Chainlink's Recent Surge and Market Outlook

Chainlink (LINK) has gained significant attention in recent weeks due to its positive price movement and key partnerships. Over the past month, LINK has seen a price increase of roughly 10%, driven primarily by strategic collaborations such as the one with Taurus, which aims to accelerate the adoption of tokenized assets in the institutional sector. Chainlink’s current price range is between $10 and $11, with analysts predicting a rise to $12 by the end of the quarter. This surge marks a positive shift for Chainlink as it continues to strengthen its market presence and attract both institutional and retail investors.

The broader market sentiment around Chainlink remains bullish, fueled by its growing integration in key sectors like decentralised finance (DeFi), gaming, and traditional finance. As a decentralised oracle platform, Chainlink plays a crucial role in connecting smart contracts with external data, offering a reliable and secure solution for cross-chain interoperability and real-time data feeds. This has solidified its position as one of the most influential cryptocurrencies in the blockchain ecosystem.

The Role of Chainlink in Institutional Adoption

One of the most significant developments for Chainlink is its partnership with Taurus, which has made tokenized assets more accessible to institutional investors. This collaboration is expected to enhance the infrastructure for tokenized assets, making it easier for financial institutions to leverage blockchain technology. With Chainlink’s decentralised oracle network enabling secure and transparent data transfers, its technology has attracted increased interest from financial institutions. The partnership not only highlights Chainlink's growing influence but also expands its use case in the broader financial ecosystem.

By providing trusted price feeds and secure cross-chain transactions, Chainlink’s decentralised oracles are becoming integral to institutional adoption of blockchain. This makes Chainlink a vital player in facilitating the connection between traditional financial markets and decentralised applications, further expanding its role in the evolving DeFi space. The partnership with Taurus is just one example of how Chainlink is driving innovation and adoption in both traditional and decentralised financial markets.

