Bitcoin's Recent Surge and All-Time High Hopes

Bitcoin (BTC) has experienced a robust upward movement recently, rallying by 8.2% over the past week and breaking the $70,000 level to reach a high of $73,000. This marks the first time Bitcoin has hit these heights since June 2024, showing a clear resurgence in bullish sentiment.

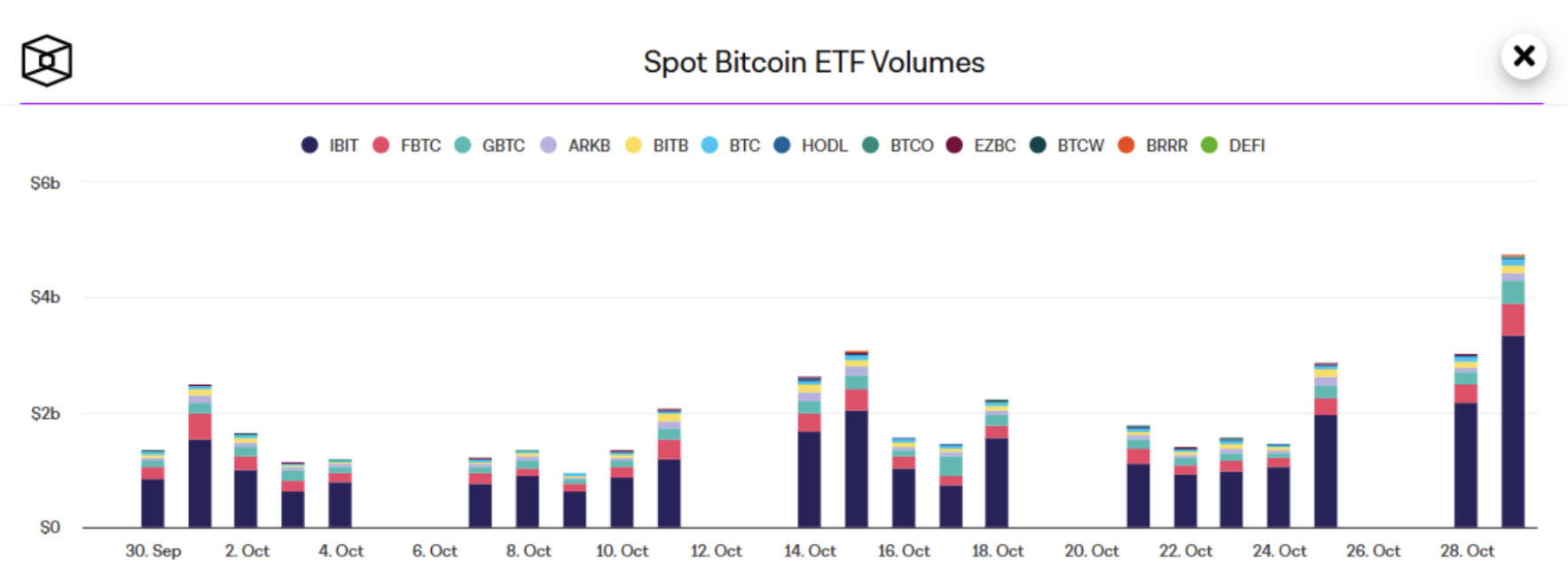

A significant portion of this rally is attributed to increased institutional interest, with notable inflows into Bitcoin exchange-traded funds (ETFs), highlighting growing demand. BlackRock's iShares Bitcoin Trust recorded inflows of over $300 million, and ARK Invest’s Bitcoin ETF added $59.8 million. These high-volume ETF investments underscore Bitcoin’s appeal to institutional investors and have continued to support its push above the $70,000 threshold. The substantial inflow into ETFs reflects confidence in Bitcoin's long-term value, as more investors recognise the asset's potential as a resilient investment.

Source: TheBlock

The Role of Bhutan’s Bitcoin Holdings

Bhutan’s strategic moves in the crypto space have added another layer to the narrative of government and institutional adoption. On October 29, Bhutan moved 929 Bitcoin, valued at over $66 million, to the centralised exchange Binance—its first transfer of BTC since July. Initially testing the process with 100 BTC, Bhutan then followed with an 839 BTC transfer, illustrating the Kingdom’s confidence in centralised platforms for asset management. The country’s crypto investment strategy is distinct; rather than accumulating BTC from seizures, Bhutan has actively mined its holdings through repurposed national infrastructure. With its 12,456 BTC holdings, valued over $885 million, Bhutan holds one of the world’s largest sovereign-controlled Bitcoin reserves. This move to Binance signifies Bhutan’s readiness to adapt to market dynamics while emphasising the role of government entities in shaping global crypto trends.

