Crypto Weekly Wrap: 14th March 2025

Crypto Market Faces Severe Downturn Amid Trump's Trade Policies

The cryptocurrency market has experienced a major sell-off, as investor concerns over President Donald Trump’s latest trade measures intensify. The heightened economic tensions with Canada, Mexico, and China have sent shockwaves through financial markets, triggering a broad-based sell-off across both traditional and digital assets.

Bitcoin (BTC) took a sharp hit, dropping 8.19% to $83,344, while Ethereum (ETH) suffered an even deeper 16.98% decline, now trading at $1,889. Other leading altcoins faced significant losses: Cardano (ADA) tumbled 23.13%, Solana (SOL) fell 14.48%, and Dogecoin (DOGE) dropped 17.75%. Chainlink (LINK) led the declines with a massive 22.07% loss, while BNB (-2.94%) and XRP (-11.85%) also posted steep drops.

The only positive performer in the market was LEO, gaining a modest 0.31% to $9.89, standing out in an overwhelmingly red market.

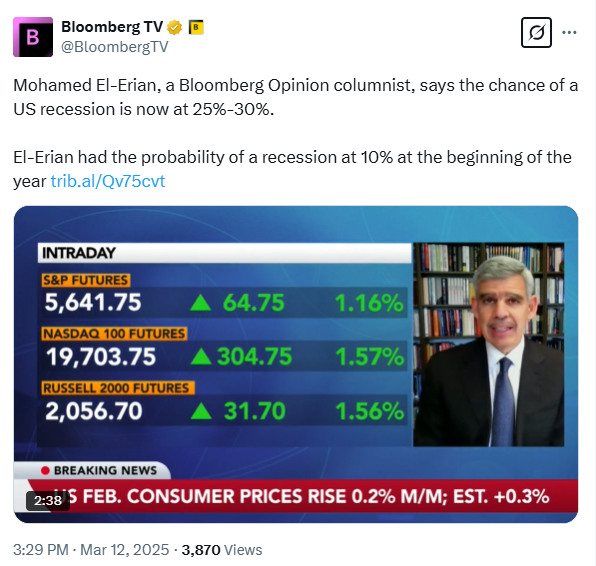

The broader financial markets also remain under pressure, with the S&P 500 erasing all gains since Trump’s re-election, falling nearly 3% in the same period. As investors continue to offload risky assets, cryptocurrencies remain highly vulnerable to further losses in the coming days.

Weekly Heatmap

Source: Quantifycrypto

Bitcoin Reserve Fails to Halt Market Downturn

Trump’s recent announcement of a Strategic Bitcoin Reserve has failed to ease investor concerns, instead triggering a "sell the news" reaction. The reserve, which consists only of seized Bitcoin rather than new acquisitions, has not provided the expected support for BTC prices.

Meanwhile, broader economic uncertainty and inflation fears continue to fuel concerns about macroeconomic instability in the coming weeks.

Source: WhiteHouse

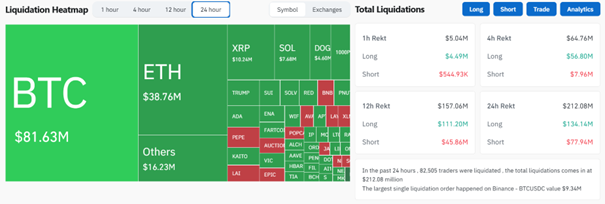

Crypto Liquidations Hit $212 Million as Market Faces Turbulence

The cryptocurrency market has witnessed significant liquidations totaling $212.08 million in the past 24 hours, impacting over 82,500 traders, according to recent CoinGlass data.

Breakdown of Liquidations:

Bitcoin (BTC) led the liquidations with $81.63 million, reflecting its dominant trading volume.

Ethereum (ETH) followed with $38.76 million, highlighting continued volatility.

XRP ($10.24M), Solana ($7.68M), and Dogecoin ($4.60M) also faced notable liquidations.

Smaller altcoins contributed $16.23M to the total liquidation pool.

Long vs. Short Liquidations:

Long positions accounted for $134.14M, as bullish traders were caught off guard by price drops.

Short liquidations totaled $77.94M, indicating some market recovery attempts.

Notable Events:

The largest single liquidation order was recorded on Binance (BTC/USDC) valued at $9.34M.

12-hour liquidations reached $157.06M, with long traders losing $111.20M.

4-hour liquidations hit $64.76M, with $56.80M from long positions.

Despite continued market uncertainty, analysts note that liquidation levels have eased compared to previous market crashes. Traders remain cautious, monitoring macroeconomic trends and regulatory developments for market direction.

Source: CoinGlass

Bitcoin ETFs Experience Modest Rebound After Seven Days of Outflows

Bitcoin exchange-traded funds (ETFs) saw a net inflow of $13.3 million on March 12, reversing a seven-day streak of outflows. The positive inflows pushed the cumulative total net inflow to $35.42 billion.

