Crypto Weekly Wrap: 14th February 2025

Crypto Market Update: Valentine’s Day Edition – Bitcoin’s Next Move, Robinhood’s Record Profits & Memecoin Surprises

Valentine's Day is here, love is in the air, but for crypto traders, it’s the charts and market trends that are making their hearts race. Will Bitcoin break past resistance and deliver a sweet surprise for investors? Or will the market experience another heartbreak with further corrections?

With Bitcoin hovering near $97,000, the broader crypto market is seeing institutional accumulation, rising trading volumes, and memecoins making headlines. Meanwhile, Robinhood has posted record Q4 profits, Litecoin is gaining attention for a potential ETF, and Dogecoin fans are dreaming of a $4 breakout. Let’s dive into the latest updates shaping the crypto space this Valentine’s season.

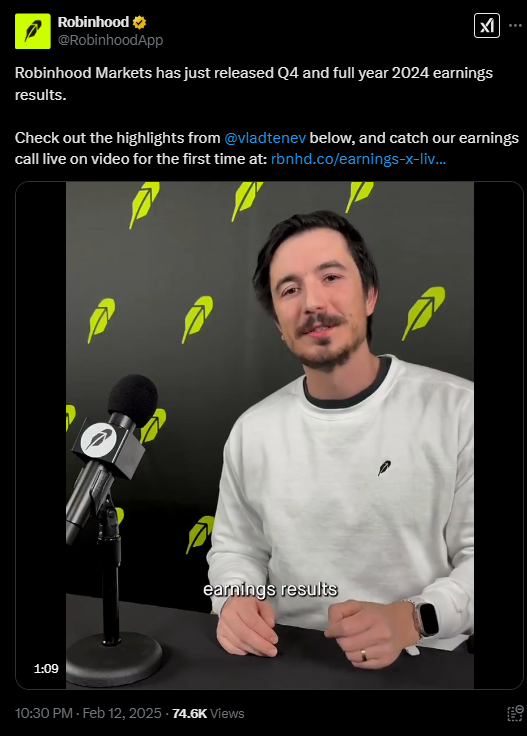

Robinhood’s Record Q4 Profits as Crypto Trading Surges

Robinhood posted a record-breaking Q4, largely fueled by a surge in crypto trading after Donald Trump’s election victory.

- Transaction-based revenue surged 200% to $672 million.

- Crypto trading revenue skyrocketed by 700%, contributing $358 million to overall gains.

- The platform achieved its first annual profit, with earnings of $1.56 per share, exceeding expectations.

- Assets under custody soared to $193 billion, reflecting an 88% year-over-year increase.

This growth was primarily driven by Bitcoin’s rally toward $100,000, which ignited renewed enthusiasm among retail and institutional investors. With the acquisition of Bitstamp and new crypto features such as Ethereum staking in the EU, Robinhood is solidifying its position in the crypto ecosystem.

Assets under custody soared to $193 billion, reflecting an 88% year-over-year increase.

This growth was primarily driven by Bitcoin’s rally toward $100,000, which ignited renewed enthusiasm among retail and institutional investors. With the acquisition of Bitstamp and new crypto features such as Ethereum staking in the EU, Robinhood is solidifying its position in the crypto ecosystem.

