Crypto Weekly Wrap: 28th February 2025

The cryptocurrency market has experienced significant turbulence recently, with major updates on wallet integrations, institutional adoption, and price movements affecting Bitcoin, Solana, and other altcoins. Below, we break down some of the most critical developments shaping the industry today.

MetaMask Expands to Bitcoin and Solana: A Game Changer for Multi-Chain Accessibility

One of the biggest announcements at ETHDenver was MetaMask's expansion to support Bitcoin and Solana, marking a strategic shift from its Ethereum-centric model. This move aligns with the growing demand for multi-chain wallets that offer users a seamless experience across different blockchain ecosystems.

Key Upgrades in MetaMask’s Roadmap

Bitcoin integration (Q3 2025): Users will be able to store, send, and swap BTC natively within MetaMask without the need for wrapped tokens or additional wallets.

Solana support (May 2025): MetaMask will integrate Solana’s ecosystem, allowing users to interact with Solana-based dApps while benefiting from the wallet’s security infrastructure.

Programmable Accounts: Ethereum’s Pectra upgrade will introduce built-in multisig, two-factor authentication (2FA), and delegated access for AI-driven transactions.

Flexible Gas Payments: A feature launching in March will allow users to pay gas fees with any token, preventing disruptions caused by insufficient ETH balances.

These improvements are set to streamline blockchain interactions, making MetaMask a true multi-chain wallet capable of supporting both EVM and non-EVM networks. The addition of a multichain API will further enhance developer access to multiple networks, eliminating the silos that have historically hindered mainstream adoption.

Source: CryptoNews

Bitcoin’s Price Struggles Amid Market Uncertainty

Bitcoin (BTC) is currently facing downward pressure, struggling around $80,471, following a significant correction from recent highs. The price recently dipped below $78,000, marking a notable decline as macroeconomic uncertainty and new tariff policies from President Donald Trump weigh on market sentiment.

Key Market Indicators:

BTC has dropped over 26% from its all-time high of $109,000 recorded in January.

The Relative Strength Index (RSI) is at 67.91, nearing overbought conditions, suggesting a possible short-term rebound.

Trading volume has increased to 325.73 million, indicating renewed market activity after the sharp decline.

While some analysts warn of a potential move toward $70,000, institutions remain optimistic. Standard Chartered predicts BTC could hit $200,000 by year-end, with further bullish targets set for $500,000 over the next four years.

For now, traders are closely monitoring support at $78,000 and resistance near $84,000 as Bitcoin’s next directional move remains uncertain.

Source: TradingView

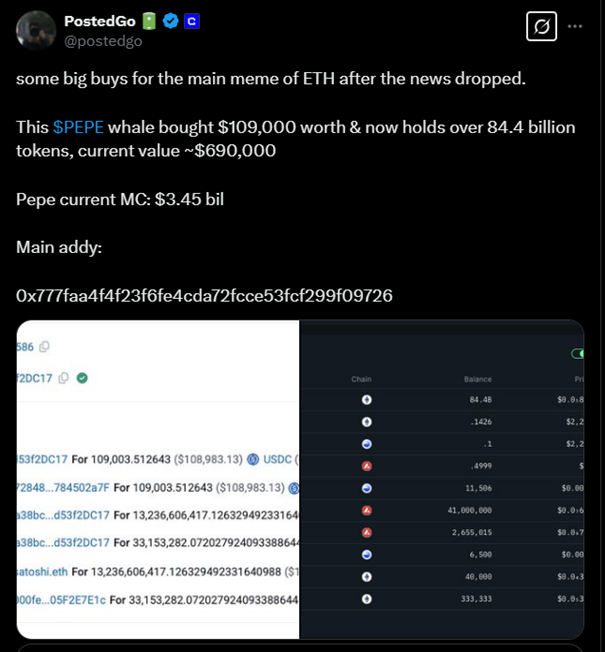

Whales Accumulate PEPE as Market Dips: A Hidden Opportunity?

Meme coin investors have noticed a quiet accumulation of PEPE by large holders (whales), signaling a potential price surge in the near future. While PEPE is down over 70% from its December highs, whale activity suggests that institutional players are preparing for a bullish reversal.

Key Observations:

PEPE’s 14-day RSI is near oversold levels, historically a strong buy signal.

Past oversold periods in August 2023, January 2024, and November 2024 led to sharp price rallies.

Despite the bearish trend, sentiment remains optimistic as the broader market stabilizes.

For traders looking for high-risk, high-reward plays, PEPE’s accumulation phase may indicate an upcoming breakout, though caution is still advised in the current volatile environment.

Source: X

Solana Technical Analysis

Solana (SOL) is showing signs of a potential recovery after dipping to a recent low near $124. Currently trading at $131.36, SOL is attempting to reclaim lost ground but faces immediate resistance near $135-$138. The Relative Strength Index (RSI) at 67.19 suggests that buying momentum is increasing but nearing overbought conditions, indicating possible short-term consolidation. The 24-hour trading volume of 269.53M shows renewed investor interest, but sustained bullish momentum will be needed to push SOL above the $140 resistance level. If the price fails to break above resistance, support at $128-$125 could be retested before another upward move.

Source: TradingView

SEC Dismisses Lawsuits Against Coinbase and Other Crypto Firms

The US Securities and Exchange Commission (SEC) has dismissed its lawsuit against Coinbase, marking a major shift in regulatory policy under the new administration. This follows the SEC’s decision to drop cases against Robinhood, Consensys, Gemini, and Uniswap, suggesting a more crypto-friendly regulatory environment.

Key Takeaways:

The SEC’s new Crypto Task Force, led by Commissioner Hester Peirce, aims to create a clearer regulatory framework.

The dismissal of lawsuits signals a potential softening of enforcement actions against the industry.