However, sentiment remains mixed, as evidenced by the following ETF activity:

iShares Bitcoin Trust (IBIT) by BlackRock faced a $47 million outflow.

Grayscale Bitcoin Trust (GBTC) saw an $11.8 million outflow.

ARKB (Ark & 2) recorded a strong inflow of $82.6 million.

Fidelity Bitcoin ETF (FBTC) remained stable, with no inflows or outflows.

Despite these movements, Ethereum ETFs continued to struggle, seeing a $10.4 million net outflow on March 12. The Ethereum-based products have faced ongoing negative sentiment, as traders remain cautious about ETH’s price trajectory.

Source: CoinMarketCap

Bitcoin Struggles to Maintain Momentum Above $83K

Bitcoin (BTC) is experiencing increased volatility, currently trading around $83,058 after a brief dip to $83,015. Despite recent recoveries, selling pressure remains high, raising concerns about further downside risks in the near term.

Key Technical Indicators:

RSI at 43.90, indicating that BTC is approaching oversold territory but still lacking strong bullish momentum.

24-hour trading volume stands at 903.53 million, showing a slight decline in market activity.

Support levels to watch: $82,000 and $80,500. A break below these could lead to further corrections.

Resistance sits at $84,500-$85,000, where a breakout could signal renewed bullish momentum.

While Bitcoin remains resilient, uncertainty in macro conditions and market sentiment continues to weigh on price action. If buyers fail to regain control, BTC could retest lower support levels in the coming days.

Source: TradingView

Ethereum Struggles to Recover Amid Market Weakness

Ethereum (ETH) is facing continued downward pressure, with its price currently hovering around $1,890.71 after a failed attempt to reclaim $1,900. Analysts warn that further declines could lead to a retest of $1,800, with potential downside toward $1,750 if bearish momentum persists.

Key Technical Indicators:

RSI is at 60.13, suggesting neutral-to-bullish conditions, but the market remains volatile.

Trading volume stands at 311.59 million, showing reduced activity compared to earlier sessions.

Support levels to watch: $1,850 and $1,800. A break below could open the door to $1,750.

Resistance remains at $1,950-$2,000, which must be reclaimed for any meaningful recovery.

Despite Ethereum’s long-term strength in DeFi and smart contracts, macroeconomic concerns and weakening sentiment continue to pressure its price. If selling pressure increases, a drop toward $1,750-$1,800 remains a high probability in the coming weeks.

Source: TradingView

SEC Softens Stance on Crypto Regulation, Dropping Major Lawsuits

In a significant shift, the U.S. Securities and Exchange Commission (SEC) has reversed its aggressive enforcement actions against several crypto firms, signaling a more collaborative regulatory approach.

Recent SEC decisions include:

Dropping the case against Coinbase, which was previously accused of operating as an unregistered exchange.

Closing its investigation into Robinhood Crypto, citing a lack of sufficient evidence for enforcement.

Dismissing its lawsuit against Kraken, which had been accused of commingling customer funds.

Halting its legal action against Consensys, the developer behind MetaMask.

Source: CBS News

Market experts believe that the SEC’s shift could foster more institutional participation in crypto markets and enhance regulatory clarity for digital asset firms. Slava Demchuk, CEO of AMLBot, noted that the new approach will allow crypto businesses to focus on innovation without fear of sudden enforcement actions.

Cardano’s Market Performance and Technical Indicators

Cardano (ADA) has faced a pullback after its 80% surge following its inclusion in the U.S. Crypto Reserve, raising concerns about its long-term momentum. ADA’s price is currently trading around $0.7273, with resistance near $0.74-$0.75 and support around $0.70-$0.68. The Relative Strength Index (RSI) is at 60.45, suggesting strong buying interest, though nearing overbought conditions. Trading volume has declined to 75.65 million, indicating reduced market activity after a period of heightened volatility. Institutional accumulation remains evident, with whale wallets holding 1M-10M ADA increasing by 16.5%. However, the broader market trend and regulatory sentiment will determine whether Cardano can sustain its bullish trajectory or see further corrections in the coming weeks.

Source: TradingView

Conclusion: Uncertain Times Ahead for Crypto Markets

The cryptocurrency market is currently facing multiple challenges, including Trump’s aggressive trade policies, fears of economic slowdown, and large-scale liquidations. Bitcoin and Ethereum remain under pressure, while ETF inflows suggest that institutional sentiment remains mixed.

Additionally, the SEC’s regulatory pivot may provide long-term relief to crypto companies, but in the short term, market uncertainty remains high. Investors should closely monitor macroeconomic developments and technical indicators before making any major trading decisions.

Source: X