical Outlook: Key Levels to Watch in March

Bitcoin (BTC) is currently trading at $94,173, showing an impressive gain after rebounding from recent lows near $80,000. The 30-minute chart indicates BTC has broken past key resistance levels and is now testing the next resistance zone.

Technical Analysis Summary

Resistance Levels: Immediate resistance is around $95,000, with the next key level at $98,500.

Support Levels: The $90,000 zone now acts as support, while a break below could see BTC retest $85,000.

Market Indicators: The RSI (Relative Strength Index) is at 80.13, indicating overbought conditions, which could lead to short-term corrections.

Trading Volume: 24-hour volume stands at 280M, reflecting strong buying pressure driving BTC’s recent surge.

With BTC’s RSI signalling potential overextension, a brief consolidation or pullback is likely before the next leg up. If Bitcoin clears $95,000, it could open the path toward $100,000, while failure to hold momentum might lead to a retest of lower support zones.

Source: TradingView

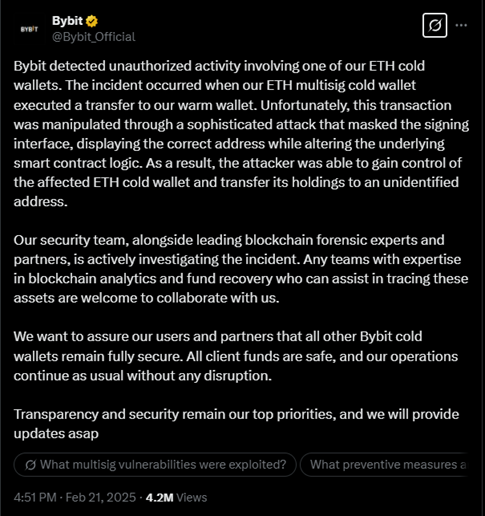

Bybit’s $1.5B Hack Raises Security Concerns in Crypto Industry

February saw a major security breach, with Bybit suffering a $1.5 billion hack, making it one of the largest hacks in crypto history. Unlike previous exploits that targeted DeFi protocols, this attack was linked to vulnerabilities in Safe Wallet infrastructure rather than Bybit’s internal systems.

Key Takeaways from the Hack

The breach exposed security flaws in centralized platforms, sparking debates at ETHDenver over crypto security standards.

Industry experts criticized centralized key management, calling for better security protocols, decentralized storage, and tamper-proof data solutions.

Analysts suggested that improved multi-signature authentication and offline (air-gapped) systems could have prevented such a massive loss.

This incident has renewed calls for decentralized security models, reinforcing the need for greater transparency and better custodial practices in exchanges.

Ethereum Monthly Overview and Technical Analysis

Ethereum (ETH) has experienced a notable decline over the past month, dropping from levels above $2,800 to its current price of $2,225.20. The price action suggests that ETH has been in a consistent downtrend, though recent consolidation indicates a possible attempt at recovery.

The Relative Strength Index (RSI) sits at 54.84, reflecting neutral momentum, meaning neither overbought nor oversold conditions are present. Trading volume remains subdued at 167.81M, suggesting that strong buying pressure is yet to emerge.

Key resistance lies near $2,400, while support is around $2,100—a breakdown below this level could signal further downside risk. To confirm a reversal, ETH must break above the $2,400–$2,500 zone, which could pave the way for a move toward $2,700 or higher.

Until then, traders should watch for a potential range-bound movement between $2,100 and $2,400 in the coming weeks.

Source: TradingView

Conclusion: What’s Next for Crypto?

February highlighted the crypto market’s resilience amid macroeconomic challenges, with Bitcoin ETFs seeing record outflows and fresh inflows, security concerns resurfacing, and institutional investors doubling down on Bitcoin exposure.

While Bitcoin’s recent rally is promising, broader market uncertainties—including trade wars, inflation, and regulatory shifts—could continue to drive volatility. As the industry enters March, investors will closely watch Trump’s Crypto Summit, the Fed’s next moves, and whether BTC can sustain its current upward momentum.

For now, Bitcoin remains in a critical price range, and whether bullish momentum sustains or fades will depend on continued institutional support, ETF inflows, and macroeconomic developments in the weeks ahead.