Ripple (XRP): Latest Developments, Price Trends, and Technical Analysis

XRP Faces Harsh Sell-Off as Tariff Shock Shakes Markets

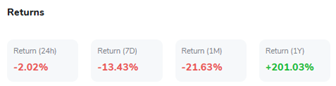

XRP entered April under intense pressure following Donald Trump’s announcement of sweeping new trade tariffs, which sparked panic across global financial markets. As investors rushed to de-risk, XRP tumbled from above $2 to a weekend low of $1.64, marking a 6.2% 24-hour loss at one point.

The drop came amid an overall decline in crypto sentiment, with the Fear and Greed Index sinking to 18, deep in “Extreme Fear” territory. Trading volumes surged by more than 570%, reflecting heightened volatility and investor uncertainty. The token broke below a key support level at $1.78, where it had been stable for months, raising concerns about a deeper correction.

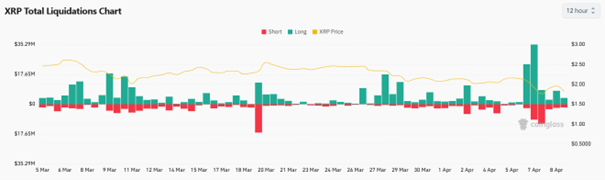

A break below this area shifted focus to $1.30 and even the psychologically critical $1 mark. Market-wide corrections, especially across derivatives, further fueled bearish sentiment, as traders liquidated over $59 million in long XRP positions within 24 hours.

Source: Coinmarketcap

Source: Binance

Technical Analysis: Bearish Momentum Intensifies

The 5-day chart of XRP reveals a clear pattern of weakness, with price consistently printing lower highs and lower lows. After a weekend crash, XRP attempted a minor rebound, stalling around $1.90, but the recovery lacked follow-through.

RSI readings fell as low as 37, suggesting the token entered oversold territory, though a slight uptick toward 41.67 indicates some cautious accumulation. Despite this, the inability of RSI to break past the neutral 50 level reinforces bearish control.

MACD analysis (based on the text data) also points to continued downside, with multiple red histogram bars over the past 48 hours.

Meanwhile, the 24-hour volume reached over 640 million, highlighting that recent price action was driven more by panic than fundamental buying. Unless XRP recaptures and holds above $1.90, further downside toward $1.65 and $1.30 remains on the table.

Source: TradingView

A Milestone for XRP: First ETF Launches in the U.S.

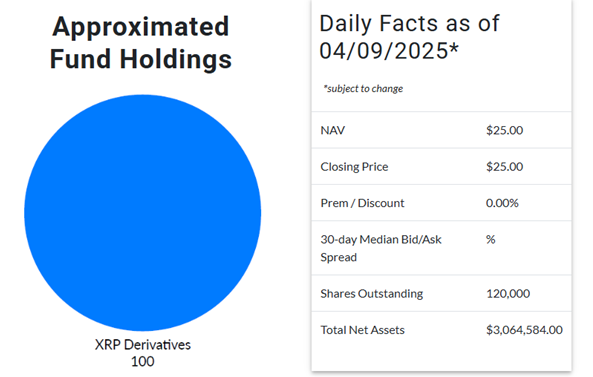

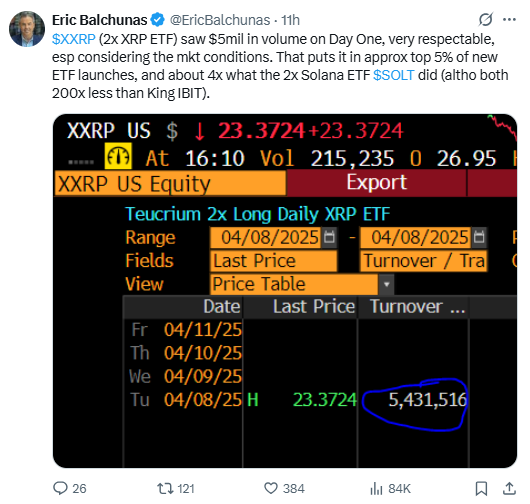

Wall Street is officially embracing XRP with the launch of the Teucrium 2x Long Daily XRP ETF (XXRP), marking the first U.S.-based ETF linked to the token’s performance. Unlike a spot ETF, this is a leveraged product using derivatives to offer double exposure to XRP’s daily price moves—aimed at active traders seeking high-risk, high-reward strategies. While it doesn’t directly hold XRP, its debut signals growing institutional appetite for crypto volatility.

Source: Teucrium

The launch also arrives alongside news that the SEC has acknowledged a filing for a spot XRP ETF from Canary Capital, initiating a 21-day review window. This parallel development—derivative product approved, spot ETF under review—reflects a regulatory environment slowly evolving toward broader crypto integration. If approved, a spot ETF would offer more transparent and less volatile exposure, especially for long-term investors. Teucrium’s XXRP may be just the first of many steps bridging traditional finance and digital assets.

Source: X

On-Chain Metrics Signal Deepening Derivatives Weakness

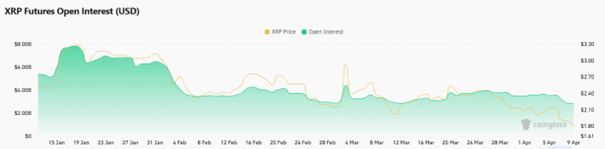

XRP’s recent downturn is clearly mirrored in its derivatives and on-chain data, which now signal mounting fragility. Open interest in XRP futures has plunged by 63% since its January peak near $7.8 billion, now sitting below $3 billion, reflecting reduced capital inflows and waning speculative appetite. This decline coincides with a marked drop in trading volume, as seen in the second chart, with no significant spikes since mid-March despite heavy price swings—indicating that enthusiasm is drying up even amid volatility.

Source: CoinGlass

The total liquidations chart also highlights large-scale long liquidations on April 6–7, surpassing $30 million, which amplified the recent price crash. Meanwhile, short liquidations remain minor, reinforcing that sellers dominate the market.

Source: CoinGlass

These indicators reflect growing fear among investors and an absence of confident buyers. For XRP to regain strength and restore trust in its ecosystem, it must reignite organic demand and reverse these troubling derivatives trends.

Source: CoinGlass

XRP Price Outlook: Is $1 the Next Stop?

Given the combination of macroeconomic pressure, weak technicals, and deteriorating on-chain health, XRP appears vulnerable to additional downside. If the $1.65 support fails decisively, the next target lies at $1.30, representing a potential 21% drop from current levels. Should that zone break, the market may test the $1.00 psychological level, which could trigger heavy retail selling.

While the short-term trend is clearly bearish, analysts remain cautiously optimistic about long-term recovery, especially with the potential approval of a spot XRP ETF and the end of the SEC lawsuit. Investors should closely monitor how XRP performs around the $1.65 and $1.30 zones, as these could determine whether the correction deepens or stabilizes. In the interim, leveraged traders are advised to tread carefully, with technical indicators like MACD and RSI still confirming bearish control.

Conclusion

XRP's near-term outlook is defined by intense selling pressure and macroeconomic uncertainty, but long-term catalysts like regulatory clarity and institutional adoption via ETFs offer hope. For now, all eyes remain on key support levels and whether the market can absorb further panic-driven exits.