2024: Crypto Year in Review

Key takeaways

Bitcoin's Performance and Technical Analysis

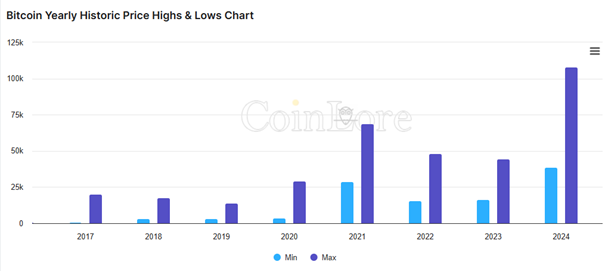

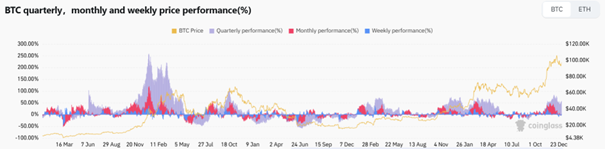

Bitcoin's price movement throughout 2024 demonstrated a combination of resilience and volatility.

After starting the year near $68,000, Bitcoin rallied to an all-time high of $108,000, driven by increased adoption, institutional interest, and broader market momentum.

However, the cryptocurrency faced significant pullbacks later in the year, trading near $97,400 as of December 2024.

Key technical indicators highlight Bitcoin's critical support and resistance levels. The 21-day SMA at $99,600 has acted as short-term resistance, while the 50-day SMA at $94,650 provides crucial support.

The Relative Strength Index (RSI) currently stands at 52, signalling neutral momentum. Bitcoin's ability to reclaim the $100,000 psychological level remains vital for sustaining bullish sentiment.

Analysts anticipate potential price targets of $108,000 and beyond, provided Bitcoin breaks through its current resistance levels.

Despite short-term challenges, Bitcoin's fundamentals remain robust. Increased trading volumes and institutional adoption suggest that the long-term outlook for the leading cryptocurrency is optimistic.

As Bitcoin continues demonstrating its role as a store of value and hedge against inflation, it remains a cornerstone of the crypto market.

Spot ETFs and Institutional Interest

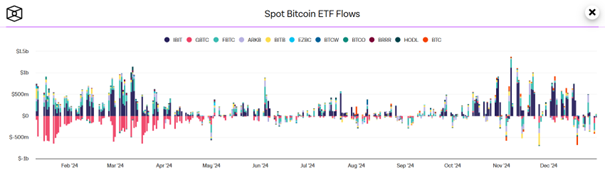

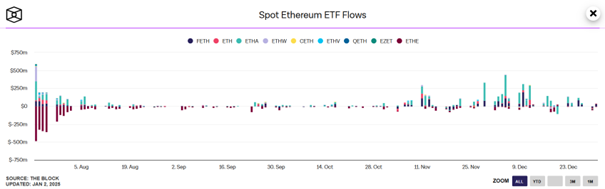

One of the most significant developments of 2024 was the proliferation of spot Bitcoin and Ethereum ETFs. These investment vehicles attracted substantial inflows, providing retail and institutional investors easier access to cryptocurrencies.

While Bitcoin ETFs initially witnessed consistent inflows, the market reversed in December, with $1.5 billion withdrawn over four days. BlackRock's IBIT and Fidelity's FBTC were among the most affected funds, highlighting the dynamic nature of ETF investments.

Ethereum ETFs also gained traction, with cumulative inflows reaching $2.46 billion by the end of the year. BlackRock's ETHA led the charge, showcasing growing interest in Ethereum as a key player in the decentralized finance (DeFi) ecosystem. These ETFs bolstered market liquidity and signalled increasing acceptance of cryptocurrencies within traditional financial systems.

Regulatory Landscape: Challenges and Opportunities

Regulation played a pivotal role in shaping the crypto market in 2024. The United States witnessed significant changes with the resignation of SEC Chair Gary Gensler and the appointment of crypto-friendly Paul Atkins as his successor.

This transition is expected to bring a more constructive approach to cryptocurrency regulation, focusing on fostering innovation while addressing investor protection.

Meanwhile, Europe led in regulatory clarity by implementing the Markets in Crypto-Assets (MiCA) framework.

MiCA-compliant stablecoins gained prominence, providing a secure and transparent alternative to traditional cryptocurrencies. These regulatory advancements underscore the importance of balancing innovation and compliance, setting the stage for more widespread adoption of digital assets.

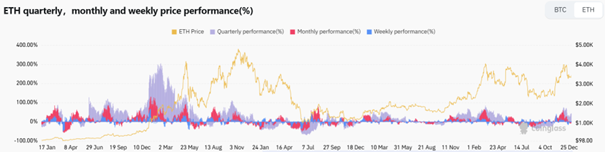

2024 Coins Performance

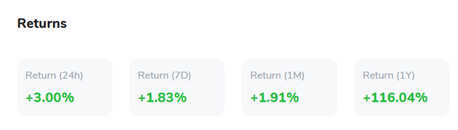

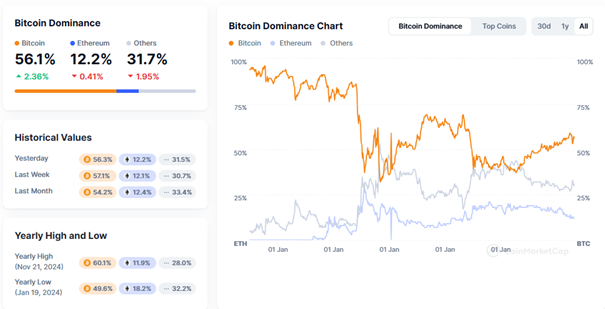

Bitcoin and Ethereum continued to dominate the cryptocurrency market, as reflected by Bitcoin's impressive rise to $97,742.24, representing a 115.6% increase, and Ethereum's surge to $3,471.44, a 46.75% gain.

