Crypto Weekly Wrap: 17th January 2025

- SEC Appeal Against Ripple: Ripple vs. SEC Takes a New Turn

- Bitcoin Surges Above $100K Before Stabilizing

- Bitcoin’s Path to $200K: Optimistic Projections

- Technical Analysis: Key Levels in Focus

- Altcoin Market Gains Momentum

- Cryptocurrencies by 24H Return

- Regulatory Developments and Global Crypto Adoption

- Elon Musk and the SEC: A High-Stakes Battle

- Conclusion

SEC Appeal Against Ripple: Ripple vs. SEC Takes a New Turn

The SEC has filed an opening brief in its appeal against Ripple Labs, urging the Second Circuit Appeals Court to classify XRP sales to retail investors as unregistered securities. The SEC's argument is rooted in the belief that XRP buyers were influenced by Ripple’s promotional efforts, aligning it with the Howey Test’s investment contract definition. Ripple's leadership, including CEO Brad Garlinghouse, remains defiant, calling the appeal a "rehash of failed arguments."

Analysts suggest that the incoming Trump administration may halt non-fraud-related litigation, potentially changing the regulatory landscape for Ripple and other crypto projects. Despite the legal uncertainties, XRP surged by 10% following the news, reflecting growing optimism among investors.

Source: X

Bitcoin Surges Above $100K Before Stabilizing

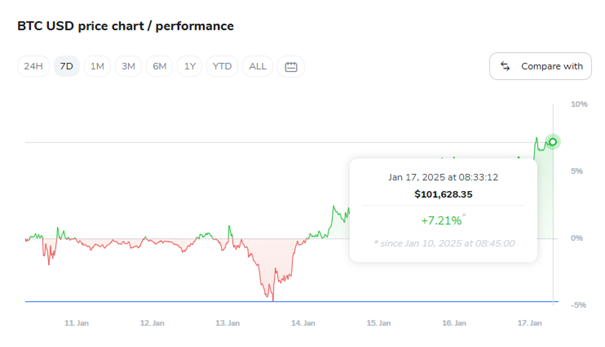

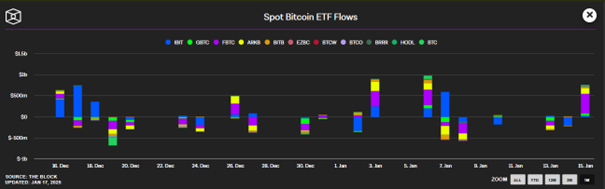

Bitcoin briefly surpassed the $100,000 mark, climbing to $101,641 before retreating to $101,040. The move underscores Bitcoin's resilience amid broader macroeconomic shifts, as traders observed a decisive rebound following prior dips.

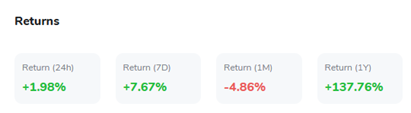

On-chain data, as seen in the chart, highlights increased buying activity driving Bitcoin's recent rally. Despite this momentum, concerns persist, with Bitcoin ETFs experiencing $209 million in outflows, suggesting cautious institutional sentiment.

Source: TheBlock

Bitcoin’s Path to $200K: Optimistic Projections

Long-term projections remain optimistic, with reports indicating Bitcoin could reach $200,000 by the end of 2025. This bullish forecast is supported by growing institutional interest, spot Bitcoin ETFs drawing over $37 billion in capital inflows, and increasing adoption by U.S. states like New Hampshire and North Dakota.

As the cryptocurrency market cap approaches $10 trillion, Bitcoin continues cementing its role as "digital gold," attracting institutional and retail investors eager to capitalise on its potential.

Source: CoinMarketCap

Technical Analysis: Key Levels in Focus

Bitcoin is trading at $101,641, with its RSI at 61.28, signalling bullish momentum yet cautioning against potential overbought conditions.

After rebounding from a low of $91,000, Bitcoin now finds support at $100,000 and resistance near $102,000. The RSI reflects steady demand, while the volume indicator suggests sustained interest as buyers dominate the market.

Momentum indicators like the Awesome Oscillator (AO) remain positive, and a bullish breakout above $102,000 could pave the way for further gains. However, traders are advised to monitor macroeconomic conditions and Bitcoin's ability to hold key support levels.

A failure to maintain support could see Bitcoin retest the $97,000 zone, while a daily close above $102,000 would likely confirm a continuation of the uptrend.

