Cardano (ADA) Latest Developments, Market Trends, and Technical Analysis

Trump’s Crypto Strategic Reserve Sparks Market Frenzy

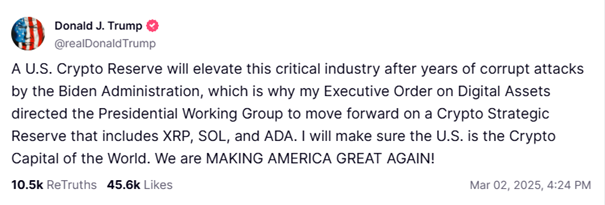

Cardano (ADA) has surged in recent days following former U.S. President Donald Trump’s announcement of a U.S. Crypto Strategic Reserve, which includes ADA alongside Bitcoin (BTC), Ethereum (ETH), XRP, and Solana (SOL). This unexpected move has ignited investor enthusiasm, pushing ADA up by over 70% in a single day.

The strategic reserve aims to enhance America’s leadership in digital assets, with Trump framing the initiative as a countermeasure against regulatory challenges faced under the Biden administration. The announcement took the market by surprise, as prior discussions of government-backed crypto reserves had primarily focused on Bitcoin as a store of value.

Source: TruthSocial

Cardano’s Institutional Legitimacy Strengthens

Trump’s endorsement of Cardano has fueled institutional confidence, with large investors accumulating significant amounts of ADA. Whales purchased over 130 million ADA within 72 hours after the announcement. This surge in institutional activity highlights ADA’s growing credibility as a long-term digital asset.

Furthermore, speculation has risen regarding the possibility of ADA being included in future U.S. financial infrastructure initiatives, further reinforcing its position in the evolving regulatory landscape.

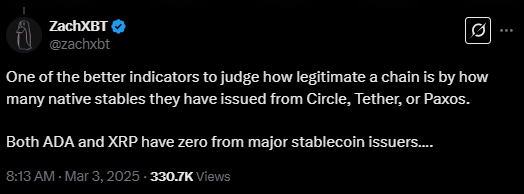

Source: X

Debate Over Cardano’s Role in the Crypto Reserve

Despite ADA’s rally, the decision to include it in the U.S. Crypto Strategic Reserve has sparked controversy within the crypto community. Blockchain investigator ZachXBT criticized Cardano and XRP, arguing that they lack major stablecoin adoption from issuers like Circle, Tether, and Paxos.

He claimed that a blockchain’s legitimacy and utility can often be measured by the presence of widely adopted stablecoins, which both ADA and XRP currently lack. However, Cardano supporters pushed back, citing the project’s strong development ecosystem and ongoing partnerships that could lead to future stablecoin adoption.

Source: X

Technical Analysis: Cardano’s Market Trends and Price Projections

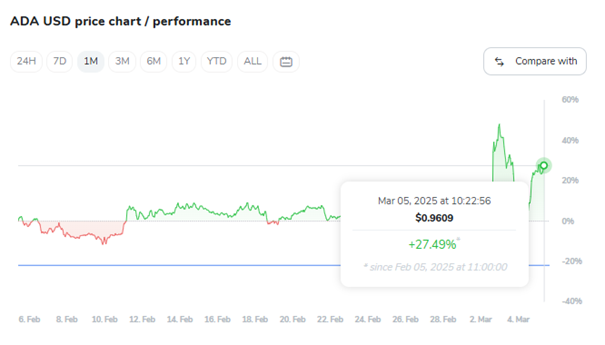

Cardano (ADA) has experienced strong volatility but remains resilient, holding onto recent gains. ADA saw a minor pullback but continued consolidating above $0.95, suggesting buyers are still active in the market. While the momentum has cooled from its initial spike, ADA remains on an uptrend, with strong buying support preventing further declines.

Key Technical Indicators

Resistance Levels: The first major resistance is near $1.00, where sellers have stepped in before. A breakout above this level could push ADA toward $1.10-$1.15 in the short term.