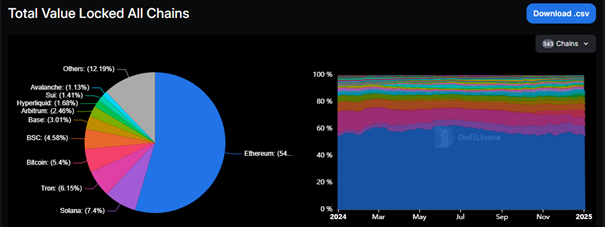

However, other major cryptocurrencies also experienced noteworthy developments in 2024. Solana (SOL), trading at $207.38 with an 88.44% increase, cemented its leadership in the DeFi space by achieving over $100 billion in DEX trading volume for consecutive months.

Despite this, Solana faced challenges like declining network activity and a high-profile lawsuit involving its co-founder.

1Y Heatmap

Dogecoin (DOGE) continued its meteoric rise with a 270.34% increase, trading at $0.34, driven by its memecoin popularity and adoption narratives.

XRP saw remarkable growth of 283.07%, trading at $2.397, fueled by speculation about its potential approval for a spot ETF.

Meanwhile, HBAR and XLM stood out with gains of 204.02% and 232.8%, respectively, showcasing their growing appeal among investors.

However, not all coins thrived—Polkadot (DOT) and Avalanche (AVAX) faced setbacks, declining by 15.24% and 5.1%, respectively, highlighting the mixed performance across the crypto landscape.

This diverse performance, from innovations to regulatory anticipation, underscores the dynamic narratives shaping the crypto ecosystem. The market's broad participation continues to be a key driver of its evolution.

Crypto Strategies: 1-Year Performers

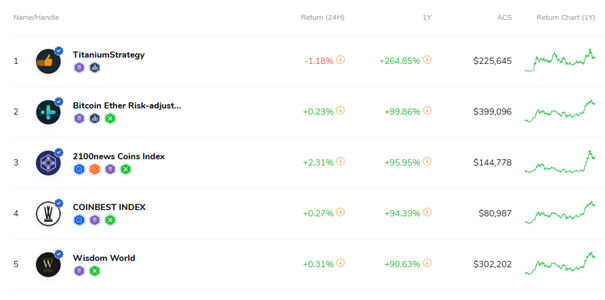

The chart showcases the top-performing crypto strategies over the past year, highlighting remarkable returns achieved by various investment approaches.

Leading the list is TitaniumStrategy, boasting a staggering 1-year return of 264.85% with a current ACS of $225,645. Following is the Bitcoin Ether Risk-adjusted Strategy, which delivered a 99.86% yearly gain and an ACS of $399,096, demonstrating strong risk-adjusted performance in a volatile market.

Other noteworthy performers include the 2100news Coins Index, which achieved a 95.95% return, and the Wisdom World Index, with a 90.63% gain, showcasing consistent upward trends.

The COINBEST INDEX rounded out the top five with a 94.39% return, further emphasizing the potential of well-structured crypto strategies.

These results reflect the increasing sophistication in crypto investment strategies, combining diverse approaches to optimize returns and manage risk effectively in a dynamic market environment.

Key Events and Market Trends

The 2024 US presidential election had a profound impact on the crypto market. President-elect Donald Trump's pro-crypto stance, including proposals for a strategic Bitcoin reserve, fueled optimism among investors. His administration's approach to fostering innovation in the digital asset space will shape market dynamics in the coming years.

Other key events included the rise of artificial intelligence (AI) agents in blockchain technology, which introduced new possibilities for decentralized applications and user interactions. AI-driven bots capable of performing tasks like trading and investment management marked a significant shift in integrating AI and blockchain.

Bitcoin's Role in a Volatile Market

Bitcoin's ability to navigate volatile market conditions in 2024 reinforced its position as a leading digital asset. Despite facing headwinds such as ETF outflows and global economic uncertainty, Bitcoin maintained its status as a reliable store of value. Its decentralized nature and limited supply continue to appeal to investors seeking alternatives to traditional assets.

As the year closed, Bitcoin's technical indicators suggested a cautiously optimistic outlook. The cryptocurrency's resilience amid mixed signals highlights its potential for continued growth, particularly as adoption and institutional interest expand.

Outlook for 2025

The crypto market is set for a pivotal year of transformation and growth. Analysts are optimistic about Bitcoin's prospects, which drive an increasingly clean regulatory environment and a significant influx of institutional capital.

The Trump administration's supportive approach towards cryptocurrency, including plans to integrate Bitcoin into US strategic reserves, could be a crucial catalyst, potentially propelling Bitcoin to new heights.

The broader market will also see the evolution of DeFi and NFT ecosystems alongside increasing mainstream adoption of cryptocurrencies by financial institutions.

The proposal to purchase up to 200,000 Bitcoin annually adds a strategic dimension to Bitcoin's positioning as a "national asset." While the near-term correction risks remain, particularly following profit-taking after Bitcoin's $108,000 peak in December 2024, the long-term outlook appears promising.

As the groundwork laid in 2024 continues to mature, stakeholders must stay vigilant and adaptive to the rapid changes in innovation, regulation, and global economic trends, setting the stage for a transformative year ahead.

Conclusion

2024 was a milestone for the cryptocurrency industry, marked by significant achievements and challenges. From Bitcoin's price performance and the rise of ETFs to regulatory advancements and technological innovations, the crypto market demonstrated its resilience and potential.

As we move into 2025, the industry is well-positioned for further growth and transformation, paving the way for a new era of digital finance.