Source: X

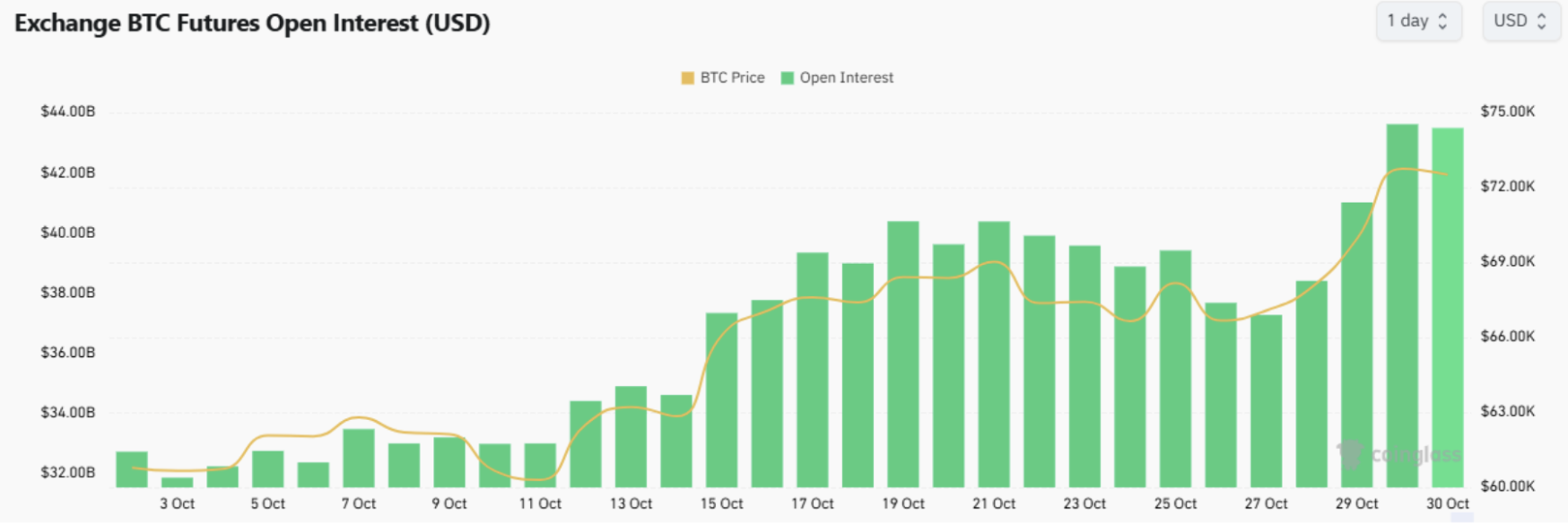

Bitcoin's Open Interest Hits Record High Amid Price Surge

Bitcoin’s impressive rally has been met with a record-high open interest in the futures market, signalling increased engagement from both institutional and retail investors. Open interest represents the total number of active contracts in the futures market that remain unsettled, and its current peak reflects the confidence of traders in Bitcoin’s bullish momentum. The rise in open interest is mainly driven by several factors, including the surge in CME Bitcoin futures contracts, heightened funding rates in perpetual futures markets, and increased capital inflows into spot Bitcoin ETFs. The CME’s dominance, representing 30% of the total market share for Bitcoin futures, highlights the influence of regulated exchanges and suggests a strong institutional interest in Bitcoin. This record-high open interest aligns with Bitcoin’s recent price breakout and underscores a bullish outlook, though it also sets the stage for potential volatility if market dynamics shift.

Source: CoinGlass

Bitcoin DeFi Growth and Partnerships

Alongside price gains, Bitcoin’s ecosystem is expanding through strategic partnerships aimed at incorporating DeFi opportunities within the Bitcoin network, a move that showcases the asset’s evolution beyond just a store of value. Hex Trust, a licensed digital asset services provider, has recently partnered with Stacks Asia to tap into the $180 billion market for Bitcoin-based DeFi products. This partnership allows Hex Trust to integrate support for Stacks-related assets and establish infrastructure for future decentralised finance applications on the Bitcoin blockchain. As Kyle Ellicott of Stacks highlighted, demand for Bitcoin-based DeFi services is notably high in Asia, where consumer interest is rising. By offering DeFi on Bitcoin, Hex Trust is positioning itself to meet the needs of a broader and maturing market. With integrations like these, Bitcoin’s financial utility expands significantly, establishing a new paradigm known as Bitcoin DeFi (BTCFi) that could reshape how investors approach the asset class.