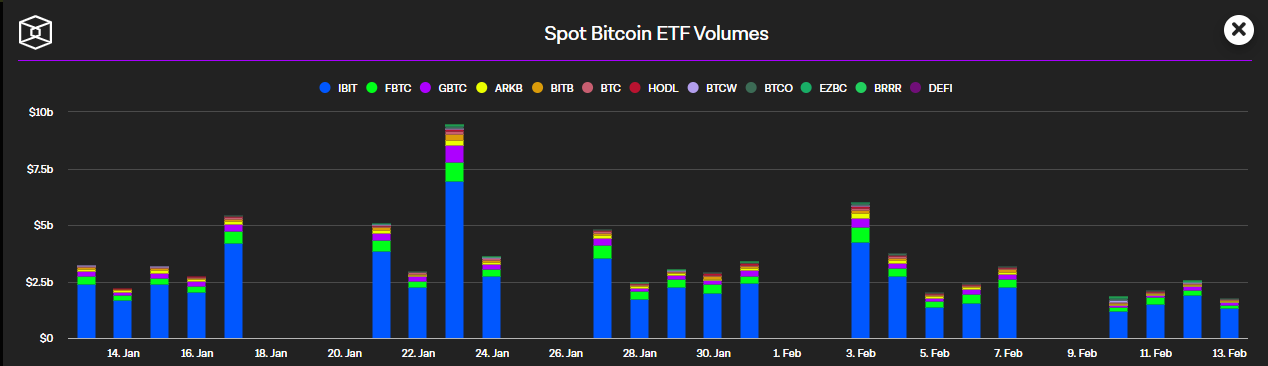

Institutional Investors Double Down on Bitcoin

While retail traders hesitate, institutional players are quietly accumulating Bitcoin.

- Goldman Sachs increased its Bitcoin ETF holdings to $2.05 billion, a 121% increase from the previous quarter.

- Bitcoin’s supply on exchanges hit a two-year low, with 69% of BTC now held by long-term investors.

- Bitcoin ETFs, including BlackRock’s IBIT and Fidelity’s FBTC, continue to attract large inflows, reflecting strong institutional demand.

As institutions stockpile Bitcoin, the available supply is shrinking, which could drive a significant price rally once buying pressure intensifies.

Bitcoin Technical Analysis: Breakout or Breakdown?

Bitcoin is trading at $96,927, consolidating within a tight range as traders watch for a decisive move.

Key Levels to Watch:

- Immediate Resistance: $97,500

- Major Resistance: $100,000 - $100,600

- Immediate Support: $96,000

- Stronger Support: $94,500 - $93,000

Indicators & Market Sentiment:

- RSI (Relative Strength Index): At 51.29, indicating neutral momentum. A move above 60 could suggest stronger buying pressure.

- Moving Averages: Bitcoin is facing resistance near $97,000, with short-term EMA acting as a ceiling.

- Volume Trends: 24H trading volume at 78.86M, showing moderate market participation but declining liquidity.

Potential Scenarios:

- If Bitcoin breaks above $97,500, it could push toward $100,000, targeting the psychological resistance zone.

- However, if Bitcoin drops below $96,000, selling pressure could intensify, potentially leading to a retest of $94,500 - $93,000.

With market consolidation and tightening price action, traders should watch for increased volume and RSI movement as confirmation signals for the next breakout direction.

Dogecoin (DOGE) Surges: Can It Continue the Uptrend?

Dogecoin (DOGE) is currently trading at $0.26681, seeing steady gains as the broader crypto market stabilizes. The memecoin king has been outperforming other altcoins, gaining 5.6% in the past 24 hours, and showing bullish momentum.

Key Levels to Watch:

- Immediate Resistance: $0.27000

- Major Resistance: $0.30000 - $0.35000

- Immediate Support: $0.25500

- Stronger Support: $0.24500 - $0.23500

Technical Indicators & Market Sentiment:

- RSI (Relative Strength Index): At 69.49, nearing the overbought zone, which could indicate a short-term correction if buying pressure slows.

- Volume Trends: 24H trading volume at 62.64M, indicating increasing market interest and potential momentum continuation.

- Fibonacci Retracement: DOGE is following an uptrend, and breaking $0.30 could confirm a strong bullish breakout.

Can DOGE Hit $4?

Analysts suggest Dogecoin could rally to $4 if it breaks above key resistance at $0.73905, following historical bullish cycles. However, sustaining strong volume will be crucial for DOGE to maintain its uptrend.

With Elon Musk’s continued DOGE-related hints and memecoin hype still strong, DOGE remains one of the most-watched altcoins heading into Q1 2025. Traders should watch volume and RSI movements closely to anticipate potential profit-taking or further surges.

Litecoin ETF Hopes Gain Traction as Price Stabilizes

Litecoin (LTC) is currently trading at $127.59, showing consolidation after recent gains. Traders are increasingly optimistic about a potential Litecoin ETF approval in 2025, which could serve as a major catalyst for the asset.