Source: X

Technical Analysis: Bullish Reversal Pattern

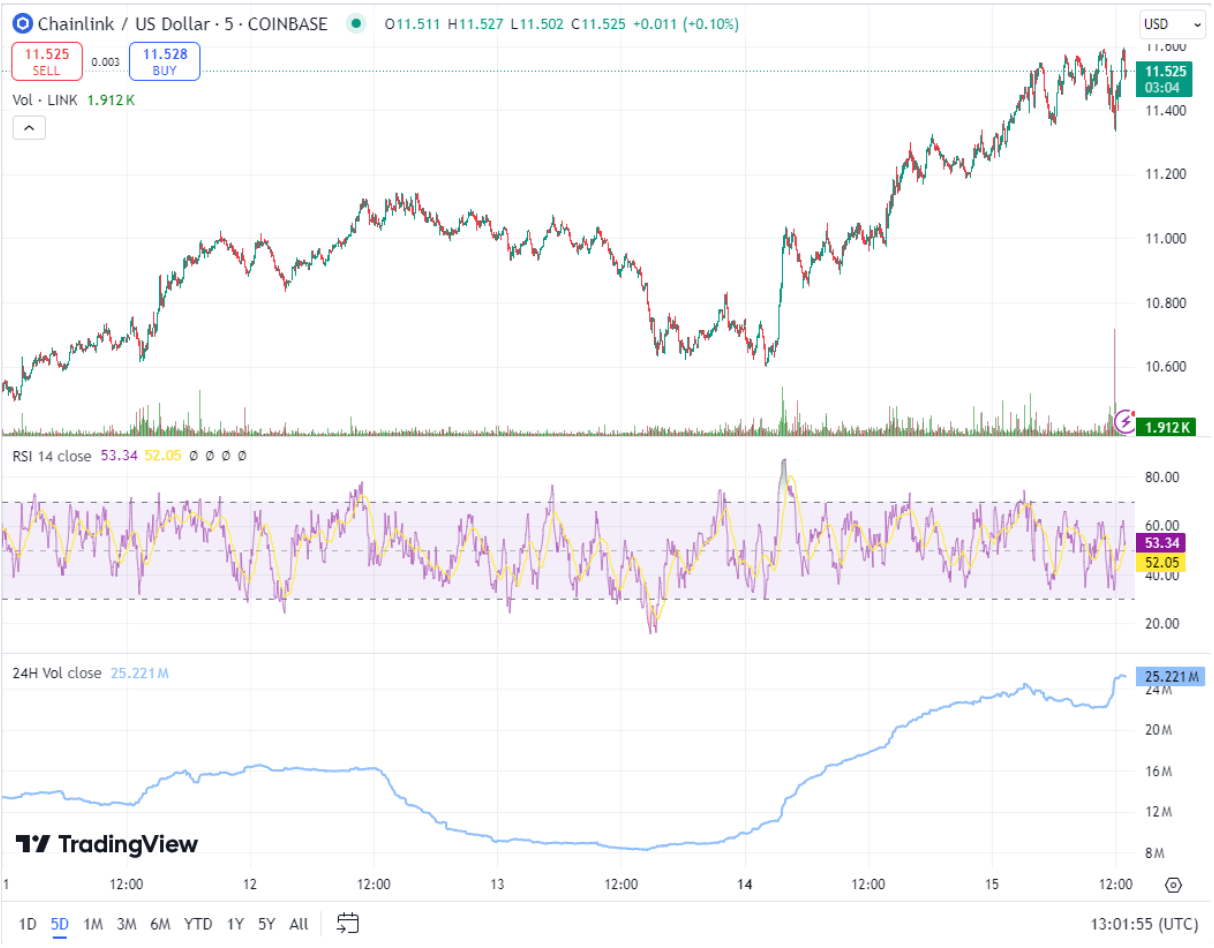

From a technical perspective, Chainlink’s price action is showing strong signals of a bullish reversal. As of mid-October 2024, LINK is trading at around $11.55 with a market cap exceeding $7.24 billion. The weekly chart highlights the formation of a rounding bottom pattern, which is a classic bullish reversal indicator that signals the end of a downtrend. This pattern often indicates renewed investor interest, with buyers stepping in to drive prices higher.

Source: TradingView

The immediate resistance level for LINK lies around $12, a key psychological level that could serve as a stepping stone toward higher gains. If LINK breaks past this level, it may challenge $20, signalling a potential long-term bull run. The volume indicators also support a bullish scenario, showing a steady increase in buying interest. Overall, while short-term traders may encounter some resistance, the long-term outlook for LINK remains highly optimistic, especially if it continues to consolidate and build momentum at current levels.