Source: Stacks

Bitcoin Technical Analysis and Future Price Outlook

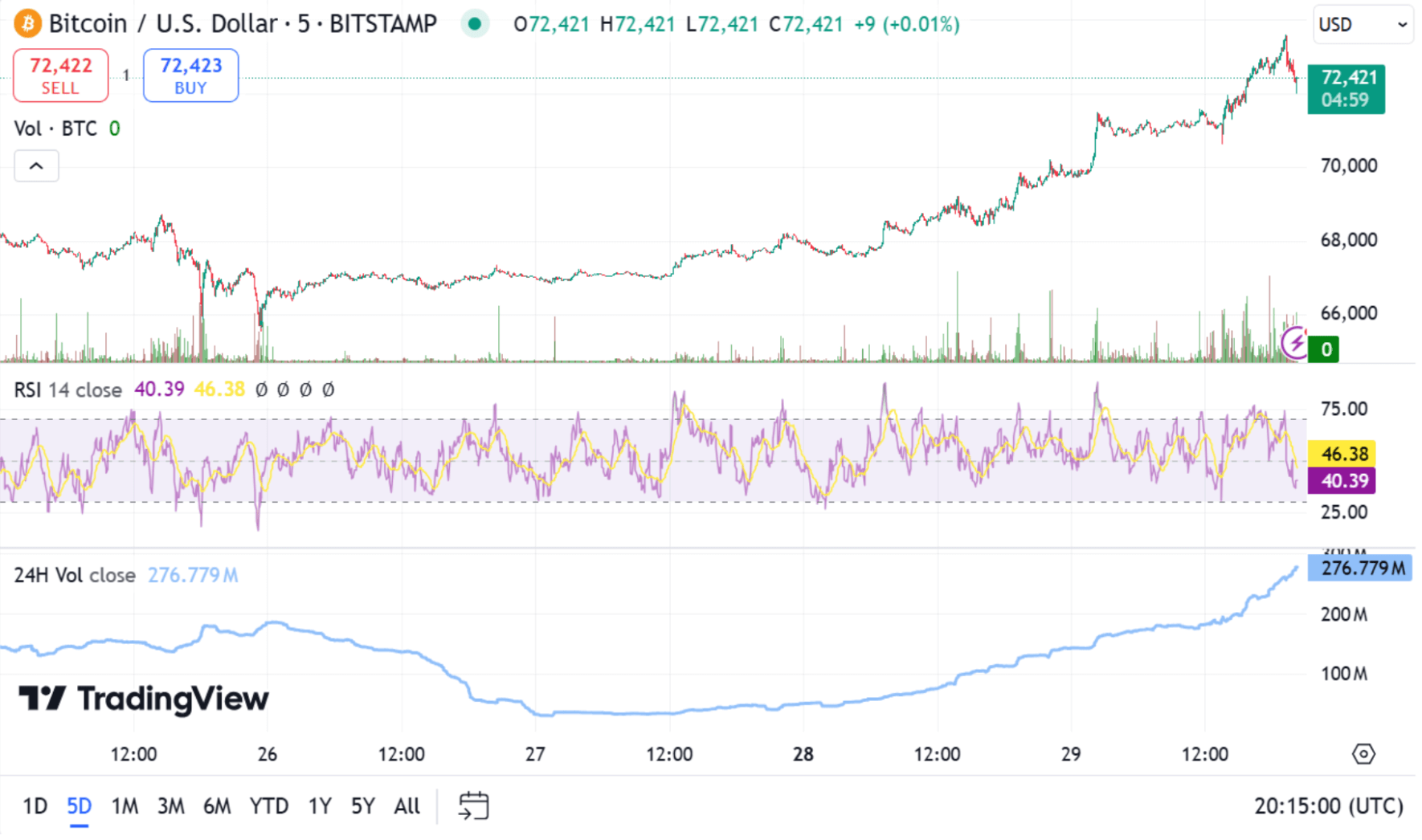

Bitcoin’s recent price movements illustrate a strong uptrend, with BTC breaking above critical resistance levels around $70,000 and aiming for even higher targets. On the daily chart, Bitcoin is trading well above key moving averages, an indicator of sustained bullish momentum that could continue in the short to medium term. For a true breakout, Bitcoin needs to close above $74,000, establishing this as a new support level and confirming long-term upward momentum.

Source: TradingView

At present, Bitcoin faces resistance at $73,700. If Bitcoin closes above this resistance level, it would offer further confirmation of a continued rally, though failure to hold above it may lead to a temporary pullback. Additionally, the Relative Strength Index (RSI) for Bitcoin is in neutral territory. In past uptrends, such indicators have often coincided with subsequent gains, suggesting that Bitcoin might still have more room to grow if positive market conditions persist.