Key Developments:

- Polymarket has raised Litecoin ETF approval odds from 50% to 84%, reflecting growing confidence in a regulatory green light.

- Nasdaq, Canary Capital, and Grayscale have submitted ETF applications, awaiting SEC approval.

- The SEC’s initial decision deadline is set for February 28, with potential delays depending on regulatory feedback.

Technical Overview & Market Sentiment:

- RSI (Relative Strength Index): At 55.40, indicating neutral momentum, with no immediate overbought or oversold conditions.

- Volume Trends: 24H volume at 62.98M, showing a steady interest in Litecoin trading activity.

- Support & Resistance Levels:

Will Litecoin Rally on ETF Approval?

While LTC has recently pulled back, this is likely due to profit-taking after its latest surge. However, if the ETF is approved, Litecoin could see significant upside momentum, potentially pushing toward the $150 - $180 range in the short term.

As institutional interest continues to rise, Litecoin remains one of the most closely watched altcoins heading into Q2 2025.

What’s Next for the Crypto Market?

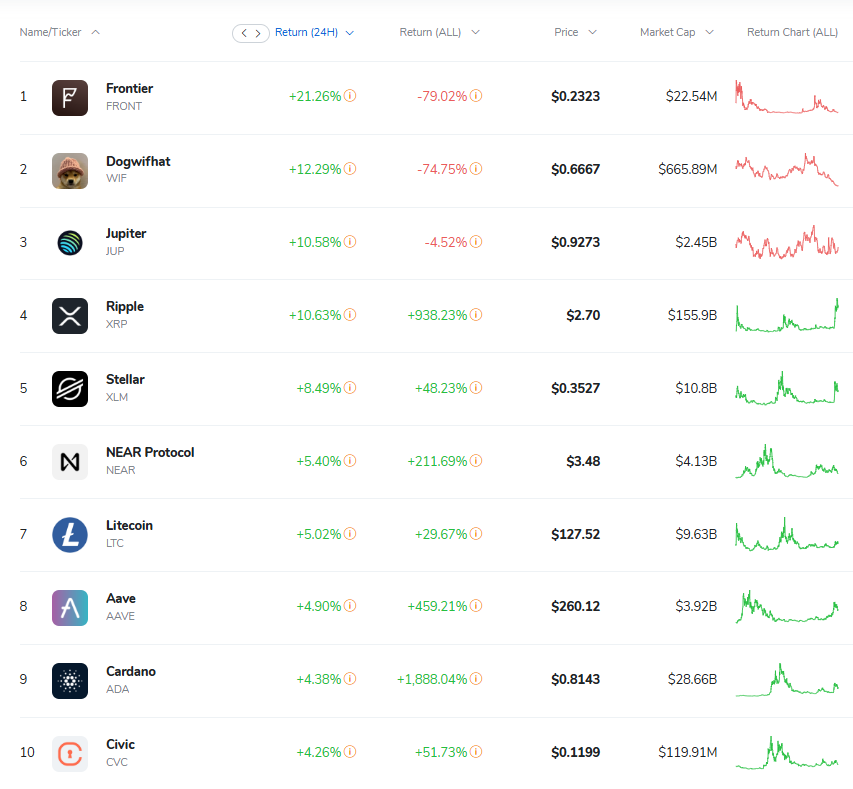

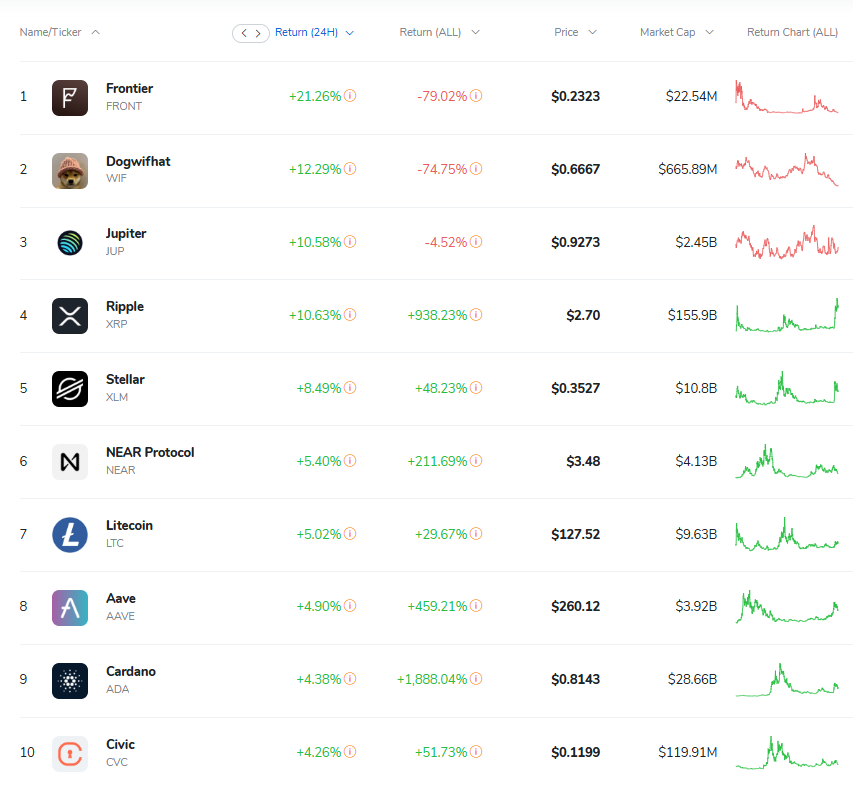

Bitcoin is consolidating around $96,954, setting the stage for its next major move. With a market cap of $3.22 trillion and a Fear and Greed Index at 38 (Fear), traders are weighing bullish and bearish scenarios in the face of increasing market volatility.

Bullish Scenario:

- A breakout above $97,200 could push Bitcoin toward $100,000, bringing renewed optimism.

- Institutional accumulation remains strong, reducing available Bitcoin supply.

- Bitcoin ETFs continue to drive demand, with declining exchange reserves supporting long-term bullish momentum.

- XRP leads today’s gains, up 10.50%, signaling renewed investor confidence in altcoins.

Bearish Scenario:

- Failure to hold $95,000 could see Bitcoin dropping toward $93,500, triggering further liquidations.

- Macroeconomic uncertainty and inflation risks may slow market recovery.

