Balancer V3 and Aave Partnership: Redefining Liquidity Solutions

Content

- AAVE Token Listing on LCX Exchange

- Technical Analysis: AAVE’s Path to $500

- rsETH Integration with Lido Instance Enhances Liquidity and Borrowing Opportunities

- Whale Activity Signals Confidence in AAVE

- World Liberty Financial Expands DeFi Horizons with Aave Integration

- AAVE's Role in the Wider Crypto Ecosystem

The collaboration between Balancer and Aave through the V3 upgrade is set to reshape liquidity solutions in the DeFi space.

Introducing 100% Boosted Pools combines Balancer's innovative automated market-making technology with Aave's robust lending infrastructure. This synergy allows users to simultaneously access yield from swaps and lending markets, maximising capital efficiency and returns.

Furthermore, the integration provides liquidity providers with a streamlined, user-friendly experience, requiring minimal management while optimising profits.

As this partnership goes live on Ethereum's Layer 2 solution, Optimism, it sets the stage for scalable and efficient liquidity strategies, garnering significant attention from DeFi stakeholders and projects.

Source: X

The listing of the $AAVE token from December 19, 2024, on the LCX Exchange is a significant milestone in Aave’s expansion strategy. It broadens Aave's user base and underscores the growing demand for its governance token.

AAVE's role as the backbone of the protocol empowers holders to vote on critical decisions, including protocol deployments and feature upgrades. Additionally, the listing aligns with Aave’s efforts to enhance liquidity and attract institutional investors.

By making the token more accessible, Aave strengthens its position as a leading player in the DeFi market, creating new opportunities for growth and adoption.

Source: LCX

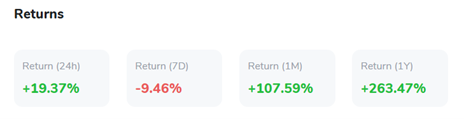

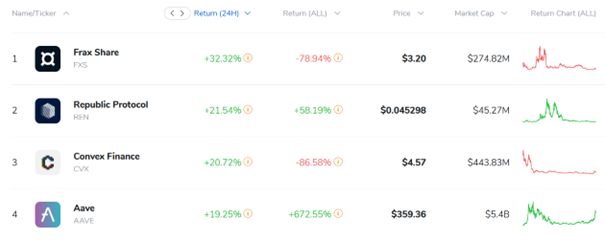

AAVE is trading at $359.75, reflecting steady momentum despite recent market fluctuations.

The token's RSI stands at 65.40, indicating bullish sentiment but nearing overbought territory.

AAVE's consistent ascending trend since mid-2024 suggests resilience, with the recent breakout of a rising parallel channel further emphasising its bullish potential.

Key resistance at $375 and $395 remains crucial for maintaining upward momentum, while $420 is the pivotal threshold that could unlock a path to $500.

Analysts anticipate this milestone could be reached by early 2025 if AAVE sustains its current trajectory. The heightened trading activity indicated by volume metrics underscores strong investor interest, and the anticipated V4 upgrade adds an extra layer of optimism, positioning AAVE for potential new highs in the coming months.

Source: TradingView

The onboarding of rsETH to the Lido Instance represents a strategic move to enhance liquidity and composability within the DeFi ecosystem.

By aligning with Aave v3's support for rsETH on Ethereum, this integration aims to provide users with greater borrowing flexibility and capital efficiency.

The synergy between liquid staking derivatives like wstETH and rsETH further strengthens the ecosystem, allowing borrowers to leverage eMode for optimised returns while adhering to a risk-conscious framework.

This development underscores the growing collaboration between major DeFi protocols to drive innovation and accessibility.

Source: X

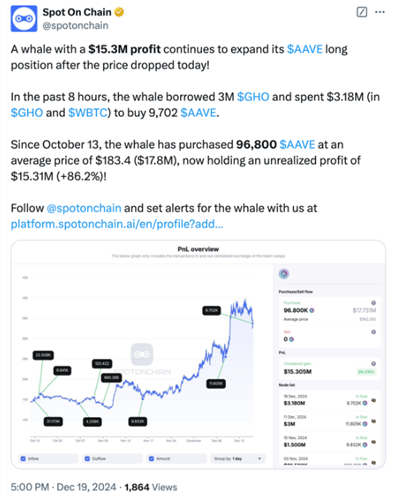

Recent whale activity has reinforced confidence in AAVE's growth potential, particularly before its V4 upgrade.

A notable whale invested $3.18 million to purchase 9,702 AAVE tokens following a recent price dip, adding to their existing long position of 96,800 tokens.

This accumulation reflects a strong belief in the token’s long-term value and the anticipated impact of the V4 upgrade on the platform’s ecosystem. The whale’s unrealised profits of $15.3 million (+86.2%) highlight the significant returns that AAVE has delivered for early investors.

This strategic buying activity also signals robust market sentiment, with large investors positioning themselves to capitalise on future price growth. As institutional interest in AAVE rises, such moves could drive further price momentum and enhance liquidity.

Source: X

World Liberty Financial’s decision to deploy a lending instance on Ethereum, powered by Aave v3, marks a significant step in bridging traditional finance with DeFi innovation.

By supporting significant assets like ETH, WBTC, USDC, and USDT, the initiative enhances user accessibility to decentralised lending while ensuring robust risk management through Aave's proven framework.

The collaboration strengthens Aave's market position and aligns with WLFI's goals of fostering DeFi adoption by simplifying over-collateralized lending for new users.

Additionally, the arrangement benefits AaveDAO with a 20% share of protocol fees and 7% of $WLFI tokens, creating a mutually advantageous ecosystem that incentivises liquidity and governance participation.

Source: X

Beyond its technical growth, AAVE plays a vital role in the broader cryptocurrency ecosystem. Its innovative DeFi solutions attract users and liquidity, solidifying its position as a key player in the decentralised finance market. AAVE’s V4 upgrade promises enhanced yields and user experience, keeping it competitive against emerging protocols.

Collaborations with platforms like Lido and World Liberty Financial further showcase AAVE’s adaptability and strategic importance. By integrating with cross-chain networks and aligning with major ecosystem upgrades, AAVE drives innovation and sets benchmarks within the rapidly evolving DeFi landscape.

Cryptocurrencies by 24H Return

Strategies with AAVE can be found here.