Dogecoin (DOGE): Surge Amid Launch of Government Website

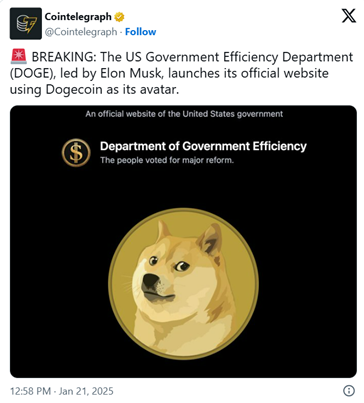

Dogecoin (DOGE) made headlines this week, witnessing a remarkable 13% surge in just 15 minutes. This price movement was sparked by the launch of the official website for the newly created Department of Government Efficiency (DOGE), unveiled by the Trump administration. The website, featuring Dogecoin’s logo, generated significant excitement within the Dogecoin community and the broader cryptocurrency market.

The Department of Government Efficiency, led by Tesla CEO Elon Musk, aims to streamline federal operations, cut excessive spending, and modernise technology. The prominent display of the Dogecoin logo on the website acted as a catalyst for DOGE’s sudden price spike, driving the token’s value up to $0.40 after hitting an intraday low of $0.33. This rapid recovery highlights the significant influence of public announcements and branding on Dogecoin’s market performance.

Source: X

DOGE USD Breaks Out of Downtrend

Dogecoin’s recent breakout above its downward trendline marks a notable turning point in its short-term price action. On January 15, DOGE reached a low of $0.33 before rebounding strongly, breaking out of its consolidation phase. The price climbed to a high of $0.40 and currently consolidates above the 50-day Simple Moving Average (SMA) at $0.36.

Analysts suggest that a sustained break above $0.434 could pave the way for Dogecoin to challenge the $0.48 resistance level. Beyond this, DOGE could target $0.59 if bullish momentum persists. However, if DOGE fails to maintain its support above the daily SMA 50, it risks falling to $0.31 or lower, with $0.27 serving as the next critical support level.

Elon Musk’s Endorsement and DOGE’s Rising Popularity

Elon Musk’s involvement continues to play a pivotal role in Dogecoin’s popularity and market dynamics. As the head of the Department of Government Efficiency, Musk’s influence has boosted the meme-inspired cryptocurrency. The department’s name, coinciding with Dogecoin’s ticker symbol, adds to the perception of Musk’s endorsement.

Musk has long been a vocal supporter of Dogecoin, frequently referencing it in social media posts and public appearances. Investors and analysts speculate that Musk’s connection to DOGE could lead to further integration of the cryptocurrency into his ventures, such as X (formerly Twitter). This potential use case could significantly enhance Dogecoin’s value proposition.

Source: X

DOGE Whale Transactions and Network Activity

Dogecoin’s network activity has seen a significant uptick, with whale transactions exceeding $1 million surging in recent days. Crypto analysts reported 588 large transactions within 24 hours, reflecting heightened interest among major holders.

One notable transaction involved 400 million DOGE worth $137.7 million being transferred to Binance. Such large-scale movements typically indicate strategic actions, such as accumulation or fund reshuffling, by institutional investors. This increase in whale activity highlights the growing confidence in Dogecoin’s potential amid its recent price recovery.

Source: CoinMarketCap

Technical Analysis: DOGEUSD Charts Point to Bullish Continuation

Dogecoin’s technical indicators reveal a mix of bullish momentum and cautionary signals. The DOGEUSD pair broke out of its downtrend, marking a key reversal point in its price action. The Relative Strength Index (RSI) currently hovers near 32, suggesting moderately bearish conditions without entering oversold territory.

The Awesome Oscillator (AO) and Moving Average Convergence Divergence (MACD) indicate upward momentum, reinforcing the potential for further gains. Key resistance levels lie at $0.434 and $0.48, with $0.59 as the next target if bullish momentum persists. On the downside, support is firmly established at $0.357, with $0.31 and $0.27 serving as critical fallback levels in case of a bearish reversal.

Traders are advised to watch for a daily close above $0.434 to confirm a continuation of the uptrend. Conversely, a failure to hold above the SMA 50 could signal a retracement toward lower support levels. Overall, Dogecoin’s price action remains tied to broader market trends and macroeconomic developments.

Source: TradingView

The Broader Implications of Dogecoin’s Popularity

Dogecoin’s rise extends beyond price movements, reflecting its cultural and economic significance. As one of the most recognizable meme coins, Dogecoin has fostered a sense of community and grassroots engagement. Its low entry barrier attracts retail investors, empowering individuals to participate in the cryptocurrency market.

From an economic perspective, Dogecoin’s growing adoption highlights the evolving role of digital currencies in financial transactions. High-profile endorsements, like Musk’s, amplify Dogecoin’s visibility and challenge traditional perceptions of value. However, Dogecoin’s energy efficiency compared to Bitcoin has also sparked discussions about sustainability in the crypto industry.

Source: X

Potential Integration with X and Future Outlook

Speculation around Dogecoin’s integration into X’s upcoming payments system continues to fuel investor optimism. Such a development could position Dogecoin as a key player in the digital payments space, leveraging Musk’s influence and X’s global reach.

While Dogecoin’s price remains far below its all-time high of $0.73, its recent performance suggests resilience and room for growth. Investors should remain cautious, as the token’s pricing outlook is highly speculative. However, with the crypto bull market gaining traction, Dogecoin could benefit from renewed momentum, particularly if it secures more use cases and institutional backing.

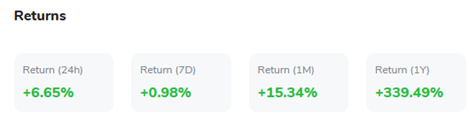

Source: CoinGecko

Conclusion: Dogecoin’s Role in the Future of Crypto

Dogecoin’s journey from a meme-inspired joke to a legitimate cryptocurrency demonstrates its unique position in the digital asset space. The launch of the Department of Government Efficiency’s website, coupled with Musk’s endorsement, has reignited interest in DOGE and underscored its cultural significance.

While challenges remain, including regulatory scrutiny and market volatility, Dogecoin’s community-driven appeal and potential for broader adoption make it a noteworthy player in the crypto market. As the industry evolves, Dogecoin’s impact on digital economies and its role in reshaping perceptions of value will be fascinating to observe.