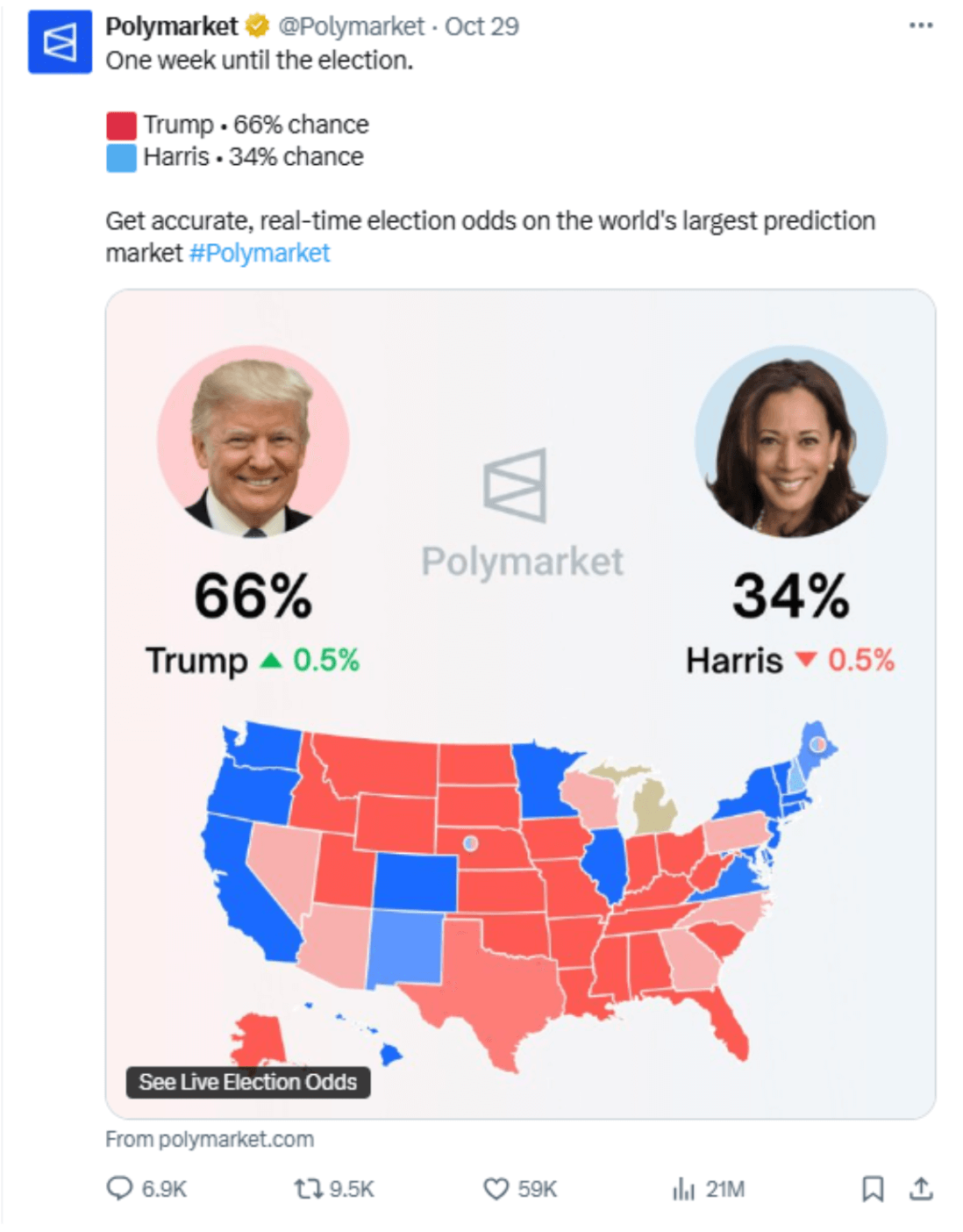

Institutional Investment, U.S. Elections, and Macro Influences on Bitcoin’s Future

Institutional interest in Bitcoin is on the rise, buoyed by a blend of favourable macroeconomic and geopolitical factors. Spot Bitcoin ETF demand and the potential for pro-crypto policies from the U.S. government following the upcoming presidential election are especially impactful, sparking optimism among institutional investors. A victory by a crypto-friendly candidate, such as Donald Trump, is anticipated to create a supportive regulatory landscape, potentially accelerating Bitcoin's integration into mainstream finance. In addition, ongoing rate cuts by the Federal Reserve are enhancing Bitcoin’s appeal as an inflation hedge. Historically, the fourth quarter has been Bitcoin’s strongest period, and current conditions may propel the cryptocurrency toward new all-time highs. With robust institutional engagement and supportive macroeconomic factors, Bitcoin stands poised for sustained growth. This convergence of influences could see Bitcoin not only setting new records but also solidifying its role within institutional portfolios and broader financial markets.

Source: X