- A break below $92,000 could open the door for a sharper decline toward $84,000, with traders turning risk-averse.

Key Market Factors to Watch:

- Institutional inflows into Bitcoin ETFs and their impact on market sentiment.

- US regulatory developments and how they shape crypto policies under the Trump administration.

- Macroeconomic indicators, including inflation rates and central bank interest rate decisions.

With Valentine’s Day bringing market excitement, Bitcoin and altcoins like Ethereum (+1.54%) and Solana (+2.34%) are setting up for potentially volatile price action in the coming days.

Source: CoinMarketCap

US Highway Patrol Association’s Bitcoin Investment: A Historic Move

In a landmark decision, the Wyoming Highway Patrol Association (WHPA) became the first US law enforcement association to explore Bitcoin investments.

- The "Get Off Zero" initiative encourages institutions to allocate a portion of their reserves into Bitcoin.

- Wyoming Senator Cynthia Lummis, a strong Bitcoin advocate, endorsed the move, calling it a “step toward financial sovereignty”.

- If other law enforcement agencies and unions follow suit, this could set a precedent for further institutional adoption of Bitcoin

Final Thoughts: Love, Crypto, and Market Trends

As we enter Valentine’s Day, Bitcoin and the crypto market remain at a crucial turning point. Will Bitcoin deliver a bullish surprise, or are more corrections ahead?

- Robinhood’s record-breaking quarter highlights the growing interest in crypto trading.

- Institutional investors continue accumulating Bitcoin, shrinking available supply.

- Dogecoin is targeting $4, fueled by strong demand and technical strength.

- Litecoin’s ETF approval odds are climbing, bringing excitement to traders.

With 2025 shaping up to be an exciting year for crypto, investors are closely watching key levels and upcoming regulatory decisions.

Happy Valentine's Day to all crypto enthusiasts! May your trades be green and your portfolios filled with gains.