Ronin Adopts Chainlink Protocol for Enhanced Security

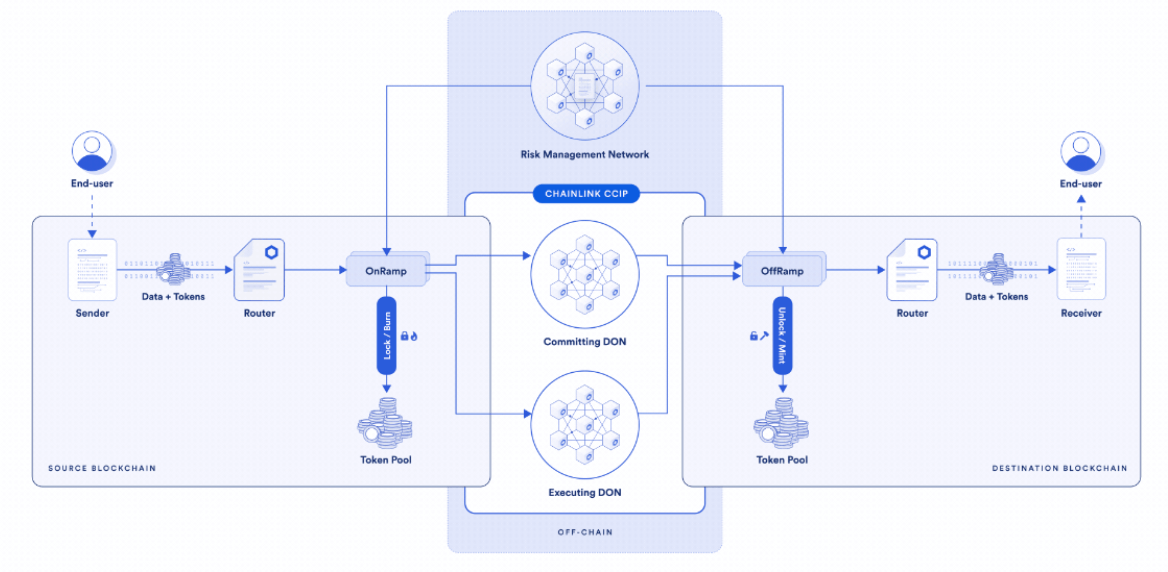

In an important development, Ronin Network, the blockchain gaming platform developed by Sky Mavis, has integrated Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to improve the security of its Ethereum bridge. This decision comes after a series of security breaches that impacted Ronin, including a major hack in 2022 where $622 million in assets were stolen. Chainlink’s CCIP was chosen through a voting process, with security being the primary concern for the Ronin ecosystem.

Source: Chainlink

The integration of Chainlink’s CCIP will significantly boost the security of assets transferred between Ethereum and the Ronin Network. The CCIP offers a decentralised, multi-layered security approach that includes risk management features and decentralised oracle networks. By adopting Chainlink’s protocol, Ronin aims to provide a more secure cross-chain experience, enhancing both user trust and the platform’s resilience. This partnership also sets the stage for further collaboration, as Ronin plans to integrate additional Chainlink services to support its DeFi growth.

Source: X

Chainlink Integrated By IDA to Enhance Transparency of HKDA Stablecoin

Another significant advancement for Chainlink is its integration with IDA Finance to improve the transparency and security of the HKDA stablecoin, a digital currency backed by the Hong Kong dollar. IDA Finance has adopted Chainlink’s Proof-of-Reserves (PoR) technology, which will provide on-chain verification of the assets backing the HKDA stablecoin. This integration aims to mitigate risks associated with insufficient reserves and enhance the credibility of the stablecoin for holders.

In addition to the PoR technology, IDA plans to use Chainlink’s Cross-Chain Interoperability Protocol (CCIP) to enable secure movement of HKDA across multiple blockchains. This will increase the utility and accessibility of HKDA, allowing it to be used for cross-border transactions and real-world asset tokenization. Chainlink’s role in verifying collateralization and enhancing cross-chain operations positions it as a key player in the stablecoin market, further expanding its use cases in global finance.