Source: TradingView

Altcoin Market Gains Momentum

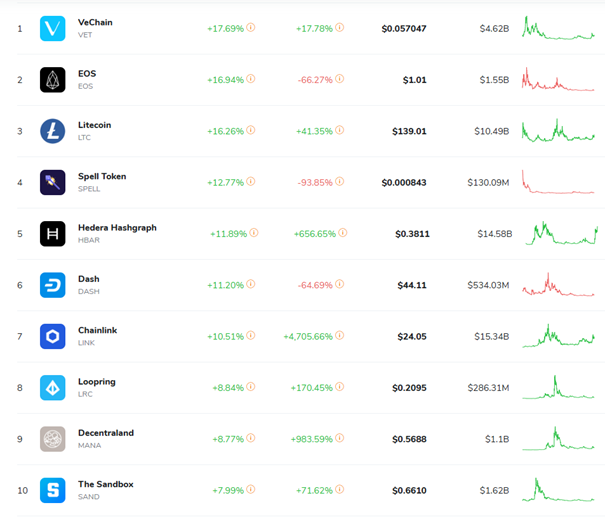

The altcoin market demonstrated remarkable performance, with several cryptocurrencies posting impressive gains in the last day. VeChain (VET) led the surge with a 17.69% increase, trading at $0.057, reflecting strong investor confidence.

EOS followed closely with a 16.94% gain, while Litecoin (LTC) climbed 16.26%, reaching $139.01, driven by its continued relevance in digital payments. Hedera Hashgraph (HBAR) showed a notable 11.89% rise to $0.381, showcasing its appeal for enterprise-grade blockchain solutions.

Other notable performers include Dash (DASH), up 11.20%, and Chainlink (LINK), which recorded a 10.51% gain to $24.05, reflecting its continued utility in decentralised oracle solutions. Loopring (LRC) and Decentraland (MANA) also gained 8.84% and 8.77%, respectively, as interest in Layer-2 solutions and metaverse projects remained robust.

The Sandbox (SAND) rounded out the top performers with a 7.99% increase to $0.661, fueled by renewed interest in virtual real estate and gaming ecosystems. This broad-based rally underscores the altcoin market's resilience and growing investor interest in diverse blockchain projects.

Cryptocurrencies by 24H Return

Regulatory Developments and Global Crypto Adoption

The evolving regulatory landscape in the US and EU continues to influence crypto adoption. The EU's MiCA regulations, effective since December 2024, have introduced stringent compliance requirements and enhanced trust in the crypto market.

In the US, the election of a pro-crypto administration is expected to usher in a more favourable environment for digital assets, fostering innovation and institutional confidence.

Analysts believe these developments will bridge the gap between traditional finance and decentralised ecosystems, paving the way for broader adoption.

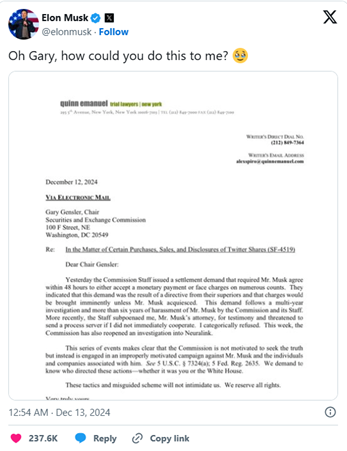

Elon Musk and the SEC: A High-Stakes Battle

Elon Musk has found himself in the crosshairs of the SEC once again, facing allegations of securities law violations tied to his 2022 Twitter share acquisition. The SEC claims Musk failed to promptly disclose his stake in Twitter, allowing him to purchase shares at "artificially low prices," underpaying by at least $150 million.

This latest legal skirmish adds to Musk's contentious history with the regulatory agency, which he has criticised as overly aggressive and biased.

Musk's legal team has dismissed the allegations as baseless, describing the lawsuit as a “sham” and a continuation of the SEC's long-standing campaign against him. Beyond the legal implications, Musk's actions have also sparked political and regulatory debates, including accusations from German authorities of meddling in election politics.

These controversies underscore the complex interplay between influential figures, regulatory frameworks, and the cryptocurrency market, as Musk remains a significant driver of sentiment within the space.

Source: X

Conclusion

Bitcoin's recent performance, coupled with developments across the crypto market, highlights the industry's dynamic and evolving nature. While macroeconomic challenges persist, institutions' growing adoption of digital assets and favourable regulatory shifts provide a promising outlook.