Market participants are hopeful that XRP’s ongoing legal battle may also see a favorable outcome.

This regulatory shift could lead to broader institutional adoption of crypto, as companies gain greater clarity on compliance requirements.

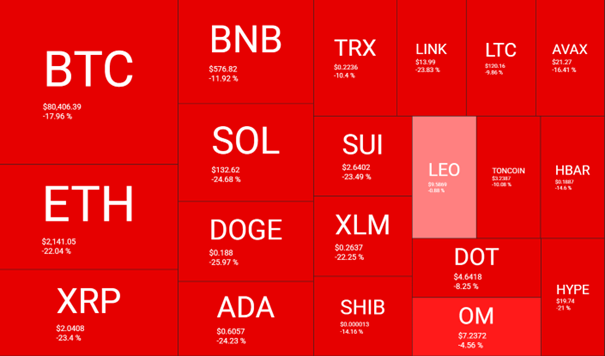

Price Analysis: Crypto Market Faces Heavy Sell-Off

Ethereum (ETH)

Current Price: $2,141.05

Key Levels: Support at $2,000, Resistance at $2,250

Analysis: ETH has plunged 22.04% this week, struggling to regain footing amid broader market downturns. If ETH fails to hold $2,000, further downside toward $1,800 is possible. A bounce above $2,250 could trigger recovery toward $2,500.

XRP

Current Price: $2.04

Support: $2.00

Resistance: $2.20

Performance: XRP has declined 23.4%, mirroring the broader crypto sell-off. If support at $2.00 fails, further downside to $1.80 is likely.

Sui (SUI)

Current Price: $2.64

Support: $2.50

Resistance: $3.00

Market View: SUI has dropped 23.49%, showing strong bearish momentum. Holding $2.50 is critical to prevent a further slide toward $2.00.

Dogecoin (DOGE)

Current Price: $0.188

Support: $0.175

Resistance: $0.200

Trend: DOGE is down 25.97%, with meme coin sentiment weakening. If it breaks below $0.175, it could drop to $0.150.

The overall market sentiment remains bearish, with nearly all top cryptocurrencies experiencing double-digit losses. A recovery will depend on improving macroeconomic conditions and renewed investor confidence.

Source: QuantifyCrypto

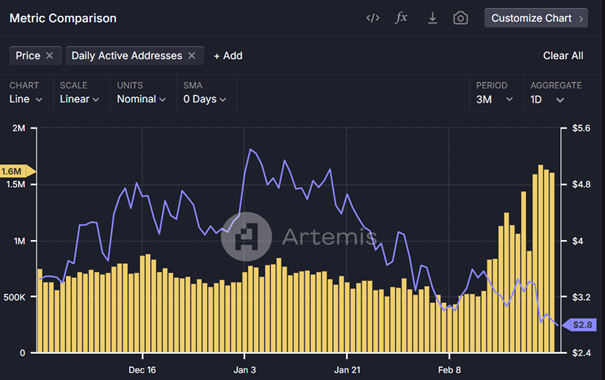

Sui's Resilience Amid Market Volatility: Can It Rebound?

Sui has faced significant price declines in recent weeks, dropping 46.5% from its all-time high of $5.35. However, its network fundamentals remain strong, with active addresses surging to 57 million, highlighting increasing adoption. Despite the broader market downturn and the impact of the Bybit hack, Sui has continued to expand, with its Total Value Locked (TVL) reaching $1.26 billion, driven by growing usage of Sui-based applications like Suilend and Navi Protocol.

While market sentiment remains cautious due to macroeconomic factors like U.S. tariffs on Mexico and Canada, Sui’s modular Move programming language and consistent ecosystem growth indicate long-term potential. Analysts suggest that if network activity continues to rise and demand strengthens, Sui could recover to the $3.25 level by the end of March. However, maintaining this momentum will depend on investor confidence, broader crypto market stability, and sustained development within the Sui ecosystem.

Source: Artemis

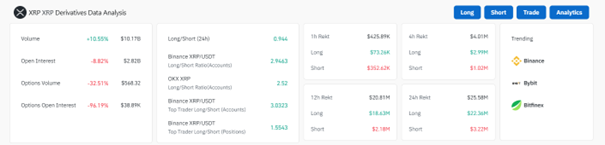

XRP's Futures Market Weakens as Traders Grow Cautious

XRP's futures open interest has dropped to $1.33 billion, marking its lowest level in 2025 and reflecting an 8% decline from the previous week. While this does not necessarily signal a broad bearish trend, it does indicate reduced leveraged interest in the asset. The funding rates for XRP perpetual contracts remain neutral, suggesting a lack of aggressive buying pressure compared to past rallies. Analysts note that the last major surge in leverage demand occurred in December 2024, leading to a 140% price increase followed by a steep correction. Currently, XRP is struggling to maintain bullish momentum, with resistance at $2.25 and $2.30 acting as key hurdles. If traders regain confidence and break these levels, XRP could attempt a push toward $2.40. However, lingering regulatory uncertainty surrounding Ripple's legal battle with the SEC remains a significant factor influencing XRP’s market sentiment.

Source: CoinGlass

Conclusion: What’s Next for the Crypto Market?

As the crypto market faces macroeconomic uncertainty, regulatory shifts, and technological innovations, traders and investors must stay informed to navigate the volatility. Key developments to watch include:

Bitcoin’s price movement near the $80,000 level.

MetaMask’s expansion into Bitcoin and Solana.

Whale accumulation of PEPE and other meme coins.

SEC’s evolving stance on crypto regulations.

With institutional adoption rising and new blockchain innovations emerging, the long-term outlook for crypto remains promising despite short-term volatility. Traders should monitor support and resistance levels closely, as the market prepares for its next big move.