Support Levels: The nearest support lies at $0.90-$0.93. If this level fails to hold, ADA could see a correction toward $0.85, where buyers have previously shown interest.

Relative Strength Index (RSI): The RSI is at 67.58, indicating bullish momentum but also nearing overbought conditions. This suggests a potential consolidation phase before another upward move.

MACD (Moving Average Convergence Divergence): A bullish trend remains intact, with no signs of immediate reversal. However, traders should monitor momentum shifts that could signal a short-term pullback.

Trading Volume: ADA’s 24H volume is 340.17 million, showing strong market activity, but a slight decline from its recent peak, which suggests cooling enthusiasm.

ADA remains bullish as long as it stays above $0.90. A break above $1.00 could accelerate gains, while failure to hold $0.90 support may trigger a deeper retracement. Traders should watch for volume increases and RSI cooling before the next potential breakout.

Source: TradingView

Will Cardano Secure a U.S. Spot ETF?

One of the biggest catalysts for ADA’s long-term growth could be the approval of a Cardano exchange-traded fund (ETF) in the United States. With Bitcoin ETFs now widely accepted and Ethereum ETFs gaining traction, analysts speculate that ADA could be among the next altcoins to receive ETF approval.

This would provide institutional investors with direct exposure to ADA, potentially driving significant capital inflows into the asset. If approved, an ADA ETF could serve as a major price driver, pushing ADA toward its previous all-time high of $2.90 from 2021.

Cardano’s Future Outlook and Long-Term Viability

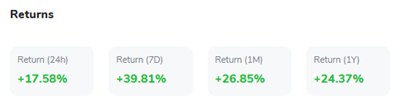

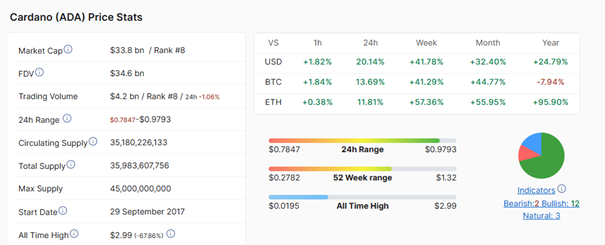

Cardano (ADA) continues to demonstrate strong market performance, ranking #8 with a market cap of $33.8 billion and an FDV of $34.6 billion. Despite short-term fluctuations, ADA remains one of the most resilient cryptocurrencies, with a 41.78% gain over the past week and a 32.40% increase this month against the USD. Its yearly growth of 24.79% further solidifies its long-term potential.

The blockchain ecosystem is expanding, with more dApps, DeFi projects, and governance upgrades reinforcing ADA’s role as a leading smart contract platform. Additionally, ADA's 52-week range of $0.2782 - $1.32 highlights its recovery potential, especially given that it is still 67.86% below its all-time high of $2.99.

Institutional interest is increasing, with ADA now outperforming Bitcoin (BTC) and Ethereum (ETH) over multiple timeframes. Notably, ADA gained 57.36% against ETH in the past year, showcasing its strong momentum. With favorable regulatory shifts and Cardano’s continued network expansion, ADA could play a significant role in the next phase of crypto adoption and institutional investment.

Source: CoinLore

Conclusion: What’s Next for ADA?

Cardano’s recent market surge, fueled by Trump’s strategic reserve announcement, has brought it back into the spotlight. While short-term volatility is expected, ADA’s technical structure remains bullish, with $1.30 as the key breakout level. Long-term, growing institutional interest, potential ETF approvals, and ecosystem expansion make Cardano a strong candidate for continued price appreciation. However, investors should stay cautious, as macro risks and regulatory shifts could influence ADA’s trajectory in the coming months.

For now, Cardano remains one of the most closely watched assets in the crypto market, with its next price target set at $1.30 and beyond.