Crypto Weekly Wrap: 21st February 2025

Trump’s Pro-Crypto Policies, Bitcoin’s Rise, and Altcoin Trends

As the cryptocurrency market continues to evolve, recent developments have significantly impacted investor sentiment and price action. From Donald Trump’s pro-crypto administration shaking up regulations to Bitcoin ETFs outpacing gold investments, the market is shifting in favor of digital assets.

Additionally, altcoins like Solana (SOL), and Dogecoin (DOGE) are seeing major moves, while AI-integrated DeFi (DeFAI) is facing challenges. In this market update, we’ll dive into the latest news, trends, and technical insights for leading cryptocurrencies.

A Crypto Revolution in the Making?

In his first month in office, US President Donald Trump has taken bold steps to integrate cryptocurrencies into mainstream finance. His administration has brought in pro-crypto figures to key regulatory positions, including SEC Commissioner Paul Atkins replacing Gary Gensler, and Scott Bessent as the new Treasury Secretary. These appointments are expected to bring clearer regulatory guidelines and a more crypto-friendly environment.

Additionally, Trump established the Department of Government Efficiency (DOGE), led by Elon Musk, aiming to improve transparency in federal spending. In a surprise move, Trump also launched his own memecoin, TRUMP, on the Solana blockchain, which surged to a $15 billion market cap before correcting by 40%. This growing acceptance of crypto at the highest levels of government has fueled speculation about the possibility of a national crypto reserve.

However, not all has been smooth sailing. DOGE has already been hit with lawsuits regarding violations of the Federal Advisory Committee Act (FACA), while new tariffs imposed by Trump on Mexico, Canada, and China have caused stock and crypto market volatility.

Source: ABC News

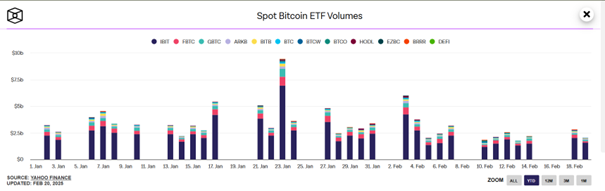

Bitcoin ETFs Dominate as Gold Loses Appeal

Bitcoin’s recent surge past $97,000 has been largely driven by a strong wave of institutional investment in Bitcoin ETFs. Spot Bitcoin ETFs have accumulated over $40 billion in net inflows, significantly outperforming gold ETFs, which saw minimal demand despite gold’s 45% price surge to $2,950 per ounce.

President Trump’s pro-crypto stance has strengthened Bitcoin’s position as a potential safe-haven asset, shifting investor sentiment away from traditional commodities like gold. With institutions like Metaplanet expanding their BTC holdings and raising funds to accumulate more Bitcoin, confidence in digital assets continues to grow.

Source: TheBlock

Solana’s Price Action: Can It Reclaim $200?

Solana (SOL) is currently trading around $175.27, showing mild gains in the past 24 hours. While the token has struggled in recent weeks, its long-term fundamentals remain strong due to increased adoption of Solana-based dApps like Jito, Jupiter, and Raydium. Additionally, the network continues to see heightened activity from memecoins such as TRUMP and MELANIA, which have driven transaction volumes.

From a technical perspective, SOL is showing signs of recovery after bouncing off the $170 support level. The Relative Strength Index (RSI) sits at 61.14, indicating moderate bullish momentum. If Solana breaks above $180, traders may look toward $200–$210 as the next key resistance zone. However, network scalability issues remain a concern, with congestion problems persisting during periods of high demand. To address this, Solaxy ($SOLX) has raised $22.5 million to develop a Layer 2 solution aimed at improving transaction efficiency on the Solana blockchain.

Source: TradingView

SEC Backs Down on Crypto Oversight After Court Ruling

In a significant shift in regulatory stance, the U.S. Securities and Exchange Commission (SEC) has withdrawn its appeal against a federal court ruling that struck down its controversial broker-dealer rule. Originally introduced in February 2024, the rule sought to classify DeFi platforms and large crypto entities as brokers and dealers, subjecting them to stricter registration requirements.

However, after strong legal challenges from the Blockchain Association and Crypto Freedom Alliance of Texas, the court ruled that the SEC had exceeded its authority, potentially harming the decentralized finance sector. With the new pro-crypto administration under Trump, the SEC, now led by Mark Uyeda, appears to be reconsidering its regulatory approach.

This decision marks a major victory for the crypto industry, as it signals a shift towards more balanced, transparent, and innovation-friendly regulations. Furthermore, this move aligns with Trump’s executive order to establish a clear framework for digital assets, reinforcing the administration’s commitment to fostering crypto adoption while ensuring regulatory clarity.

Source: X

Dogecoin’s Next Move: Can DOGE Maintain Its Momentum?

Dogecoin (DOGE) is currently trading at $0.25453, showing a slight 0.03% increase in the last 24 hours. Despite moderate price fluctuations, DOGE remains one of the stronger-performing memecoins, holding firm against competitors like Shiba Inu (SHIB) and Bonk (BONK), which have seen more significant losses year-to-date.

From a technical analysis perspective, DOGE is approaching resistance near $0.26-$0.28, a key level that could determine its next breakout. The Relative Strength Index (RSI) sits at 57.05, indicating neutral to slightly bullish momentum. If DOGE successfully breaks above $0.28, the next major resistance level to watch is $0.30, which could pave the way for an extended rally toward $0.40 and beyond. However, for sustained bullish momentum, an increase in trading volume is necessary, which currently stands at 33.38M over the last 24 hours.

