AAVE: Latest Developments, Price Trends, and Technical Analysis

AAVE’s DeFi Evolution: From ETHLend to a Multi-Chain Powerhouse

AAVE has come a long way since its inception as ETHLend in 2017. Originally a peer-to-peer lending platform on Ethereum, it evolved into a liquidity pool model and rebranded as Aave—Finnish for “ghost”—in 2018. This pivot transformed Aave into a key player in decentralised finance (DeFi). Today, it operates across 16 blockchains and manages a total value locked (TVL) of $18.415 billion, according to DeFiLlama.

Aave’s on-chain financial footprint reflects its scale: with over $11.13 billion borrowed, $63.64 million in annualised revenue, and $273.44 million in daily trading volume, it's clear the protocol commands serious attention. Its market cap sits at $2.29 billion, with $432.02 million worth of AAVE staked—around 18.86% of the circulating supply. The platform supports diverse lending and borrowing needs through variable and stable rates, pioneering concepts like flash loans. As a non-custodial, permissionless protocol, Aave empowers users with transparent, efficient capital management and remains a DeFi cornerstone with long-term relevance.

Source: DefiLlama

RLUSD Integration: A Strategic Leap into Institutional Finance

Aave’s integration of Ripple’s enterprise-grade stablecoin RLUSD into its V3 Ethereum Core Market marks another milestone in the protocol's evolution. With an initial lending cap of $50 million and a borrowing limit of $5 million, the listing brings RLUSD’s utility directly into DeFi’s largest lending protocol by TVL. Though utilisation of the pool remains minimal for now—liquidity and reserve size hover around $125 and utilisation sits at 0%—the move lays the groundwork for broader institutional involvement.

The listing also signals Ripple’s ambitions in decentralised finance, complementing RLUSD’s existing enterprise use cases like global payments and cross-border settlements. Already supported by platforms like Kraken and Bitstamp, RLUSD is designed for institutional efficiency and compliance, backed by approval from the New York State Department of Financial Services. With over $294 million in market cap and $10 billion in transaction volume since launch, RLUSD’s Aave listing strengthens its credibility and opens new frontiers for lending-based utilities.

Source: X

Interest in Aave V3 on Ethereum remains active. According to Dune Analytics, the platform has welcomed 85,831 total unique users, with 54,969 of them joining during the current tracked period. Even today, 91 new users have onboarded. This steady growth in adoption underlines the potential impact of future lending incentives or yield strategies involving RLUSD. Ripple’s enterprise ambitions are further validated by its regulatory backing and exchange support. The stablecoin’s $294 million market cap and $10 billion in historical transaction volume make its Aave listing more than symbolic—it’s a practical foundation for institutional DeFi integration.

Source: Dune

Community Ownership: The Power Behind the AAVE Token

The AAVE token is more than just a governance tool—it's the fuel that powers the entire ecosystem. Capped at 16 million tokens with over 14 million in circulation, AAVE holders enjoy direct control over protocol upgrades, interest rate models, and new asset listings. This participatory structure ensures decentralisation isn’t just a buzzword—it’s baked into Aave’s operating model.

Recently, Aave launched a $1 million-per-week buyback initiative, redistributing purchased tokens to stakers. This not only incentivises token holding but also supports the price through consistent buy-side pressure. The buyback strategy aligns with Aave’s broader shift toward the "fee switch" model, which redirects a portion of protocol revenue toward tokenholder rewards. These moves demonstrate the project’s intention to sustain long-term growth by rewarding its most committed participants.

Source: X

Price History and Ecosystem Resilience

Over the years, AAVE has demonstrated resilience across multiple market cycles. From its 2021 peak above $600 to its recent recovery around $139, the token reflects the broader volatility of the crypto space. Despite bear markets and the evolving regulatory landscape, Aave has maintained a strong position thanks to ongoing development, strong fundamentals, and a highly active community.

Its resilience is further supported by continued expansion into real-world assets (RWAs), cross-chain compatibility, and a steady stream of new features. Aave’s recent partnership with Chainlink to capture Smart Vault Revenue (SVR) and its ongoing integration of its native stablecoin, GHO, showcase the protocol’s multipronged approach to revenue generation and utility. These developments make Aave not just a survivor, but a pacesetter in the DeFi sector.

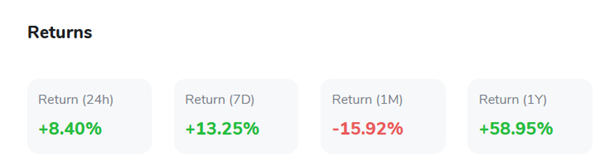

Technical Analysis: Uptrend Strengthens Amid Growing Volume

AAVE has shown strong upward momentum over the past five days, surging past the key $150 psychological level and currently trading near $152.80. This breakout is significant, as previous resistance at this level had held firm for several sessions. The 24-hour volume has steadily climbed to $12.66 million, reflecting growing trader interest and stronger liquidity behind the move.

The Relative Strength Index (RSI) currently sits at 62.50, suggesting the asset is approaching overbought territory but still leaves room for further upside before signalling exhaustion. A steady rise in volume paired with an RSI pushing higher typically points to bullish continuation. Meanwhile, RSI support near the 50 level indicates solid momentum support in recent pullbacks.

Should buying momentum persist and AAVE push past $155, the next targets lie at $165 and $180. Conversely, immediate support lies around the $145 zone, with stronger backing near $138 should the trend cool. Overall, the technical structure is bullish in the short term, backed by rising volume, strong RSI levels, and sustained buying pressure. This aligns well with the broader positive sentiment surrounding AAVE’s protocol expansion and buyback initiatives.

Source: TradingView

The Road Ahead: Aave’s Role in DeFi’s Institutional Era

Looking forward, Aave is clearly shaping the future of decentralised finance by aligning its infrastructure with growing institutional demand. The protocol’s expansion across 16 blockchains, strategic integration of RLUSD, and commitment to weekly buybacks are all positioning Aave as more than just a lending platform—it’s becoming a decentralised financial network with enterprise-grade appeal.

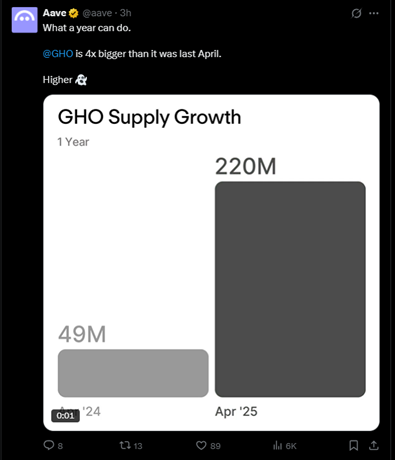

One standout indicator of Aave’s rising influence is the explosive growth of its native stablecoin, GHO. As shared in a recent update, GHO’s circulating supply has surged from 49 million in April 2024 to an impressive 220 million by April 2025—an almost 4.5x increase in just one year. This surge reflects heightened adoption and investor confidence, particularly as GHO becomes central to the platform’s yield strategies and payment use cases.

With new initiatives like Aave V4 and the Horizon project for Real-World Asset tokenisation, Aave is bridging DeFi with traditional finance more effectively than ever. Its transparency, governance-led upgrades, and solid revenue streams make it one of the most resilient and future-ready DeFi platforms. In a market increasingly seeking credible and compliant solutions, Aave stands poised to lead the institutional wave.

Source: X