Chainlink’s Growing Ecosystem: Expanding Use Cases in Gaming and Finance

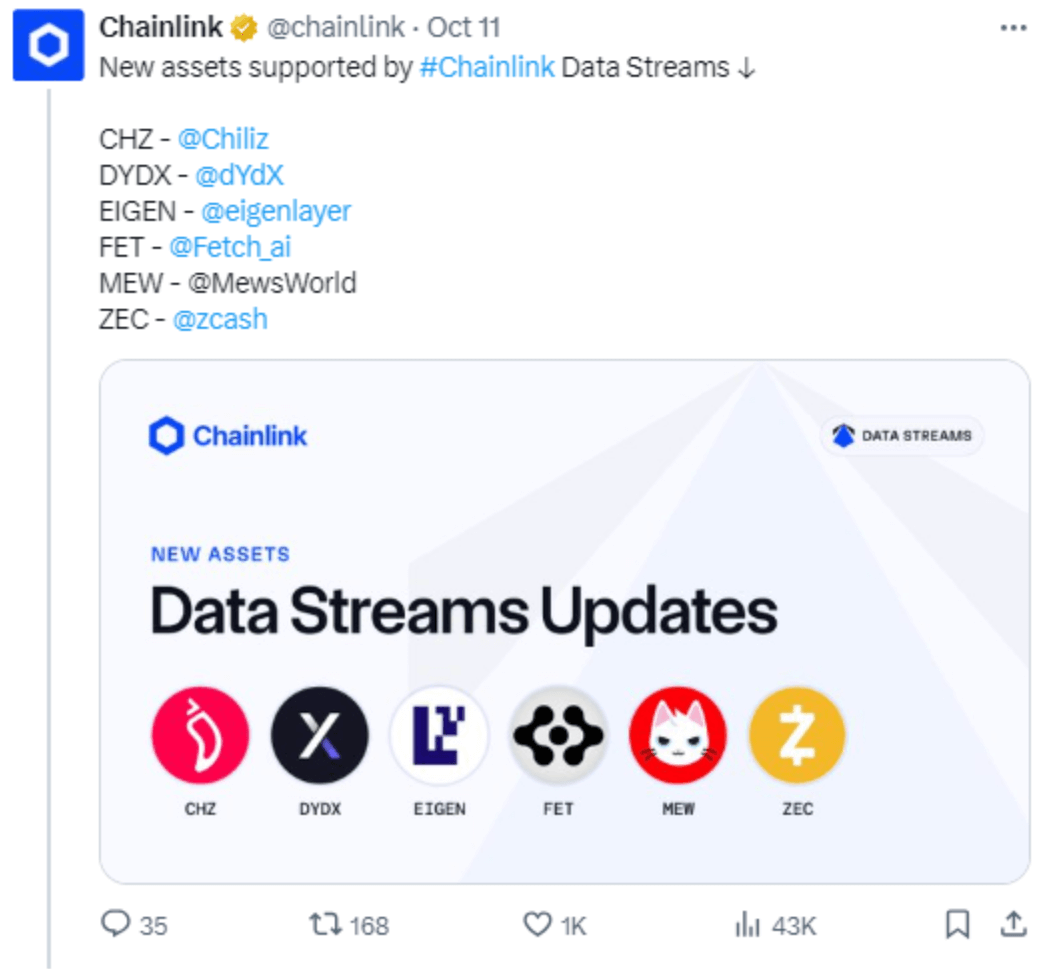

Chainlink’s ecosystem continues to expand through strategic partnerships across sectors such as gaming, decentralised finance, and banking. In the gaming sector, Chainlink has partnered with Sony’s Soneium to enhance cross-chain interoperability and real-time data through its CCIP and Data Feeds. This collaboration marks a major step for Chainlink in the gaming industry, allowing for seamless integration of blockchain technologies in gaming platforms. Additionally, ANZ bank’s use of Chainlink’s CCIP for cross-border payments and tokenized asset transactions highlights its growing importance in the banking sector.

These partnerships underscore Chainlink’s role as a key enabler of decentralised finance and its ability to bridge the gap between traditional financial systems and the blockchain. By providing secure and reliable data feeds, Chainlink continues to drive adoption in real-world applications, from decentralised lending platforms to tokenized assets.

Source: X

Future Outlook and Long-Term Potential for Chainlink

Looking ahead, Chainlink’s future appears promising as it continues to expand its ecosystem and integrate new technological solutions. With its potential to break out of the current accumulation phase, LINK could rally significantly and challenge its all-time high of $53. The recent whale activity and surge in trading volume further indicate strong investor confidence in the long-term potential of Chainlink.

As Chainlink continues to innovate and form strategic partnerships, it is well-positioned to lead the decentralised oracle space and drive broader adoption of blockchain technology. Its ability to provide cross-chain interoperability, secure data feeds, and proof-of-reserves solutions makes it a critical player in the growing DeFi ecosystem. Whether through collaborations in gaming, finance, or stablecoins, Chainlink is set to continue its upward trajectory, making it one of the top cryptocurrencies to watch in 2024.