With Elon Musk’s ongoing endorsements and Dogecoin’s expanding role in blockchain integrations, investors continue to watch DOGE closely. If market sentiment remains positive, a retest of higher levels remains possible, but failure to break resistance could result in another pullback toward $0.24.

Source: TradingView

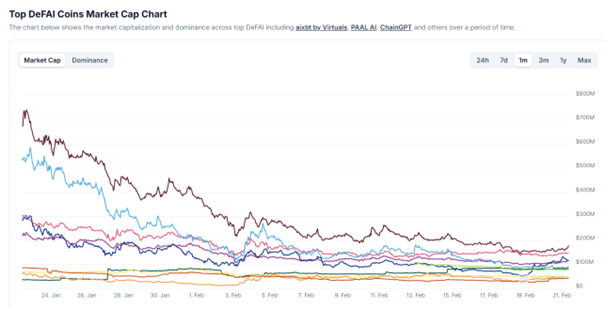

AI and DeFi Integration: Can DeFAI Recover?

The nascent DeFi + AI (DeFAI) sector saw massive growth in late 2024 but has since faced a sharp downturn. The total market cap of DeFAI tokens dropped nearly 80% from its peak, falling from $7 billion to just $1.4 billion.

Several factors contributed to this crash, including a sell-off in AI-related tech stocks like Nvidia, concerns over AI model scalability, and uncertainty in the crypto market. Despite this downturn, DeFAI developers remain optimistic. Projects like Orbit, Griffain, and Vader DAO are actively working on AI-powered DeFi assistants to help users automate trading, lending, and liquidity management.

However, DeFAI faces an existential challenge: how to define the sector and ensure AI agents don’t “hallucinate” bad outcomes for users. Recent security concerns—such as an AI-powered bot on the Base network getting tricked into giving away $50,000—highlight the need for stronger safeguards before AI can fully integrate into DeFi.

Source: CoinGecko

Bitcoin’s Technical Outlook: Testing Resistance Amid Market Volatility

Bitcoin (BTC) is currently trading at $98,511, showing a 0.18% decline in the last 24 hours. Despite the minor pullback, BTC remains in a strong uptrend, with the price approaching a key resistance level near $98,900. If Bitcoin breaks above this zone, the next psychological barrier at $100,000 could come into play, attracting further bullish momentum.

From a technical perspective, the Relative Strength Index (RSI) is at 55.75, indicating neutral momentum without overbought conditions, meaning there is still room for further gains. Meanwhile, the 24-hour trading volume has climbed to 163.26M, reflecting increased market participation. The overall price action suggests continued strength, with the 50-period EMA acting as dynamic support for the ongoing uptrend.

If BTC successfully clears $98,900, traders could target $100,200 as the next major resistance. However, failure to sustain momentum at these levels could result in a retracement toward $96,800 or even $95,700, where stronger support awaits. While the short-term outlook remains bullish, market participants should remain cautious of potential pullbacks or consolidation before a decisive breakout.

Source: TradingView

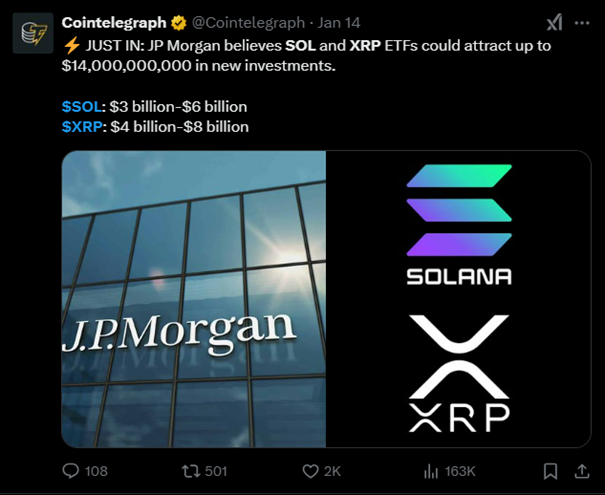

XRP vs. Solana: The ETF Approval Race Intensifies

The competition between XRP and Solana to secure the next crypto ETF approval is heating up, with both assets seeing increased institutional interest and ongoing regulatory hurdles. Solana appears to have a slight edge, as Polymarket bettors currently assign an 85% probability to its ETF approval in 2025, compared to 80% for XRP.

The SEC’s acknowledgment of Grayscale’s Solana Trust ETF application on February 6 has added weight to Solana’s case, setting up an October deadline for a decision. Meanwhile, XRP’s legal clarity following Ripple’s partial victory against the SEC in 2023 strengthens its position, as it is one of the few altcoins with a defined regulatory precedent.

However, concerns remain over Ripple’s influence on XRP, which could make regulators hesitant. Adding another layer to the debate, Litecoin (LTC) has now emerged as a dark horse in the ETF race, with Bloomberg analysts suggesting it may be the first altcoin to gain approval before both Solana and XRP.

Source: X

Conclusion: The Road Ahead for Crypto

With Trump’s administration pushing pro-crypto policies, institutional investment in Bitcoin ETFs, and altcoins showing strong momentum, the cryptocurrency market remains in an exciting phase of growth. However, regulatory uncertainty, scalability concerns, and macroeconomic volatility continue to pose risks.

Key factors to watch in the coming weeks include:

SEC and CFTC regulatory developments under new leadership.

Bitcoin’s ability to sustain its rally above $97,000.

Solana’s congestion issues and whether Layer 2 solutions can improve scalability.

Dogecoin’s price movement and Elon Musk’s continued involvement in crypto.

DeFAI’s ability to recover and prove its long-term utility in the market.

As institutional adoption grows and new technological innovations emerge, crypto investors should stay informed, analyze key trends, and prepare for potential volatility in the market.